Skydo: A Game-Changer in Freelance Finance

Have your freelance earnings stagnated over months and you struggle to achieve your financial goals?

Chances are you need a better system to track your income and expenses. This involves using real-time insights to plan and manage your finances.

Skydo offers real-time payment tracking and quick insights to achieve your financial goals.

This blog explains how you can use Skydo to increase your freelance earnings and meet your financial goals.

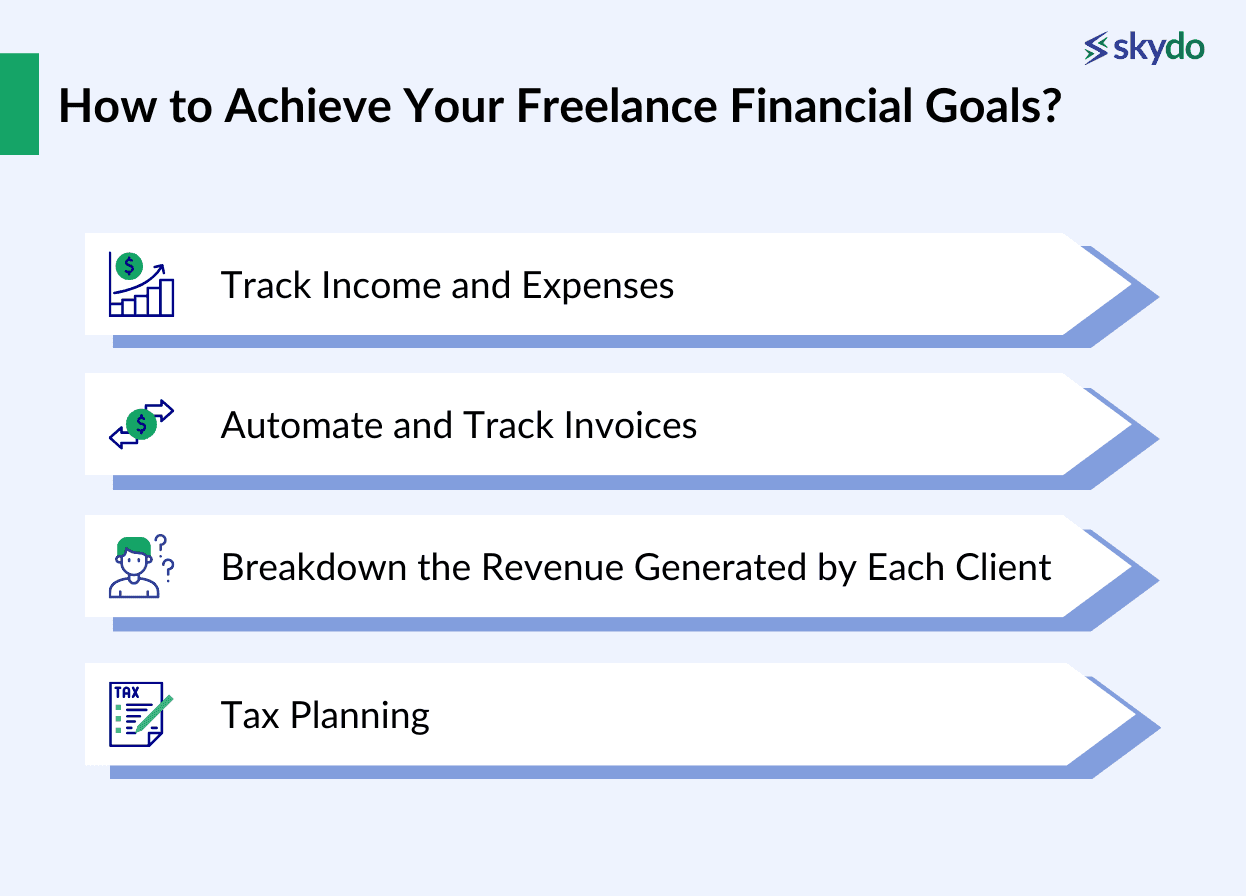

How to Achieve Your Freelance Financial Goals?

While freelancing offers flexibility and unlimited growth potential, the main concern is income instability. Here are some ways you can reduce financial risk and achieve your financial goals.

1. Track Income and Expenses

One way to attain stability is to “Diligently track your income and expenses to maintain a budget,” says Nash David, a freelance writer.

