How to Claim Input Tax Credit Refund in India

Updated on 22nd December 2025

India's Goods and Services Tax (GST) system has emerged as a transformative force, revolutionising how businesses conduct financial transactions. At the heart of this progressive tax framework is a crucial mechanism that empowers enterprises like never before – Input Tax Credit (ITC).

TL;DR

- Input Tax Credit (ITC) lets you set off GST paid on purchases against GST on sales; refund is allowed mainly for zero-rated supplies (exports/SEZ without payment of tax) and inverted duty structure, subject to exclusions.

- To claim a refund of unutilised ITC, you file Form GST RFD-01 on the GST portal; you can club multiple tax periods and even span two financial years in one application.

- Refund must be applied within 2 years from the relevant date under Section 54 of the CGST Act, and officers are expected to sanction within 60 days of a complete application.

- If the refund is delayed beyond 60 days, interest at 6% is payable; courts have clarified this applies even when the refund is allowed after appeal on an earlier rejected claim

- GST now has more system-driven ITC matching (GSTR-2B, invoice-level IMS), but fully automatic ITC refunds are still largely limited to specific export/IGST flows—most ITC refunds still need a proper RFD-01 + documentation

What is Input Tax Credit in GST?

Input tax credit meaning, a potent tool that allows businesses to claim tax benefits on their purchases, ITC plays a pivotal role in mitigating tax liabilities, optimising cash flow, and fostering a thriving business ecosystem. It ensures that businesses can offset the tax they pay on inputs against the tax they collect on their outputs.

It encourages businesses to maintain proper records, adhere to GST compliance, and accurately report their financial transactions. Furthermore, ITC refunds also allow exporters to claim refunds on the tax paid on their inputs used in the export process, making Indian goods and services more competitive in the global market.

Recently, the Indian government also launched Automatic ITC. This mechanism simplifies the tax process by seamlessly providing credit for the GST paid on purchases without manual intervention.

From reducing tax liabilities to fostering export growth, the benefits of ITC are a testament to the progressive strides of India's tax landscape. Let’s understand the Input Tax Credit under India's GST regime in detail.

Understanding Eligibility for Input Tax Credit Refund

Claiming Input Tax Credit (ITC) refunds in India are subject to criteria defined by the GST law. Meeting these criteria is crucial for businesses to avail themselves of ITC refund benefits successfully.

Below are the key conditions to be eligible for claiming ITC refunds.

- Registration under GST: The foremost requirement is that the business must be a registered taxpayer under the GST Act. Only registered entities can claim ITC on the taxes paid on their purchases.

- Presence of Input Tax Credit: To claim an ITC refund, the taxpayer should have accumulated credit in the electronic credit ledger. This credit should result from taxes on eligible inputs and services used during the business.

- Timely Filing of GST Returns: Eligibility for ITC refunds depends on the business's compliance with the timely filing of GST returns. You must ensure that all relevant returns are filed promptly and accurately.

- Possession of Valid Documents: The taxpayer must possess valid and authentic documents to substantiate their ITC claim.

Businesses can claim an automatic GST credit refund if they have accumulated excess ITC due to higher credits than tax liabilities for a given period. The tax department usually initiates the refund which is automatically processed in the taxpayer's bank account.

The documents required to claim ITC are explained below in detail.

