FIRC Full Form & Meaning: A Complete Guide for Indian Exporters, Freelancers & Businesses

Updated: 14th November 2025

Foreign Inward Remittance Certificate (FIRC) is a key term for anyone in India receiving payments from abroad, be it exporters shipping goods overseas or freelancers offering services to international clients.

Are you dealing with international payments and confused by terms like FIRC? If you’ve ever received money from abroad for your business or freelance work, you might have been told to get a FIRC. Don’t worry – you’re not alone in finding this acronym puzzling. In this conversational guide, we’ll demystify Foreign Inward Remittance Certificates (FIRC) – explaining what they are (including the full form and meaning), why they’re important, who needs them, and how to obtain one. By the end, you’ll know exactly why FIRC matters for Indian exporters, freelancers, small businesses, and even accountants handling cross-border transactions. Plus, we’ll share tips on making the whole process much easier (hint: there are modern solutions that do the heavy lifting for you). Let’s dive in!

What is FIRC? (Full Form and Definition)

Let’s start with the basics: FIRC stands for Foreign Inward Remittance Certificate. It’s essentially an official document from an Indian bank that confirms you’ve received a payment from abroad. Think of it as a receipt or proof of an inward remittance (foreign money transfer) into your Indian bank account.

In practical terms, a FIRC contains details of the foreign payment you received – such as the amount in foreign currency and INR, who sent the money (the sender’s name and country), who received it (your name/business name), the date, and the purpose of the payment. It’s issued by your bank (specifically, banks authorized to deal in foreign exchange, known as AD Category I banks) whenever you receive money from overseas.

In simpler words: if a client overseas wires you funds for an export or a freelance project, the FIRC is the document from your bank saying “Yes, we’ve got the money from abroad, and here are the details.” It’s an official proof that foreign funds landed in India into your account.

Quick note: Sometimes people use “FIRC” loosely to also refer to similar documents like a foreign inward remittance advice (FIRA). Essentially, all these serve the same purpose – proving that an international payment was received. We’ll explain the differences in a bit, but generally if someone asks for a FIRC, they mean the proof of a foreign payment credit.

Why is FIRC Important?

Whether you are an Indian exporter, a freelancer providing services globally, or a small business owner, obtaining a FIRC (or its equivalent advice) for your foreign earnings is very important. Here are the key reasons why a FIRC matters so much:

- ✔️ Regulatory Compliance: A FIRC ensures you meet the RBI and FEMA regulations for foreign exchange transactions. It’s an official record of your inward remittance, which keeps you on the right side of Indian law. Authorities like the RBI, Income Tax Department, or DGFT can ask to see proof of foreign payments, and a FIRC is the recognized document for that. Essentially, it legitimizes your foreign income and declares, “This money is legal and reported.”

- ✔️ Proof of Payment & Audit Trail: The FIRC provides a solid paper trail for the money you received from abroad. If your accounts are being audited or you need to show income sources (for instance, during tax assessments or bank credit evaluations), a FIRC clearly shows that a particular sum came from overseas and for what purpose. It’s like having a signed receipt that the funds came in via official banking channels. This transparency can be invaluable if there’s ever any question about where a credit in your bank account came from.

- ✔️ Claiming Export Incentives & GST Refunds: For exporters of goods and services, government benefits often hinge on proof of foreign currency realization. Many export promotion schemes (such as duty drawback schemes, the RoDTEP scheme, etc.) and GST tax refunds on exports require evidence that you actually received payment in foreign currency for your export. A FIRC (or its modern replacements like FIRA/e-BRC) is usually required when you apply for these incentives or refunds. Without it, you might miss out on tax exemptions, GST refunds, or other incentives because you can’t prove the payment was received. In short, no FIRC can mean no export benefits – a costly miss for any exporter.

- ✔️ Taxation Clarity: While the FIRC itself isn’t a tax document and receiving an inward remittance isn’t a tax in itself, having FIRCs can help during taxation processes. For instance, if you earn in foreign currency, those earnings might be eligible for certain income tax exemptions or benefits (export income is often treated favorably). A FIRC helps you substantiate any claim that the income was indeed from exports or foreign clients. It essentially backs up your case if you claim deductions or need to show foreign income in your tax returns. (Note: The FIRC does not mean you owe tax; it’s just proof of foreign income. The taxation will depend on the nature of income, but at least with a FIRC you have the documentation ready.)

