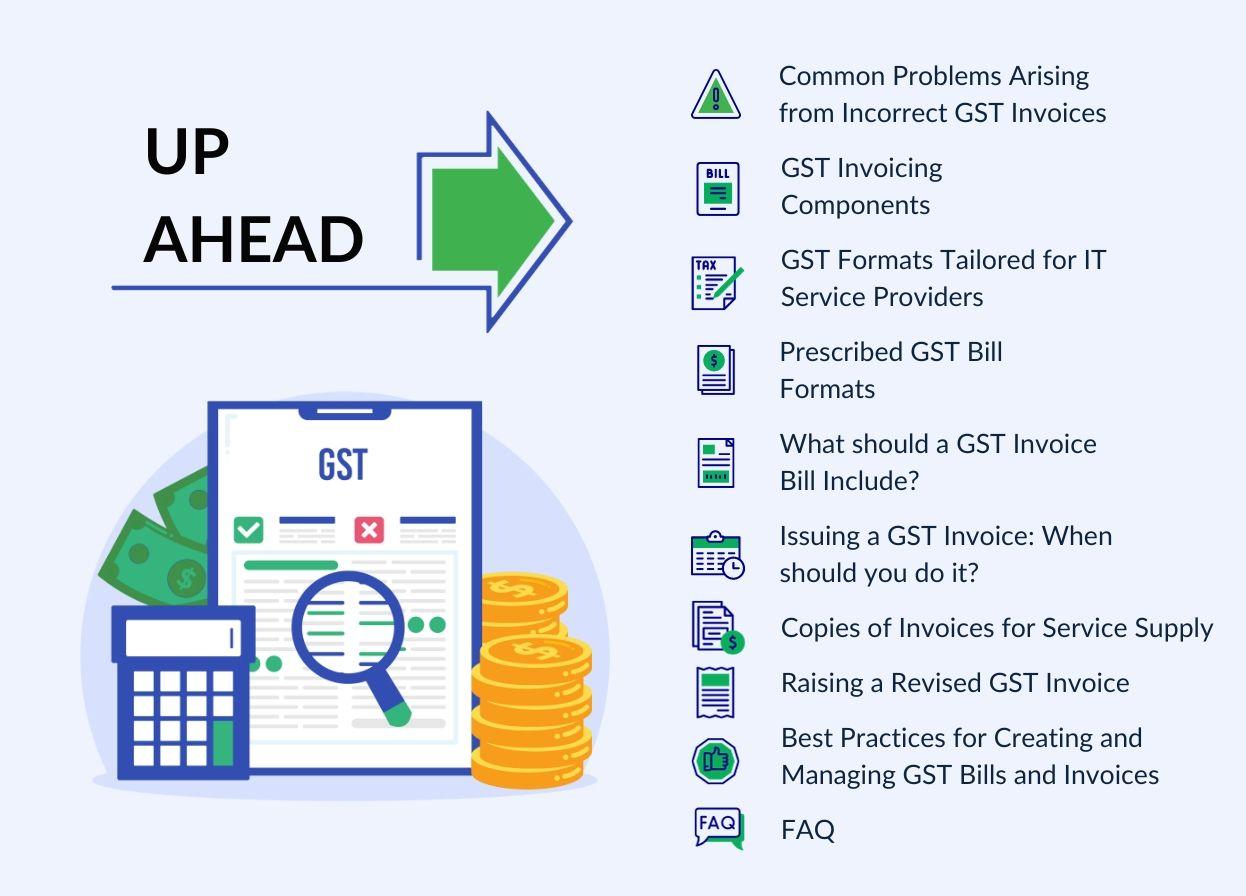

GST Bill Format: Here’s What it Includes

At the heart of business and financial transactions lies the Goods and Services Tax (GST), an ever-evolving taxation system designed to streamline commerce and empower economies.

GST serves as documentary evidence of the supply of goods or services. Additionally, GST filing is vital for tax compliance, claiming input tax credits, and maintaining transparent financial records.

Within the vast GST universe, two essential players take centre stage: the GST bill format and the GST invoice. However, it is vital to get the invoice details right. Here’s why.