Malay Damania, a business coach for MSMEs says, “Tracking financials is like keeping a scoreboard in a game. It offers motivation to grow your business.”

2. Automate and Track Invoices

Brian Miller, a career coach, recommends freelancers to “Create a payment system using software, apps or spreadsheets to organise receipts, payments, invoices, and deductions.” It helps monitor cash flow and understand tax liability, which helps you achieve financial goals faster.

3. Break down the Revenue Generated by Each Client

Jennifer Gregory, a freelance technology writer, suggests analysing how much each client makes up of your total freelance earnings. She says, “Check each client's percentage to understand how they impact your income and, if they were to leave, then how you can replace that income.” This helps manage risk and boost stability.

4. Tax Planning

Will Brooks, a leadership and business career coach, recommends calculating your tax liability beforehand and setting aside the amount for tax, investment, and retirement to manage your finances. This helps you analyse expenses and prepare financial goals accordingly.

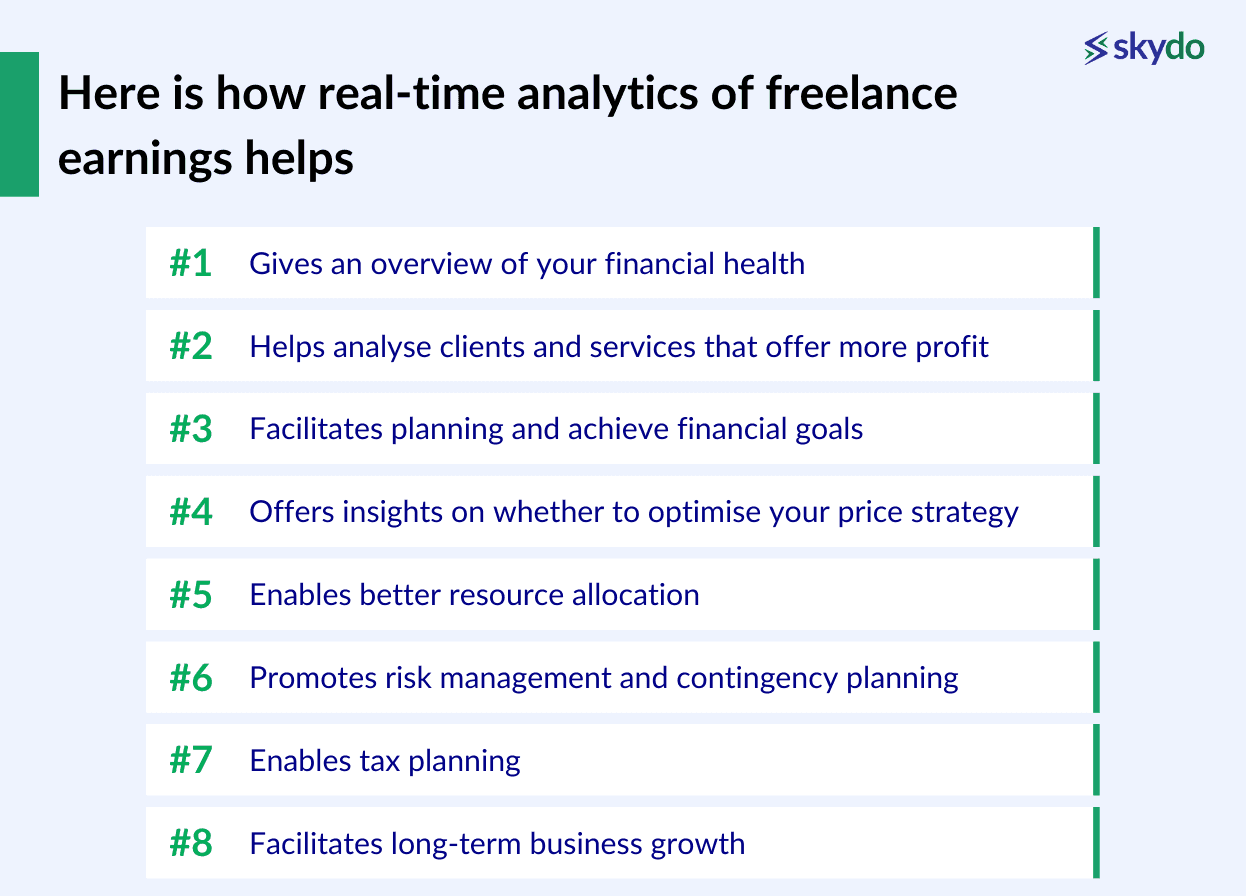

All these suggestions have one thing in common—tracking and analysing freelance payments to understand your profits and liabilities. Here is how real-time analytics of freelance earnings helps.