- ✔️ Business Credibility & Easy Banking: Producing FIRCs can boost your credibility with financial institutions or partners. Because a FIRC is issued by a bank, it’s often seen as a sign of legitimate business activity. For example, if you apply for a business loan or seek investment, being able to show a history of foreign remittances (supported by FIRCs/FIRAs) can strengthen your case – it demonstrates you have bona fide international business. Similarly, if you’re dealing with overseas clients or online marketplaces, having proper remittance documents can make compliance checks or account verifications smoother. It shows you’re organized and transparent in your operations.

In summary, a FIRC is more than just a piece of paper. It’s crucial for compliance, unlocking financial benefits, and keeping clean records of your foreign income. In India’s regulated foreign exchange environment, this certificate (or its digital equivalent) becomes a cornerstone for anyone transacting internationally.

Who Needs a FIRC?

Now that we know why it’s important, you might wonder: “Do I actually need a FIRC?” If you fall into any of the following categories, the answer is likely yes:

- Exporters of Goods: If your business exports physical products from India and you receive payments from foreign buyers, you will need FIRCs/FIRAs for those payments. These are later used to close export documentation and claim export incentives.

- Exporters of Services: This includes freelancers, IT/Software service providers, consultants, designers, or any individual offering services to clients abroad. When you get paid in foreign currency (USD, EUR, etc.) for your service, that inward remittance should be accompanied by a FIRC. Even if you’re a solo freelancer tutoring international students or a small agency serving overseas clients, an FIRC is your proof of income from abroad.

- E-commerce Sellers & Remote Workers Paid from Abroad: If you run an online business (like an e-commerce store) that has customers paying in foreign currency, or if you are a remote employee/contractor for an overseas company receiving salary in foreign currency, you’ll need FIRCs as evidence of those international payments.

- Anyone Claiming Export-Related Benefits: If you plan to claim any government benefit tied to exports (GST refunds, duty drawbacks, etc.), the authorities will ask for FIRCs or related proof. So even a startup or individual that normally might not bother with the paperwork will need to obtain the FIRC when it’s time to claim those benefits.

- Foreign Investments Received: Slightly different scenario, but worth mentioning: if your company receives foreign direct investment (FDI) or venture capital from abroad, the bank will issue a FIRC for that inflow too. Regulators require it for tracking such capital investments. So, startups raising funds from an overseas investor also end up needing a FIRC for those investment remittances.

In a nutshell, any Indian individual or business receiving money from outside India should obtain a FIRC for each such inward payment. This spans everyone from large export firms to freelance graphic designers paid via PayPal. It’s a best practice even if not mandatory in every case, because it’s your safety net and proof if questions arise later.

FIRC in India: RBI Guidelines and the Switch to FIRA

It’s important to understand how FIRCs are handled in India today, because there have been regulatory changes in the past decade. Historically, banks issued a physical FIRC on security paper for every foreign inward remittance received against exports. However, since 2016, the RBI changed the process for most cases. Let’s break down what that means:

- Physical FIRC Discontinued for Exports: In 2016, the Reserve Bank of India introduced the Export Data Processing and Monitoring System (EDPMS) to digitize export transaction tracking. With this change, RBI directed banks to stop issuing physical FIRCs for export payments. Instead, for general export remittances (payments for export of goods or services), banks now issue a Foreign Inward Remittance Advice (FIRA) or Statement (FIRS) on the bank’s letterhead, or simply update the transaction in the EDPMS system. In other words, for most export-related payments, the traditional FIRC document has been replaced by a digital advice that contains the same information and serves the same purpose as FIRC used to.

- FIRC Reserved for FDI/FII Transactions: Does that mean FIRC is gone completely? Not exactly. Banks still issue “FIRC” in certain special cases – primarily for foreign investments, such as Foreign Direct Investment (FDI) or Foreign Institutional Investment (FII) coming into India. So if your inward remittance is related to, say, an overseas investor buying equity in your company, the bank would issue a FIRC to record that capital inflow (since that’s not an export of goods/services, but an investment). But if you’re exporting services or software and receiving client payments, you will likely receive a FIRA/FIRS rather than a traditional FIRC. Many bankers and businesses still loosely call it “FIRC” out of habit, but technically it might be an advice document.

