What Is Withholding Tax in India? All You Need to Know

GlobalTech Solutions, an I.T. service export provider headquartered in India, secured a contract with a client in Germany. As GlobalTech Solutions progressed with the project and submitted their invoices for the services rendered, they were surprised to receive reduced payments from their client in Germany. The unexpected reduction in revenue not only strained their financial resources but also affected their profit margin.

Upon further investigation, they discovered that the client deducted withholding tax. Typically, the payer deducts this tax amount before remitting the funds to the non-resident service provider. GlobalTech Solutions was unaware of this fact initially.

While they lost a certain amount due to a tax compliance oversight, you can avoid such financial setbacks by learning everything you need to know about withholding tax in this guide.

Withholding tax is the amount deducted at the payment source by the payer before remitting the amount to the recipient. This tax amount is paid directly to the government.

In India, withholding tax takes the form of Tax Deducted at Source (TDS) for domestic transactions. However, withholding tax in international or cross-border transactions includes collecting taxes from non-residents on income generated within their jurisdiction.

Withholding tax requires the payer to hold back a certain percentage of the payment and remit it to the tax authorities on behalf of the recipient. This tax withholding serves as a prepayment of the recipient's tax liability.

Tax expert and CA, Juhi Shah, states, "Withholding tax ensures that non-resident individuals or entities contribute their fair share of taxes on income earned within a country's borders. Therefore, proper withholding tax compliance is not just a legal obligation but an essential component of responsible tax management."

Let’s consider an example of a software development company based in India providing I.T. services to a client based in the USA. The agreed-upon fee for the services is $10,000. However, the USA imposes a 30% withholding tax on payments made to non-resident service providers.

When the software development company invoices the client for $10,000, the client must withhold 30% of that amount ($3,000) as withholding tax. Thus, the client remits $7,000 to the software development company.

Other countries, like The United Kingdom, impose 20% on certain interest payments, rents or royalties. In Australia, withholding tax applies to payments made to non-residents for certain types of income, such as dividends, interest, royalties, and fees for the performance of entertainment or sports activities. The withholding tax rate is generally 10%.

However, the landscape of international tax laws is complex and dynamic. Each country has its regulations and tax rates. Therefore, in the previous example, while the client deducted withholding tax in the US, the remaining income of $7000 may be subject to another form of tax in India. This phenomenon is known as double taxation.

Double Taxation: Why Is It Charged?

This form of taxation applies to the same income in two or more jurisdictions. It can happen when income is subject to tax in the country where it is earned and then again in the country where the taxpayer resides.

Offering tax credits or exemptions can avoid or minimise double taxation. Therefore, countries enter into double tax treaties that aim to provide relief to taxpayers by specifying rules for allocating taxing rights.

According to a report by the Organization for Economic Co-operation and Development (OECD), more than 3,000 double tax treaties are in effect worldwide, reflecting the intricate nature of international taxation.

Then, how can you avoid losing your business’s hard-earned money in international taxes?

Withholding Tax Example

Imagine a tech company in India called ABC Tech Solutions. They provide tech services to companies around the world. One of their clients, XYZ Corporation, owes them Rs 1,000,000 for services.

As per RBI rule, before paying this money to ABC Tech Solutions, XYZ Corporation can set aside a portion for taxes. Let's say it's 10%, which amounts to Rs 100,000. So, instead of paying the full Rs 1,000,000 to ABC Tech Solutions, XYZ Corporation pays Rs 900,000 and keeps Rs 100,000 separately for taxes.

It's now XYZ Corporation's responsibility to give this Rs 100,000 to the government as withholding tax. They're holding onto it on behalf of ABC Tech Solutions.

ABC Tech Solutions, receive Rs 900,000 in their account, but they know that Rs 100,000 has been kept aside for taxes by XYZ Corporation. When ABC Tech Solutions files its income tax return, it can show this Rs 100,000 as a credit.

It helps them because they've technically already paid some tax through XYZ Corporation's withholding.

Withholding Tax Rates

Let's discuss the current rates for withholding tax paid by non-resident individuals. The following rates are applicable.

- For interest, the tax rate is 20%.

- There is no tax charged on dividends paid by domestic companies.

- The tax rate for royalties is 10%.

- Technical services are taxed at 10%.

- For other services, individuals are charged 30% of their income, while companies are charged 40%.

These rates apply to countries without a Double Taxation Avoidance Agreement (DTAA) with India.

