Why was a certain amount deducted from my SWIFT payment?

Inner voice: The client's payment will finally arrive in the business account today! I earned this. The entire team earned this!

A message arrives–the amount you received is less than what you charged.

It feels like a loss because it is a loss. But how and why did it happen?

If you transact internationally, a reduced amount appearing in your bank account can be disheartening, stressful, and puzzling. This is particularly true with SWIFT payments sent to India, where unexpected deductions may occur in your SWIFT money without explanation.

SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a financial organisation enabling global transactions. It acts as a bridge between banks and other financial institutions worldwide to facilitate international payments.

This payment mode is vital for businesses and individuals who engage in global investments and trade. SWIFT payments come with the challenges of lengthy verification processes before funds are released.

Certain banks serve as intermediaries, transmitting funds from a sender to the recipient's bank account. Although their role is crucial to secure a safe and efficient transfer of funds, it can also lead to unexpected deductions in the final payment due to some factors.

How Does SWIFT Payment Work?

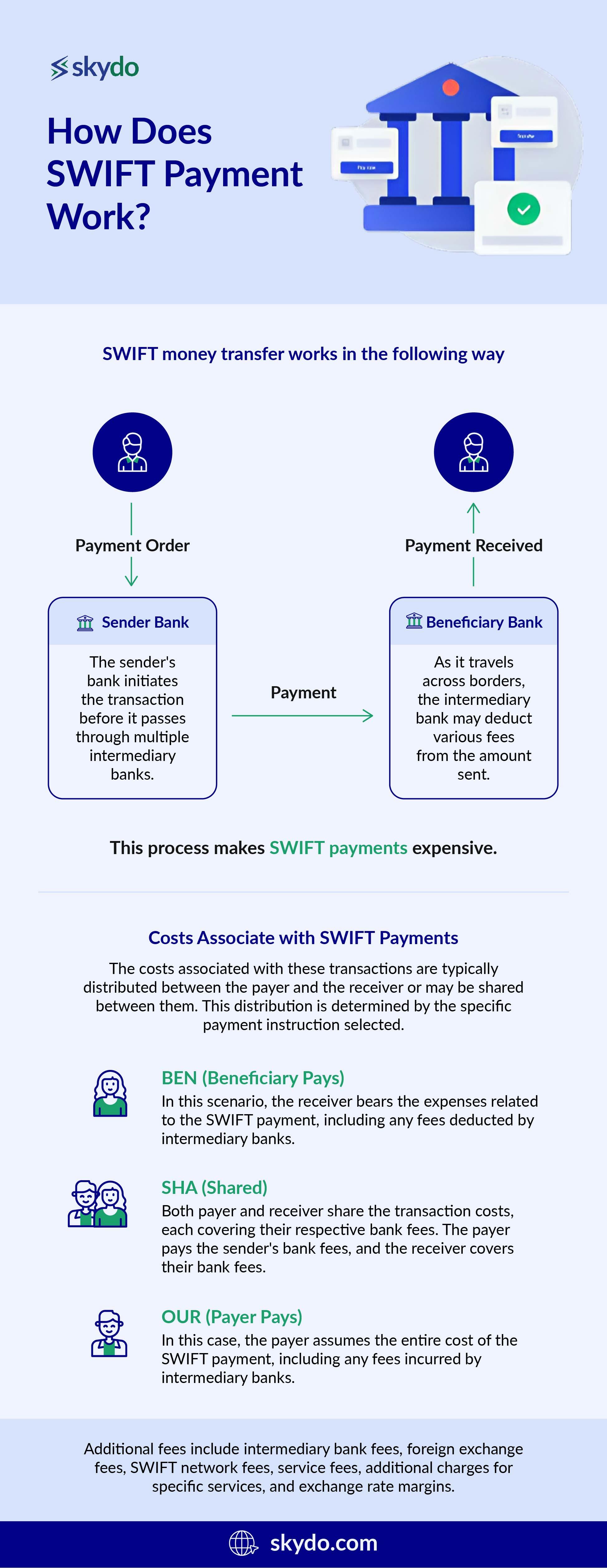

SWIFT money transfer works in the following way.

- The sender's bank initiates the transaction before it passes through multiple intermediary banks.

- As it travels across borders, the intermediary bank may deduct various fees from the amount sent.

