How to Finance Your Startup

Securing funding is vital to bringing your startup ideas to fruition. Without ample financial resources, even the most innovative ideas may face challenges in gaining traction.

A study by Skynova revealed that lack of financing led to the failure of 47% of startups in 2022.

Fortunately, a range of funding options are available to startups, each with unique advantages and considerations. This blog lists various funding options for entrepreneurs seeking capital.

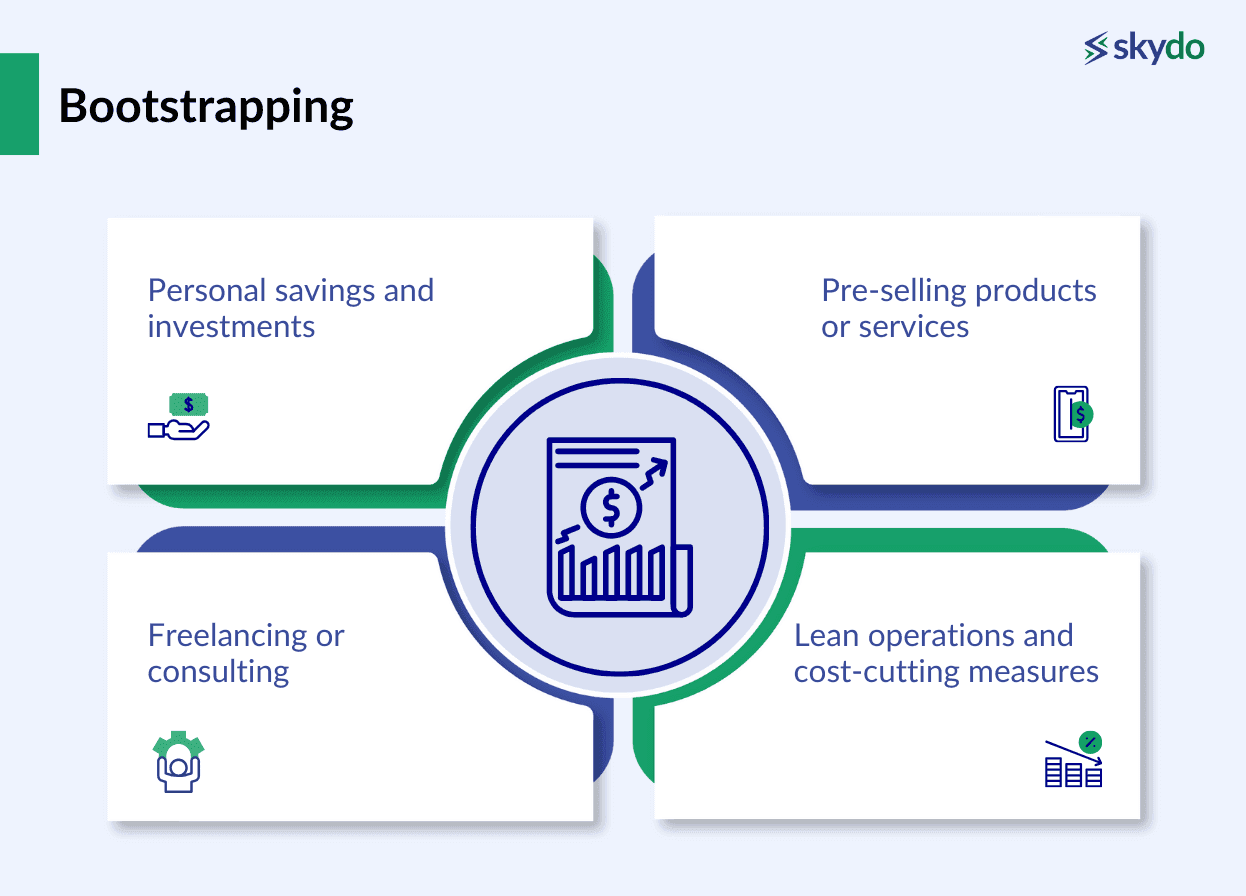

1. Bootstrapping

Bootstrapping means using personal resources and business revenue generated to fund itself. It offers several benefits, including independence from external investors and complete control over decision-making processes.