All these suggestions have one thing in common—tracking and analysing freelance payments to understand your profits and liabilities.

This is where you need Skydo.

Introducing Skydo: A Game-Changer in Freelance Finance

A comprehensive payment platform like Skydo gives you real-time insights about your freelance earnings.

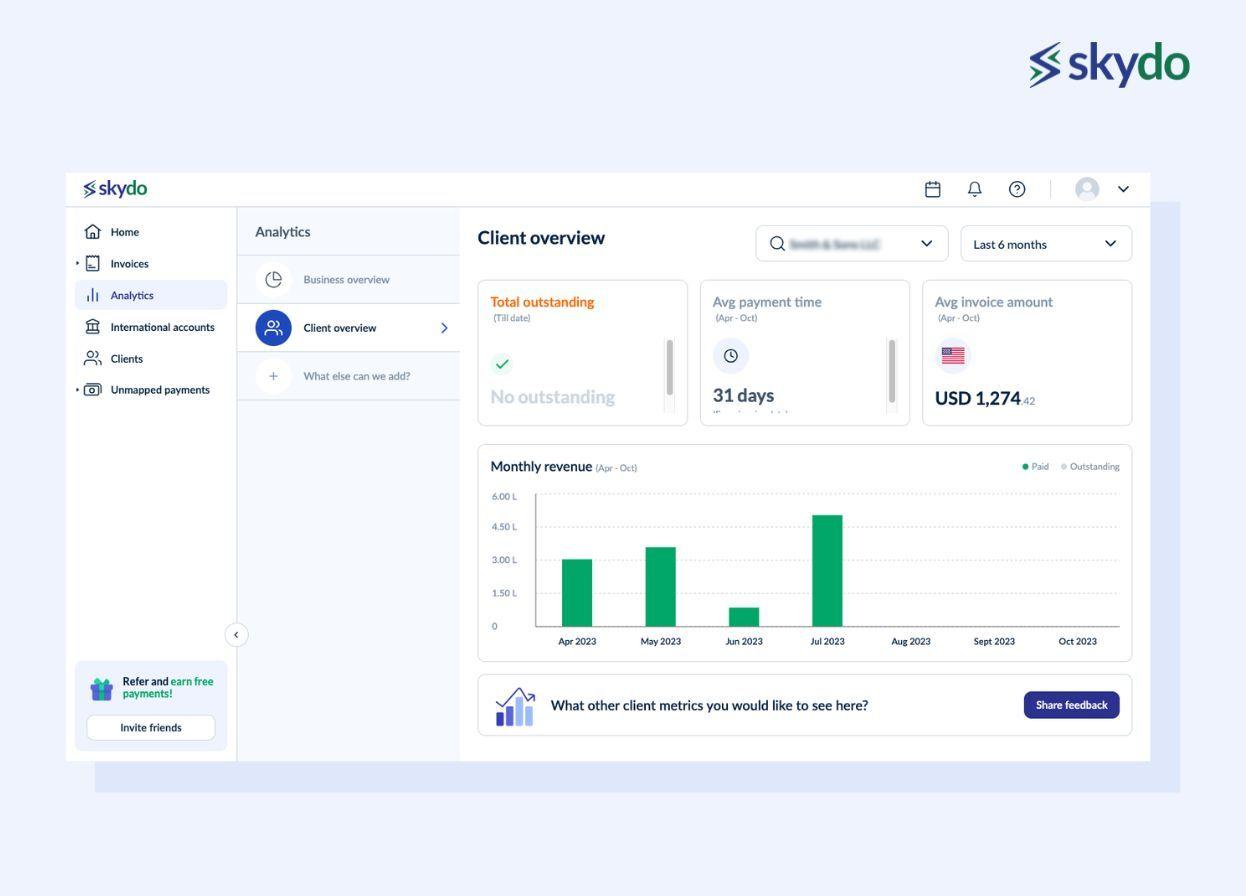

Its intuitive dashboard enables you to track foreign payment transactions and avoid payment delays.

