Get the Most Out of Your Forex Savings With Skydo

"Foreign exchange (Forex) volatility directly impacts business profitability and is the third-biggest business risk," says a 2021 KPMG survey. This statistic is relevant for all global businesses, as rapid currency fluctuations can reduce export earnings and, by association, business profitability.

Furthermore, a 2020 report reveals that Indians paid INR 263 billion in foreign exchange fees. INR 97 billion amounted to hidden exchange markup fees on currency conversions, and the remaining INR 166 billion was the total transaction fees.

Businesses lose much of their foreign earnings yearly due to currency conversion, transactions, or hidden fees. If used appropriately, such earnings can significantly impact a business's financial health.

There are two ways to save these earnings.

- Ask foreign clients to pay in Indian currency, which can be problematic

- Switch to modern payment platforms that convert your currency as per real-time exchange rates without charging unreasonable forex markup fees.

The latter is possible with Skydo. It is a comprehensive payment solution with a transparent pricing model that does not charge hidden fees and provides a real-time exchange rate based on the market benchmark.

This blog introduces Skydo's payment platform and explains how to use the FX calculator to estimate your FX savings. It further delves into the various features of Skydo that help mitigate foreign exchange risk for businesses.

Introducing Skydo

Skydo helps receive cross-border payments seamlessly and cost-effectively for businesses and freelancers. Contrary to other payment platforms, Skydo charges a fixed transaction fee for each foreign remittance, which is transparent.

Here are some of the essential features of Skydo that enable FX management and helps businesses boost FX saving:

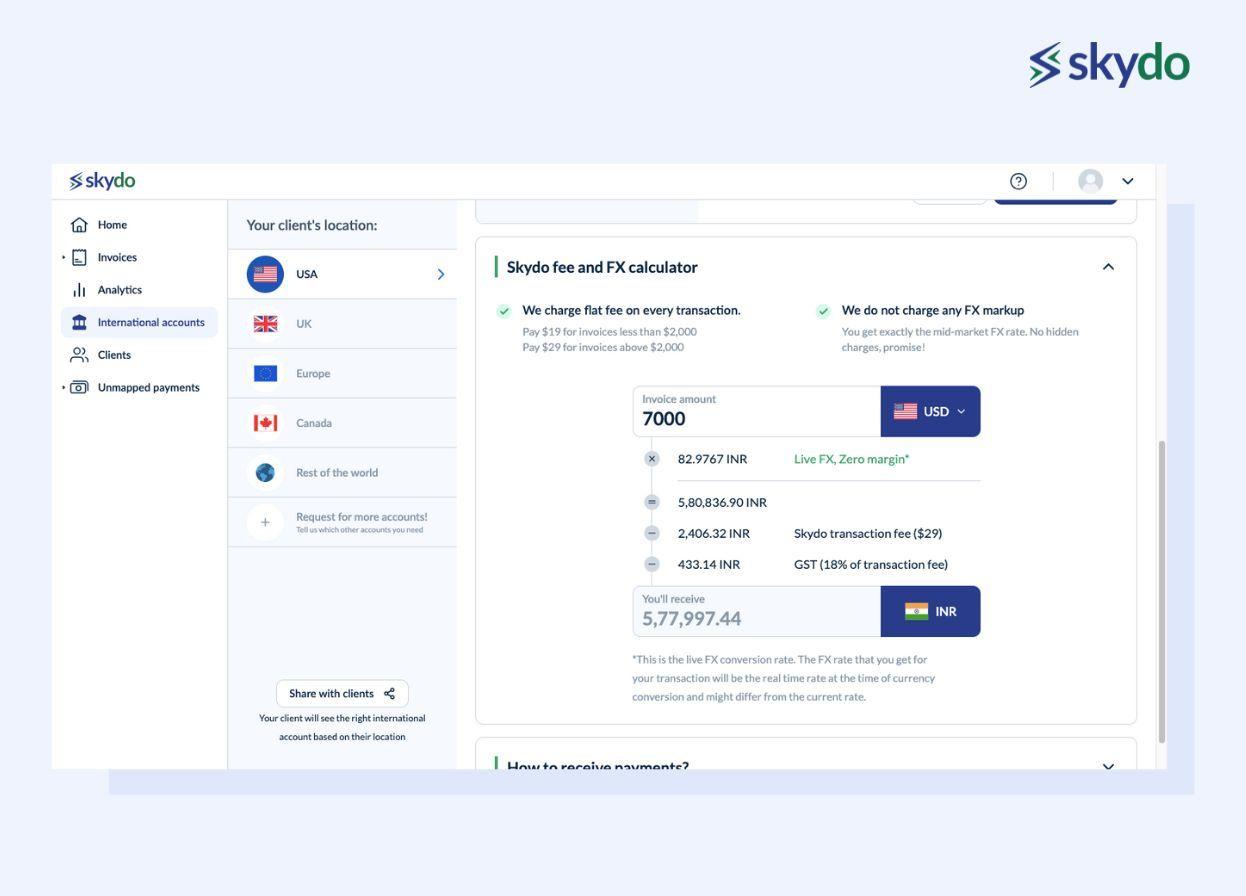

1. FX Calculator

International payment gateways like PayPal, Payoneer, and Wise charge up to a 4% conversion fee per transaction, which can significantly decrease your business profitability over time.

Additionally, it is difficult to estimate the real cost of each transaction as you may not be aware of the volume of your earnings lost in 'transaction costs'.

However, Skydo's FX calculator helps businesses estimate how much money they will get based on the transaction amount and the currency exchange rate at the time, including Skydo’s flat fee.

You can try Skydo's FX calculator to check how much you save by not using other payment methods, such as bank, PayPal, Payoneer, and Wise.

You must choose the currency in which you receive your earnings, whether USD, EUR, or CAD. Then, select your payment method/platform and enter your monthly revenue. You can see how much extra money you spend on a forex markup fee. Using Skydo for your FX savings helps you save that much amount.

For example, if your business's monthly revenue is USD 50,000, you can save up to ₹5,94,956 with Skydo which would not be the case if you used PayPal to receive international payments.