This process makes SWIFT payments expensive. The costs associated with these transactions are typically distributed between the payer and the receiver or may be shared between them. This distribution is determined by the specific payment instruction selected.

- BEN (Beneficiary Pays): In this scenario, the receiver bears the expenses related to the SWIFT payment, including any fees deducted by intermediary banks.

- SHA (Shared): Both payer and receiver share the transaction costs, each covering their respective bank fees. The payer pays the sender's bank fees, and the receiver covers their bank fees.

- OUR (Payer Pays): In this case, the payer assumes the entire cost of the SWIFT payment, including any fees incurred by intermediary banks.

Additional fees include intermediary bank fees, foreign exchange fees, SWIFT network fees, service fees, additional charges for specific services, and exchange rate margins. The cumulative impact of these fees and potential variations in exchange rates can result in higher costs compared to other payment methods.

The result is a reduced payment by the time it reaches its destination - the recipient's bank in India.

The implications of SWIFT payment deductions in India are real and can greatly impact businesses and individuals. Let's examine the causes behind these deductions, providing examples of how they have impacted the financial well-being of those affected.

Factors Influencing The SWIFT Payment and The SWIFT Money You Receive

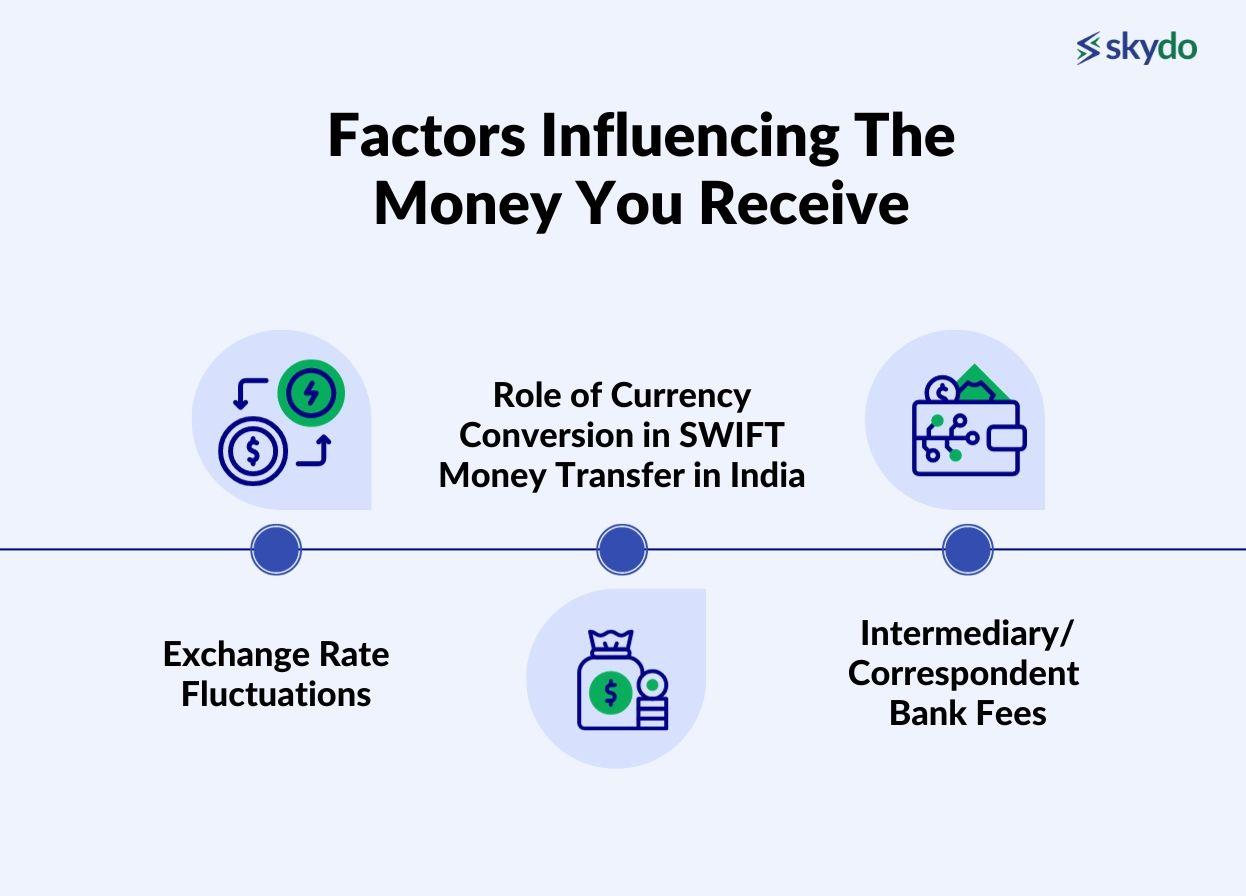

1. Exchange Rate Fluctuations

The difference between expected and actual payment amounts can be significant due to exchange rate fluctuations. The changes in the value of currencies affect the currency conversion process that often occurs in international payments.

When a business in the United States sends a payment of $10,000 to a supplier in India, the initial exchange rate of 85 Indian Rupees (INR) per US Dollar (USD) will result in a payment of INR 850,000.

However, if the exchange rate changes to INR 84 per USD by the time it reaches India, then the final amount would be INR 840,000. This difference of INR 10,000 is lost due to currency fluctuations.

2. Role of Currency Conversion in SWIFT Money Transfer in India

Currency conversion is often required for SWIFT payments to send funds to the recipient's currency. Unfortunately, banks may charge a hidden fee known as a margin or spread to cover the cost of this exchange process. This factor reduces the amount you receive from the actual amount sent.

If your cousin in the United Kingdom wants to send you 1,000 British Pounds (GBP) in India, they can use a bank that offers an exchange rate of 90 INR per GBP for the conversion.

However, the interbank rate (the rate at which banks exchange currencies with each other) is INR 89 per GBP. This means that due to the margin held by the bank, 1 INR will be deducted from every pound sent, leading to a certain deduction.

3. Intermediary/Correspondent Bank Fees

Intermediary banks have a crucial role in the SWIFT payment system, as they act as the middleman between the sender's and recipient's banks. However, these services come with a cost.