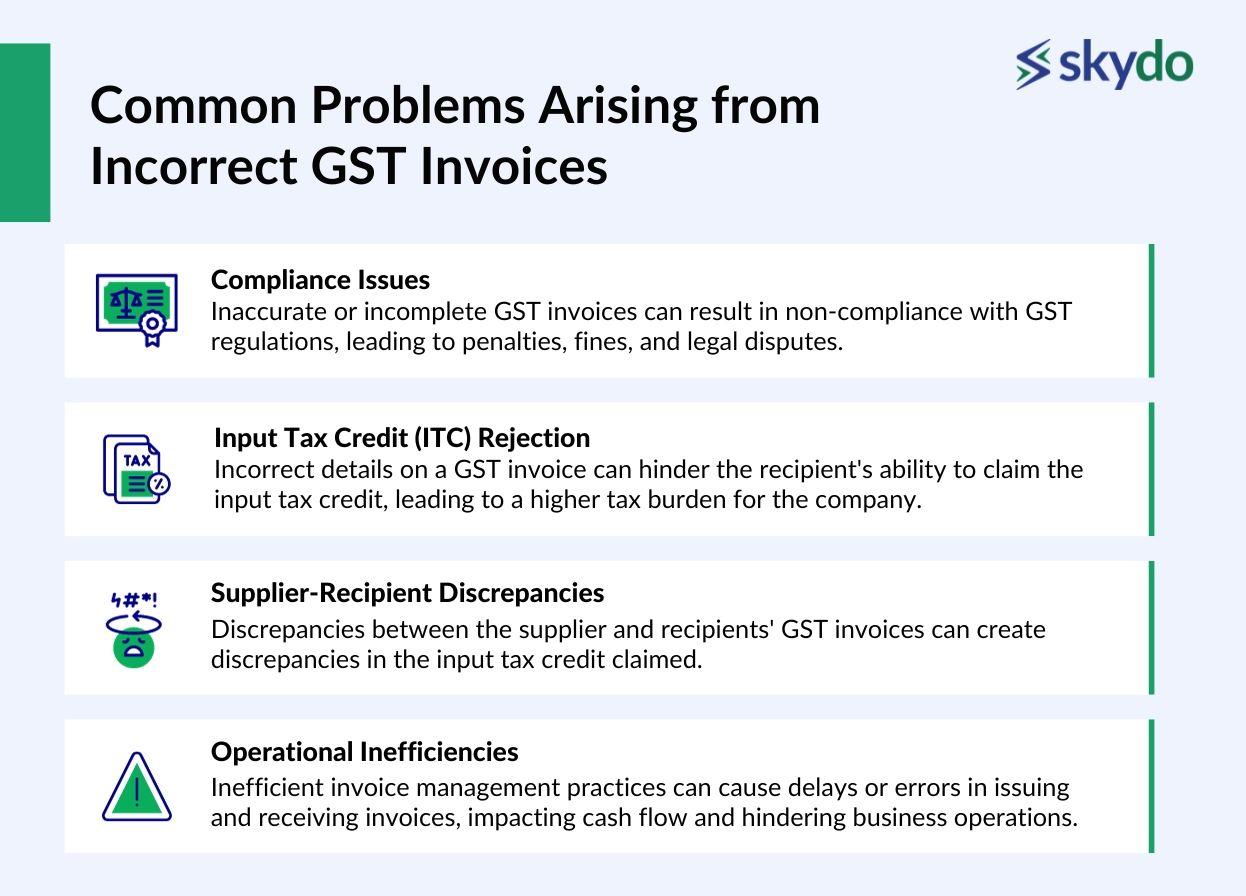

Common Problems Arising from Incorrect GST Invoices

Incorrect GST invoices can seriously affect businesses, particularly IT service providers, in the following ways.

- Compliance Issues: Inaccurate or incomplete GST invoices can result in non-compliance with GST regulations, leading to penalties, fines, and legal disputes.

- Input Tax Credit (ITC) Rejection: Incorrect details on a GST invoice can hinder the recipient's ability to claim the input tax credit, leading to a higher tax burden for the company.

- Supplier-Recipient Discrepancies: Discrepancies between the supplier and recipients' GST invoices can create discrepancies in the input tax credit claimed.

- Operational Inefficiencies: Inefficient invoice management practices can cause delays or errors in issuing and receiving invoices, impacting cash flow and hindering business operations.

To avoid these problems, what are the components of a GST invoice? What is the ideal GST bill format to follow? When should you release the invoice? Below are a few things to remember.