- Authorised Dealer (AD) Banks: As mentioned earlier, only banks licensed as AD Category I can issue these certificates. RBI’s guidelines specify that AD Cat-I banks (major banks authorized to deal in forex) are the ones who provide FIRC/FIRA. Typically, when you receive a foreign payment into your account, your bank – if it’s an AD bank – will generate the necessary advice or certificate. If you receive the funds through an intermediary (like a payment gateway or a fintech platform), the final credit still lands in an AD bank which will issue the FIRC or equivalent. For example, if a service like Wise or Payoneer routes a payment to you via their partner bank in India, that partner bank (HDFC, Yes Bank, etc. in many cases) will be the one to issue the FIRA/FIRC. Some services like Stripe, provide a payment advice which you need to share with the bank to get your FIRC. The key point: the certificate always comes from an Indian bank, not the foreign sender.

- Purpose Codes and Reporting: Whenever an inward remittance comes in, banks in India also report the details to RBI via EDPMS, using specific purpose codes for why the money was received. The FIRC or FIRA will typically include the purpose code or description (e.g., export of IT services, freelance programming services, consultancy fee, etc.), which helps regulators track the nature of foreign exchange inflows. It’s important to give your bank the correct purpose code when you receive a payment, because an incorrect code can cause compliance issues or delays. For example, an export payment might use a code like P0104 (for services export) or P0102 (for goods export payment after shipment) – using the wrong one might lead to confusion or even rejection of the remittance by the bank.

- FIRA vs FIRC – Don’t Get Confused: The bottom line is that for most readers (exporters/freelancers), when you ask your bank for a proof of the foreign payment, you will get a Foreign Inward Remittance Advice (FIRA), which is functionally the same as what was earlier known as FIRC. Many people and even banks casually still use the term “FIRC” when referring to these advices, so it’s not wrong to say “get a FIRC from the bank” even if technically the document title might read FIRA. Just remember that if a bank tells you “we don’t issue FIRC anymore,” it usually means they issue the advice or digital certificate instead, which fulfills the same requirements. Only if your transaction is related to FDI or certain equity investments will an actual FIRC (in the strict sense) be issued. For all other foreign receipts, a FIRA or similar letter is issued and is accepted by authorities just as a FIRC would be.

What is an e-FIRC?

You might also have seen the term e-FIRC. This is a bit tricky because e-FIRC isn’t a separate document you receive in hand – it’s more of a concept/number in the background banking systems.