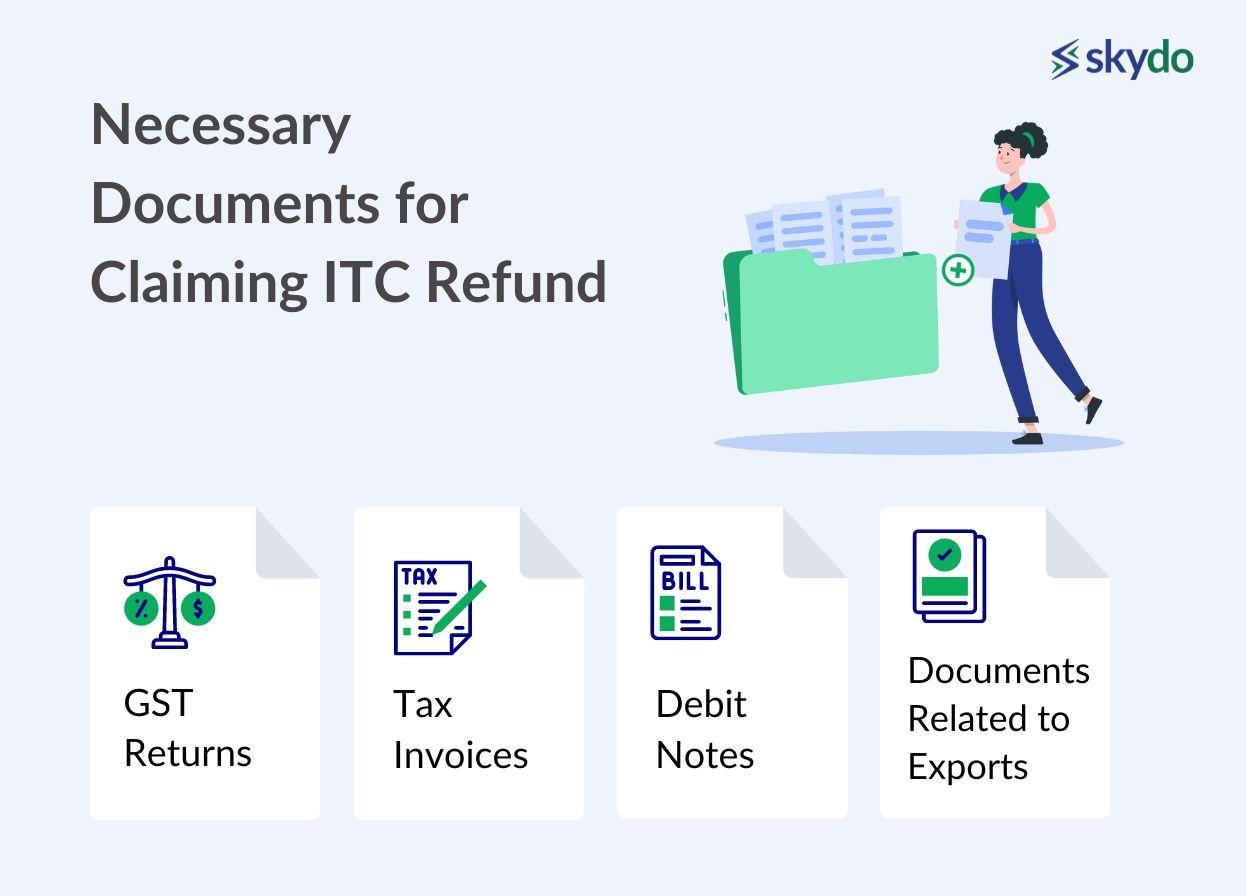

Necessary Documents for Claiming ITC Refund

The availability of accurate and comprehensive documentation is critical to support the legitimacy of the ITC refund application. Below is a list of essential documents required for claiming ITC refunds under the GST system:

- GST Returns: These returns include GSTR-1 (Outward Supplies), GSTR-2 (Inward Supplies), and GSTR-3B (Summary Return). The filed returns reflect the taxes paid and collected during the period, forming the basis for ITC calculation.

- Tax Invoices: Valid tax invoices issued by suppliers for the inputs and input services used in the business should be available. These invoices should comply with the GST law's specific requirements, including details such as GSTIN, invoice number, date of issue, and taxable value.

- Debit Notes: Debit notes (if any) reduce the input tax credit and should form part of the application.

- Documents Related to Exports: In the case of exports, documents supporting export transactions, such as shipping bills, export invoices, and relevant customs documents, must be submitted to claim ITC refunds on export supplies.

- Bank Account Details: For automatic ITC, the taxpayer's valid bank account details are necessary to credit the tax refund.

According to Ms. Juhi Shah, an experienced Chartered Accountant, "Having meticulously organised and verified documents is crucial when claiming ITC refunds. Proper documentation expedites the refund process and strengthens the case for refund approval."

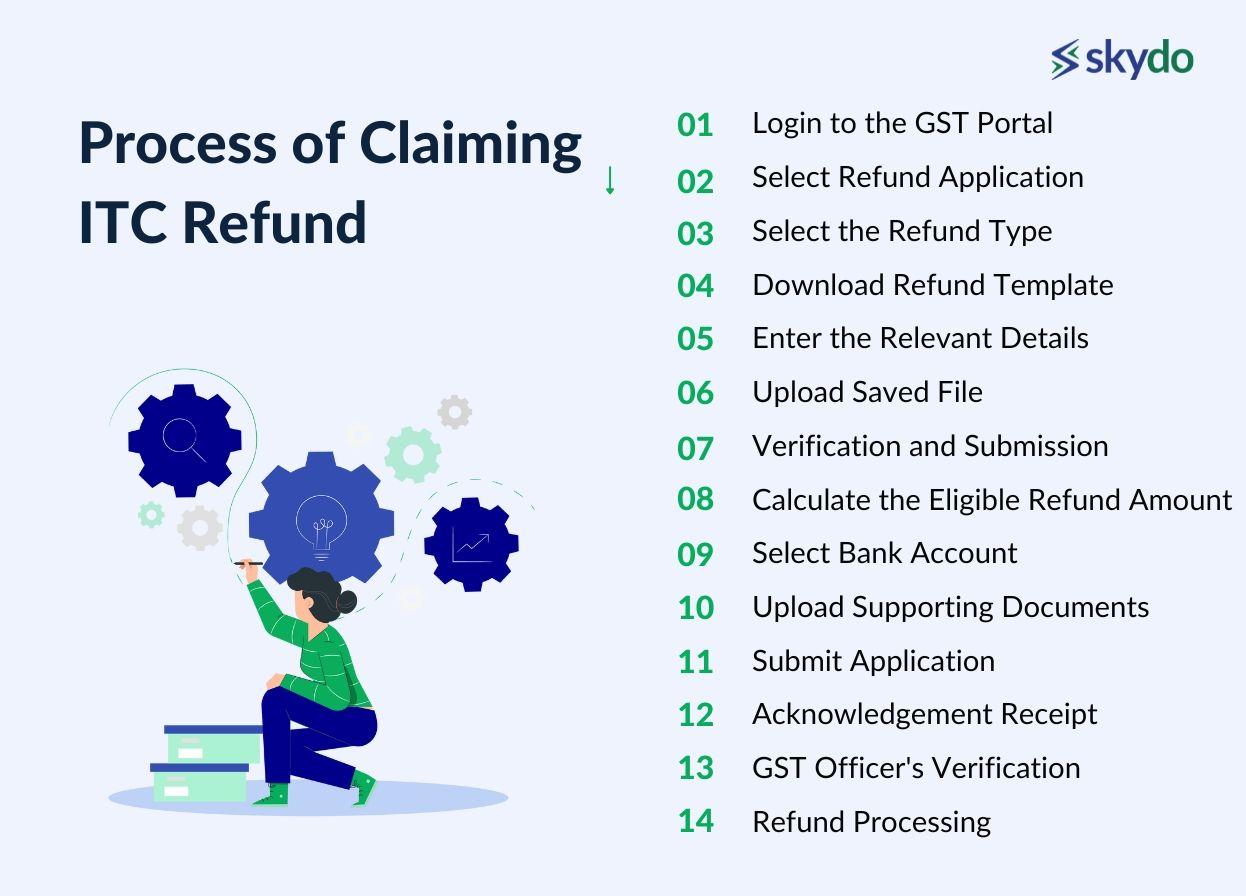

Process of Claiming ITC Refund

Claiming Input Tax Credit (ITC) refunds through the GST claim portal is a systematic and streamlined process defined by the Government of India. You can follow these step-by-step instructions to apply for ITC refunds and ensure a smooth and efficient refund process.

