How to File Taxes as a Freelancer in India (2025 Guide)

Filing income tax returns is usually straightforward for salaried employees – they rely on Form 16 for a neat breakdown of income and TDS, then fill out ITR-1 and they’re done. However, freelancer tax in India can be much more complex. If you’re a developer, designer, consultant, or marketer working independently, the process is not the same as for salaried individuals. Different Income Tax Return (ITR) forms apply, there are Goods and Services Tax (GST) considerations, advance tax rules, and even foreign payments handling (like FIRA documents) that add to the confusion.

But don’t worry – this single guide will help put all that confusion to rest. By the end of this blog, you will understand:

- Which ITR form you must file for the Assessment Year (AY) 2025-26 (for income earned in FY 2024-25).

- How to calculate your taxable income earned in the financial year 2024-25.

- What deductions you can claim to save tax.

- How to handle foreign payments and FIRA (Foreign Inward Remittance Advice documents).

Are Freelancers in India Required to Pay Taxes?

Yes – freelancers in India are subject to income tax just like anyone else. The Income Tax Act doesn’t explicitly define the term “freelancer,” but it treats your freelance earnings as “Profits and Gains from Business or Profession” (PGBP) similar to income from a business or self-employment.

In other words, if you work independently and earn money by providing services (software development, graphic design, content writing, digital marketing, consulting, etc.), you are considered a self-employed professional – essentially a freelancer – for tax purposes.

Who Qualifies as a Freelancer?

If you earn income independently by providing professional or technical services – such as writing code, designing graphics, consulting, writing content, marketing, etc. – and not as a salaried employee of a company, then you’re a freelancer. In tax terms, you’re a self-employed individual carrying on a profession or vocation that requires intellectual or manual skill. Even if the Income Tax Act doesn’t use the word “freelancer,” this is the bucket your income falls into.

When Do Freelancers Need to Pay Taxes?

You are required to file an income tax return (and pay any tax due) if your total income in a financial year exceeds the basic exemption limit. For the financial year 2024-25 (relevant to AY 2025-26), the limit is ₹2.5 lakh under the old tax regime (for individuals below 60). If you opt for the new tax regime, the basic exemption limit is ₹3 lakh.

This is the minimum threshold under the Income Tax Act for requiring a return. On top of that, the government provides rebates that effectively make income up to ₹5 lakh (old regime) and ₹7 lakh (new regime) tax-free In other words, under the old regime you get a ₹12,500 rebate (Section 87A) and under the new regime a ₹25,000 rebate – meaning you don’t have to pay any tax on income up to ₹5,00,000 and ₹7,00,000 respectively.

However, you still need to file an ITR if your income exceeds the basic exemption (₹2.5L/₹3L), even if the rebate makes your net tax zero.

Do You Need a PAN to File Taxes?

Absolutely. A Permanent Account Number (PAN) is mandatory for all taxpayers in India, including freelancers. You will need an active PAN to file your income tax return and comply with all freelancer tax rules in India. If you don’t have one, be sure to apply for a PAN before attempting to file your taxes.

Which ITR Form Should Freelancers File?

Freelancers in India typically need to choose between two ITR forms, depending on their income and accounting method:

- ITR-4 (Sugam): Use this if you are opting for the presumptive taxation scheme (more on this below) and your gross freelance receipts in the previous year were up to ₹50 lakh. In fact, ITR-4 is specifically designed for freelancers and small business owners using presumptive tax provisions. Recent rules even allow a higher threshold of ₹75 lakh for professionals if most of your payments are digital – in that case, you can still use ITR-4 as long as you meet certain conditions:

a. Cash receipts are less than 5% of your total gross receipts, and

b. The remaining receipts (95% or more) are through banking channels (online transfers, account-payee cheques, etc.)

- ITR-3: If your freelance income exceeds ₹50 lakh (or ₹75 lakh with the above conditions), or if you choose not to opt for the presumptive scheme, then you must file ITR-3. ITR-3 is meant for individuals and Hindu Undivided Families (HUFs) with income from a proprietary business or profession. Filing ITR-3 means you’ll need to maintain detailed books of account for your freelance business and possibly get your accounts audited by a Chartered Accountant if your turnover is above the prescribed limit (currently ₹50 lakh for professionals under Section 44AB).