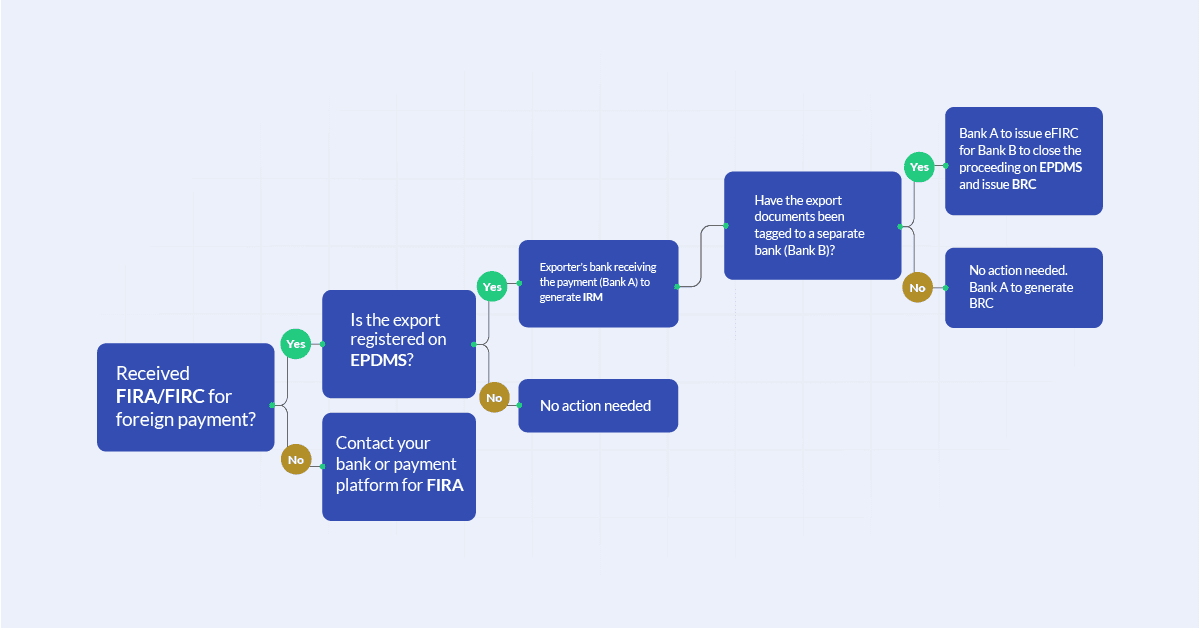

- Electronic FIRC Number: When banks stopped issuing paper FIRCs, the process went digital via EDPMS. An Inward Remittance Message (IRM) is generated in the EDPMS when a foreign payment comes in, which is essentially the digital record of that remittance. The IRM reference number is sometimes referred to as an e-FIRC number. For exporters, this e-FIRC number is used by banks and regulators to match the inward payment with the corresponding export documents (like shipping bills or Softex forms for IT exports).

- Use Case: The e-FIRC number comes into play especially if you have one bank handling your export documentation and a different bank account where the money came in. For example, say you export software and submit your export documents through Bank A, but the payment was received in Bank B. Bank B will issue an e-FIRC (a digital intimation) to Bank A via EDPMS. This lets Bank A know that the payment for the export has been received in India, so Bank A can then close the export entry and help generate the BRC. In essence, the e-FIRC ties together the paperwork and the money when two different banks are involved, ensuring nothing falls through the cracks in compliance.

For most small businesses or freelancers who use a single bank (or a single platform) to both receive funds and handle paperwork, you may not need to worry much about the term “e-FIRC” – your bank’s advice and the automated systems take care of it. Just know that it refers to the electronic trail of your remittance in RBI’s systems.

FIRC vs BRC: What’s the Difference?

Two acronyms that often come up together in export finance are FIRC and BRC. They are related but serve different purposes, and it’s important not to confuse them:

- FIRC/FIRA – Proof of Payment Receipt: As we’ve established, a FIRC (or the advice letter now issued in its place) confirms that you received a foreign payment into your bank in India. It’s about the money coming in, and it will detail the amount, sender, receiver, date, and purpose.

- BRC (Bank Realisation Certificate) – Proof of Export Realisation: A BRC is issued by banks (now usually as an electronic BRC via the DGFT portal) after the export process is fully completed. If you exported goods or services, you would have filed certain documents (e.g. a shipping bill for goods, or a Softex form for software exports) with your bank or online systems. Once you receive the payment for that export and the bank can match it to the export documentation, the bank will then issue a Bank Realisation Certificate. The BRC basically says “the payment for XYZ export has been realized (received) in India.” It includes details like the export invoice value, the amount realized in INR, the exporter’s details, the date of realization, etc.

In simpler terms, think of it as a two-step chain: First, you get the FIRC/FIRA when money comes in. Then, that leads to a BRC which connects the money to a specific export transaction.

For example, suppose you shipped 100 units of a product on a certain date (your shipping bill records this) and later you got USD 1,000 for that shipment. When the $1,000 arrives, your bank gives you a FIRA confirming receipt. You then inform the bank (or it knows via systems) that this $1,000 corresponds to that shipping bill. The bank updates the records and an e-BRC is generated which you can download from the DGFT portal as proof that the export transaction is closed with payment received. Why is BRC needed? Because to claim many export incentives or to fulfill export obligations, you have to show BRCs to the government – it proves you not only exported but also got paid for it.

- Do service exporters or freelancers need a BRC? Generally, if you’re exporting services (and not under any specific obligation scheme), you won’t typically have a BRC because there was no customs shipping bill. Your FIRC/FIRA serves as the main proof of earning. BRCs are more relevant for goods exports or services routed through certain formal schemes. If you’re a freelancer doing, say, graphic design for a foreign client, you’ll just deal with FIRCs. BRC comes in if, for instance, you had to file a Softex form for a large software export through an STPI unit or something – then an e-BRC would be part of closing that loop. But for most small service transactions, BRC isn’t issued. So don’t worry if you never got one – FIRA is usually enough for your purposes.

Bottom line: FIRC (or FIRA) confirms money received; BRC confirms that money was tied to an export. Both are important for exporters of goods (first you get FIRC, then BRC to claim benefits). Freelancers and pure service exporters mostly just handle FIRCs unless they are in scenarios that require reporting exports formally.