Moreover, Skydo’s payment platform automates invoice creation, sending, tracking, and managing processes.

Achieving Financial Goals with Skydo

Here is how you can use Skydo to achieve your financial goals.

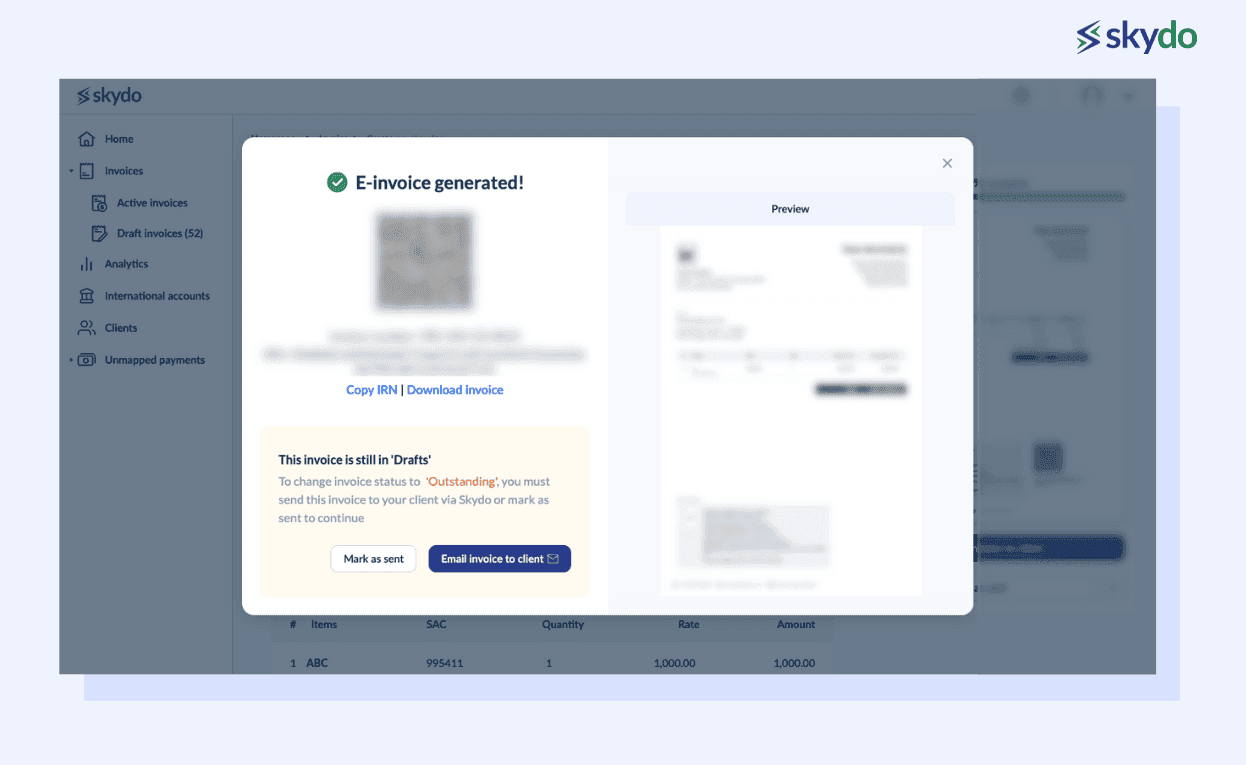

1. Send Invoices with Ease

You can create professional freelance invoices on Skydo by customising invoice templates, downloading them, and sending them as a PDF or e-invoice to the client.

2. Real-Time Payment Tracking

Once you send the invoice to the client, you get real-time notifications for invoice receiving, payment processing and payment completion. It helps track potential payment delays and enables you to resolve any issues.

Even if you sent an invoice to a client without using Skydo, you can still add it to the record by adding invoices@skydo.com in CC while sending an email to the client. This way, you can track, view and analyse all your freelance payments in one place.