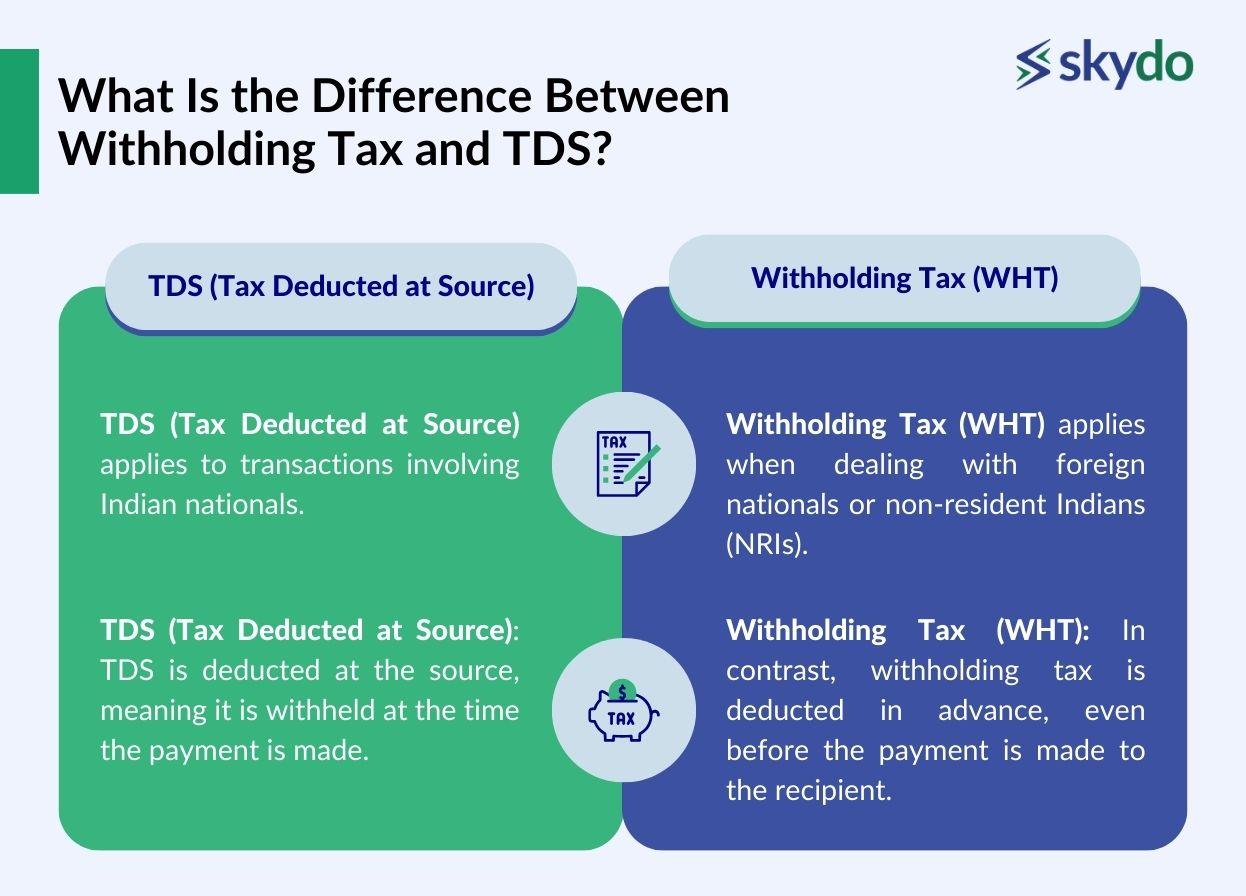

What Is the Difference Between Withholding Tax and TDS?

Let's break down the key differences between Withholding Tax (WHT) and Tax Deducted at Source (TDS).

Applicability to Nationals

- TDS (Tax Deducted at Source) applies to transactions involving Indian nationals. For instance, if a business is paying for services to a local vendor who is an Indian citizen, TDS is applicable. The payer deducts a certain percentage of the payment and remits it to the government.

- Withholding Tax (WHT) applies when dealing with foreign nationals or non-resident Indians (NRIs). If a business pays a vendor outside of India, withholding tax applies. The payer withholds a portion of the payment to meet tax obligations.

Timing of Deduction

- TDS (Tax Deducted at Source): TDS is deducted at the source, meaning it is withheld at the time the payment is made. If a business is paying salary, interest, or any other form of income, TDS is subtracted and paid to the government at the time of the actual transaction.

