How to Optimise Financial Operations with Skydo's Payment Platform

Outdated financial systems and processes can create significant inefficiencies and costly business errors. Finance Heads are often forced to spend time firefighting instead of strategising. Unfortunately, the role of the modern Finance Head is about more than just overseeing financial operations; it's about leading businesses through uncharted waters.

Platforms like Skydo offer a solution to these deep-rooted problems through their payment platform. This guide explains how you, as a Finance Head, can make your organisation more agile, and efficient, and stay ahead of the curve with Skydo.

As a key strategic partner in driving growth, you navigate the complexities of a globalised business landscape. Despite this expanded role, there are still numerous challenges that come with being at the top of the finance tier in a company.

- A high volume of transactions

Modern businesses are constantly operating across multiple channels and executing a large number of transactions every day. Keeping track of and ensuring the accuracy of these transactions can be overwhelming since they often involve different platforms and systems.

- Cross-border payment regulations and compliance

As businesses expand globally, heads of finance face challenges in navigating international payment regulations. Each country has its unique rules, making it a difficult and potentially risky task to ensure compliance.

Ensuring Data Security and Fraud Prevention

- Risks of financial data breaches

With the increasing value and vulnerability of data, it's crucial to have strong security measures in place to prevent breaches. Not only can financial data breaches result in huge monetary losses, but they can also damage stakeholder trust and harm a company's reputation.

- Fraudulent activities in payment processes

The digital age has brought about convenience, but it has also created opportunities for sophisticated fraudulent activities. As a result, Finance heads like you have no choice but to prioritise robust systems in place to detect and prevent any unauthorised transactions.

Manual and Time-Consuming Workflows

- Inefficiencies in invoice processing

Manual invoice processing and approvals are time-consuming and prone to errors, causing payment delays, disputes, and financial discrepancies. Streamlining this process with automation can save businesses time and money while ensuring accuracy.

- Resource drain on repetitive tasks

Redundant tasks can consume a significant amount of time for finance teams, draining resources and diverting attention from more strategic, value-added activities. By automating these tasks, finance teams can focus on more critical tasks and increase productivity.

Lack of Real-Time Visibility

- Tracking payment statuses

You may be dealing with outdated systems that don't provide timely updates on payment statuses. It leads to uncertainties and potential cash flow issues, hindering the company's success.

- Implications for decision-making

For top-tier finance officials, timely insights into financial operations are crucial for effective decision-making. Without real-time data, they may make reactive decisions instead of proactive ones, which can hamper the company's growth trajectory.

Being a modern Finance head comes with its share of challenges but also great influence and strategic importance. To effectively address these challenges, a combination of technology, process optimisation, and forward-thinking is necessary. With the right approach, you can have a major impact on a company's success.

Overcoming Finance Challenges with Skydo: A Comprehensive Solution

Skydo’s payment platform is designed specifically to address the pain points of Finance Heads iterated above. Here's how we help overcome these challenges and achieve company goals.

Navigating Regulatory Compliance with Ease

1. Auto-generated FIRAs

Operating in international markets includes the daunting task of ensuring compliance with local regulations. But with Skydo, this process is simplified thanks to our auto-generated Foreign Inward Remittance Certificates (FIRAs). As soon as the amount reaches the business bank account, the FIRA is available to download to ensure compliance.

Businesses can rest assured that they are always compliant without dealing with manual hassle.