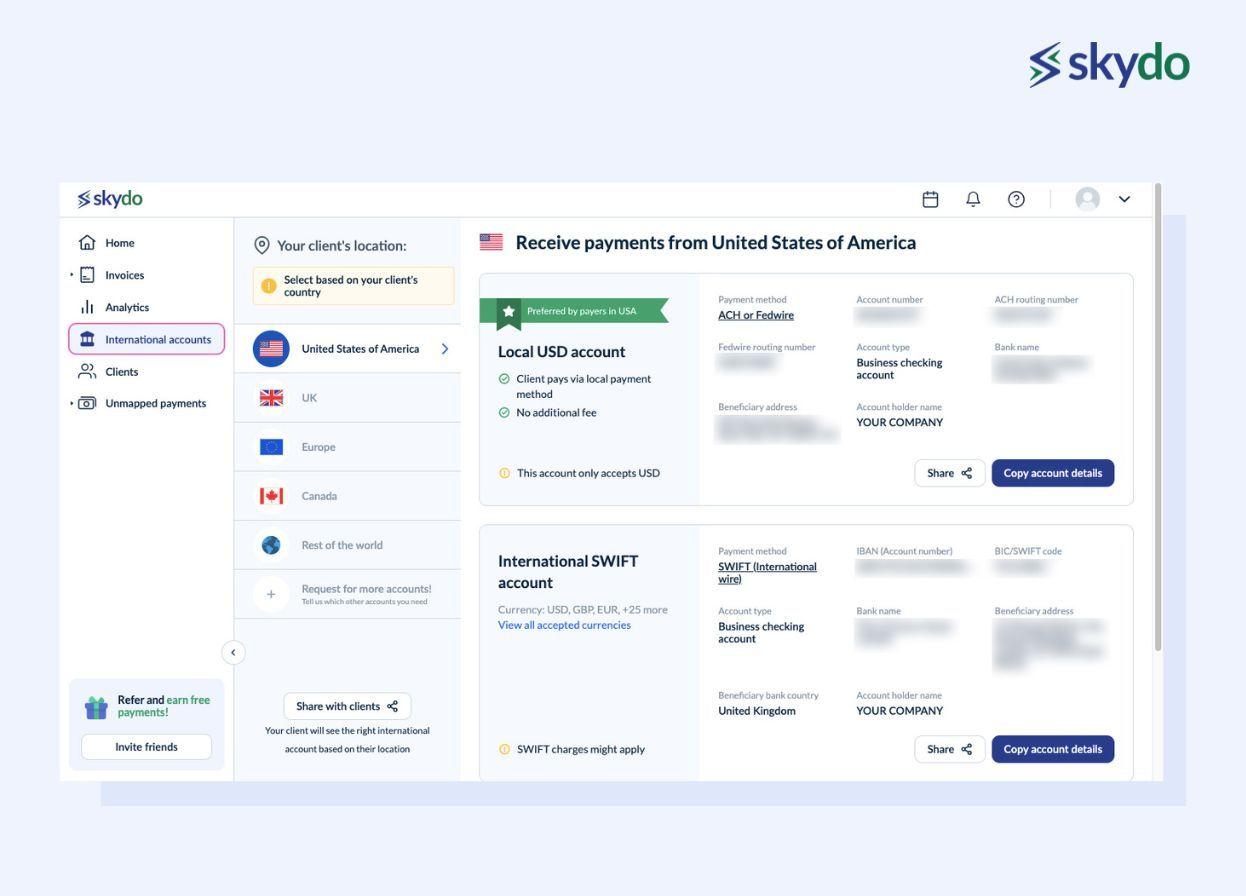

2. Multi-Currency Accounts

Skydo offers multi-currency accounts to tackle cross-border payment issues, like delayed payments.

This account is powered by SWIFT. Therefore, instead of relying on your foreign clients to follow the lengthy procedure of transferring the money to your Indian bank account and paying various fees on multiple occasions, they can simply transfer the whole payment via SWIFT into your local bank account, avoiding any unnecessary charges.