The fees charged by intermediary banks can vary greatly depending on factors such as the number of correspondent banks involved, the complexity of the transaction, and the specific services provided.

For example, if an Australian business sends a payment of 2,000 AUD to a business in India. During its journey, the payment passes through 4 correspondent banks that each charge a fee of 20 AUD. This results in an overall deduction of 80 AUD from the original payment amount.

Regulatory and Compliance Factors of SWIFT Money Transfer

1. Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are necessary for the global financial system. AML laws safeguard against illegal profits entering the legal financial system, while KYC policies necessitate that banks and other financial institutions authenticate their customers' identities.

To comply with international AML and KYC regulations, banks and financial institutions must conduct due diligence on the parties involved in a transaction. This process involves verifying the source of funds, confirming the identities of the sender and recipient, as well as assessing the nature of the transaction to ensure that no money laundering or other illicit activities are taking place.

The discrepancies or issues discovered during the due diligence process can cause banks to temporarily freeze or delay the transfer until they are addressed, resulting in extra costs and delays.

When a business in the United States sends a payment to a new supplier in India, the recipient's bank may place the payment on hold due to discrepancies found in their KYC process.

The supplier may miss out on the best exchange rates or favourable market conditions at the time the payment was initially initiated. Since exchange rates fluctuate, and market conditions can change rapidly, any delay may result in the supplier receiving a lower amount than expected. It may also potentially strain financial planning and business operations.

2. Withholding Tax

The government imposes withholding tax on certain types of income earned by non-residents. This tax is usually deducted directly from the payment source, such as the payer's bank via SWIFT payments.

This policy aims to ensure that taxes are collected on any income earned within a particular jurisdiction, no matter where the recipient may be located.

When making a SWIFT payment, consider withholding tax, as it can affect the total amount received by the recipient. The amount of tax withheld and the type of income subject to withholding varies by country. When applicable, the withholding amount will be deducted from the payment before sending it to its recipient.

For example, if an Indian company exports goods to Cambodia, the company may face a 14% withholding tax when receiving payments via SWIFT. This withholding tax is imposed by Cambodia on certain income earned by non-residents.

As a result, the Indian company will receive 14% less of the total payment, deducted directly due to the withholding tax, ensuring compliance with Cambodia's tax regulations.