You can use this decision tree to decide which one do you need.

FIRC Certificate Format: What Information Does it Include?

This is a sample FIRC document. All crucial remittance details have been masked for security purposes. Now let’s break the content of a FIRC down:

If you’ve never seen a FIRC or FIRA document, you might wonder what it looks like and what details it carries. While formats can vary slightly from bank to bank, a typical FIRC/FIRA document (usually a PDF or letter these days) will include the following key information:

- Remitting Bank(Sender) Details: the name of the foreign bank or intermediary that initiated the transfer.

- Remitter details: The name and often address of the person or company who sent the money from abroad.

- Beneficiary (Recipient) Details: Your name (or your company’s name) and account number that received the funds in India. It may also mention your bank’s name (the Indian bank that credited the money to you).

- Transaction Reference Number: A unique transaction ID, often the UTR (Unique Transaction Reference) or SWIFT reference number of the remittance. This helps trace the transaction in case of any queries.

- Amount Details: Both the foreign currency amount and the equivalent amount in INR that was credited to your account. For example, it might say $1,000 = ₹82,000 credited (after conversion).

- Exchange Rate: The foreign exchange rate that was applied to convert the foreign currency into Indian Rupees. This is useful for record-keeping and any conversion clarifications.

- Date of Credit: The date on which the money was received in your Indian account (and sometimes the date it was sent from abroad as well).

- Purpose of Remittance (Purpose Code): A brief description or a code indicating why the money was received. India uses specific purpose codes for all foreign transactions. For instance, code P0104 might indicate “Export of Business Services – Software”, P0802 might be “Freelance/Consultant Services”, etc. If you provided this info to the bank, it will show up on the FIRC. This is important for compliance, as it tells regulators what the nature of the transaction was. (Giving the correct purpose code when you receive the money is crucial – an incorrect code could cause compliance issues or confusion later.)

- Bank’s Confirmation: There is usually a line or sign-off in the document indicating that this is an official certificate/advice from the bank, often with an authorized signature (in digital form) or a stamp in a physical copy. Essentially, it’s the bank vouching that the above details are recorded in their books for that inward remittance.

A modern FIRA might not have the word “Certificate” on it, but it contains the same info as the old FIRC. Some banks still title it “Certificate of Foreign Inward Remittance” even if it’s a PDF. In any case, all the above details are what make it valuable – ensure everything matches your expectations when you receive one (more on that in a moment).

How to Obtain a FIRC (Procedure to Get the Certificate)

Obtaining a FIRC or FIRA for a foreign payment is not always automatic – often, you’ll need to request it from your bank. The process can vary slightly by bank, but here’s a general step-by-step guide for Indian businesses or freelancers:

1. Receive the Foreign Payment: This might sound obvious, but you can only get a FIRC after the money from abroad has credited to your bank account in India. So, first step – make sure the funds have arrived. Note down the transaction details like the date of credit, the amount in foreign currency and INR, and any reference number (UTR) if available. This info will be needed for the request.

2. Contact Your Bank to Request the FIRC/FIRA: Reach out to your bank’s branch or your relationship manager and let them know you need a FIRC (Foreign Inward Remittance Certificate) or advice for a particular transaction. Many banks have a specific form or format for this request. Depending on the bank, you might do one of the following:

- Fill out a FIRC request form (a physical form at the branch).

- Submit a written application or letter with details of the transaction.

- Some modern banks allow requests via email or online banking (for example, sending a secure message when logged in, or a dedicated request option in the net banking portal).

In your request, you’ll generally need to provide:

- Your account details: Name on account and account number that received the funds.

- Details of the remittance: Sender’s name (who sent you the money) and if possible their address or country, the date you received the money, the amount in foreign currency (and INR if known), and the UTR/SWIFT transaction number of that payment.

- Purpose of remittance: What was the payment for (e.g. freelance software development services, export of textiles invoice no.123, etc.). If you know the exact purpose code, include that, or the bank will have it from when the money came in.

- Basically, you’re helping the bank locate and verify the transaction in their system to issue the FIRC.

Tip: If your bank has a mobile app or online banking, search for terms like “FIRC request” or “Remittance Certificate” – some banks have digitized this. Otherwise, a quick email to your branch manager with the details might do the trick.

