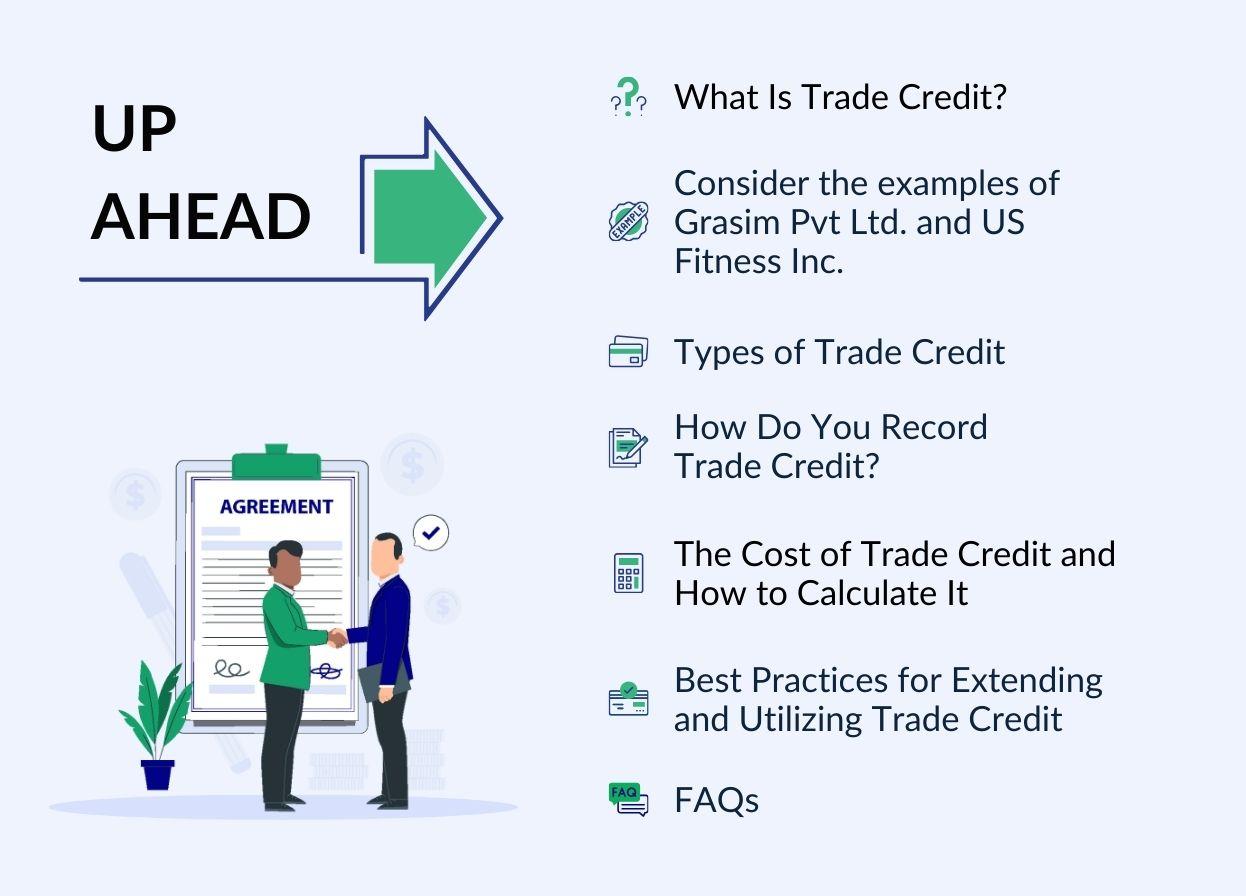

What Is Trade Credit?

This guide is your manual to understand trade credit - the financial GPS that can keep your collaborations running smoothly, making success your constant companion.

What Is Trade Credit?

Trade credit is an arrangement wherein a supplier allows a buyer to purchase goods or services, deferring payment for a specified period. It serves as a short-term financing option. Typically, trade credit terms outline the credit period, interest rates, and repayment conditions. Credit terms in international trade aren't uniform, varying across businesses and industries.