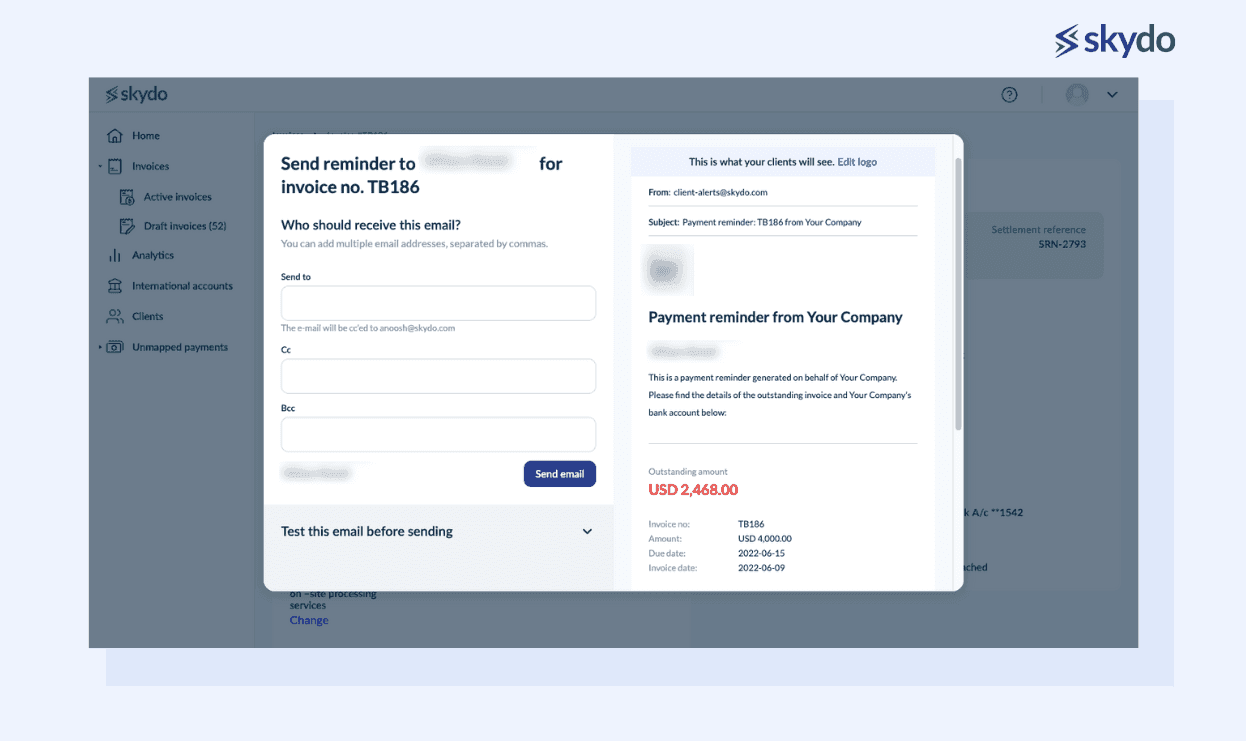

3. Automated Payment Reminders

With Skydo, you don't have to constantly chase clients through emails. You can generate payment reminders and send them to the client. Skydo tracks when the payment reminder has been viewed by the client and keeps a record of all reminders.

Timely reminders reduce the risk of delayed payments and help you achieve financial goals faster.

