How to Choose the Right Currency Exchange Rate for Invoicing

Every entrepreneur dreams of scaling their business beyond domestic boundaries. A global presence for a business is a crucial step towards heightened profitability. However, achieving this profitability relies on invoicing with a suitable currency exchange rate.

Navigating the complexities of foreign currency invoices is critical to businesses that transact internationally to ensure regulatory compliance and transparent accounting.

Additionally, when there are many diverse currencies to consider during invoicing, exchange rate risks can be a significant challenge, impacting your business's financial stability and profitability.

This blog explains how to choose the right currency exchange rate to invoice international customers.

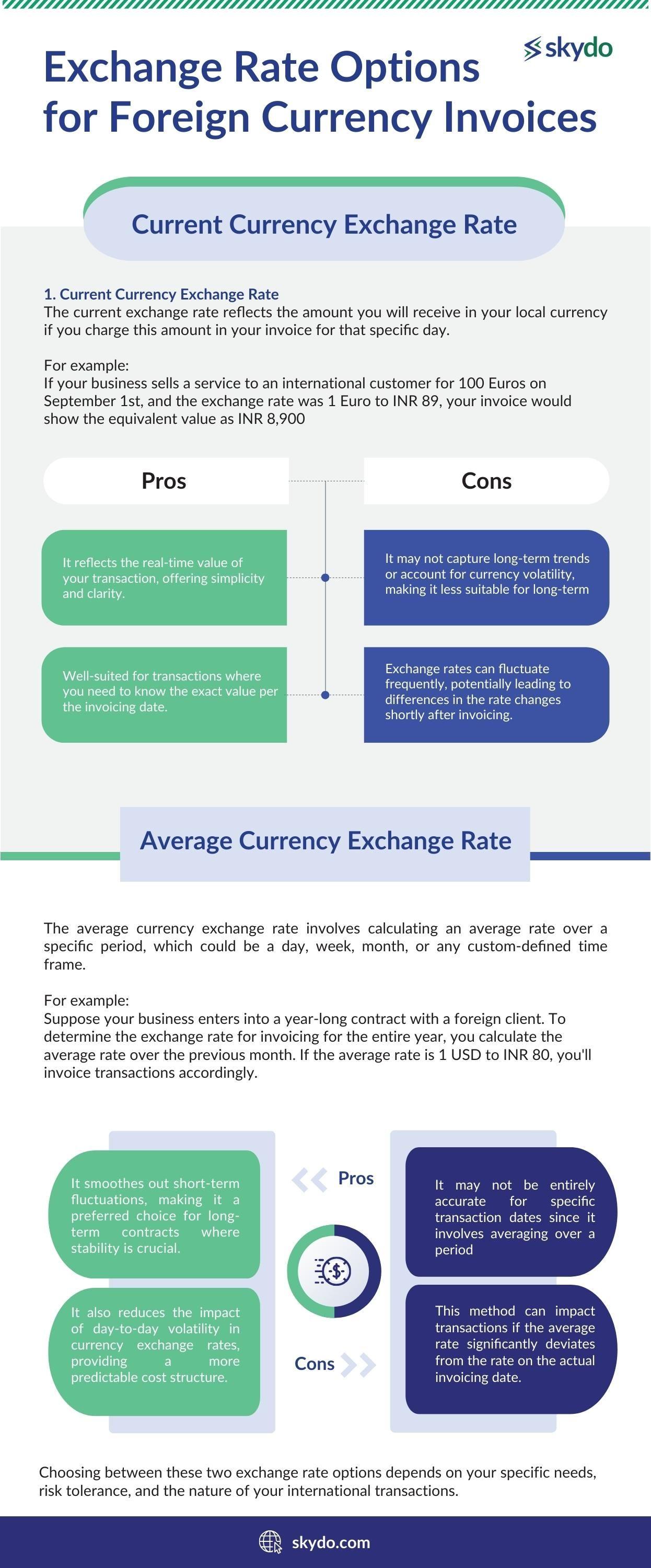

Exchange Rate Options for Foreign Currency Invoices

The exchange rate effect determines the amount you receive for the work done for a foreign client. However, as the currency exchange rate fluctuates frequently, determining the right invoice amount could be the difference between making a profit or an absolute loss for the work done.