Trade credit is a common practice, enabling companies to maintain inventory levels, meet operational needs, and navigate economic fluctuations.

Credit limits are not static and can change over time based on the buyer's evolving credit history, based on assessment of the creditworthiness. Borrowers who consistently maintain a positive credit history may find opportunities for credit limit increases.

Consider this case study of Grasim Pvt Ltd. and US Fitness Inc.

In a cross-border collaboration, Grasim Pvt Ltd., known for its custom mobile applications, engages with US Fitness Inc., a leading US fitness firm. The task involves delivering three specialized mobile apps tailored to suit the unique needs of US Fitness Inc.’s operations.

According to the terms, US Fitness Inc. commits to making payments within fifteen days of receiving each mobile application. Grasim Pvt Ltd. delivers the first app as the collaboration unfolds, and US Fitness Inc. has a fifteen-day window to complete the payment. This process repeats for the subsequent two applications, each installment with a fifteen-day payment timeline.

The trade-credit terms allow US Fitness Inc. to evaluate each application before making payments. This arrangement aids their decision-making process and benefits the working capital requirement.

For Grasim Pvt Ltd., the trade credit terms provide a stable cash flow, with staggered payments offering financial predictability throughout the transaction. This case study exemplifies the strategic use of trade credit in international transactions, fostering a mutually beneficial relationship between the two businesses.

Types of Trade Credit

1. Open Account

Open account trade credit allows buyers to receive goods upfront and defer payment within an agreed period.

- Flexibility: An open account provides flexibility; the repayment period is usually between thirty and ninety days.

- Trust-Driven Relationship: This model relies heavily on the established trust between the buyer and seller, fostering a flexible yet mutually dependent business relationship.

- Enhanced Cash Flow: Buyers benefit from immediate access to goods, optimizing cash flow by delaying payment until later

2. Trade Acceptance

Trade acceptance introduces a more formal structure where a detailed draft outlines payment terms.

- Clear Commitment: The buyer's acceptance of the draft signifies a commitment to making the payment on a specified date, creating a transparent framework.

- Risk Mitigation: Mitigates risk by clearly defining payment obligations and providing a formalized mechanism for dispute resolution.

3. Promissory Note

A promissory note is a written commitment where the borrower pledges to repay a specific amount by a predetermined date.

- Versatility: It can function as a standalone financial instrument or be integrated into a broader credit agreement, offering versatility in financial arrangements.

- Legal Documentation: The promissory note is crucial, providing a clear and documented record of the debt and its repayment terms.

Understanding different types of effective financial arrangements is crucial for the following reasons:

| Criteria | Open Account | Trade Acceptance | Promissory Note |

|---|---|---|---|

| Risk Management | Suitable for customers with proven credit history | Provides structured cash planning | Reduces risk for unfamiliar transactions |

| Cash Flow | Allows delayed payments | Offers structured cash planning | Aligns with cash flow needs, versatile |

| Building Relationships | Special arrangements for specific relationships | Fosters trust and collaboration | Tailored commitment for enduring collaborations |

| Legal Compliance | May involve legal risks | Ensures stringent legal documentation | Formal commitment with clear legal terms |

| Strategic Financial Planning | May lack structure for evolving financial needs | Provides a structured approach for evolving needs | Offers adaptability for versatile financial solutions |

How Do You Record Trade Credit?

Recording trade credit involves choosing between cash and accrual accounting methods, each impacting financial statements and cash flow differently.

Cash Accounting

The accounting of trade credit transactions is done when actual payment occurs. This provides a straightforward view of actual cash movements, making it simpler for small businesses. However, it doesn’t accurately represent the financial health as it doesn't consider credit transactions until payment.

Accrual Accounting

Accrual accounting recognizes transactions when incurred, not when cash changes hands. For trade credit, this means recording transactions when goods or services are received, regardless of the payment date. It accurately represents a business's financial position, requires meticulous record-keeping, and may not align with actual cash flow.