3. Provide Supporting Documents (if required): Banks might ask for some documents to ensure the request is legit and to attach as proof of the transaction’s purpose. Common ones include:

- Invoice or Agreement: If the payment was for a business transaction, attaching the invoice or contract can be helpful, especially to show the purpose and amount.

- Shipping Bill or Softex form: In case of an export of goods (shipping bill) or software export (Softex), the bank might need those details to update in EDPMS and eventually issue BRC. If you’ve already given the shipping bill to the bank earlier, they may not ask again, but be ready to provide reference numbers.

- Declaration of Purpose: Some banks have a simple declaration form where you state the purpose of inward remittance if it wasn’t captured at the time of credit.

- KYC documents: Usually not needed if your bank account is already KYC-compliant, but if you’re requesting a FIRC for a transaction in a new account or through an intermediary, they might ask for ID proof.

Not every bank will ask for all of these – often if the transaction was straightforward and coded correctly, a FIRC request might go through with just the form. But don’t be surprised if they ask for an invoice copy or such, especially for higher amounts or the first time you’re requesting.

4. Pay the Bank’s Fee (if any): Here’s the part not everyone realizes: many banks charge a small processing fee for issuing a FIRC/FIRA. The fee varies by bank but is typically in the range of ₹200 to ₹500 per certificate, plus GST. For example, one bank might charge ₹300 + taxes for each FIRC. Some banks waive it for premium account holders or in special cases, but generally expect a fee. Usually, the bank will deduct this fee from your account or ask you to pay it upfront. When you fill the request form, it might mention the fee or your branch will inform you. (As a rough timeline, after you request, it often takes around 1–2 weeks for the bank to issue the FIRC. Some get it done in just a few days, but don’t bank on it – pun intended!)

Good News: If this process sounds a bit old-fashioned, you’re right – it can be tedious. But lately, some fintech platforms and modern banking services offer FIRA certificates for free and instantly as a perk. (We’ll talk more about that in a moment when discussing easier ways.)

5. Wait for the Certificate to be Issued: Once you’ve submitted the request (and any docs and fees), the bank’s forex operations team will verify the details. They’ll match the info you gave with the actual inward remittance record. If everything checks out, they will generate the FIRC (or FIRA). Nowadays, this is usually a PDF document on the bank’s letterhead with a digital signature, which they might email to you or make available for download (some still might print it for collection at the branch if you specifically need a hard copy). The time frame can vary:

- Some banks issue within 2-3 working days.

- Others might take a week or more, especially if approvals are needed from a central office.

- If it’s been, say, 7-10 days, it’s perfectly fine to follow up with the bank politely, providing your request reference or UTR number.

Keep an eye on the email you provided (and check the spam folder just in case, since it’s often an automated email with a PDF attachment).

6. Verify the Details on the FIRC: When you finally receive the certificate/advice, do not skip this step! Carefully check all the details:

- Your name and account number – are they correct?

- The foreign currency amount and the INR amount – do they match what you expected?

- The date – is it the correct date when you got the money?

- Purpose code/description – does it correctly describe the transaction? (E.g., if you were paid for IT services, it shouldn’t accidentally say something like export of goods.)

- Sender/Remitter info – is the sender’s name recognizable and correct?

If you spot any error (typos in your name, wrong amount, incorrect purpose code, etc.), contact the bank immediately to correct it. It’s important the FIRC reflects the truth of the transaction. Banks can issue an amended FIRC if needed, but you may have to give proof of the correct info (for instance, if your name was spelled wrong, you might send a copy of your PAN or passport; if the amount in INR is off, maybe a statement copy). It’s best to catch errors early and have them fixed, so you don’t run into problems later when using the FIRC for official purposes.

7. Use the FIRC for Your Needs: Once you have the FIRC/FIRA in hand (or in email):

- Keep it in your records for compliance. If tomorrow a tax official or RBI auditor asks “hey, what’s this $1,000 in your account?”, you have the proof ready.

- Export Incentives/GST: Use the FIRC when applying for GST refunds or other export incentives. For example, if filing a GST refund for export of services, you might need to upload a copy of the FIRA as proof of foreign exchange realization. Or if claiming an incentive from DGFT, you’d quote the e-BRC details which came from that FIRA.