There are two ways to decide on an estimated exchange rate to help you break even or profit from the work done for a foreign client.

1. Current Currency Exchange Rate

This exchange rate applied to your foreign currency invoice is the rate on the day you send it to the client. The current exchange rate reflects the amount you will receive in your local currency if you charge this amount in your invoice for that specific day.

For example:

Let's say your business sells a service to an international customer for 100 Euros on September 1st. That day, the exchange rate was 1 Euro to INR 89. Your invoice would show the equivalent value as INR 8,900.

The Pros of this currency exchange rate option include–

- It reflects the real-time value of your transaction, offering simplicity and clarity.

- Well-suited for transactions where you need to know the exact value per the invoicing date.

The Cons of this currency exchange rate option include–

- It may not capture long-term trends or account for currency volatility, making it less suitable for long-term financial planning.

- Exchange rates can fluctuate frequently, potentially leading to differences in the rate changes shortly after invoicing.

2. Average Currency Exchange Rate

The average currency exchange rate involves calculating an average rate over a specific period, which could be a day, week, month, or any custom-defined time frame. This approach smooths out short-term fluctuations in exchange rates.

For example:

Suppose your business enters into a year-long contract with a foreign client. To determine the exchange rate for invoicing for the entire year, you calculate the average rate over the previous month. If the average rate is 1 USD to INR 80, you'll invoice transactions accordingly.

The Pros of this currency exchange rate option include–

- It smoothes out short-term fluctuations, making it a preferred choice for long-term contracts where stability is crucial.

- It also reduces the impact of day-to-day volatility in currency exchange rates, providing a more predictable cost structure.

The Cons of this currency exchange rate option include–

- It may not be entirely accurate for specific transaction dates since it involves averaging over a period.

- This method can impact transactions if the average rate significantly deviates from the rate on the actual invoicing date.

Choosing between these two exchange rate options depends on your specific needs, risk tolerance, and the nature of your international transactions.

The current exchange rate is suitable for those who require real-time values, while the average exchange rate is a better choice for long-term financial planning and stability, particularly when dealing with international partners and long-term contracts.

However, businesses must consider additional factors before choosing between the current and average currency exchange rates as specified below.