Note: The presumptive scheme we’re referring to is under Section 44ADA of the Income Tax Act. It applies to specified professions (including legal, medical, engineering, accountancy, technical consulting, architecture, interior design, etc.), which cover most freelance activities. If you are in one of these professions and your gross receipts are within the limits stated, you can use this simplified scheme.

What Is Presumptive Taxation (Section 44ADA)?

Presumptive taxation under Section 44ADA is a simplified tax scheme designed for professionals like freelancers. If your gross receipts from freelancing do not exceed the threshold (₹50 lakh, or up to ₹75 lakh with minimal cash transactions as noted), you can opt for this scheme to ease your tax filing. Here’s how it works:

- You declare 50% of your gross receipts as your taxable income by default. The tax department “presumes” the other 50% to be your business expenses, no questions asked. You pay tax only on the remaining 50%.

- No need to maintain detailed books of accounts or painstakingly track every business expense. Compliance is simpler.

- No audit required as long as you play by the presumptive rules (i.e. you don’t report a profit lower than 50% or exceed the turnover limit).

For example, if you earned ₹10 lakh from freelancing in the year, under Section 44ADA, you can straightaway treat ₹5 lakh (50% of ₹10L) as your taxable income. You would then calculate your income tax on ₹5 lakh as per the applicable slab rates (old or new regime). You are not required to itemise or prove that you actually spent ₹5 lakh on business expenses – it’s automatically given.

However, presumptive taxation ceases to be available if your freelance receipts exceed ₹75 lakh in the year (or if you’re not in the list of professions allowed). In that case, you must switch to the regular provisions and file ITR-3. Under the regular scheme, you’ll compute your actual profit by deducting actual expenses from your income, maintain proper books, and you may need to get a statutory audit of your accounts (for instance, if your turnover exceeds ₹50 lakh for a profession, as per Section 44AB audit rules).

Note: Section 44ADA’s presumptive scheme is only for certain professions (legal, medical, engineering, architecture, accountancy, technical consultancy, interior decoration, etc.). Other presumptive sections exist for businesses (44AD for small businesses, 44AE for transporters), but those are not applicable to typical freelancers in professional services.

If you opt for presumptive taxation (44ADA), half your income is taxable and the rest is presumed as expenses. If you feel your actual expenses are much higher than 50%, you might be better off not using 44ADA – but then you’ll have more compliance to do (books and audit). Also note that once you opt into presumptive taxation for a year, if you later opt out (say your income grows beyond the limit or you decide to maintain books for a more accurate profit), you might be barred from re-opting the presumptive scheme for the next 5 years. So choose wisely.

How to Calculate Your Freelance Taxable Income

When it comes to calculating how much of your freelance earnings are taxable, you have two options:

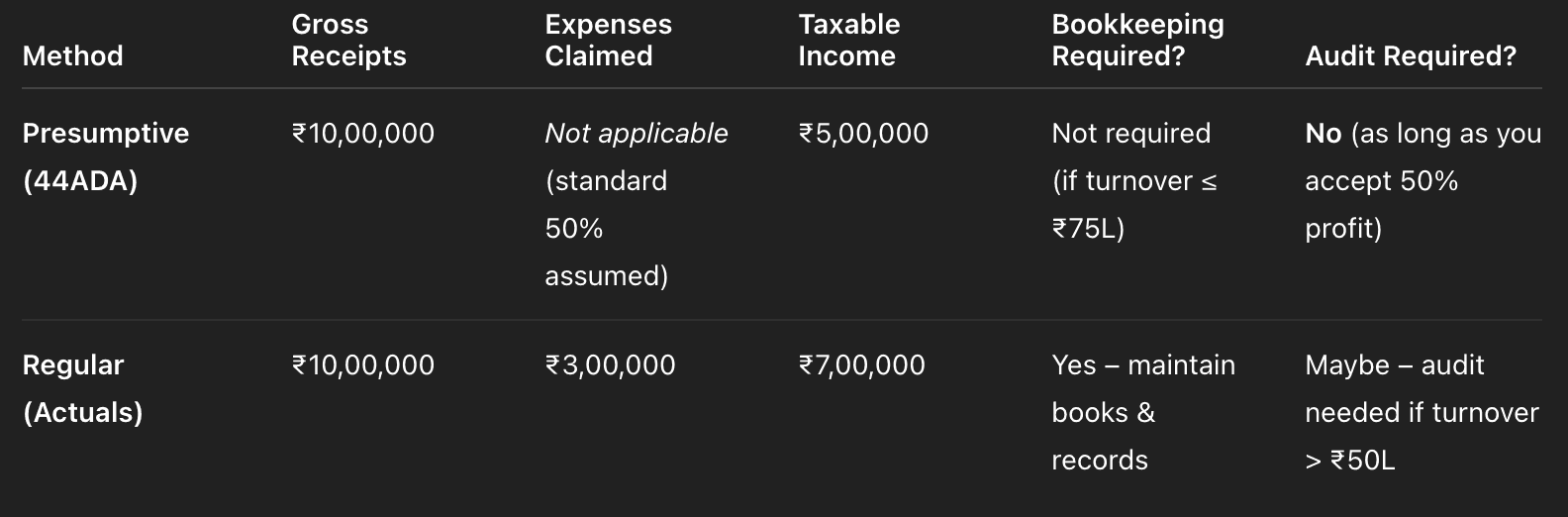

- Presumptive Method (Section 44ADA): As explained, simply take 50% of your gross receipts as your taxable income. You don’t have to itemize any expenses. This method is straightforward and reduces paperwork. For example, with gross receipts of ₹10,00,000, your deemed taxable income is ₹5,00,000. You’d then calculate your tax on ₹5 lakh according to the tax slabs (remember you can choose old or new regime).

- Actual Profit (Regular Method): If you don’t opt for Section 44ADA, you must use the normal method of accounting for actual business expenses. Calculate your net profit by subtracting all deductible expenses related to your freelance work from your gross receipts. For instance, if you earned ₹10,00,000 and you have proof of ₹3,00,000 of business expenses (equipment, internet bills, rent, software subscriptions, etc.), your taxable profit would be ₹7,00,000 (₹10L – ₹3L). You will pay tax on ₹7 lakh as per the slabs. This method requires you to maintain books of account (income/expense records, receipts, invoices) and potentially get an audit if your turnover is high.

Here’s a comparison of the two approaches for the same income, to illustrate the difference:

As you can see, if your actual expenses are relatively low, the presumptive scheme can significantly reduce your taxable income (and paperwork). On the other hand, if your business expenses are high (well above 50% of income), you might save more tax by claiming actual expenses – but you’ll need diligent record-keeping and possibly an audit. Assess your situation to decide which route is more beneficial.

Advance Tax for Freelancers: Do You Need to Pay?

Advance tax means paying your income tax in instalments throughout the year instead of waiting until the end. The idea is to help the government get a steady revenue stream and to help taxpayers avoid a huge lump-sum payment at filing time.

Do freelancers have to pay advance tax? Yes, if your total tax liability for the year is expected to exceed ₹10,000, you are required to pay advance tax. This rule applies equally to salaried folks, freelancers, self-employed professionals, and business owners. If you’re a freelancer making a decent income, you’ll likely cross this ₹10k tax threshold and need to budget for advance tax. For example, if after calculating your taxable income you find you owe, say, ₹50,000 in income tax for the year, you shouldn’t wait until filing time to pay it – you need to pay it in instalments as the year progresses.

Special case – Presumptive Taxpayers: If you are using the presumptive scheme (44ADA), the tax laws let you pay your entire year’s tax in one go by 15th March of the financial year (instead of quarterly instalments). This is a big relief for freelancers on presumptive taxation – you can just estimate your total tax for the year and pay 100% of it by March 15, and you’re done with advance tax(Of course, you could also choose to pay in instalments earlier if you want, but the point is there’s no interest penalty as long as it’s all paid by 15th March.)

For freelancers not under presumptive scheme, advance tax is paid in four scheduled instalments during the year, as shown below:

| Due Date | Advance Tax Payment Due |

| 15th June, 2024 | At least 15% of your total tax for FY 2024-25 |

| 15th September, 2024 | At least 45% of your total tax (cumulative) |

| 15th December, 2024 | At least 75% of your total tax (cumulative) |

| 15ty March 2025 | 100% of your total tax (the balance due) |

Who needs to adhere to these? All taxpayers with a >₹10,000 tax liability (except those on presumptive scheme who choose to pay all by March 15) should pay according to the above schedule. Salaried individuals often don’t worry about this because their employers deduct TDS evenly through the year. But as a freelancer, it’s on you to calculate and pay advance tax. Missing these deadlines can result in interest charges (discussed next).

