How Does GST Affect Foreign Payments?

When you invoice a foreign client from India, GST usually does not apply on that payment – it’s treated as an export of services. This is a “zero-rated” supply under the IGST Act.

In practice, if all five conditions are met (your business is in India, the buyer is abroad, the place of supply is outside India, you’re paid in foreign currency, and the payment doesn’t come into India as INR) then your invoice carries 0% GST. In other words, you simply send an export invoice without adding GST. (Pro tip: registered exporters should file a LUT to export without paying IGST upfront.)

The takeaway: As long as you meet the export-of-service criteria, you don’t pay GST on the foreign remittance itself. For example, if a US client pays you $1,200 and it’s credited to your account in dollars, you owe ₹0 GST on that ₹amount. Those rules hold for freelancers and businesses alike.

In contrast, foreign-related fees and conversions do attract GST. Banks and payment providers charge GST on their service charges for international transfers. Specifically, conversion fees or wire transfer fees are treated as domestic “services” and taxed at 18%. For example, if your bank charges a ₹1,000 fee to send money abroad, they will add ₹180 (18%) GST on top. Always check your transaction receipt: it should clearly state the GST portion on any service charge. (Note: transactions between banks/ADs are GST-exempt, but the fee to you is still taxed.)

Banks also charge for compliance paperwork. When you receive foreign payments, you often need an FIRA/BRC certificate. The bank’s fee for issuing these certificates comes with 18%, the GST on FIRC/BRC is handled by reverse charge (the foreign client pays it via you), so it doesn’t change your tax invoice – you just pay the quoted fee.

Key Examples:

- Case 1: You export software development to a UK client and get paid in GBP. You issue an invoice without GST because it’s an export (all conditions met). You only pay GST on any bank charges for the money transfer

- Case 2: A European client pays you, but via an INR transfer. Here, the payment technically came in as INR, so GST does apply. In that scenario, the entire invoice value (received in INR) would be subject to 18% GST.

- Case 3: You buy foreign equipment using an international remittance. That’s an import of goods, so import customs duty (not GST) applies. (GST on imports of services would apply if you paid a foreign vendor for a service; that is handled via reverse charge by you as the importer.)

On the other hand, your banks’/providers’ fees are always taxable. The fee itself is your domestic supply, so it attracts 18% GST. In effect, whether you use Skydo, Wise, or your bank, they all charge GST on the service fee. For instance, if a currency exchange costs you ₹5,000, expect an additional ₹900 in GST. Keeping your invoices and receipts is key – you’ll see GST clearly listed on those fee invoices.

What Transactions Do Attract GST?

Not all cross-border transactions are GST-free. Here are the main cases where GST does apply:

- Exports without an LUT/Bond: If you export goods or services without furnishing a Letter of Undertaking (LUT) or bond, you must charge IGST at the time of export. However, you can later claim a refund of that IGST paid. So it’s not a permanent cost, but it does create a cash flow impact until the refund is processed.

- Imports of Services: If you purchase services from abroad (for example, hiring a consultant based overseas), GST is applicable in India under the Reverse Charge Mechanism (RCM). You, as the importer of services, are liable to pay the GST.

- Online Information and Database Access or Retrieval (OIDAR) Services: Digital services provided by foreign companies (like SaaS subscriptions, cloud platforms, or streaming services) are also taxable under GST. If you’re the recipient in India, GST is payable, either by the foreign supplier registered in India or by you under RCM.

For most exporters of services, as long as you meet the conditions for “export of services” (foreign currency received, recipient outside India, etc.), you typically don’t charge GST to your foreign client. Your GST liability usually arises only on the bank’s service charges or if you fall into the scenarios listed above.

Other Important Points

- GST Invoices in Foreign Currency: Yes, you can invoice in USD/EUR. Indian GST law allows foreign-currency invoices, but you must also show the INR equivalent (either on the same invoice or a separate one). This ensures you comply with GST invoicing rules while dealing in dollars.

- GST Returns and LUT: As an exporter, maintain proper docs (FIRCs, LUTs). If you don’t file an LUT, you’d technically pay IGST on your export invoice and then claim a refund. Most freelancers and exporters file LUT annually to simplify this (0% on the invoice directly).

- Input Tax Credit: Remember, even though you charge no GST on export invoices, you can still claim credit for GST you paid on business expenses (software subscriptions, etc.) – this is a key benefit of zero-rating.

In summary

For Indian freelancers and exporters, receiving payments from abroad is usually GST-free as long as the export rules are met.

The only GST you normally pay is on the related services (bank fees, FIRC issuance, etc.) – and even then, it’s minor compared to 18% of the full amount. By using authorised channels and keeping good records (FIRCs, LUT, export invoices), you ensure compliance.