- Withholding Tax (WHT): In contrast, withholding tax is deducted in advance, even before the payment is made to the recipient. The payer sets aside a portion of the payment for tax purposes before releasing the funds to the payee. This ensures that the tax liability is cleared before the payee receives the payment.

Withholding Tax Certificate

In India, a withholding tax certificate is a document acknowledging the deduction of taxes at the source. It is issued by the payer to the payee, confirming the amount withheld from payments made. This certificate is crucial for the recipient to claim credit for the deducted tax while filing income tax returns.

It includes details such as the payer and payee's information, the amount paid, the applicable tax rate, and the actual tax withheld. This certificate serves as evidence of tax compliance and ensures transparency in financial transactions, facilitating accurate reporting and adherence to regulatory requirements in India's taxation framework.

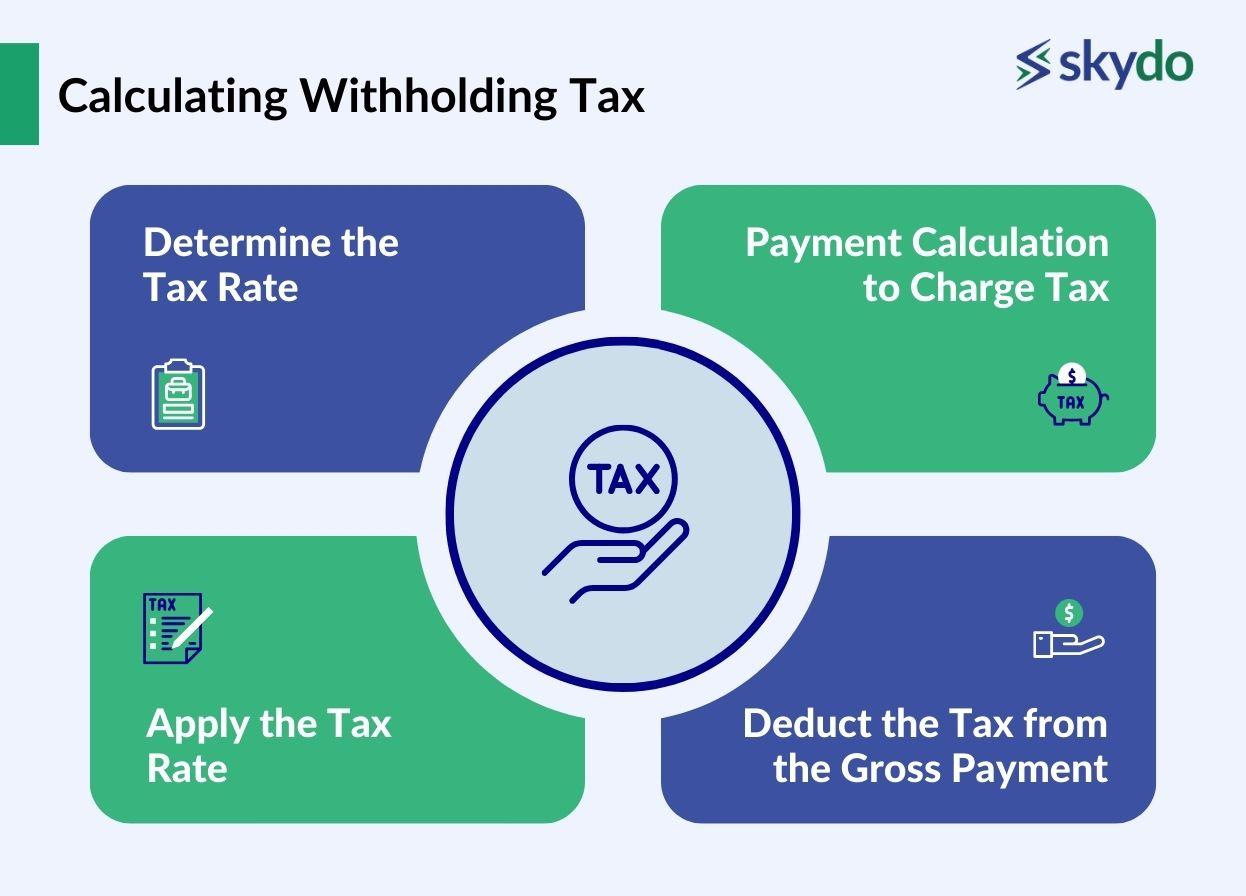

Calculating Withholding Tax

Calculating withholding tax involves a series of steps to ensure that the appropriate amount of tax is deducted from a payment. Here's a breakdown of the process:

- Determine the Tax Rate: The first step is to identify the applicable tax rate. This rate is determined based on the type of income and the residential status of the recipient. Different types of income may have different tax rates, and the residency status of the recipient plays a role in determining the withholding tax rate.

