How to File GST Monthly and Quarterly for Freelancers

For freelancers, timely and accurate GST filing is non-negotiable. Failure to comply can result in hefty penalties. With two filing frequencies—monthly or quarterly—ensuring you file them during these set durations is crucial.

This blog simplifies GST for freelancers, covering registration, filing returns, and staying compliant.

Under GST regulations, mandatory registration is necessary in the following scenarios.

- When the turnover surpasses Rs. 20 lakhs (for general cases).

- When the turnover exceeds Rs. 10 lakhs (specifically for North-east states).

- For services falling under Online Information and Database Access and Retrieval services (OIDAR).

- The export of services constitutes "zero-rated supplies" and falls under the category of "inter-state supply" as per the IGST Act.

In 2019, the Union government introduced the composition scheme, offering freelancers earning less than Rs. 50 lakhs annually to pay GST at a reduced rate. Under this scheme, freelancers must pay a combined GST rate of 6% every quarter, with 3% allocated for CGST and 3% for SGST.

To verify your existing GST registration status, follow these steps.

- Visit the official GST Portal.

- Navigate to the "Services" section.

- Click on "Services Registration Track Application Status."

- Access the module.

- Select "Registration" from the drop-down menu.

- Enter the ARN (Application Reference Number) received via email after submitting your GST registration.

- Provide the captcha code.

- Click on "Search."

- A pop-up will appear, showing the status of the ARN number within your selected timeframe.

- Your GST registration status will be visible.

- You can download the acknowledgement for your records if the status shows approval.