What If You Miss the Advance Tax Deadlines?

If you forget or fail to pay the required advance tax by the stipulated dates (or underpay the instalments), the Income Tax Department can levy interest penalties under Sections 234B and 234C of the Income Tax Act:

- Section 234B: This applies if you haven’t paid at least 90% of your total tax liability by March 31 of the year. In that case, you’ll be charged interest at 1% per month on the shortfall from April 1, 2025, onwards until you pay off the balance. Essentially, if you underpaid overall, 1% interest per month kicks in for the underpaid amount.

- Section 234C: This is for delays in the quarterly instalments. If you miss any of the instalment due dates (June 15, Sept 15, Dec 15, or pay less than the required percentage), you’ll incur 1% interest per month for 3 months on the shortfall for that quarter (for the last instalment due March 15, the interest is 1% for one month). In simpler terms, each instalment shortfall gets penalised with ~3% total (1% × 3 months) interest, except the last one, which gets ~1%.

These interest charges are in addition to your tax – basically a cost of not paying on time. So it’s in your best interest to stay on top of advance tax if it applies to you.

How to File Income Tax Return (ITR) as a Freelancer

Filing your ITR as a freelancer may seem daunting, but it’s quite manageable if you prepare well. Here’s a step-by-step guide to walk you through the process:

- Gather Your Documents: Collect all essential documents beforehand. This includes your PAN card, Aadhaar card, bank account details (account number, IFSC, bank branch), and all invoices/receipts for the freelance income you earned during the year. If any tax was deducted at source (TDS) by clients, also download your Form 26AS or Annual Information Statement from the income tax portal to reconcile those amounts.

- Prepare Your Income Statement: Sum up all your freelance earnings for the financial year 2024-25. You can use a simple Excel sheet or an accounting software to list every payment received for your services. The total of these is your gross receipts. This is the figure you’ll be reporting as your turnover or gross income from profession.

- Choose the Correct ITR Form: Based on the discussion earlier, decide whether you’ll file ITR-4 or ITR-3. - If you are using the presumptive taxation (Section 44ADA) and your gross receipts are within ₹50 lakh (or ₹75 lakh with conditions), choose ITR-4 (Sugam). If you are not using presumptive scheme, or your receipts exceed the limit, use ITR-3.

- If you are not using presumptive scheme, or your receipts exceed the limit, use ITR-3.

- Log in to the Income Tax Portal: Go to the official e-filing portal www.incometax.gov.in. Log in using your PAN (which is your user ID) and password. If you’re a first-time filer, you’ll need to register on the portal by providing your PAN, name, date of birth, and a mobile/email for OTP verification.

- Start a New ITR Filing: Once logged in, select “File Income Tax Return.” Choose the Assessment Year 2025-26 (which corresponds to FY 2024-25). Select status as “Individual” and proceed. Choose the ITR form (ITR-4 or ITR-3) as determined in step 3. You can opt for “online” filing which lets you fill the form step by step on the portal.

- Fill in Personal and Income Details: The form will first show your personal details (name, address, PAN, etc.) – verify that these are correct. Then it will ask for income details. Since you’re a freelancer, you will enter your gross receipts under the “Profits and Gains from Business/Profession” section. If you selected ITR-4 (presumptive), you will need to provide just the gross amount and the portal will typically auto-calculate 50% as taxable income (you should double-check this section). If you’re on ITR-3, you’ll have to fill the Profit & Loss details – either a condensed version if eligible or full details of income and expenses. Also, report any other income you have (for example, interest from bank accounts, rental income, etc.) in the relevant sections.

- Add Deductions (if applicable): Under Chapter VI-A of the form, you can claim tax-saving deductions like Section 80C, 80D, 80G, etc., but only if you are using the old tax regime. This includes deductions for investments (PPF, ELSS mutual funds, life insurance, etc. under 80C), health insurance premiums (80D), education loan interest (80E), donations (80G), contributions to NPS (80CCD(1B)), and others. If you opted for the new tax regime, remember that most deductions are not allowed – you generally cannot claim 80C, 80D, and so on. (New regime allows only a few specific deductions like employer NPS contribution under 80CCD(2), certain pension scheme contributions under 80CCH, or deduction for new employment under 80JJAA, which usually don’t apply to individual freelancers).