1. Login to the GST Portal

Access the GST portal (www.gst.gov.in) using your registered credentials, including the username and password.

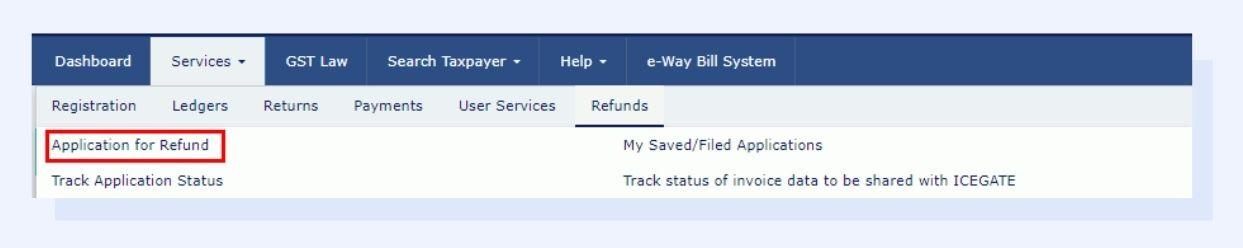

2. Select Refund Application

Navigate to the "Services" tab on the GST portal's dashboard after logging in. Choose "Refunds" From the drop-down menu and click "Application for Refund."

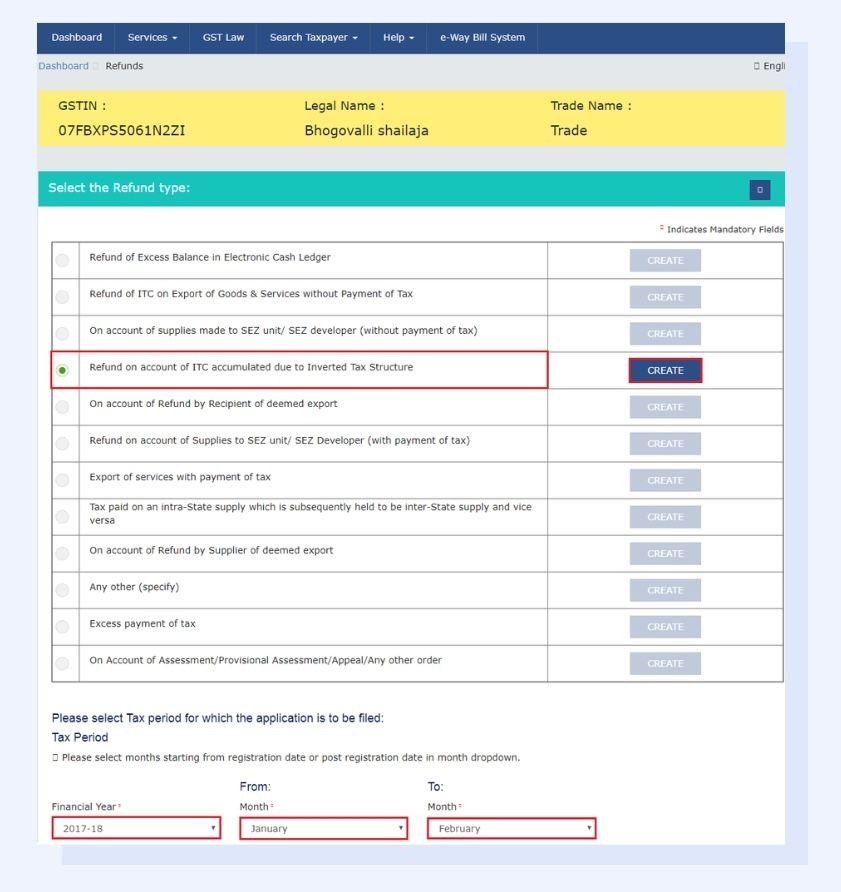

3. Select the Refund Type

On the refund application page, select "Refund of Excess ITC on Account of Export of Goods/Services without Payment of Tax" from the list of refund types. This option applies to businesses engaged in export transactions.