- EDPMS/Closure of Export Obligations: If you had any open export entries in the EDPMS (as discussed earlier), providing the FIRA to the bank will help them mark those exports as realized. In many cases, once the bank issues the advice, they themselves update the EDPMS. But it doesn’t hurt to ensure your export documents are linked – especially for goods exports, follow up that your shipping bill is closed with an e-BRC issued.

In short, use the FIRC anywhere you need to prove “I got paid from abroad for X purpose.” It’s your golden ticket for compliance and benefits.

8. Remember: One FIRC = One Transaction: If you receive multiple foreign payments, you will generally need to request separate FIRCs for each. Say you’re a freelancer who got five different payments from five clients – you’d have five FIRC documents (and possibly five fees…). Some payment aggregators or services might give a consolidated statement for multiple small payments, but banks usually treat each inward remittance as a separate record and issue individual certificates.

Getting FIRC the Easy Way (Automatic FIRC with Modern Platforms)

At this point, you might be thinking, “Wow, that’s a lot of steps and wait time just to get a certificate!” 🤯 Indeed, dealing directly with banks for FIRCs can be slow and involve charges. Here’s where fintech solutions come to the rescue.

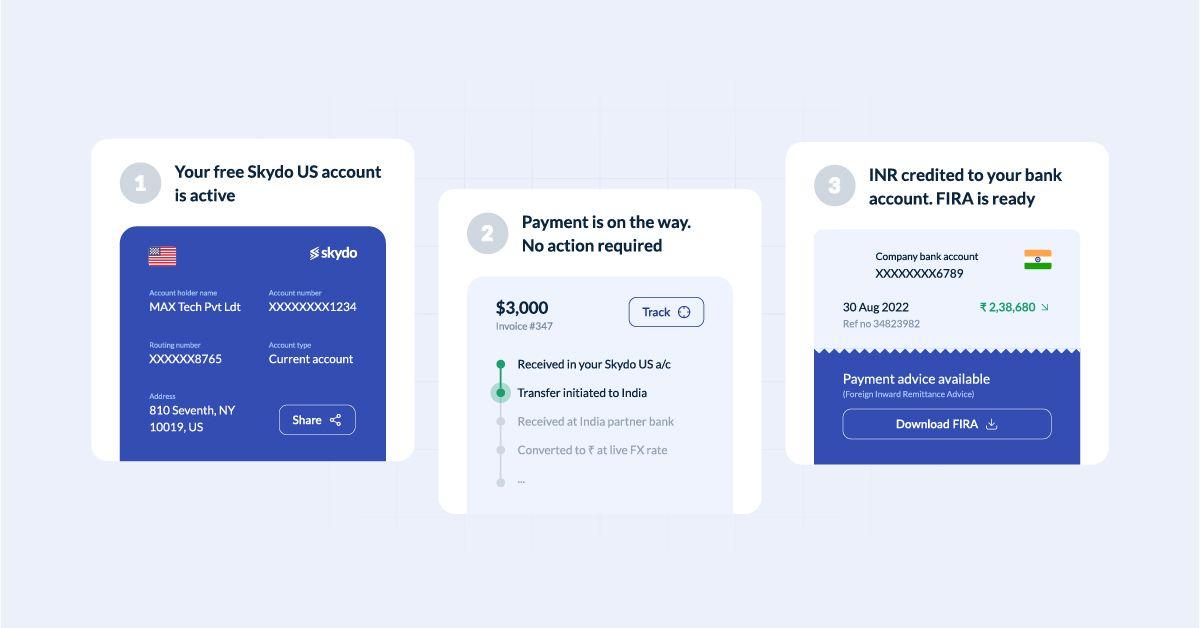

Platforms like Skydo offer a much smoother experience for handling foreign payments. For instance, when you receive an export payment through Skydo, the FIRC (or FIRA) is generated for you automatically – and at no extra cost. It’s basically built into the process. You don’t have to file separate requests or wait weeks. As soon as the payment is received and processed, you can log into your Skydo dashboard and download the remittance advice instantly. All the details (amount, purpose, etc.) are neatly recorded, compliant with RBI rules, without you lifting a finger to request it.

This kind of solution is a game-changer for freelancers and small businesses: you get paid faster (since such platforms often streamline the transfer) and you get the FIRC document instantly for each transaction. No bank queues, no follow-ups, no fees per certificate. If you’re frequently dealing with international clients, using a modern global payments platform can save you a lot of headaches when it comes to compliance paperwork like FIRCs.