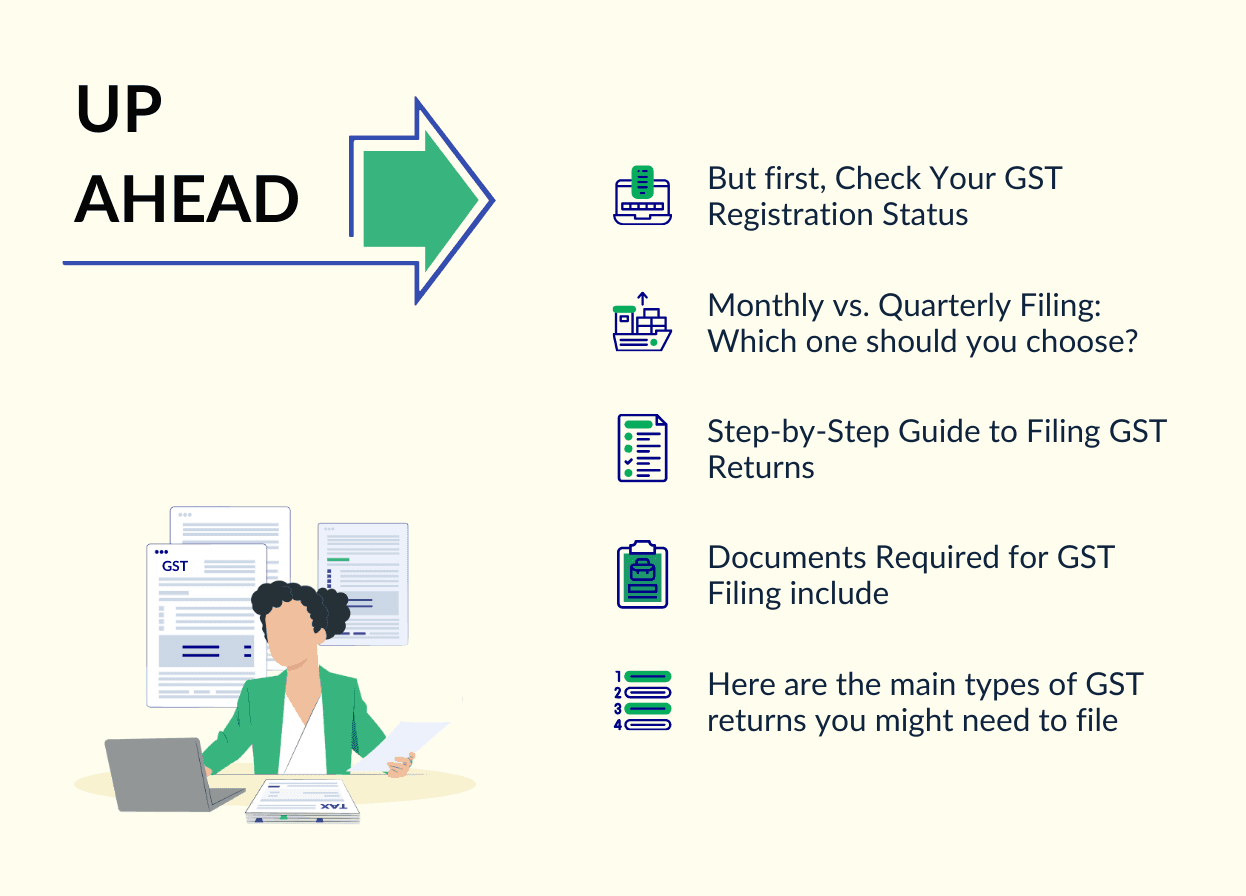

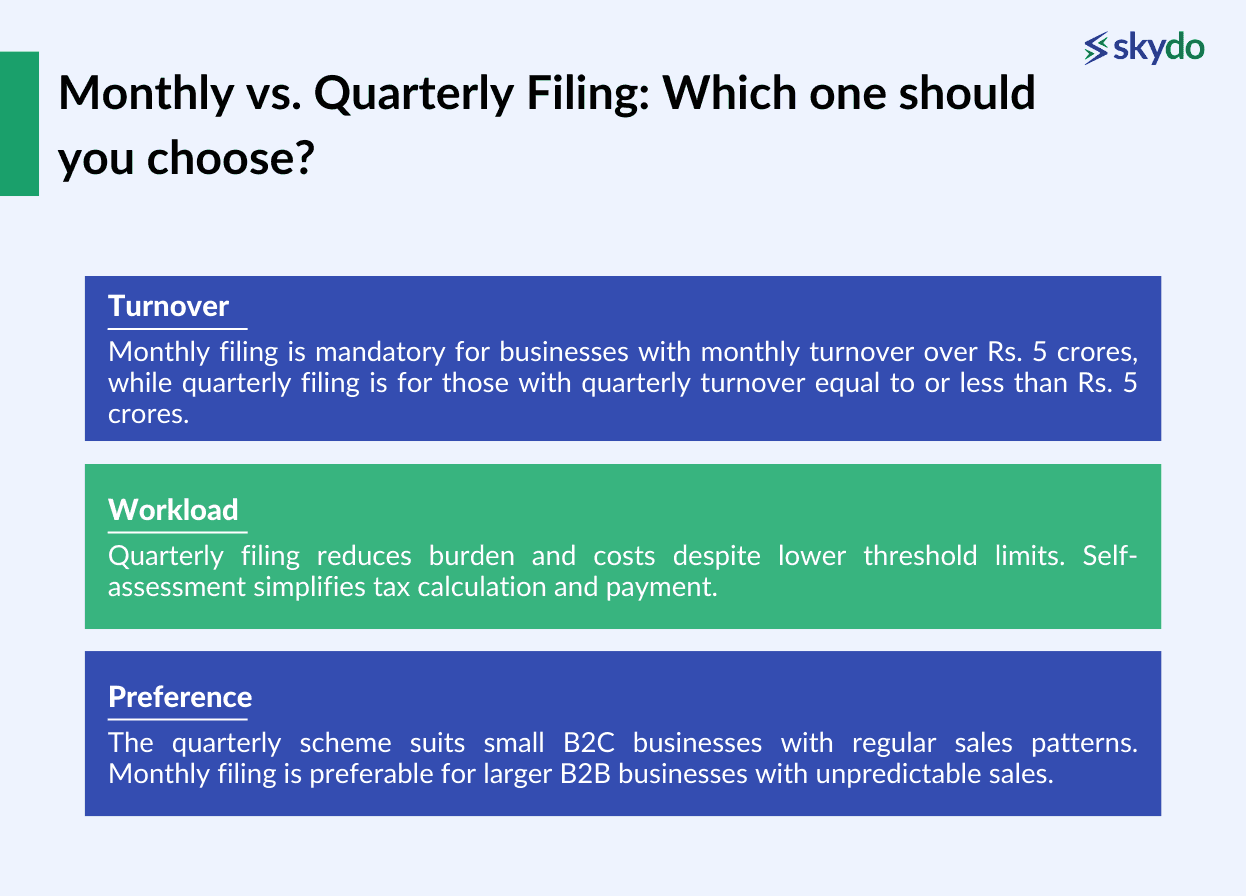

Monthly vs. Quarterly Filing: Which one should you choose?