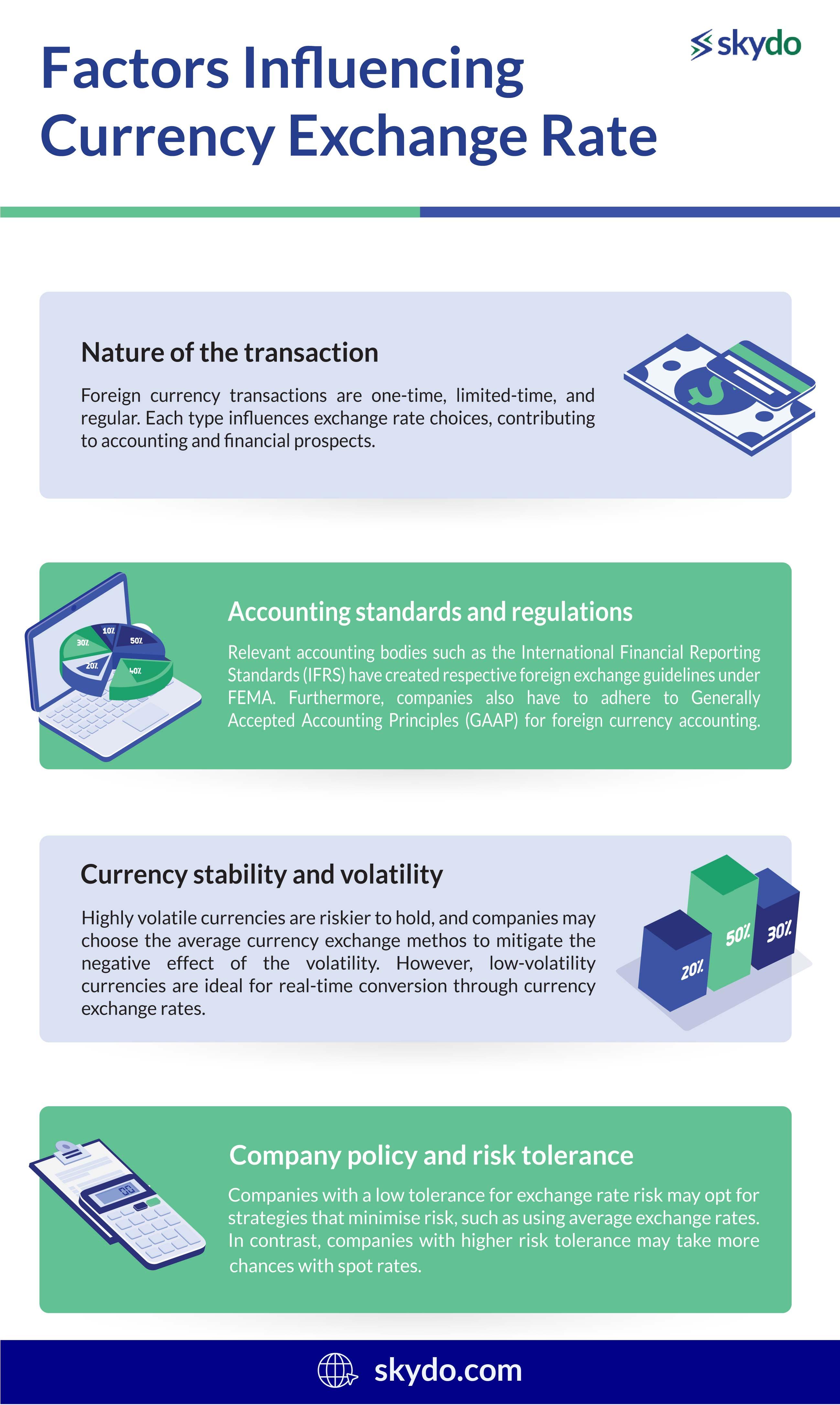

Factors Influencing Currency Exchange Rate

Currency exchange rates fluctuate based on demand and supply, trading volumes, and many other parameters. These dynamic market factors create a chain reaction resulting in currency exchange rates fluctuating in real-time.

1. Nature of the transaction

Foreign currency transactions are one-time, limited-time, and regular. Each type influences exchange rate choices, contributing to accounting and financial prospects.

For example, as an Indian tech service exporter, you offered a one-time software development project to a U.S. client. In this case, it is a one-time foreign currency transaction, and the choice of exchange rate can influence the project's profitability and financial records.

2. Accounting standards and regulations

Businesses may have to comply with specific regulations and accounting standards when dealing with foreign exchange. Relevant accounting bodies such as the International Financial Reporting Standards (IFRS) have created respective foreign exchange guidelines under FEMA.

Furthermore, companies also have to adhere to Generally Accepted Accounting Principles (GAAP) for foreign currency accounting. These standards and regulations can impact the choice of exchange rate for financial reporting and taxation purposes.

3. Currency stability and volatility

180 currencies circulate in 197 countries worldwide. Some currencies, such as USD or EUR, are stable compared to AUD or JPY.

Highly volatile currencies are riskier to hold, and companies may choose the average currency exchange method to mitigate the negative effect of the volatility. However, low-volatility currencies are ideal for real-time conversion through currency exchange rates.

4. Company policy and risk tolerance

Companies with a low tolerance for exchange rate risk may opt for strategies that minimise risk, such as using average exchange rates.

In contrast, companies with higher risk tolerance may take more chances with spot rates. Furthermore, some companies may have agreements with foreign suppliers or customers to use a specific average exchange rate for invoicing.

Best Practices for Choosing an Exchange Rate Approach

Choosing the right exchange rate is crucial for businesses dealing with invoicing in foreign currencies. The choice between the current currency exchange rate and the average currency exchange rate should align with the specific business needs.