- Validate and Preview: Once all details are filled, use the “Validate” or error-check feature in the portal to catch mistakes or omissions. The portal will highlight if any mandatory field is missing. After validation, use the “Preview Return” option to review the entire ITR form in a single view. Go through it carefully to ensure all information is accurate – check PAN, address, bank details (for refunds), income figures, deductions claimed, and tax calculated. If something looks off, you can go back and correct it before submission.

- Submit and E-Verify: After you’re satisfied with the filled ITR, click “Submit.” But note, your tax filing isn’t complete until you verify the return. The easiest way is e-Verification – you can verify using an OTP sent to your Aadhaar-linked mobile, or through net banking, or by using an EVC (Electronic Verification Code). Choose one of the e-verify options presented after submission. This step must be done within 30 days of filing (else your return is considered invalid).

- (Optional) Seek Assistance: If at any point you feel unsure, consider getting help. You could consult a Chartered Accountant (CA) for professional guidance or use reputable tax filing software which can automate many calculations. While it costs a bit, it might save you time and ensure accuracy, especially if your situation is complex.

Tax-Saving Tips for Indian Freelancers

Being smart about taxes can help you hold on to more of your hard-earned money. Here are some tips to legally reduce your tax burden as a freelancer in India:

- Opt for Presumptive Taxation (44ADA): If eligible, this is often the simplest tax hack. By paying tax on only 50% of your gross receipts, you’re automatically claiming a 50% deduction without needing any bills or proof. This not only potentially lowers your taxable income (especially if your actual expenses are less than 50%) but also saves you the headache of maintaining detailed accounts. It’s a major relief in terms of compliance and paperwork.

- Leverage Deductions under Chapter VI-A (Old Regime): If you’re under the old tax regime, make full use of the available deductions to reduce taxable income. Some popular ones for individuals are: Section 80C – Invest up to ₹1.5 lakh in PPF, ELSS mutual funds, NSC, life insurance premiums, etc. Section 80D – Premiums for health insurance (mediclaim) for yourself, family, and parents (limits vary from ₹25k to ₹50k). Section 80E – Interest paid on an education loan (for higher studies) can be deducted. Section 80CCD(1B) – An additional ₹50,000 deduction if you contribute to the National Pension System (NPS) on top of 80C. Section 80G – Donations to specified charities or relief funds (e.g., PM Relief Fund) can be partially or fully deducted. (...and others like 80TTA for savings account interest, 80TTB for senior citizens, etc., if applicable.)

- Understand the New Regime Trade-off: Under the new tax regime (introduced from 2020 and tweaked in 2023), tax rates are lower and simpler but most deductions and exemptions are removed. You cannot claim the common deductions like 80C, 80D, HRA, etc., if you opt for new regime rates. The only notable deductions allowed in new regime are: Section 80CCD(2): Employer’s contribution to your NPS (this is rare for pure freelancers since you typically don’t have an “employer” contributing to your pension). Section 80JJAA: Deduction for additional employment (again, rarely relevant unless you have employees on payroll).Section 80CCH: Certain contributions under the Agnipath Scheme (applicable only if you’re an Agniveer – likely not relevant to most freelancers). Aside from those and a standard deduction on salary (if you have a side salary income), the new regime doesn’t let you reduce taxable income. So, if you have significant tax-saving investments or expenses, you might stick to the old regime. If not, the new regime’s lower rates might benefit you. Calculate both scenarios to see which yields a lower tax.

- Record and Claim Business Expenses (if not on Presumptive): For freelancers going the actual expense route (ITR-3), remember to claim all legitimate business expenses. This could include your laptop and phone, software subscriptions, internet and electricity (the portion used for work), co-working space rent, travel expenses for client meetings, office supplies, upskilling course fees, etc. Keep receipts and invoices for everything. These can substantially lower your taxable profit. Just ensure the expenses are directly related to your freelance work and are not personal in nature.

By utilizing these strategies – either the presumptive scheme or careful tax planning under the old regime – you can minimize your tax outgo and also avoid any last-minute scrambles. Always stay informed about the latest tax provisions, since rules can change with new budgets (for instance, thresholds or deductible limits may be updated).