Possible Reasons for Reduced SWIFT Payment: Summary

To summarise the factors mentioned above about reduced SWIFT payments, there could be various reasons why a certain amount was deducted from your SWIFT payments. Some possible reasons include the following.

- Transaction Fees: SWIFT payments may incur transaction fees, which can vary depending on the banks involved in the transfer.

- Currency Conversion: If the payment involves currency conversion, there might be charges associated with converting the funds to the recipient's currency.

- Correspondent Banks: SWIFT payments often pass through multiple banks (correspondent banks) before reaching the final destination. Each bank in the chain may deduct fees for processing the transaction.

- Intermediary Bank Charges: In some cases, an intermediary bank may deduct a fee for facilitating the transfer.

- Regulatory Charges: Regulatory requirements and compliance issues can lead to deductions, especially when transferring funds across borders.

- Recipient Bank Fees: The recipient's bank may also impose fees for receiving international payments.

To get a clear understanding of the deductions, it is advisable to check with your bank or the sending bank to inquire about the specific fees associated with your SWIFT payment. Additionally, reviewing the payment details and seeking clarification from the involved banks can help identify the exact reasons for the deductions.

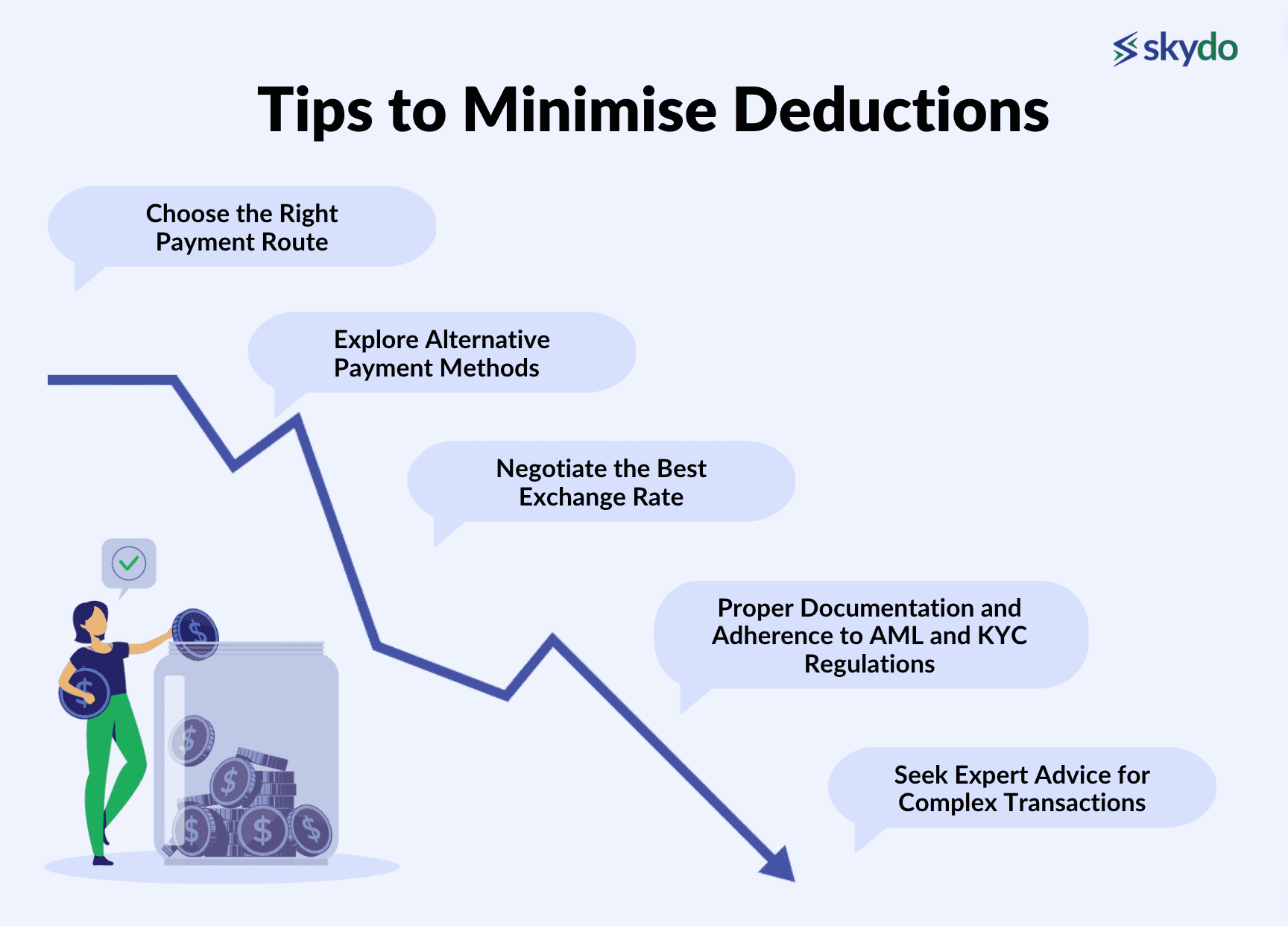

Tips to Minimise Deductions for Your SWIFT Payments

When dealing with international payments via SWIFT in India, reducing SWIFT charges and ensuring the funds arrive at their destination safely is essential. Here are some useful strategies to help you accomplish this goal.

1. Choose the Right Payment Route

Consider your options carefully and decide which payment method is best for your transaction. Different approaches could include different numbers of intermediate banks, each of which might add charges and cause delays.

2. Explore Alternative Payment Methods

Look into alternative payment options that can offer reduced fees and quicker processing. Online payment platforms like Skydo can do all this and more for a very low fee.

3. Negotiate the Best Exchange Rate

When dealing with international transactions and currency conversion, securing a favourable exchange rate is crucial for minimising costs. Banks often offer exchange rates that may not be as competitive as what you could find in the open market. However, by negotiating with your bank, you can potentially secure a more advantageous rate.

4. Proper Documentation and Adherence to AML and KYC Regulations

Accurate and comprehensive documentation is necessary when dealing with international payments. Provide all the required information, such as identification, source of funds, and transaction details to meet Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Delaying compliance with KYC and AML regulations can affect the conversion rate you receive considering its highly fluctuating nature. Maintain meticulous records and comply with AML/KYC rules to make payments smoother and reduce any unexpected delays.