Is FIRC Mandatory for GST Refunds and Other Purposes?

One common question that arises is whether having a FIRC is mandatory for certain claims, especially the GST refunds on exports. The short answer: Yes, if you’re claiming a refund or benefit on the basis of an export, you’ll need proof of foreign inward remittance – usually in the form of FIRC/FIRA.

When you export goods or services from India, those exports are considered “zero-rated” for GST, meaning you don’t have to pay GST on the sale. However, you might have paid GST on inputs (input tax credit) and you’d want to get that refunded since your output was zero-rated. To process this refund, the tax authorities require evidence that you indeed received payment in convertible foreign exchange for that zero-rated supply. FIRC is that evidence. It authenticates that the money entered India’s banking system against your export.

Here’s how it typically works for a GST refund on exports:

- You file a refund application on the GST portal for the unutilized input tax credit (or IGST refund if you paid IGST on export).

- Along with the application, you need to attach supporting documents: the FIRC/FIRA for the payments received, the export invoice, and in case of goods, the shipping bill (which should show “exported under bond/LUT” if no IGST was paid).

- The details on the FIRC (amount, date, payer) should match with what you’re claiming for the export invoice in question.

- The GST officer will verify these documents. Essentially, they want to see that foreign exchange came in for the export, as declared.

- If all is in order, the refund is processed to your bank account.

If you don’t have a FIRC to show and try to claim a GST refund, the claim likely won’t be accepted because you haven’t furnished proof of realization of export proceeds. It’s a critical document for this purpose.

Similarly, for other schemes like certain subsidies or duty credits for exporters, the requirement is often to show the BRC or FIRC to prove that the export was completed monetarily.

For freelancers or service exporters who may not deal with GST refunds (if, say, you’re below GST threshold or exports of services under LUT), it might not feel “mandatory” day-to-day. But consider that under income tax or any scrutiny, you’d still want that FIRC as proof of earnings. Also, tomorrow if you do register for GST and want to claim something, having FIRCs from the past means you’re prepared.

In summary: For compliance and benefits, having FIRCs is effectively mandatory. It’s part of the paperwork you should maintain if you earn in foreign currency. And specifically for claiming GST refunds on exports, a FIRC is usually non-negotiable.

Conclusion: Making FIRC Hassle-Free

Dealing with cross-border payments can seem daunting at first – there’s compliance to consider and extra paperwork like FIRCs to manage. But understanding the ins and outs of FIRC means you’re now equipped to ensure every dollar, euro, or pound you earn overseas is properly documented without stress.

The good news is that you don’t have to wrestle with these processes alone. As the world of international business is evolving, so are the tools to manage it. Your focus should be on growing your business or honing your craft – not on chasing bank certificates. That’s exactly why platforms like Skydo exist: to simplify global payments and the red tape that comes with them.

With Skydo, for example, you can enjoy seamless international payments with no hidden fees, and every time you receive a cross-border payment, an auto-generated FIRC (remittance advice) is instantly available for you. No special requests, no fees per certificate, no delays – it’s just there, ready to download when you need it. This means you remain fully compliant with RBI rules effortlessly, and you can devote your energy to what truly matters: delivering great products or services and scaling your venture.

In conclusion, a Foreign Inward Remittance Certificate is a vital piece in the jigsaw puzzle of doing business globally from India. It ensures your hard-earned foreign revenues are officially recognized and securely in your pocket (or rather, your bank account). By staying informed and leveraging modern solutions, you can turn what used to be a cumbersome process into a minor footnote in your workflow. Happy exporting (or freelancing), and may all your international payments come with an easy FIRC! 🚀

What is FIRC?

FIRC or Foreign Inward Remittance Certificate, is a document issued by banks as proof of receiving international payments. Until 2016, AD Category I Banks were authorised to issue FIRCs to exporters for receiving international payments. With the introduction of EDPMS, RBI issued guidelines for banks to stop issuing FIRCs for export collections. Banks now issue FIRAs (Foreign Inward Remittance Advice) instead of FIRCs for export collections.

What does FIRC stand for?

How to get FIRC from bank?

What is FIRC and BRC

Which bank will issue FIRC?

How to get FIRC from HDFC bank?

Can we download FIRC online?

What should I do if there’s an error or delay in my FIRC?

Can I get a FIRC for an old transaction?