- Payment Calculation to Charge Tax: The next step is to calculate the amount of income on which the tax will be charged. This involves assessing the total payment or income subject to withholding tax.

- Apply the Tax Rate: With the tax rate and the income amount in hand, the next step is to apply the tax rate. Multiply the payment or income by the determined tax rate. This multiplication yields the withholding tax amount — the portion that needs to be withheld from the total payment.

- Deduct the Tax from the Gross Payment: The final step is to deduct the calculated tax amount from the gross payment. The gross payment is the total amount before any taxes are applied. Subtracting the withholding tax from the gross payment gives the net income that will be paid to the recipient.

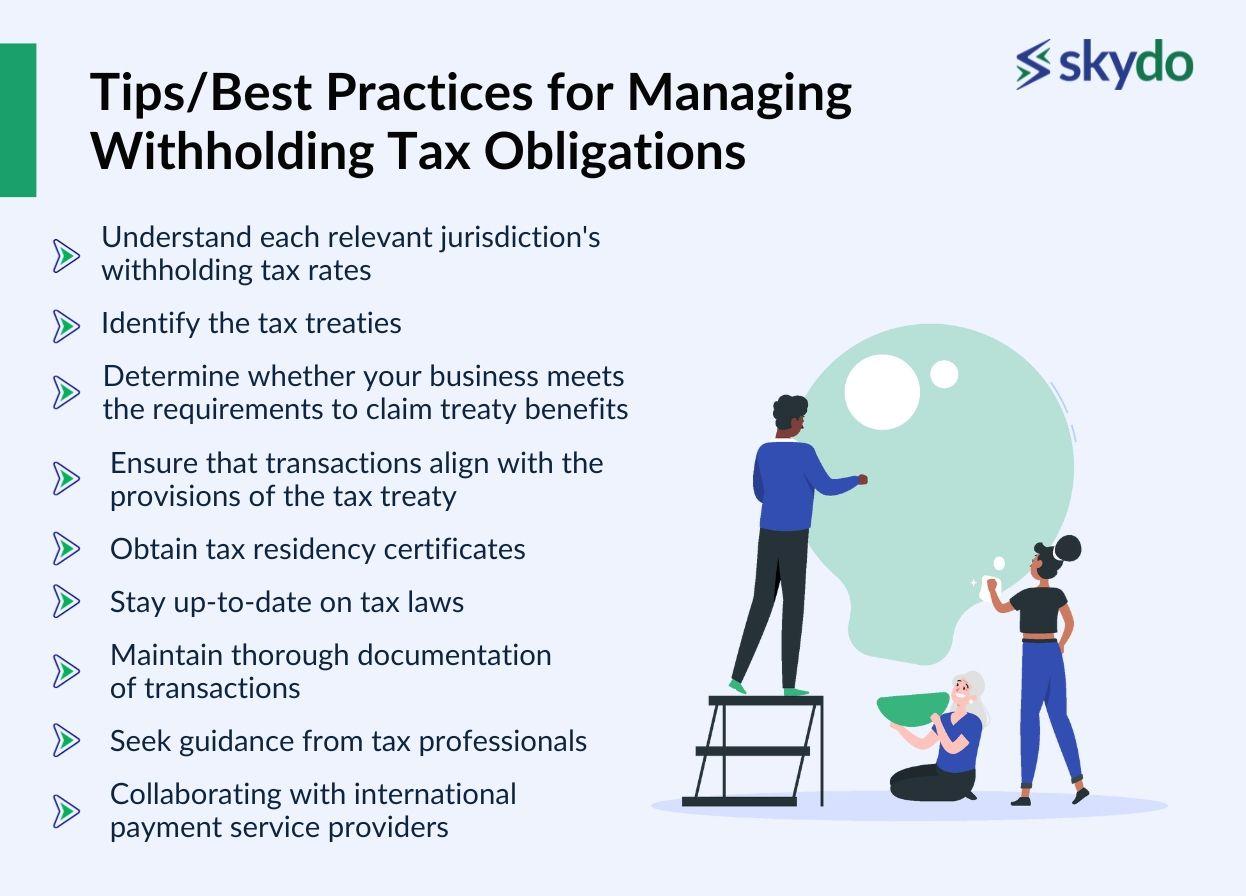

Tips/Best Practices for Managing Withholding Tax Obligations

The following tips can help overcome the complexities of international tax laws, varying tax rates, and evolving regulations concerning withholding tax.