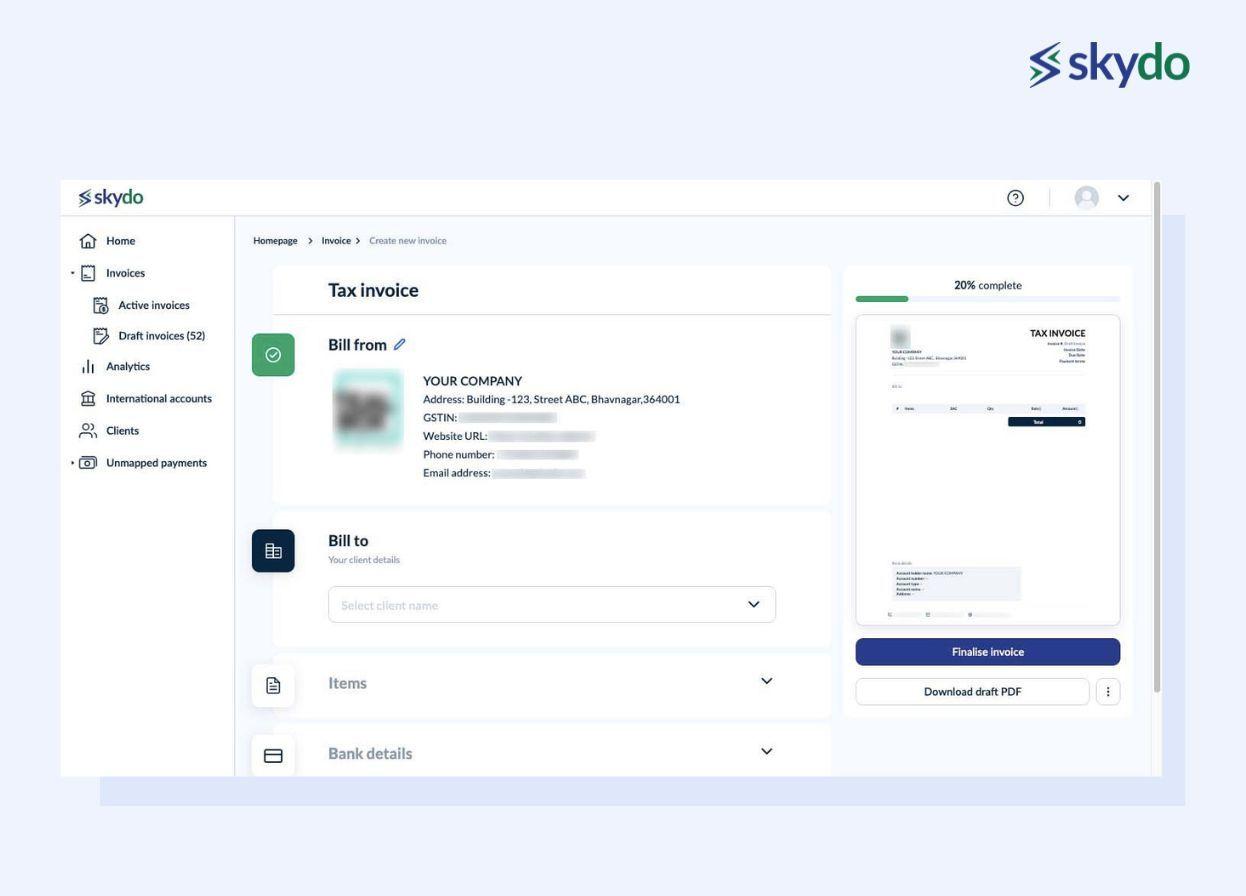

2. Purpose Code according to RBI guidelines

Skydo's purpose code field ensures that every transaction aligns with RBI guidelines, eliminating the risk of non-compliance. This pre-filled field includes the suggested codes relevant to your business, which you can simply select once the invoice is generated.

Different transactions have different purposes, and the Reserve Bank of India (RBI) mandates specific codes for each, which must be followed to comply with regulations.

Invoice creation and payment reminders

Say goodbye to manual invoicing and chasing clients for payments. Skydo offers automated invoice creation and timely payment reminders, ensuring a steady cash flow for businesses. This allows you to focus on strategic financial planning without the hassle of administrative tasks.