It allows the founders to adapt quickly to market changes without sharing equity with investors. However, gathering enough funds can take a lot of work, leading to financial risks and potentially slowing growth compared to funded startups.

Here are some strategies for bootstrapping.

- Personal savings and investments

Many entrepreneurs use their savings or investments to fund their startups. This demonstrates commitment and belief in the venture's potential.

- Pre-selling products or services

Selling products or services before they are fully developed can generate early revenue to fund operations and product development.

- Freelancing or consulting

Founders with specialised skills can generate income through freelancing or consulting while simultaneously working on their startup.

- Lean operations and cost-cutting measures

Minimising expenses and operating with a lean approach can stretch limited resources further, allowing the business to operate efficiently without relying on external funding.

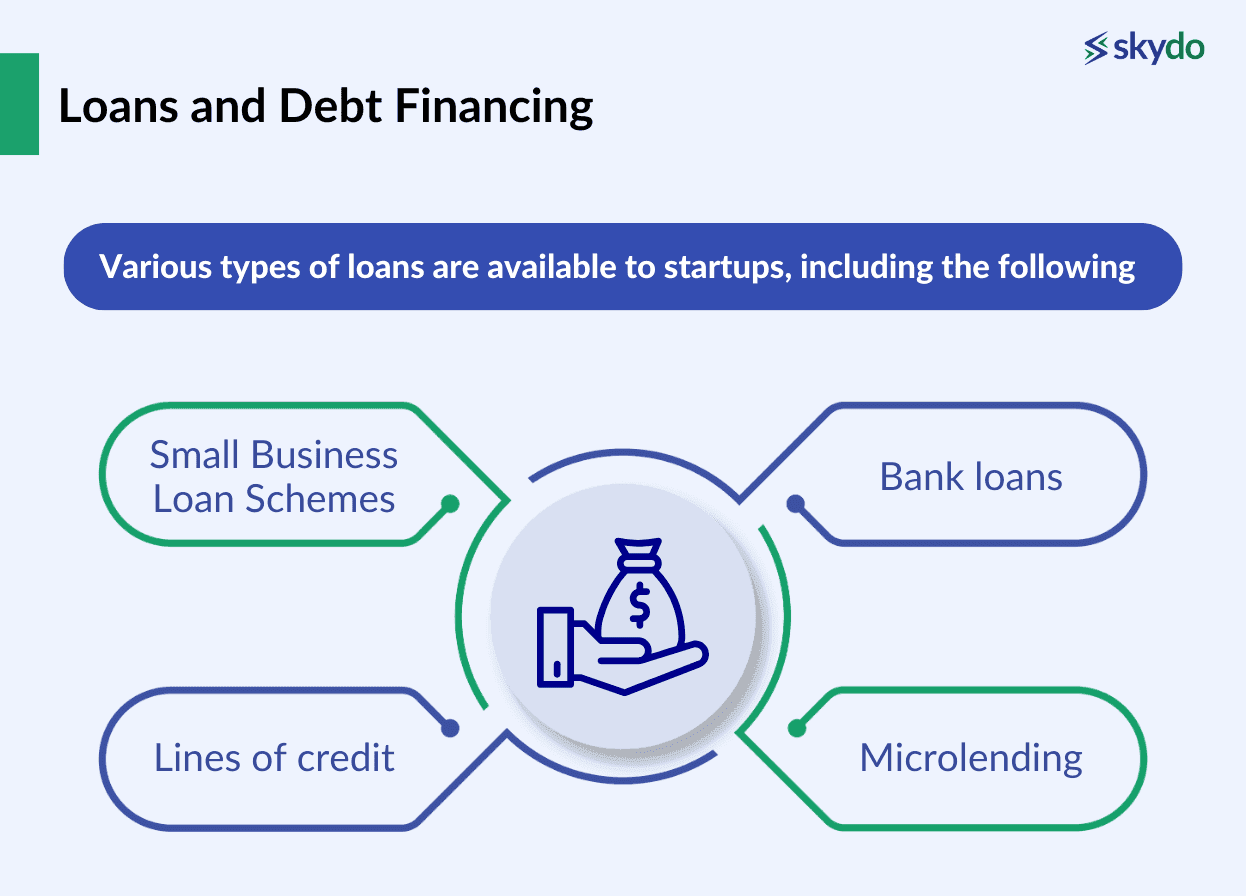

2. Loans and Debt Financing

Debt financing includes borrowing money from external sources with the obligation to repay it over time, typically with interest. Various types of loans are available to startups, including the following.