Consider the following factors to choose between monthly and quarterly GST filing.

- Turnover: Monthly filing is mandatory for businesses with monthly turnover over Rs. 5 crores, while quarterly filing is for those with quarterly turnover equal to or less than Rs. 5 crores.

- Workload: Quarterly filing reduces burden and costs despite lower threshold limits. Self-assessment simplifies tax calculation and payment.

- Preference: The quarterly scheme suits small B2C businesses with regular sales patterns. Monthly filing is preferable for larger B2B businesses with unpredictable sales.

GSTR-1 is a monthly or quarterly return that contains details of outward supplies of goods or services. It is a summary of all sales transactions made by a taxpayer during a specific period.

Timely and accurate filing of GSTR-1 is crucial to claim Input Tax Credit (ITC) and for reconciliation purposes.

For freelancers who opt for monthly filing, you need to file GSTR-1 every month, generally by the 11th of the next month. If you choose quarterly filing, you must submit GSTR-1 once every quarter, typically by the 13th of the month following the end of the quarter.

GSTR-3B is a self-declared summary GST return filed every month (quarterly for the QRMP scheme). You need to report the summary figures of sales, ITC claimed, and net tax payable in GSTR-3B.

The due date for the monthly filers is the 20th day of the next month, whereas, for quarterly GST returns, it is either the 22nd or the 24th day of the month following the quarter, depending on the state or union territory of the place of business.

Late filing will lead to accumulating interest and penalties. Therefore, choose wisely.

Step-by-Step Guide to Filing GST Returns

#1: Gather Necessary Documents

Collect all relevant documents, such as invoices, bills, and bank statements, that will be required for filing GST returns.

#2: Log In to the GST Portal

Visit the official GST portal and log in using your credentials.

#3: File GSTR-1 (Outward Supplies Details)

- For Monthly Filers: Submit monthly data detailing outward supplies made during the month.

- For Quarterly Filers: Submit cumulative data summarising outward supplies for the entire quarter.

#4: Reconcile and Finalise GSTR- 2A (Auto-populated Supplier Details)

- This step is applicable for both monthly and quarterly filers.

- Review the auto-populated details in GSTR- 2A, which include information about supplies received from your suppliers.

- Ensure accuracy and reconcile any discrepancies with your records.

#5: File GSTR- 3B (Summary Return)

- For Monthly Filers: Submit details of sales and purchases, input tax credit, and pay tax for the current month.

- For Quarterly Filers: Submit summarised data for the entire quarter and pay tax accordingly.

#6: Make Online GST Payments Based on GSTR-3B

After filing GSTR-3B, make online GST payments using the available payment options on the GST portal. Ensure timely payment of tax liabilities to avoid penalties and interest charges.

Final Words

Staying GST compliant is paramount for freelancers to avoid penalties and maintain financial health. If you need more clarification, it's wise to seek personalised advice from a tax professional.

The GST portal is your go-to resource for more help navigating GST for freelancers. It's packed with handy tools, guidelines, and updates to keep you on track with GST regulations.

If you're eager to dive deeper into tax filing strategies tailored for freelancers, don't forget to explore our blog.

FAQs

Q1. Do I need to pay advance tax if my GST liability is high?

Ans: There is no provision for paying advance tax in case of higher GST liability.

Q2. What are the benefits of opting for the Composition Scheme?

Ans: Benefits of opting for the composition scheme:

- Limited Compliance: Quarterly returns reduce the burden of record-keeping, allowing focus on core operations.

- Limited Tax Liability: Nominal tax rates under the GST Law make it financially advantageous.