Gaining a Holistic View of Financial Operations

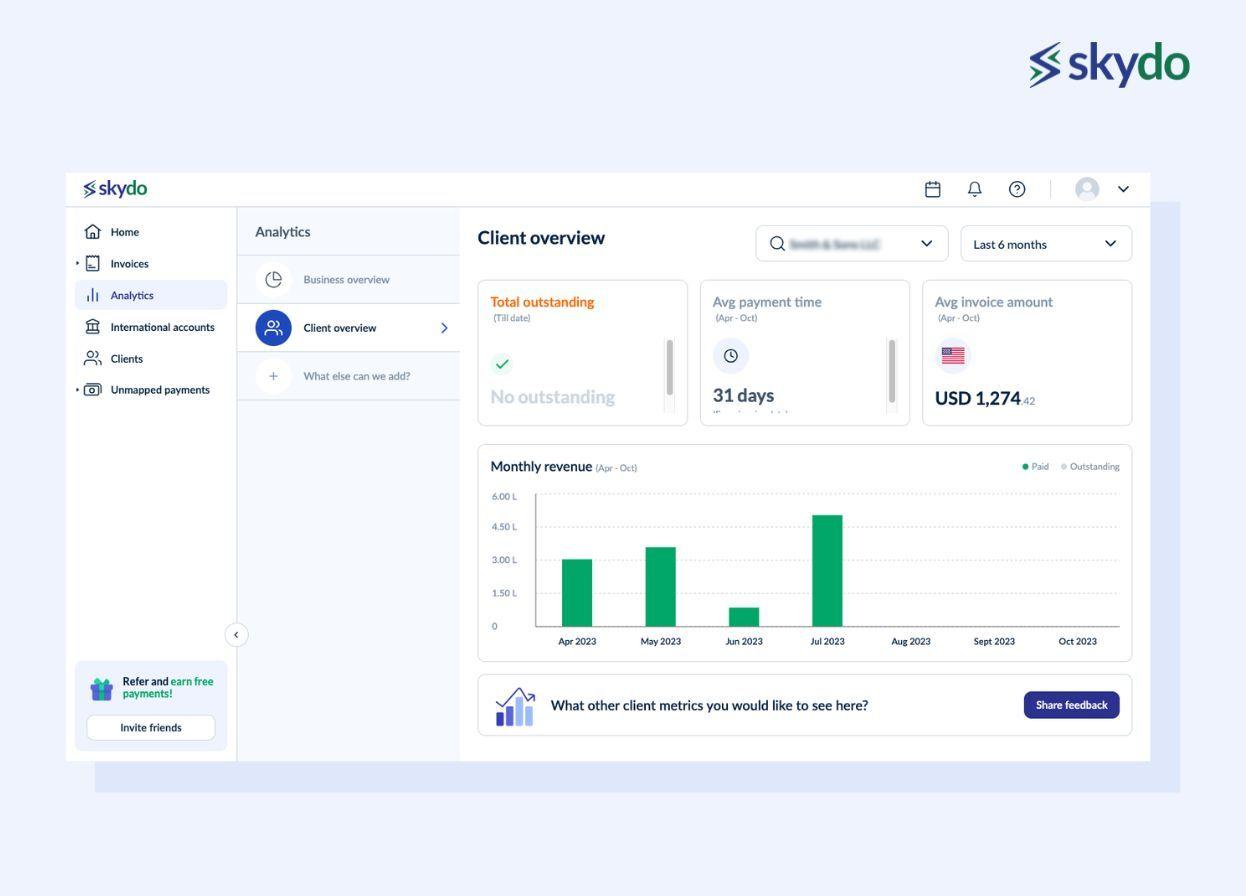

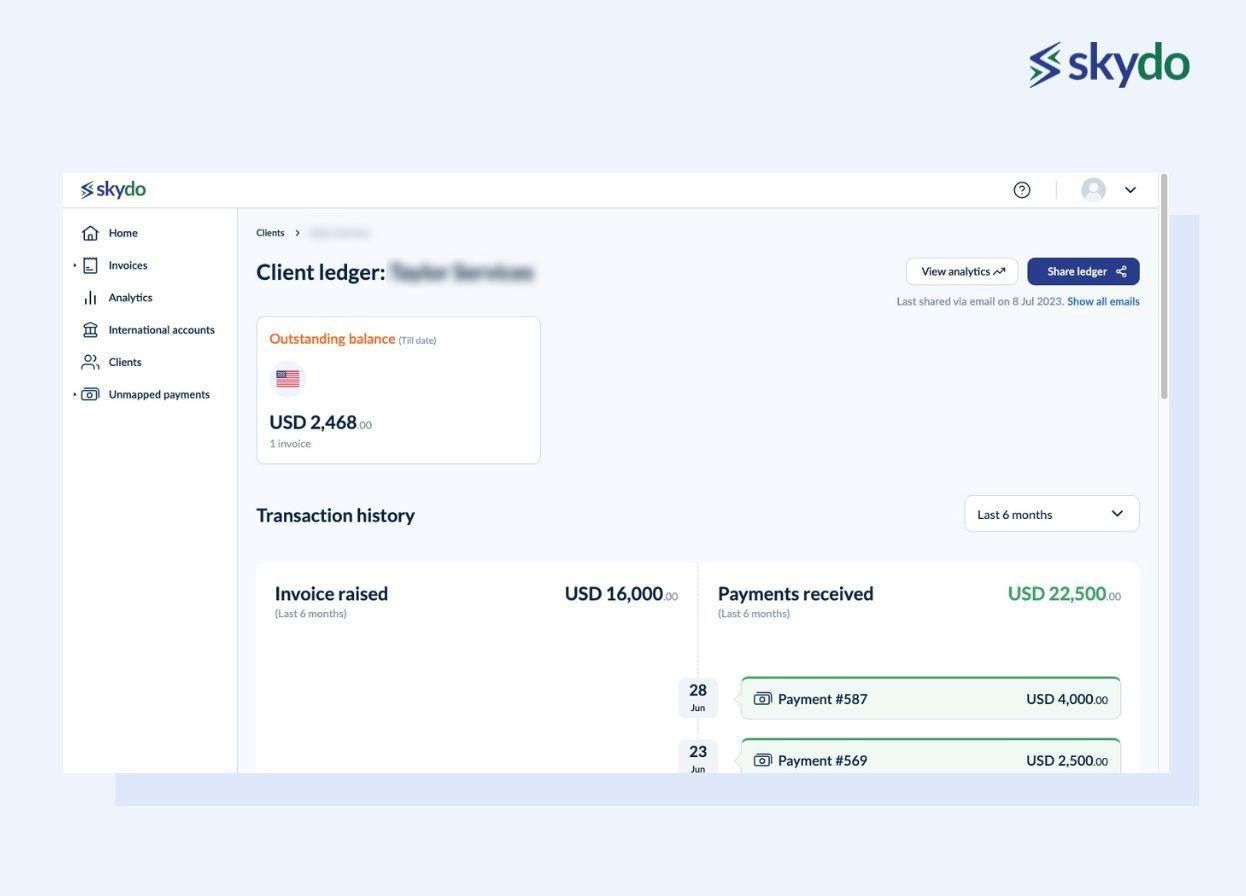

1. Client-specific overview

At Skydo, we understand that every client is unique, and their financial interactions with your business reflect that. Skydo provides a client-specific overview to help you gain a deeper understanding of each client's financial footprint.