4. Download Refund Template

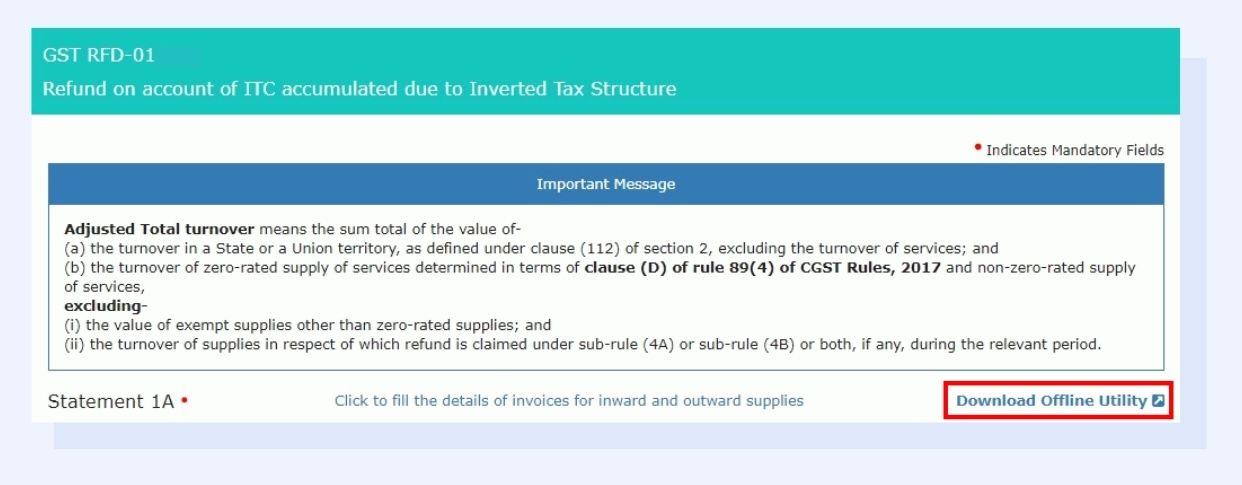

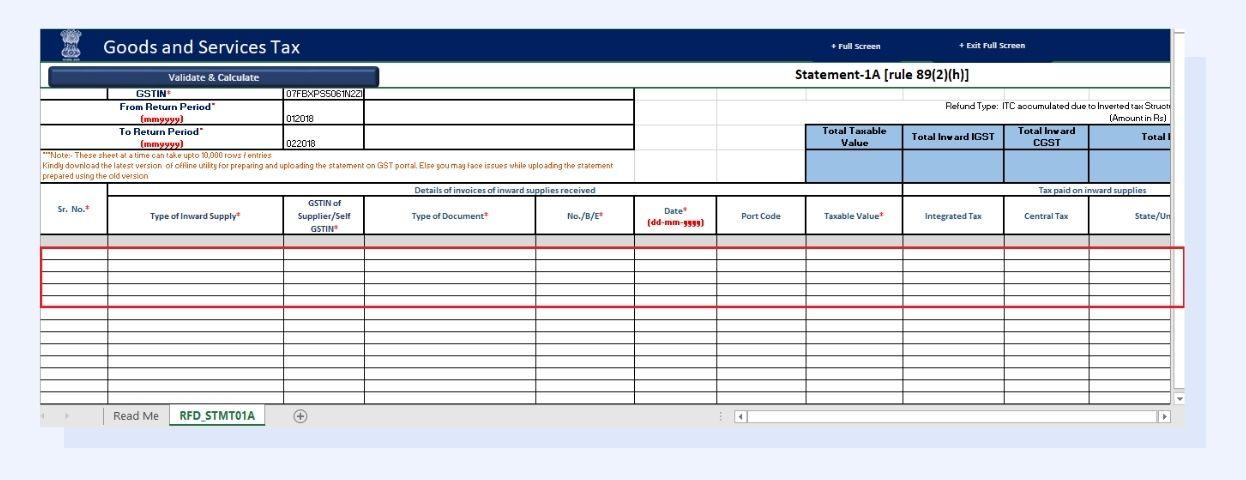

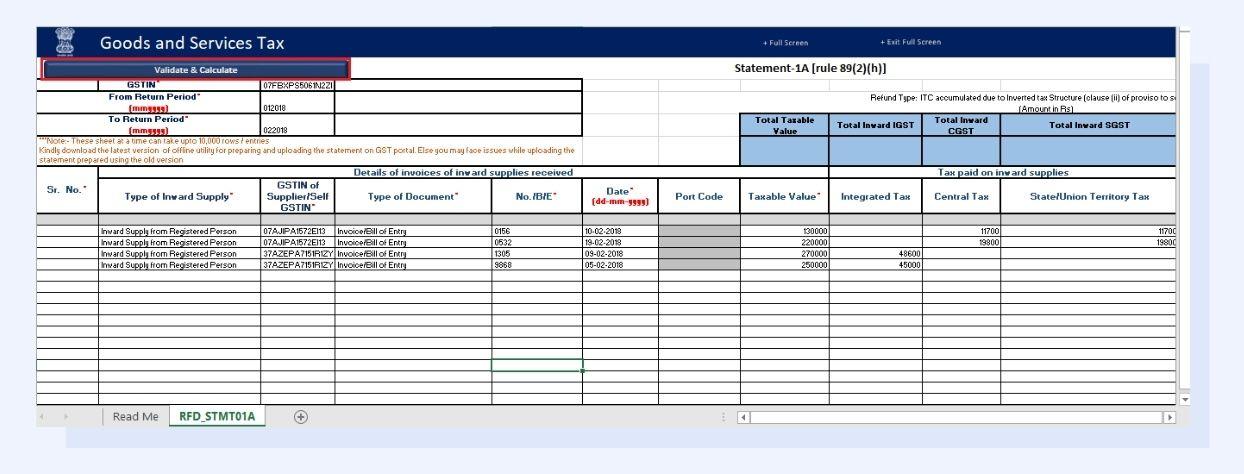

To enter all the necessary refund details, it is important to download the offline utility of the refund application. To obtain Statement 1A, simply click on ‘Download Offline Utility’, and then proceed to unzip the downloaded file. After unzipping, you can open the ‘GST_REFUND_S01A.xlsb’ template to complete the process.

5. Enter the Relevant Details

Fill in the required information on the refund application form. Select the relevant tax period for the refund, provide the amount of ITC to be refunded, and specify the bank account details for receiving the refund amount.

After you click on ‘Validate & Calculate’, wait for the total number of records in the sheet to be displayed and then click on ‘OK’. If there are any errors, you need to correct them and validate them again. Save the filled-in file on the computer.