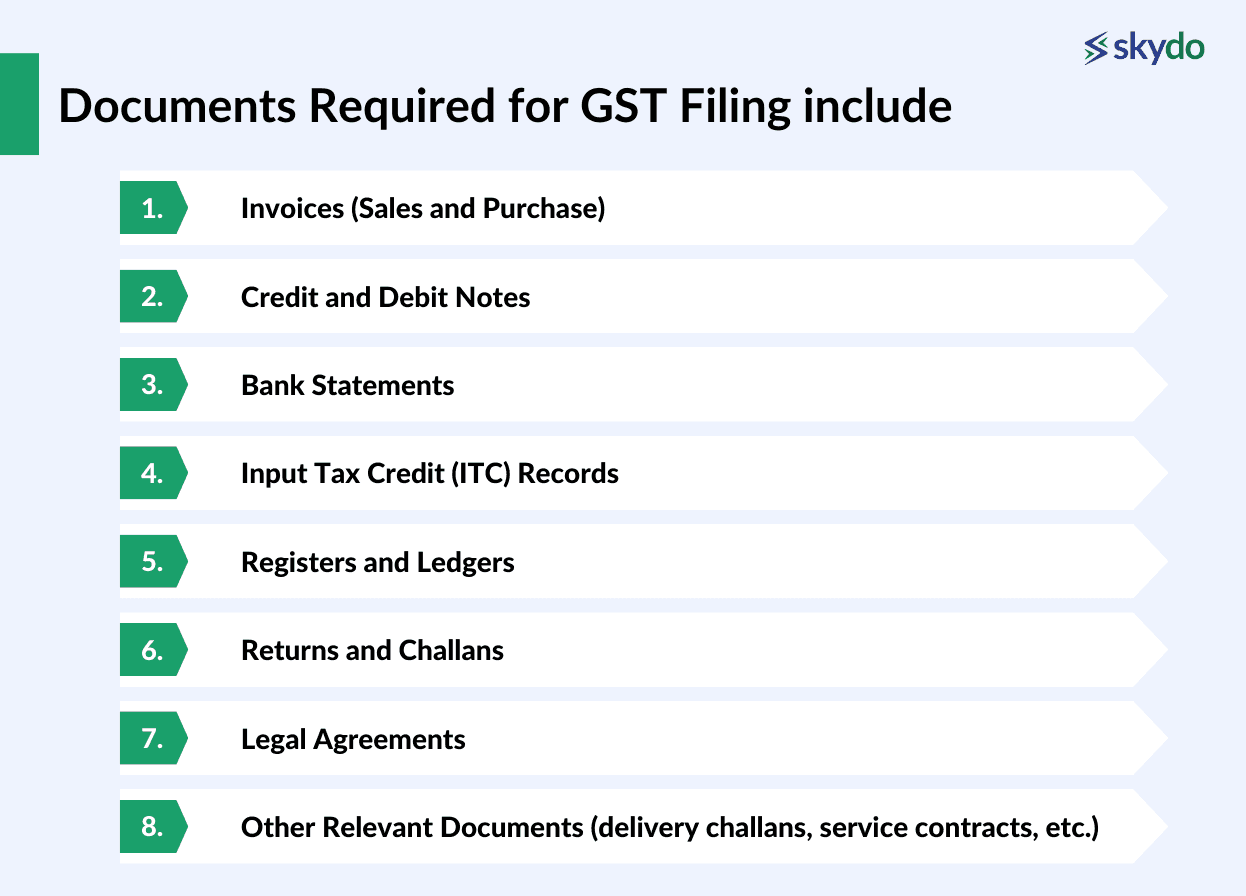

Q3. What documents do I need to keep for GST filing?

Ans: Documents Required for GST Filing include:

- Invoices (Sales and Purchase)

- Credit and Debit Notes

- Bank Statements

- Input Tax Credit (ITC) Records

- Export Documentation (if applicable)

- Registers and Ledgers

- Returns and Challans

- Legal Agreements

- Other Relevant Documents (delivery challans, service contracts, etc.)