Following these guidelines will keep your foreign transactions clean of unnecessary taxes, letting you focus on growing globally.

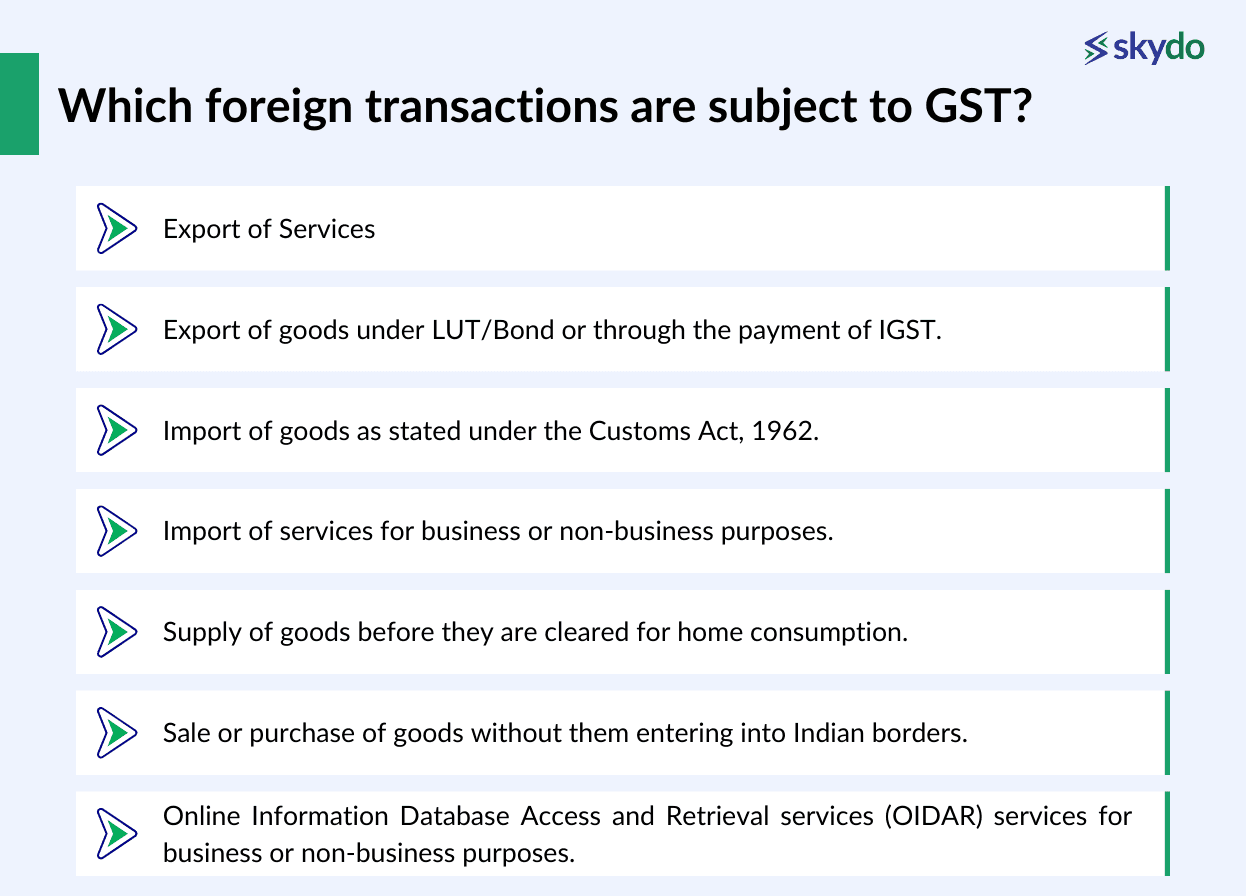

Q1. Which foreign transactions are subject to GST?

Ans: Here are the foreign transactions that are subject to GST if the payment is received in INR rather than in a foreign currency.

- Export of Services

- Export of goods under LUT/Bond or through the payment of IGST.

- Import of goods as stated under the Customs Act, 1962.

- Import of services for business or non-business purposes.

- Supply of goods before they are cleared for home consumption.

- Sale or purchase of goods without them entering into Indian borders.

- Online Information Database Access and Retrieval services (OIDAR) services for business or non-business purposes.

Q2. Can GST invoices be raised in foreign currency?

Q3. How do you calculate GST on foreign remittances?

Q4. What is the limit for foreign remittance?

Do I need an LUT to avoid paying GST on exports?

When does GST apply on imports of services?