6. Upload Saved File

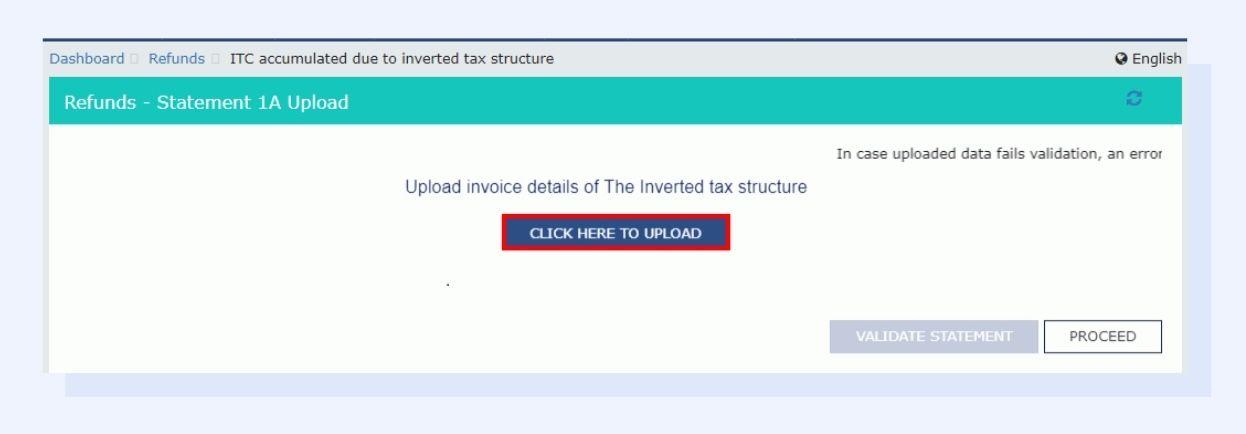

To validate Statement 1A on the GST portal, upload the saved file. On the GST portal, click on 'Click to fill in the details of invoices for inward and outward supplies' and then select 'CLICK HERE TO UPLOAD'. Choose the Statement 1A file to upload.

7. Verification and Submission

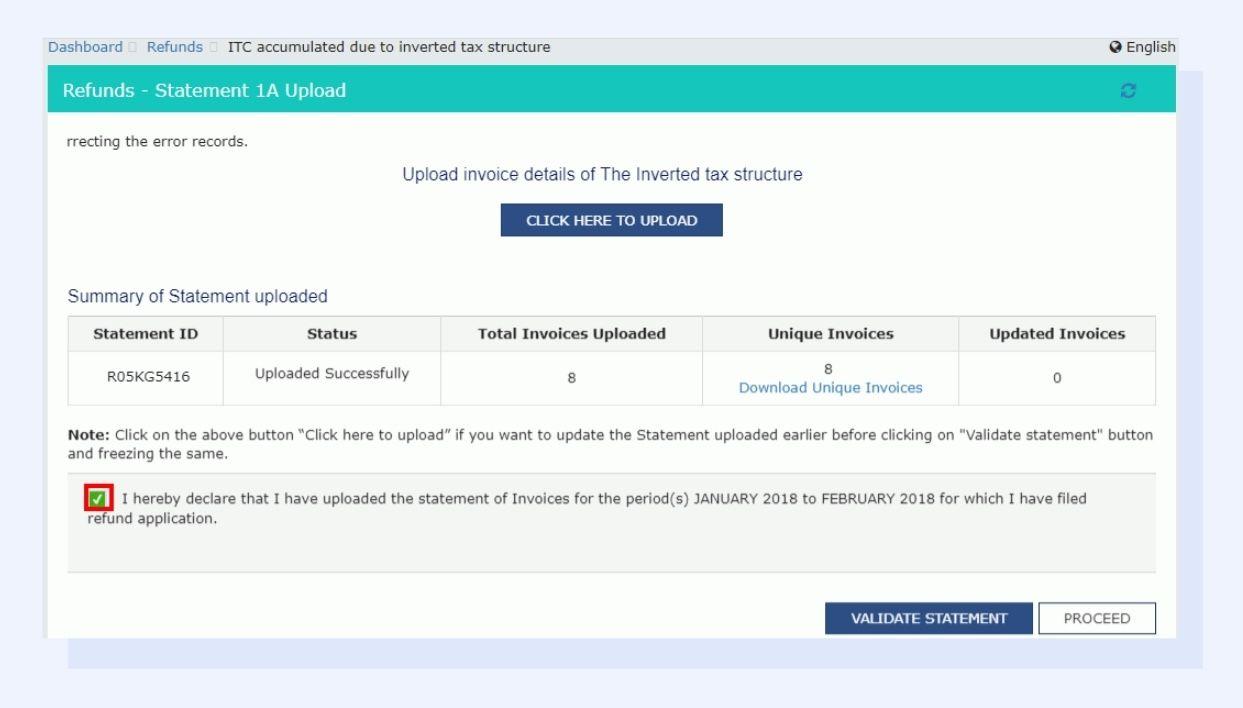

Review all the entered details and uploaded documents to verify their accuracy. Upon thoroughly checking the information, Select the declaration checkbox and click on ‘PROCEED’.