What Happens If You Don’t File Your Freelancer Taxes?

Failing to file your income tax return as a freelancer can lead to a host of problems – some immediate and some long-term. Here are the key consequences if you miss the tax filing deadline (typically July 31 of the assessment year):

- Late Filing Fees (Section 234F): If you file your return after the due date, you’ll be charged a penalty. Currently, the late fee is ₹5,000 if you file by December 31 (of the AY) and increases to ₹10,000 if you file even later. For taxpayers with income up to ₹5 lakh, the fee is capped at ₹1,000. While ₹1,000 might not sound too bad, ₹5k or ₹10k is a steep price to pay for procrastination. This fee gets added to your tax payable.

- Loss of Certain Benefits: By missing the deadline, you could lose the right to carry forward some of your losses. For example, if you had a business loss or a capital loss in the year, you are allowed to carry it forward to set off against future income only if you filed your return on time. A late return means those losses may expire unused. You also might miss out on claiming specific deductions or allowances that are only available when the return is filed before the due date.

- Tax Notices and Scrutiny: The tax department keeps track of who files and who doesn’t. If you don’t file at all, there’s a good chance you’ll eventually receive a notice seeking an explanation. They might ask you to furnish the return and pay penalties. Repeated non-compliance or significant income that’s unreported could even trigger a scrutiny or audit of your finances, adding more stress.

- Trouble Obtaining Loans or Visas: Your ITR is more than just a tax form – it’s a proof of income and financial discipline. Banks often ask for copies of your filed ITRs when you apply for home loans, car loans, or even high-value credit cards. It’s a key document to demonstrate your earning history. Similarly, when applying for visas to certain countries, you may be asked to show tax returns for the past few years. If you haven’t been filing, it can hamper these processes. You don’t want a simple thing like not filing taxes to stand between you and a loan or an overseas trip.

In summary, not filing (or delaying filing) your freelancer taxes can cost you money in penalties, deprive you of tax benefits, invite unwanted scrutiny, and limit your financial opportunities. It’s definitely best to file your returns on time each year, even if you think you don’t owe any tax.

Get the Most Out of Your International Freelance Income with Skydo

Handling taxes is just one part of a freelancer’s juggle. If you work with international clients, you also have to manage cross-border payments – raising invoices, following up on payments, dealing with high bank fees, unfavourable exchange rates, and obtaining the FIRA (Foreign Inward Remittance Advice) from banks for each payment. It’s a lot to handle on top of your core work.

This is where Skydo can be a game-changer. Skydo simplifies your international freelance payments by providing you with virtual foreign account details and a seamless platform. Here’s what Skydo offers to make your life easier:

- Local Receiving Accounts: Get virtual accounts in countries like the US, UK, and Australia. Your clients can pay you locally – for example, a US client pays into a US account – avoiding the hassles and fees of international transfers.

- Zero SWIFT Charges: Since payments are local to your client, you don’t incur hefty SWIFT or wire transfer fees that traditional banks charge for international transactions.

- Real-Time Exchange Rates (No Hidden Markup): Skydo converts your incoming payments at the real mid-market exchange rate in real time, with no extra forex margin. You get more rupees for each dollar/euro earned.

- Transparent, Low Fees: Know exactly what fee you’re paying for the service (and it’s designed to be freelancer-friendly). No more mystery deductions in your bank remittance.

- GST-Compliant Invoices & Auto-Reminders: You can generate invoices on the platform that are GST-compliant (useful if you’re registered under GST). Skydo can even send automatic payment reminders to your clients, so you spend less time chasing payments.

- Free FIRA: Whenever you receive an overseas payment, Skydo provides the Foreign Inward Remittance Advice document for free. This saves you from running after your bank for each FIRA (which is needed for compliance, especially if you’re exporting services under GST or for your records).

By streamlining the collection of your international payments, Skydo lets you focus on your work rather than on administrative hassles. Many freelancers lose a chunk of their income in bank fees or waste time with paperwork – you don’t have to be one of them.

This tax season, give Skydo a try and see the difference it makes in managing your freelance income. It’s designed for professionals like you. Sign up for a demo and make your international freelancing smoother and more profitable!