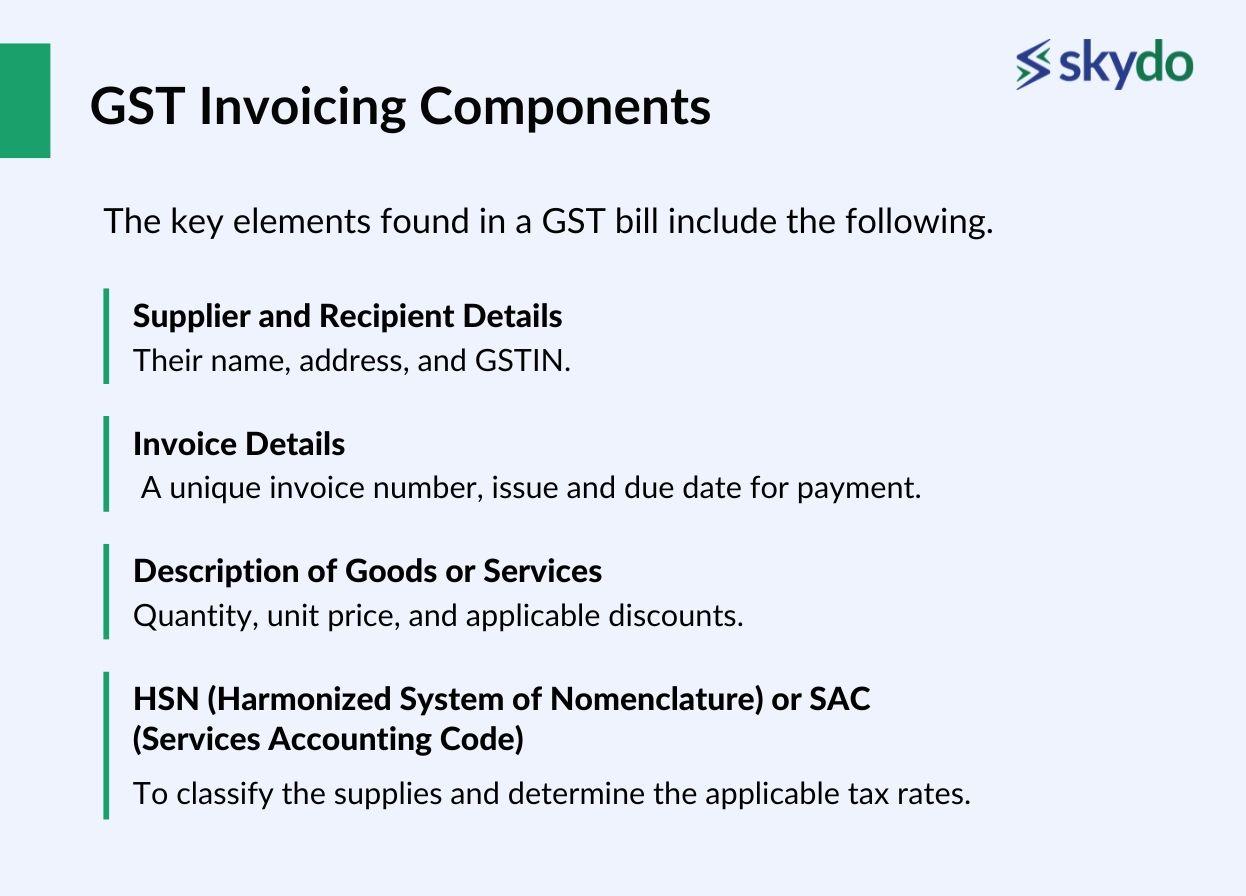

GST Invoicing Components

The key elements found in a GST bill include the following.

- Supplier and Recipient Details: Their name, address, and GSTIN.

- Invoice Details: A unique invoice number, issue and due date for payment.

- Description of Goods or Services: Quantity, unit price, and applicable discounts.

HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code): To classify the supplies and determine the applicable tax rates.

GST Formats Tailored for IT Service Providers

Below are some key aspects for IT service providers to consider regarding GST bills and invoices.

- Place of Supply Rules: IT services often involve international transactions. You must determine the correct GST treatment and apply the appropriate tax rates based on the recipient's location.

- Export of Services: The export of services is zero-rated under GST. You must comply with specific documentation and invoicing requirements to avail of zero-rated supplies.

- Reverse Charge Mechanism: In certain situations, the reverse charge mechanism applies to IT services, where the recipient is liable to pay the GST directly to the tax authorities instead of the service provider.

- Input Tax Credit: You may incur expenses on inputs such as software licenses, hardware, and professional services necessary for their operations. Ensuring proper documentation and record-keeping of input invoices is vital to claim accurate and timely ITC.

Consider the scenarios where the reverse charge mechanism is applicable and ensure compliance.

Prescribed GST Bill Formats

These standardised templates are designated by tax authorities for generating GST-compliant invoices. It outlines mandatory fields, such as supplier and recipient details, invoice number, date, description of goods or services, tax breakdown, and the total amount payable.

By adhering to these formats, you can ensure accurate documentation, enable seamless integration with financial systems, simplify auditing processes, and enhance credibility. It also promotes transparency, reduces errors, and ensures businesses meet the specific requirements set forth by tax authorities.

What should a GST Invoice Bill Include?

A GST invoice bill should include the following key elements:

- Name, address, and GSTIN of the supplier.

- A unique number for each tax invoice generated consecutively within a financial year, up to 16 characters.