8. Calculate the Eligible Refund Amount

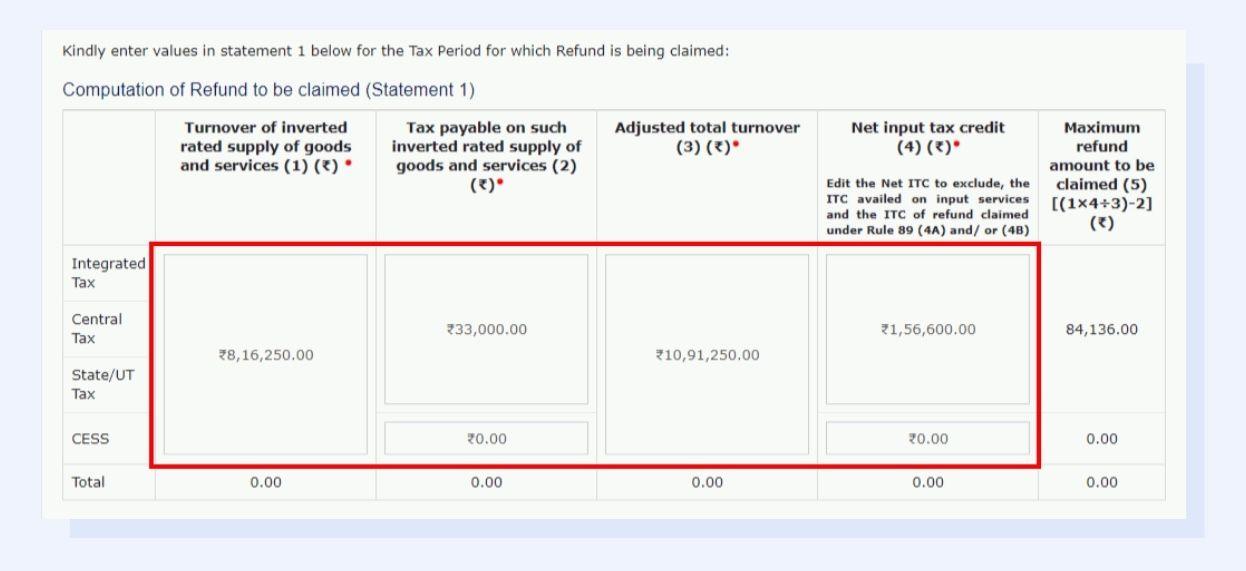

To calculate the claimable refund amount in Statement 1, you need to provide certain details. These details include the turnover of an inverted rated supply of goods and services, the tax payable on such supply, the adjusted total turnover, and the net input tax credit. The net input tax credit is already pre-filled from the Electronic Credit Ledger.

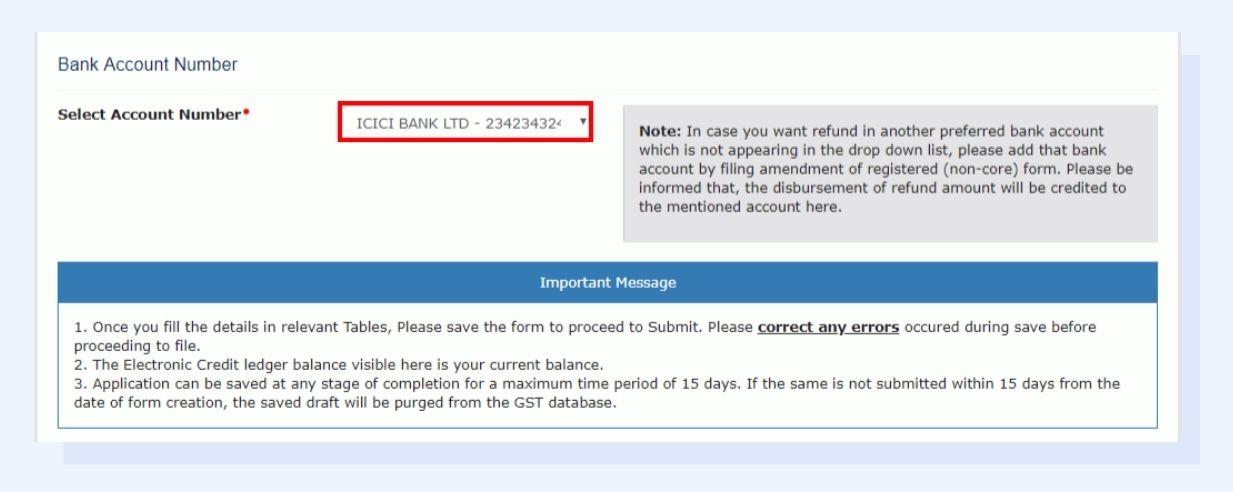

9. Select Bank Account

Choose the desired 'Bank Account Number' from the list to which you want to receive the refund amount.

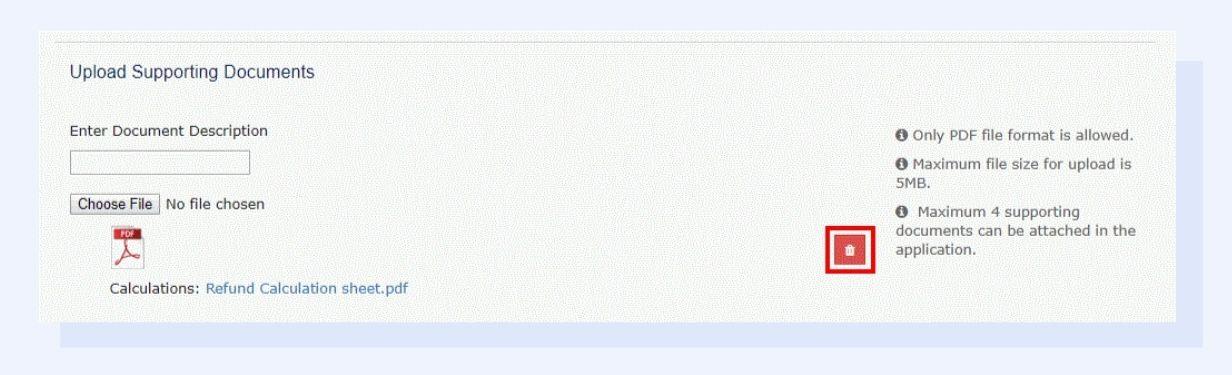

10. Upload Supporting Documents

Attach scanned copies of all the necessary documents that support your ITC refund claim. Ensure the documents are accurate, complete, and comply with the GST law's requirements.