- Small Business Loan Schemes

Government-sponsored small business loan schemes, such as the Pradhan Mantri Mudra Yojana, Stand-up India, Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), and National Small Industries Corporation (NSIC) subsidy loan schemes, support and foster the growth of small businesses.

These initiatives offer several advantages, including lower interest rates, collateral-free options, a simplified application process, and longer repayment tenures.

- Bank loans

Banks provide startup funding via various loan products tailored to the specific needs of small businesses.

- Lines of credit

A line of credit grants access to a specific sum of money to utilise as needed, with the flexibility to repay immediately or over time.

- Microlending

Microlenders specialise in providing small loans to entrepreneurs who may not get traditional bank loans. They often offer personalised assistance and support to help startups succeed. Some trailblazers in this segment include Paytm, PhonePe, BharatPe, and KreditBee.

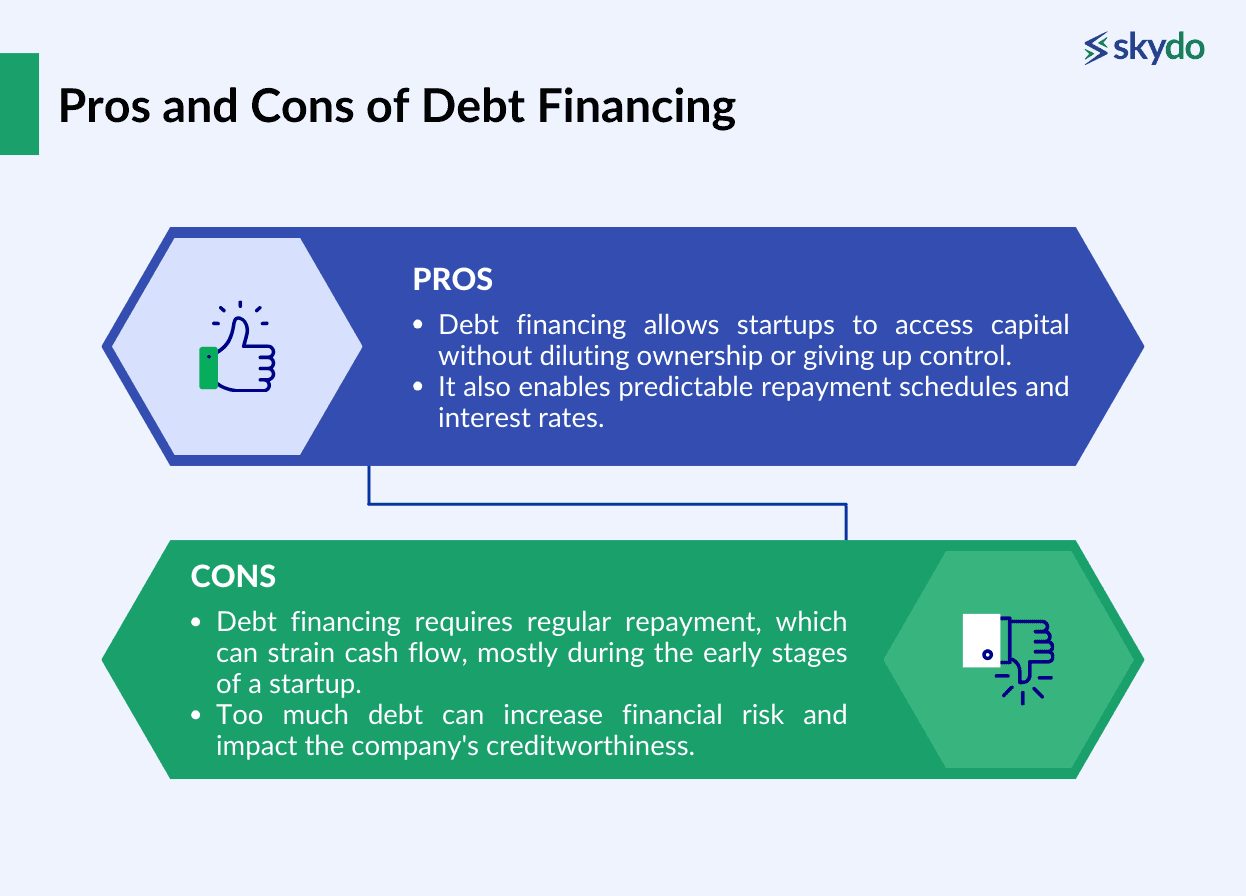

Now, let’s explore the pros and cons of debt financing.

Pros

- Debt financing allows startups to access capital without diluting ownership or giving up control.

- It also enables predictable repayment schedules and interest rates.

Cons

- Debt financing requires regular repayment, which can strain cash flow, mostly during the early stages of a startup.

- Too much debt can increase financial risk and impact the company's creditworthiness.

3. Equity Financing

Equity financing is a mode of startup funding that raises capital by selling the company's ownership shares, i.e., equity shares to investors. Common sources of equity financing for startups include the following.

- Angel investors

They are High Net-worth Individuals (HNIs) who provide capital to early-stage startups in exchange for equity ownership. They often bring industry expertise and connections to help startups grow.

- Venture capitalists (VCs)

Venture capitalists are professional investors who manage funds dedicated to investing in high-growth startups. VCs typically invest larger amounts of capital in exchange for significant equity stakes and play an active role in the startup ecosystem.

- Crowdfunding

Crowdfunding platforms allow startups to raise capital from many individual investors, often through online platforms. This approach can democratise access to funding and generate public interest in the company.

Here are a few pros and cons of equity financing.

Pros

- Equity financing provides access to substantial capital without the obligation to repay debt.

- Investors also bring expertise, resources, and networks to support the startup's growth.

Cons

- Equity financing involves diluting ownership and giving up a portion of the company's control.