5. Seek Expert Advice for Complex Transactions

When dealing with complex international transactions that involve significant sums of money, seek expert advice. Financial advisors, legal professionals, and those experienced in international finance provide crucial guidance.

This will help you navigate the complexities of SWIFT payments, comply with regulations, and identify strategies to minimise your SWIFT charges. Their insights can be invaluable in protecting your funds and optimising your transaction efficiency.

Conclusion

Minimising deductions from your SWIFT money in India is possible with careful planning and consideration of various factors, such as choosing the right payment route, selecting intermediary banks wisely, exploring alternative payment methods, optimising timing and currency conversion, and ensuring compliance.

To further improve international transactions' efficiency and financial control, consult an experienced payment solution provider such as Skydo. With Skydo's expertise and technology-driven approach to cross-border payments, you can remain assured that your transactions are secure and cost-effective.

FAQs on SWIFT Payments

Q1. What is a SWIFT transfer?

Ans: A SWIFT transfer, or SWIFT money transfer, is a method of sending money internationally between banks and financial institutions. It involves a network known as the Society for Worldwide Interbank Financial Telecommunication (SWIFT) that facilitates secure and standardised communication between banks to enable cross-border transactions.

Q2. How long does a SWIFT transfer take?

Ans: The time it takes for a SWIFT transfer to be completed can vary depending on several factors, including the banks involved, the countries of origin and destination, and any intermediary banks in the transaction. Typically, it can take several business days for the funds to reach the recipient.

Q3. What are the SWIFT transfer charges?

Ans: SWIFT transfer fees often come with various charges, including intermediary bank fees, foreign exchange fees, SWIFT network fees, service fees, and more. The specific charges can vary depending on the banks and the payment instructions chosen (BEN, SHA, OUR), leading to potential deductions from the original payment amount

Q4. What are the problems with SWIFT payments?

Ans: SWIFT payments can face issues such as unexpected deductions, delays due to regulatory compliance, exchange rate fluctuations, and withholding tax. These factors can result in the recipient receiving a reduced amount or experiencing delays in receiving funds.

Q5. How do I track a SWIFT transaction?

Ans: To track a SWIFT transaction, you can typically contact your bank or the sending bank for updates. They can provide you with information about the transaction's status, including confirmation of its progress, any potential delays, and the estimated time of arrival for the funds.