Cash accounting can make cash flow appear more stable. Accrual accounting, however, may reveal fluctuations in financial health, showing credit transactions that still need to translate into cash.

Larger businesses therefore adopt accrual accounting, which complies with Generally Accepted Accounting Principles (GAAP) and provides a more comprehensive financial picture.

The Cost of Trade Credit and How to Calculate It

Early Payment Discounts

- Early Payments Discount incentivizes prompt invoice settlement, optimizing suppliers' cash flow.

- The formula to calculate the discount is straightforward: Early Payment Discount = Invoice Amount × Discount Percentage.

- Early payments can improve relationships and secure favorable terms. Still, businesses should carefully weigh whether the discount is worth more than potential investment opportunities or the need to keep cash for operations.

Grasim Pvt Ltd. offers US Fitness Inc. a 2.5% discount on the project cost of 1 million USD for making payment within 7 days. The calculation of the early payment discount is as follows:

Early Payment Discount = 1,000,000 USD × 2.5% = 25,000 USD

However, US Fitness Inc. must weigh this discount against the value of their working capital. For example, if it needs to borrow funds for early payment, then the cost of borrowing must not exceed the early payment discount.

Late Payment Penalties

- A late payment penalty is a fee imposed on a party that fails to pay by the agreed-upon due date. This penalty is often expressed as a percentage of the overdue amount and serves as a financial consequence for not adhering to the terms of a payment agreement.

- Late Payment Penalty = Original Invoice Amount × Penalty Percentage.

- Mitigating Late Payment Risks: Frequent delays may strain business relationships. Businesses can mitigate late payment risks by setting clear payment terms in agreements. Implementing effective communication channels and reminders helps minimize the likelihood of delays.

In the above example, late payments by US Fitness Inc. would incur a 1% penalty on the project cost. The calculation for late payment penalties is as follows:

Late Payment Penalty = 1,000,000 USD × 1% = 10,000 USD

To avoid these penalties, US Fitness Inc. must evaluate each delivered mobile application within the fifteen-day window, aligning with their decision-making process and minimizing the risk of late payments.

Best Practices for Extending and Utilizing Trade Credit

Implementing these best practices enhances the effective management of trade credit, minimizes risks, and optimizes financial resources for businesses.

1. Regularly Check and Analyze Customer Credit History

- Conduct thorough assessments of customer credit histories before extending trade credit.

- Regularly review and update credit information to stay informed about changes in a customer's financial standing.

2. Consider Trade Credit Insurance

- Mitigate the risk of non-payment by exploring trade credit insurance options.

- This insurance protects against potential losses due to customer insolvency or default, enhancing financial security.

3. Finance Trade Receivables Through Invoice Discounting or Factoring

- Optimize cash flow by utilizing financial instruments like invoice discounting or factoring.

- These tools enable businesses to receive immediate cash by selling their receivables, providing liquidity to support ongoing operations.

Final Words

Trade credit is a catalyst for business expansion, fostering mutually beneficial relationships. But one must maintain a delicate balance in controlling credit and payment terms.

Businesses can navigate the complexities of trade credit by regularly assessing customer credit histories and considering tools like trade credit insurance. This proactive management safeguards against potential pitfalls and sets the stage for a resilient and prosperous B2B ecosystem.

FAQs

Q1. Who can use trade credit?

Ans: Any business that buys and sells goods or services can use trade credit. Trade credit is particularly common in the business-to-business (B2B) context.

Q2 .What is the cost of trade credit?

Ans: The cost of trade credit is the interest or discount a business may incur when it uses credit terms to make purchases. It is essentially the opportunity cost of not paying for goods or services upfront.

Q3. Is trade credit long or short-term?

Ans: Trade credit can be long-term and short-term, depending on the agreed-upon terms between the buyer and the supplier. Short-term trade credit is more common, with payment typically due within a few weeks or months after the delivery of goods or services. However, some trade credit arrangements may extend to longer periods (in specific industries).