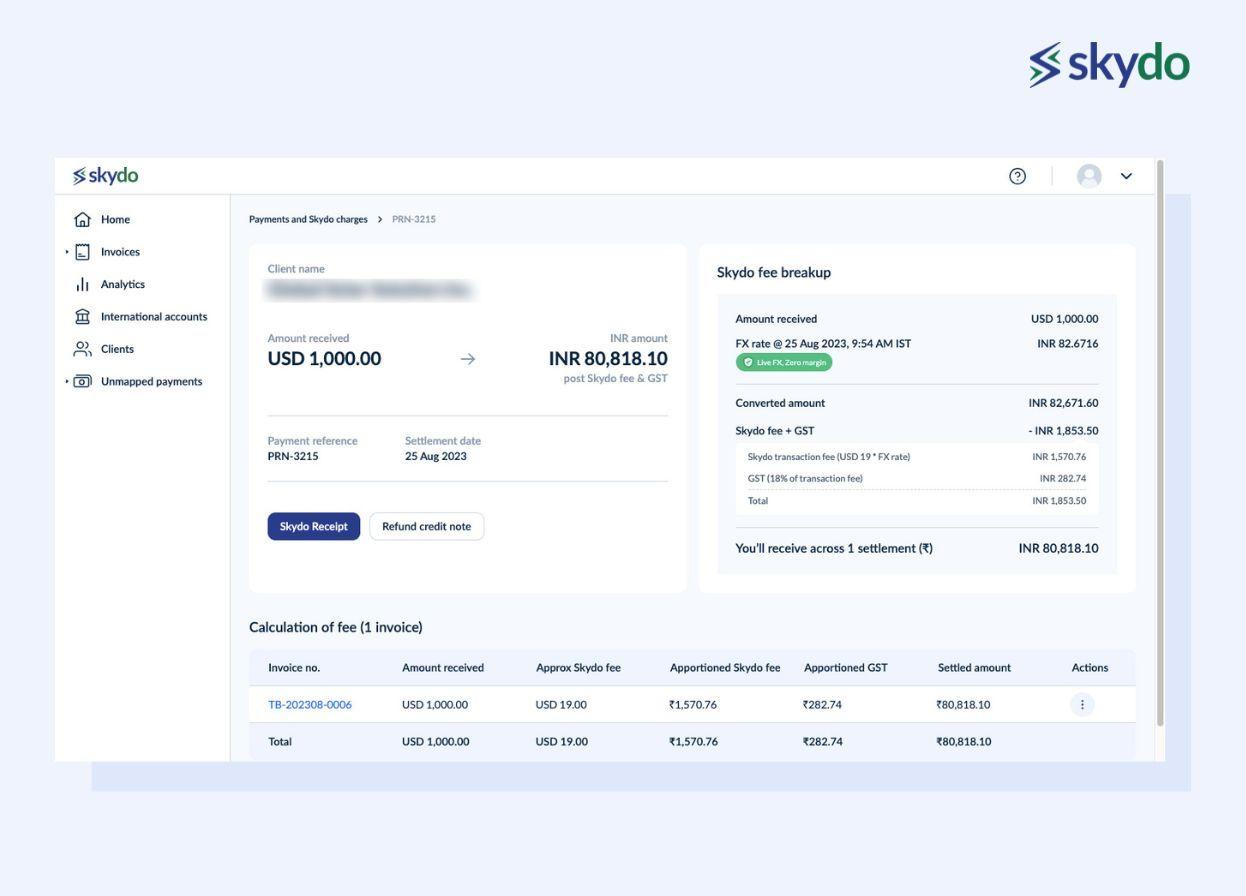

3. Real-time Exchange Rates

While converting your earnings from a foreign to Indian currency, banks or authorised dealers charge an exorbitant fee above the actual exchange rate in the market. This fee is called the Forex markup fee and is often hidden.

Moreover, many platforms also do not disclose the exchange rates. This means that businesses are often clueless about the conversion fee and how much currency conversion fees they are paying.

Skydo eliminates this challenge for businesses and freelancers. It accurately converts foreign currency into INR according to the prevailing foreign exchange rate in the market without adding any additional forex markup fee.

Thus, businesses get real-time information about currency fluctuations in the international market and can predict their earnings accordingly.

At the time of currency conversion, Skydo also adds a date and time stamp that allows businesses to verify by comparing to live FX rates in real time. Thus, Skydo ensures complete transparency and helps you increase FX savings by 3x.

4. No Conversion Fees

If you have some prior experience in receiving payments for your export service business, you may realise that if a foreign client pays you around $1000, the final amount you receive is somewhere near $750.

How and why? Banks and international payment gateways charge various fees at every step of the foreign transaction, including processing, intermediary, platform, service, and more. As a result, businesses lose a significant amount of their foreign earnings.

However, Skydo has a simple and transparent pricing structure:

- Flat USD 19 for transactions up to USD 2,000

- Flat USD 29 for transactions above USD 2,000

Instead of adding multiple hidden fees, Skydo charges a fixed fee per transaction based on the remittance amount. This helps businesses save up to ₹10,00,000 per year, which can be used for core business activities and increase profitability.