- Date of issue.

- If the buyer (recipient) is registered: Name, address, and GSTIN of the recipient.

- Description of the goods or services provided.

- Quantity of goods (number) and unit in metres, kg, etc.

- The total value of the supply of goods or services.

- The taxable value of supply after adjusting any discount.

- The applicable rate of GST: Mention the rates of CGST, SGST, IGST, UTGST, and Cess.

- Amount of tax: Breakup of amounts for CGST, SGST, IGST, UTGST, and Cess.

- Place of supply and name of destination state for inter-state sales.

- Signature of the supplier or their authorized representative.

Issuing a GST Invoice: When should you do it?

For services businesses, within 30 days from the supply date is the ideal time to issue a GST invoice. In the case of banking companies or financial institutions, the deadline is 45 days. Failure to issue the invoice within the specified timeframe can result in penalties.

However, when the transaction falls under the composition scheme, a consolidated bill of supply is issued instead of a tax invoice. This principle also applies when supplying services to unregistered individuals, where a simplified invoice may serve the purpose.

Copies of Invoices for Service Supply

Maintaining copies of service supply invoices serves as evidence for legal compliance, facilitates claiming an input tax credit, and plays a crucial role in dispute resolution. They provide a record of transactions, ensure transparency, and help businesses meet regulatory requirements while enabling smooth operations.

Raising a Revised GST Invoice

You may need to raise a revised GST invoice in certain circumstances such as–

- Correcting errors in the original invoice

- Updating details like billing address or recipient's GSTIN

- Adjusting the taxable value or tax amount due to changes in the transaction

- Issuing a credit note for goods returned or services not rendered

It is advisable to consult with a tax professional or refer to the specific guidelines provided by the tax authorities to ensure proper adherence to the revised invoice requirements.

Best Practices for Creating and Managing GST Bills and Invoices

To effectively create, issue, and manage GST invoices, consider the following tips:

- Double-check all details, including supplier and recipient information, tax calculations, and invoice numbers.

- Keep organised records of all invoices for easy reference and future audits.

- Utilise invoicing software to streamline the process, reduce errors, and automate calculations.

- Stay informed about GST regulations and changes to ensure compliance with the latest requirements.

- Avoid common mistakes such as incorrect tax rates, missing or incomplete information, or improper classification of goods or services. This meticulous record-keeping is often simplified by using digital tools that can easily convert JPG to text, ensuring accurate data entry.

For IT service providers handling large transactions, using services specifically designed for managing GST invoices can be highly beneficial. These services offer features like bulk invoice generation, automatic tax calculations, data integration with accounting systems, and compliance checks.

It helps save time, reduces errors, and ensures seamless management of invoices, enabling businesses to focus on their core operations.

Frequently Asked Questions

Q1. Is the GSTN and GSTIN the same thing?

Ans: GSTN (Goods and Services Tax Network) is the technology platform that manages the GST system, while the GSTIN meaning (Goods and Services Tax Identification Number) is a unique 15-digit number assigned to businesses for tax purposes.

Q2. What’s the difference between invoice date and due date?

Ans: The invoice date is when the GST invoice is issued, while the due date is the deadline by which the payment for the goods or services mentioned in the invoice should be made.

Q3. Is there a fee associated with obtaining a GSTIN?

Ans: Typically, there is a fee associated with obtaining a GSTIN. The fee can vary depending on the type and location of your business.

Q4. Is it mandatory to maintain the invoice serial number?

Ans: Yes, it is mandatory to maintain an invoice serial number for GST invoices to ensure proper documentation and compliance with tax regulations.

Q5. What should I do once I've obtained my GSTIN?

Ans: Once you've obtained your GSTIN, you should ensure proper maintenance of GST invoices, timely filing of GST returns, and compliance with GST regulations to avoid penalties and legal issues.

Q6. How do I file a complaint regarding a forged GSTIN?

Ans: If you suspect a forged GSTIN, you should report it to the relevant tax authorities, providing them with all available details and evidence of the forgery for investigation.

Q7. Can I digitally sign my invoice through DSC?

Ans: Yes, you can digitally sign your GST invoice using a Digital Signature Certificate (DSC) to ensure the authenticity and integrity of the document.

Q8. What should I do once I've obtained my GSTIN?

Ans: After obtaining your GSTIN, you should ensure that your GST invoices follow the prescribed tax invoice format, maintain proper records, and comply with GST regulations in your business transactions.

Q9. What is a GST number?

Ans: GST number is a common term used to refer to GSTIN (Goods and Services Tax Identification Number), a unique 15-digit identifier assigned to businesses in India for tax purposes. It is crucial for tax compliance and record-keeping in the GST system.