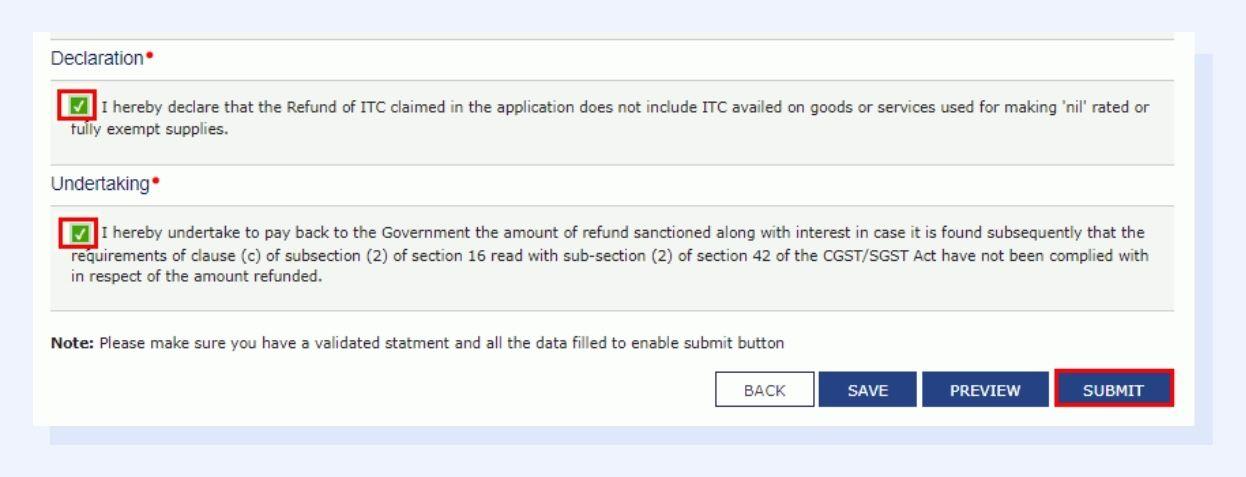

11. Submit Application

Preview and verify the refund application. To submit, select the declaration and undertaking checkbox and then click on ‘SUBMIT’.

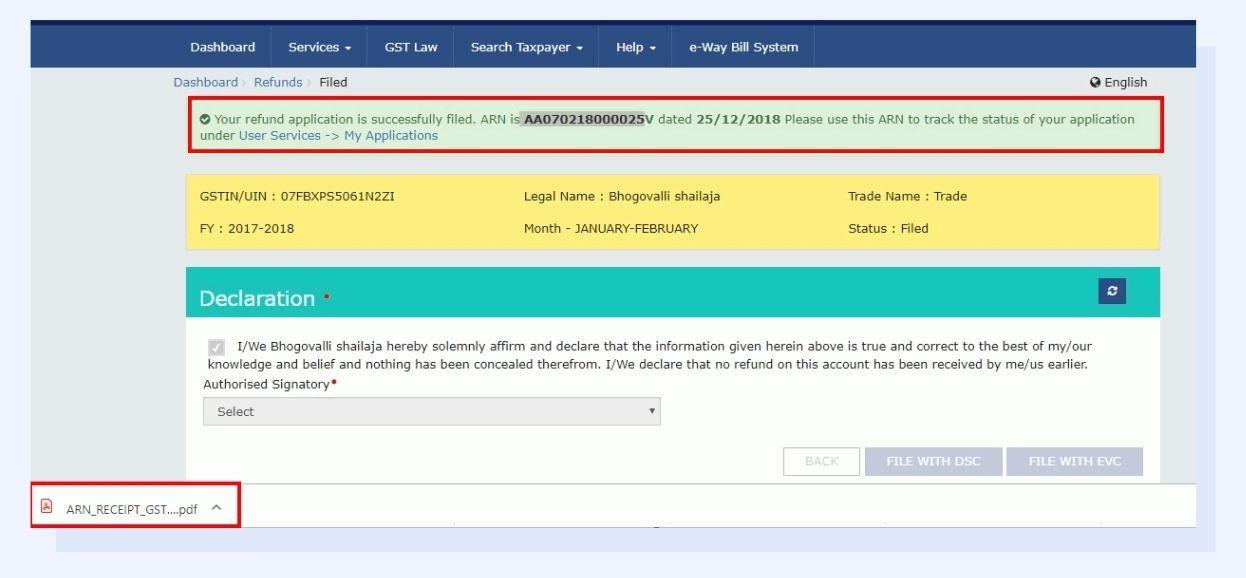

12. Acknowledgement Receipt

After submission, the GST portal will generate an acknowledgement receipt containing a unique refund application reference number (ARN). Save this ARN for future reference and tracking of the refund status.

13. GST Officer's Verification

The GST officer will verify the details and documents in the refund application. They may also seek additional information or clarification during the verification process.

14. Refund Processing

Upon successful verification, the GST officer will process the ITC refund, which will be credited directly to the bank account mentioned in the application.

For Automatic ITC in GST, the tax department will process the refund based on the information provided in the returns to check eligibility. Once the tax authorities approve the refund, they will transfer the amount directly to your registered bank account. The tax department may communicate with you regarding the refund status or request additional information.

Timeline for ITC Refund

As per GST regulations, the timeline for processing ITC refunds should not exceed 60 days from filing the refund application. Businesses generally expect to receive their ITC refunds within this 60-day timeframe, subject to successful verification and compliance with GST rules.

The timeline for processing an automatic ITC refund varies from a few weeks to a few months.

However, the refund process might take longer if the application contains complexities or discrepancies that require additional verification or investigation. In such instances, businesses should keep track of their refund status and cooperate with the GST authorities to expedite the process.