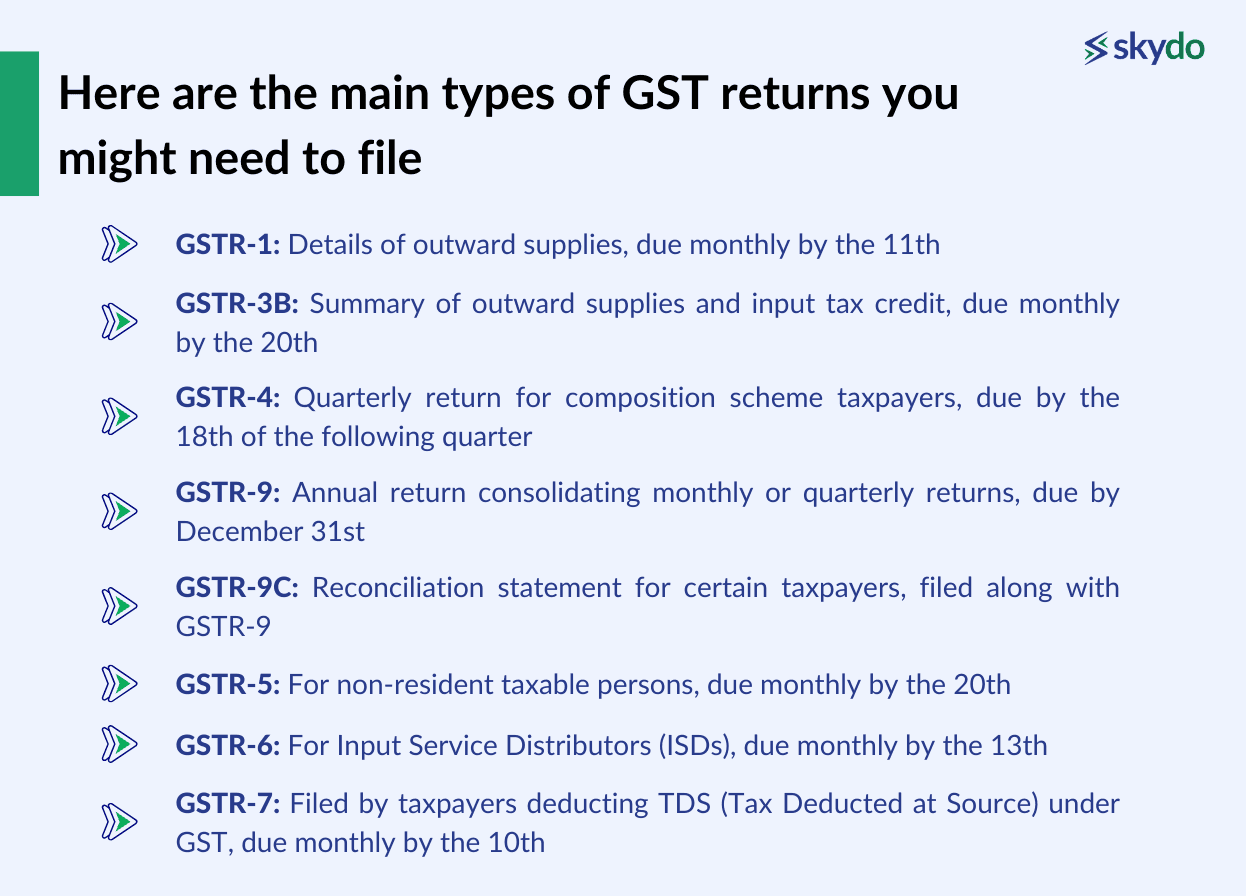

Q4. What are the different types of GST returns I need to file?

Ans: Here are the main types of GST returns you might need to file.

- GSTR-1: Details of outward supplies, due monthly by the 11th.

- GSTR-3B: Summary of outward supplies and input tax credit, due monthly by the 20th.

- GSTR-4: Quarterly return for composition scheme taxpayers, due by the 18th of the following quarter.

- GSTR-9: Annual return consolidating monthly or quarterly returns, due by December 31st.

- GSTR-9C: Reconciliation statement for certain taxpayers, filed along with GSTR-9.

- GSTR-5: For non-resident taxable persons, due monthly by the 20th.

- GSTR-6: For Input Service Distributors (ISDs), due monthly by the 13th.

- GSTR-7: Filed by taxpayers deducting TDS (Tax Deducted at Source) under GST, due monthly by the 10th.