- Comprehensively understand each relevant jurisdiction's withholding tax rates, thresholds, and reporting obligations.

- Identify the tax treaties in force between the countries involved in the transaction by consulting the official tax authorities.

- Determine whether your business meets the requirements to claim treaty benefits. It involves satisfying conditions such as residency, permanent establishment, or specific business activities outlined in the tax treaty.

- Ensure that transactions align with the provisions of the tax treaty and consider the nature and timing of income recognition and documenting the applicable treaty provisions.

- Obtain tax residency certificates or other relevant documentation to establish eligibility for treaty benefits.

- Stay up-to-date on tax laws as they are subject to frequent changes, and non-compliance can result in penalties and reputational damage. A business may face significant fines for failing to deduct and remit the appropriate withholding tax amount.

- Maintain thorough documentation of transactions, including invoices, receipts, and relevant tax forms.

- Seek guidance from tax professionals specialising in international tax matters to navigate the complexities of withholding tax obligations.

- Collaborating with international payment service providers like Skydo can streamline the payment process, reduce transaction costs, and assist in managing withholding tax requirements.

International Payment Service Providers and Withholding Tax

Payment service providers are crucial in helping businesses navigate withholding tax issues when engaging in international transactions. They often offer built-in tools for calculating and deducting withholding tax from payments, ensuring accuracy and compliance.

They also provide reporting functionalities that generate comprehensive tax reports, simplifying documentation. Additionally, they may offer tax advisory services or collaborate with tax experts to navigate complex tax regulations.

This way, you can safeguard your business’s financial interests, maintain regulatory compliance, and foster successful international business relationships.

Frequently Asked Questions

Q1. How might currency fluctuations affect my withholding tax obligations as an IT service provider?

Ans. Withholding tax is typically calculated based on the payment amount in the local currency. Exchange rate fluctuations can affect the tax liability.

Q2. How can I determine if a client's country has a tax treaty with my country to avoid double taxation?

Ans. You can refer to both countries' official tax authorities' websites to determine if a client's country has a tax treaty with your country. Alternatively, you can seek assistance from tax professionals who can analyse the specific treaty provisions applicable to your situation.

Q3. What are the consequences of non-payment of withholding tax?

Ans. Non-payment of withholding tax leads to severe consequences, including penalties and legal actions. It can result in financial losses, reputational damage, and complications with tax authorities, impacting a company's operations.

Q4. How does the nature of my IT export services affect the withholding tax? Are there specific exemptions I should be aware of?

Ans. The nature of your IT export services can impact the applicability of withholding tax and potential exemptions. Some countries may have specific provisions or exemptions for certain types of services or income.

Q5. What role can a global payment service provider play in helping me manage my withholding tax obligations?

Ans. A global payment service provider facilitates accurate calculation, deduction, and withholding tax reporting. They may provide built-in tools for tax calculations, generate tax reports, and offer compliance support. Collaborating with a reputable payment service provider, like Skydo, can streamline your payment processes and ensure compliance with withholding tax regulations across different jurisdictions.

Q6. What is the due date to file the Withholding returns?

Ans. The due date to file withholding returns is crucial; it typically falls within a month after the end of the quarter in India.

Q7. What is the Withholding tax payment due date?

Ans. Withholding tax payment is due on or before the 7th day of the month following the month of deduction, as per Indian tax regulations.

Q8. How is the assessment of Non-Resident Indians done?

Ans. Assessment of Non-Resident Indians involves evaluating their global income and determining tax liability based on applicable tax rates and treaties.

Q9. Who is responsible for withholding tax?

Ans. The entity making payments is responsible for withholding tax, ensuring deduction, and remittance to the government per the specified rates.

Q10. Which incomes are subject to withholding tax?

Ans. Various incomes, such as salaries, interest, dividends, and royalties, are subject to withholding tax, serving as a mechanism to collect tax at the source before funds are disbursed.