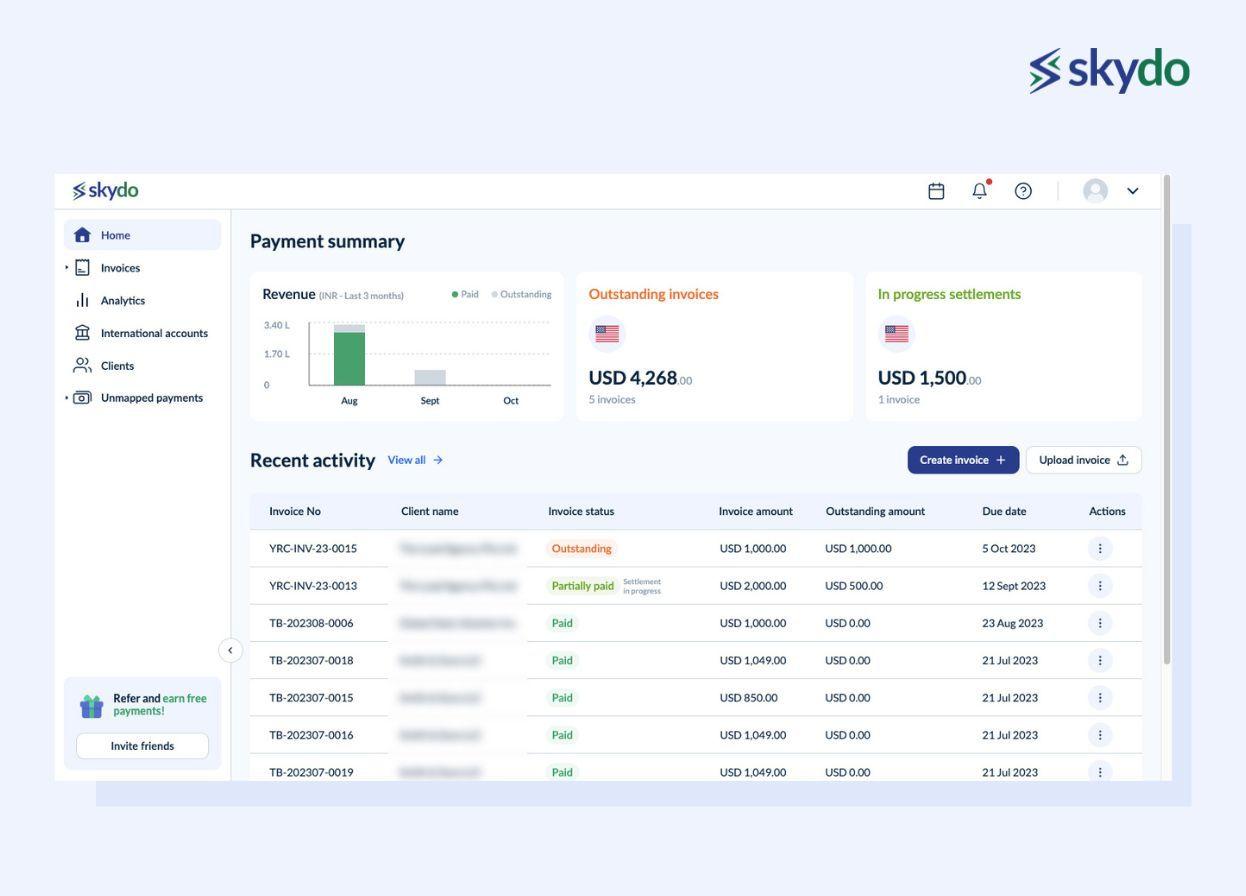

4. Robust Financial Insights

The Skydo dashboard provides an overview of all the invoices, their payment status and client details. Moreover, you can also view a visual summary of completed payments, outstanding invoices and payments in progress.

5. Analytics and Reports for Informed Decision-Making

Skydo offers a consolidated view of foreign payments across different accounts. You can leverage the data for detailed financial analytics, calculate the revenue generated from each client, and facilitate strategic financial planning.

6. Withdraw Payments Effortlessly from Freelance Platforms

You can integrate Skydo into your freelance platform accounts like Upwork, Freelancer.com, Toptal and Deel and save up to 50% on withdrawal fees.

7. Tax Compliance

Efficient tax planning and compliance are crucial to achieving your financial goals and reducing legal risks. Since Skydo records all invoices and payment details, it facilitates payment reconciliation and calculating income tax liability.

Moreover, it automatically generates FIRA for all invoices which helps claim GST refund on export of goods or services.

Conclusion

Achieving financial goals with freelancing is tricky. However, with discipline, the right strategy and efficient tools, you can maximise your savings and fulfil your goals.

Skydo is one such efficient payment platform that helps you track invoices and payment reminders in real time to optimise cash flow and boost your freelance earnings.

Sign up on Skydo today to achieve your financial goals faster!

Frequently Asked Questions

Q1. How can I do budgeting to achieve my financial goals?

Ans. You can create and maintain a freelance budget by tracking your income and expenses, opening a separate bank account for business expenses, setting a monthly limit for business and work expenses, and using steady income to pay bills with higher amounts.

Q2. How does Skydo help maximise freelance earnings?

Ans. Skydo has a flat fee structure for foreign payments and charges zero margin on currency conversion. Moreover, you can integrate Skydo into freelance payment platform accounts and reduce withdrawal fees by up to 50%. Therefore, it boosts freelance earnings and helps you attain your financial goals.

Q3. How can I use Skydo to improve my payment processes?

Ans. You can streamline your payment processes with Skydo by automating invoice creation and reminders. Moreover, you can open an international bank account within five minutes to receive foreign payments faster. Skydo also generates FIRA automatically for all invoices, which helps with tax compliance.