It should also conform to internal policies to ensure that the business minimises currency exchange risk. Additionally, it ensures that conversions occur at the most favourable exchange rate.

Here are some best practices to consider before choosing the exchange rate before you learn how to invoice customers:

- Assessing the company's risk tolerance: Your business should have clear policies regarding the level of currency exchange risk your business can comfortably absorb. If not, sit with policymakers, directors, and shareholders to assess your company’s exchange rate risk tolerance and choose between current or average foreign currency exchange rates.

- Analysing historical exchange rate trends: You can use currency exchange tools to analyse a specific currency's current trend and past performance and use technical and fundamental analysis to predict future movements. You can also choose the current or average currency exchange rate based on the exchange rate forecast.

- Consulting with financial experts: The currency exchange spectrum is complex and includes numerous monetary and compliance regulations regarding foreign currency invoicing. One of the best ways to choose an ideal currency exchange approach is to seek advice from financial professionals- like CAs- or currency risk management experts who can provide insights and recommend strategies tailored to your business situation.

How to Mitigate Currency Exchange Rate Risk

Companies must create and execute policies/activities to mitigate the currency exchange risk. Here are several strategies and techniques to achieve this objective.

- Forward contracts: You can utilise forward contracts to lock in an exchange rate for a future transaction date. This way, you hedge against unfavourable exchange rate movements by agreeing on a fixed rate in advance.

- Virtual or multi-currency accounts: You can create virtual currency accounts or open multi-currency accounts to manage currency risk by avoiding unnecessary conversions and conversion costs.

- Hedging strategies: You can leverage various financial instruments such as options, futures, or exchange-traded funds designed to mitigate currency exposure.

How to Create an Invoice with the Right Currency Exchange Rate

- Gather Details: Collect transaction details, including date, foreign currency amount, chosen exchange rate, and transaction description.

- Choose Exchange Rate: Decide between current or average currency exchange rates, ensuring you have accurate data.

- Calculate Equivalent Amount: Multiply foreign currency by the rate for local currency value.

- Include Payment Info: Specify payment due date, bank details, and instructions.

- Specify Currency: Mention the currency used, e.g., "Amount Due: USD 1,200."

- Add Description: Briefly outline goods or services delivered with quantities and totals.

- Invoice Details: Assign a unique number, include the date, and provide an exchange rate explanation if needed.

- Review & Proofread: Ensure accuracy and clarity before sending.

- Send Invoice: Forward it to the client through the agreed method.

- Follow-up: Monitor payment status and address client queries promptly.

You can also leverage Skydo’s free invoicing tool to create an international invoice in under 2 minutes.

Additionally, Skydo’s FX calculator provides live currency exchange rates without any added margins, ensuring that you receive the optimal price for your global invoices through our payment platform.

Conclusion

International transactions are vital for businesses with a global presence. However, fluctuations in exchange rate effects can impact your venture’s profitability and financial stability. Therefore, you must choose between an effective exchange rate approach to streamline your foreign currency invoices and the resulting currency conversion.

Understand the affective factors, the types of available currency exchange, and the factors you should consider before choosing between the two currency exchange options.

Frequently Asked Questions

Q1. How Do Exchange Rates Affect International Trade?

Ans: Exchange rates impact international trade by changing the relative costs of goods and services between countries. A strong domestic currency can make exports more expensive, while a weak currency can boost exports but increase the cost of imports. This affects trade balances and competitiveness.

Q2. How to Invoice as an LLC?

Ans: To invoice as an LLC, create professional invoices with your company's name and address, itemise goods or services provided, specify payment terms, and send them to clients.

Q3. What is international invoicing?

Ans: International invoicing involves creating invoices for goods or services provided to clients in foreign countries while meeting their distinct requirements and regulations to ensure compliance.

Q4. How do I make international invoices?

Ans: To create an international invoice, use your company's details, specify services and prices, add currency exchange rates, and ensure compliance with international tax regulations. Once you review all the details, send it to your client and follow up.