- Founders may also face pressure from investors to prioritize short-term growth over long-term sustainability.

4. Grants and Competitions

Government grants and competitions offer non-dilutive funding and validation for startups, particularly those in specific industries or with social impact. The objective is to support innovation, research, and development across various sectors.

A startup must navigate the application process, which often includes submitting proposals and business plans and meeting criteria set by the granting organisation or competition organisers.

Here are some of the schemes introduced by the Government of India.

- Smart Farm Challenge by STPI

- Startup India Initiative

- Dairy Entrepreneurship Development Program

- Pradhan Mantri Mudra Yojna

- Startup India Seed Fund

- Digital India Bhashini

- ASPIRE

- Startup Leadership Program

- Chunauti

- Qualcomm Semiconductor Mentorship Program

- Aatmanirbhar Bharat App Innovation Challenge

- STPI Samridh Scheme

- Digital India Genesis

- Drone Shakti

Granting organisations and competition organisers evaluate applicants based on factors such as startup ideas, feasibility, social impact, and potential for commercialisation.

Choosing the Right Funding Option

Selecting the appropriate funding option requires careful consideration of the startup's needs, stage of development, and risk tolerance. Below are some of the key factors to consider in startup funding.

- Business stage

The funding needs of a startup vary depending on its stage of development, from ideation to growth and expansion. - Risk tolerance

Founders must assess their comfort level with financial risk and determine the level of control they are willing to relinquish in exchange for funding. - Long-term goals

Aligning the chosen startup funding option with the startup's long-term goals and vision is essential for sustainable growth and success.

Conclusion

Securing funding is a critical milestone in the startup journey, and understanding the various financing options empowers founders to make informed decisions.

Whether through bootstrapping, debt financing, equity financing, grants, or competitions, each funding avenue offers unique advantages and considerations.

By evaluating the options based on their needs and goals, founders can position their startups for success while preserving their vision and values.

It's advisable to conduct further research and seek professional guidance before committing to any funding arrangement.

Q1: How much salary can a startup founder take?

Ans: Startup founders often prioritise reinvesting profits into the business. Therefore, their salary can vary widely. Factors like the startup's financial situation, industry norms, and individual preferences significantly determine founder compensation.

Q2: How does a startup get funding?