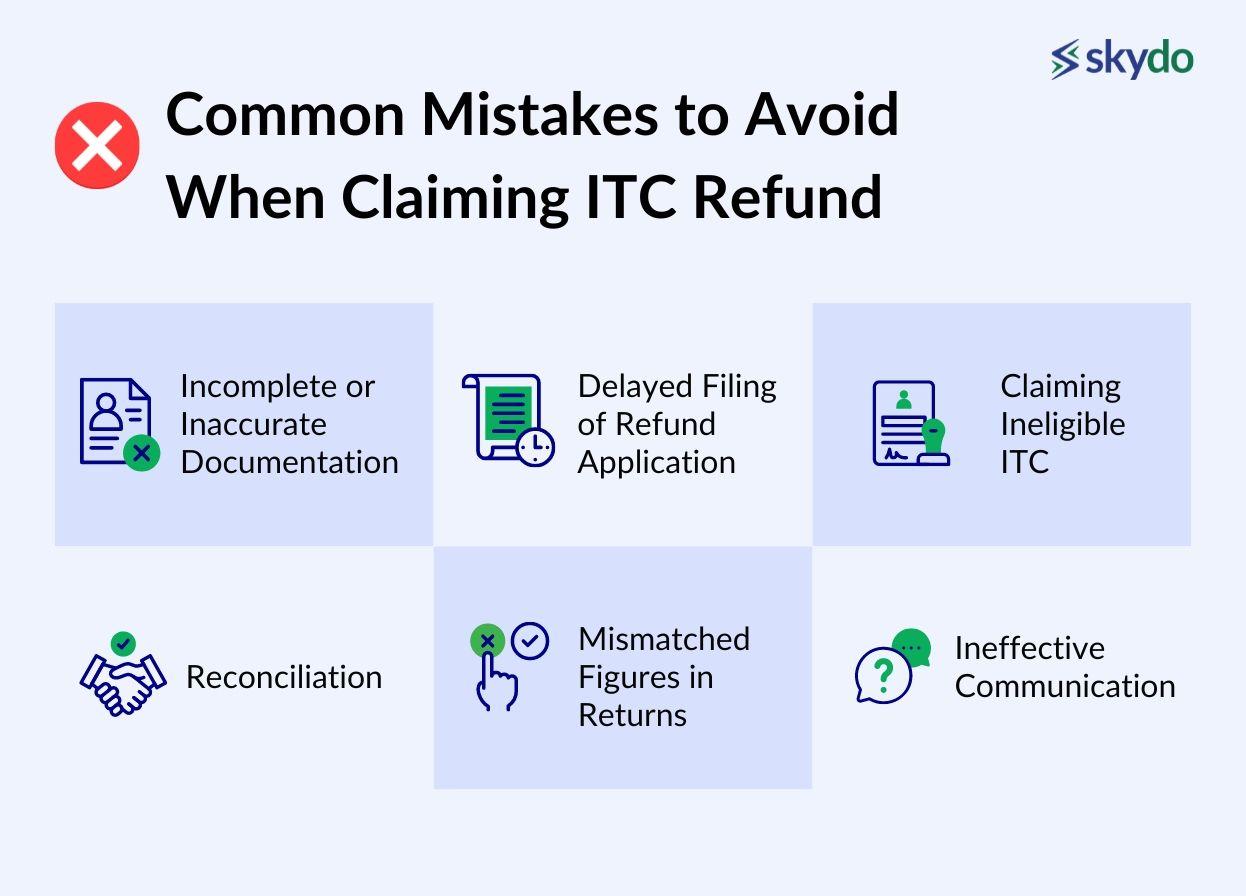

Common Mistakes to Avoid When Claiming ITC Refund

Claiming Input Tax Credit (ITC) refunds under the Goods and Services Tax (GST) system can be complex. Businesses should be mindful of the following common mistakes:

- Incomplete or Inaccurate Documentation: Inadequate supporting documents, missing invoice details, or mismatched figures can result in the rejection of the refund application.

- Delayed Filing of Refund Application: You must file your refund applications within the prescribed timeline to prevent delays in refund processing. Failure to apply on time can lead to the lapse of the refund claim period.

- Claiming Ineligible ITC: Claiming ITC on ineligible inputs or services is a common mistake businesses make. It is essential to adhere to the criteria outlined in the GST law to avoid claiming credits that do not qualify for a refund.

- Reconciliation: For automatic ITC, regularly reconcile purchase records, and ITC claims to prevent discrepancies. Additionally, verify that suppliers are registered, and their tax invoices are valid.

- Mismatched Figures in Returns: Discrepancies between the figures reported in various GST returns (such as GSTR-1, GSTR-2, and GSTR-3B) can lead to complications during the refund verification process.

- Ineffective Communication: Failure to communicate effectively with the GST authorities during verification can lead to delay. Businesses should be responsive to any queries raised by the authorities and provide the requested information promptly.

Final Thoughts

Claiming Input Tax Credit (ITC) refunds in India is essential for businesses to improve cash flow and minimise tax burdens. The process involves timely filing and accurate documentation through the GST portal. They must comply with GST regulations, maintain proper records, and submit eligible ITC claims promptly to ensure successful refunds.

Seeking guidance from qualified experts, such as Chartered Accountants, can enhance the refund application's efficiency. By adhering to the ITC refund process and complying with GST rules, businesses can optimise their financial operations and operate efficiently under the GST regime. Prompt action and compliance are key to unlocking the benefits of ITC refunds.

Frequently Asked Questions on Input Tax Credit Refund

Q1. What is the time limit for claiming ITC?

Ans: The time limit for claiming Input Tax Credit (ITC) under GST regulations is 30th November of the following year or the date of filing annual returns. Businesses generally expect to receive their ITC refunds within 60 days of filing the refund application, subject to successful verification and compliance with GST rules.

Q2. How to check input tax credit in the GST portal?

Ans: To check Input Tax Credit (ITC) on the GST portal, businesses should log in to the GST portal using their registered credentials, navigate to the "Services" tab, choose "Refunds," and select the relevant refund application type. They can then enter the required information and upload supporting documents to verify and submit the application.

Q3. Who can claim the input tax credit?

Ans: Registered taxpayers under the GST Act can claim Input Tax Credit (ITC) as long as they meet the eligibility criteria, including having accumulated credit in the electronic credit ledger, timely filing of GST returns, and possessing valid documents to substantiate their ITC claim.

Disclaimer: This article is for informational purposes only and should not be considered legal advice. Readers are encouraged to consult with a tax professional or refer to the official government resources for accurate and updated information on claiming ITC refunds.