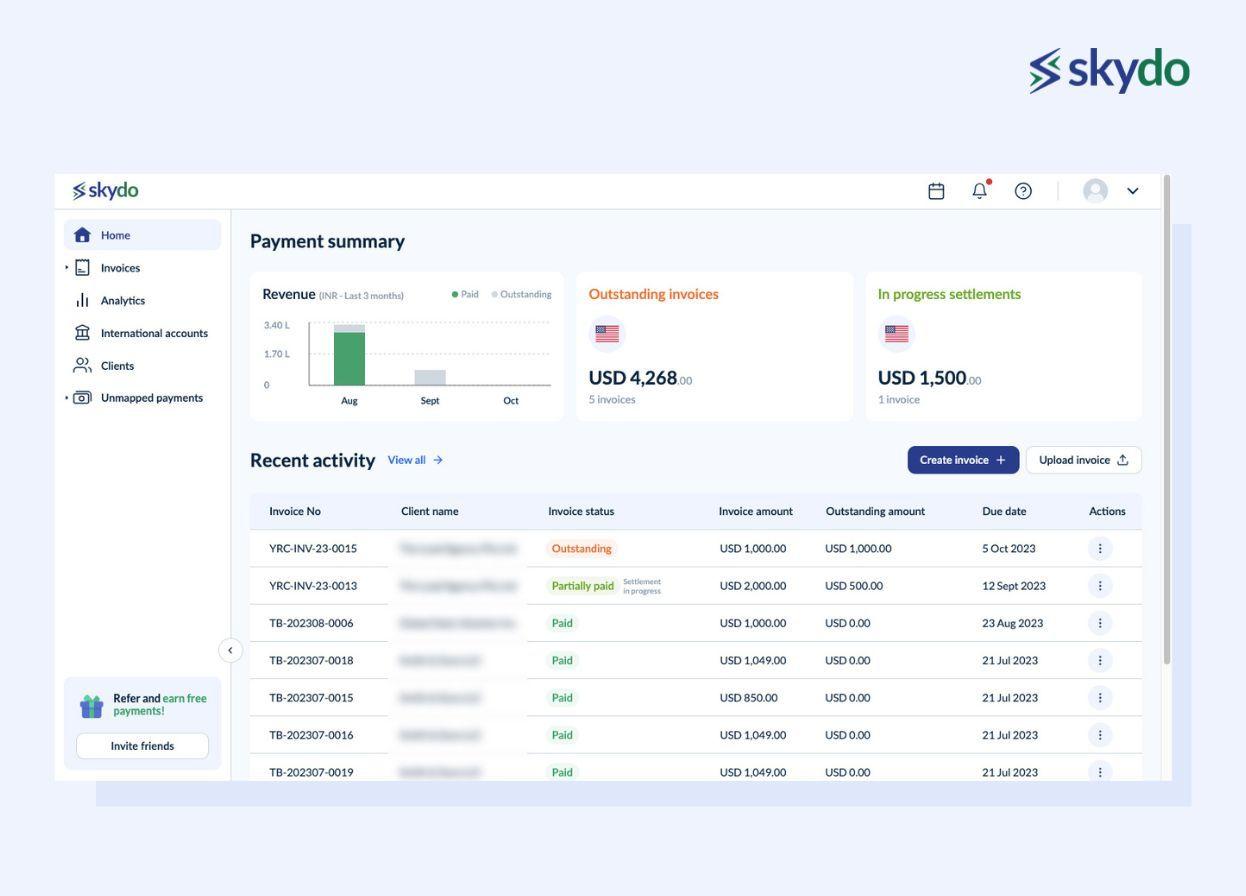

5. User-Friendly Interface

An intuitive interface supports all of Skydo's unique payment features. The dashboard is easy to navigate, and with just one click, you can check, generate, and send invoices, send payment reminders, track payments, download FIRA, and view payment summaries.

Managing your international payments has never been easier. Moreover, Skydo has an intuitive dashboard that generates payment analytics and helps you derive valuable business and payment insights. Thus, Skydo enables data-driven business decisions, helping businesses scale massively.

Conclusion

Receiving inward remittances through bank transfers or common payment platforms makes you lose a significant portion of your foreign earnings in forex markup, transaction costs, and other hidden fees.

Skydo eliminates this risk by converting currencies according to real-time conversion rates and charging a flat transaction fee. Therefore, it helps you increase your FX savings by three times.

Request a demo with Skydo today to test the Skydo FX calculator and increase your business earnings!

Frequently Asked Questions

Q1. How to use an FX calculator?

Ans: An FX calculator is a valuable tool for estimating your foreign exchange savings. To use Skydo's FX calculator, follow these steps:

- Choose the currency in which you receive your earnings (e.g., USD, EUR, or CAD).

- Select your payment method or platform (e.g., PayPal, Payoneer, or bank).

- Enter your monthly revenue.

- The calculator will show you how much money you could save on forex markup fees by using Skydo for your FX savings.

Q2. Paypal and Stripe have very high transaction fees; how can I save money from my international payments?

Ans: PayPal and Stripe are known for their relatively high transaction fees, which can impact your business earnings. To save money on international payments, consider using Skydo, a platform that offers transparent pricing with fixed transaction fees. By doing so, you can significantly reduce the fees you pay for receiving international payments and increase your overall profitability.

Q3. Why is real-time exchange rate information important for international transactions?

Ans: Real-time exchange rates provide accurate, up-to-the-minute information on currency values in the international market. Having access to real-time exchange rates is crucial for businesses, as it allows them to make informed decisions regarding currency conversions, reducing the risk of losing money due to unfavourable rates.

Q4. What are hidden exchange markup fees, and how do they impact international transactions?

Ans: Hidden exchange markup fees are additional charges applied by banks and payment platforms during currency conversion. These fees are often undisclosed and can significantly reduce the amount a business receives from international payments.

It is important to be aware of these fees and look for transparent alternatives, like Skydo, to maximise your earnings.