This insight allows for better relationship management and strategic decision-making to drive success for both your clients and your business.

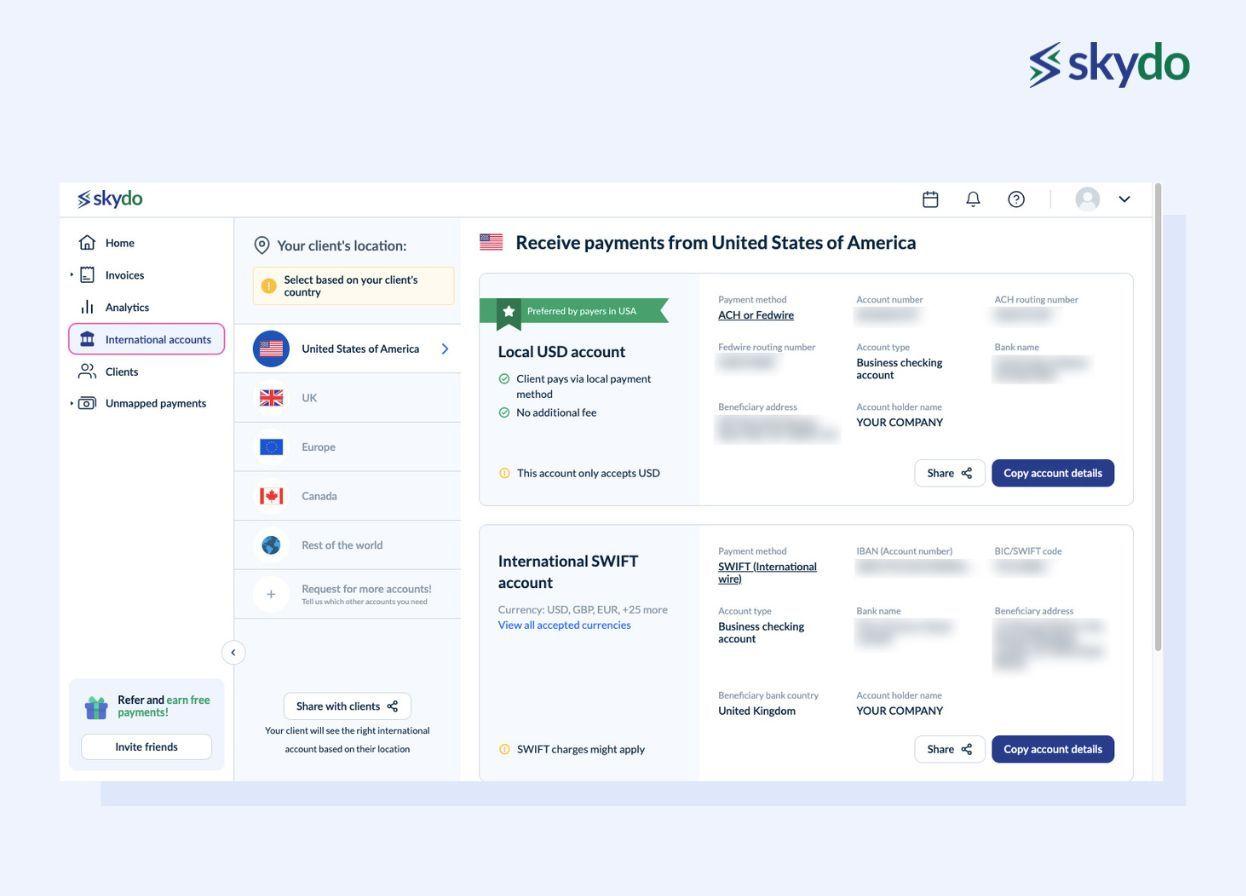

2. Track international accounts in one place

Businesses operating globally often face the challenge of managing multiple international accounts. Skydo offers a solution that consolidates all international accounts to simplify this process, providing a unified view.

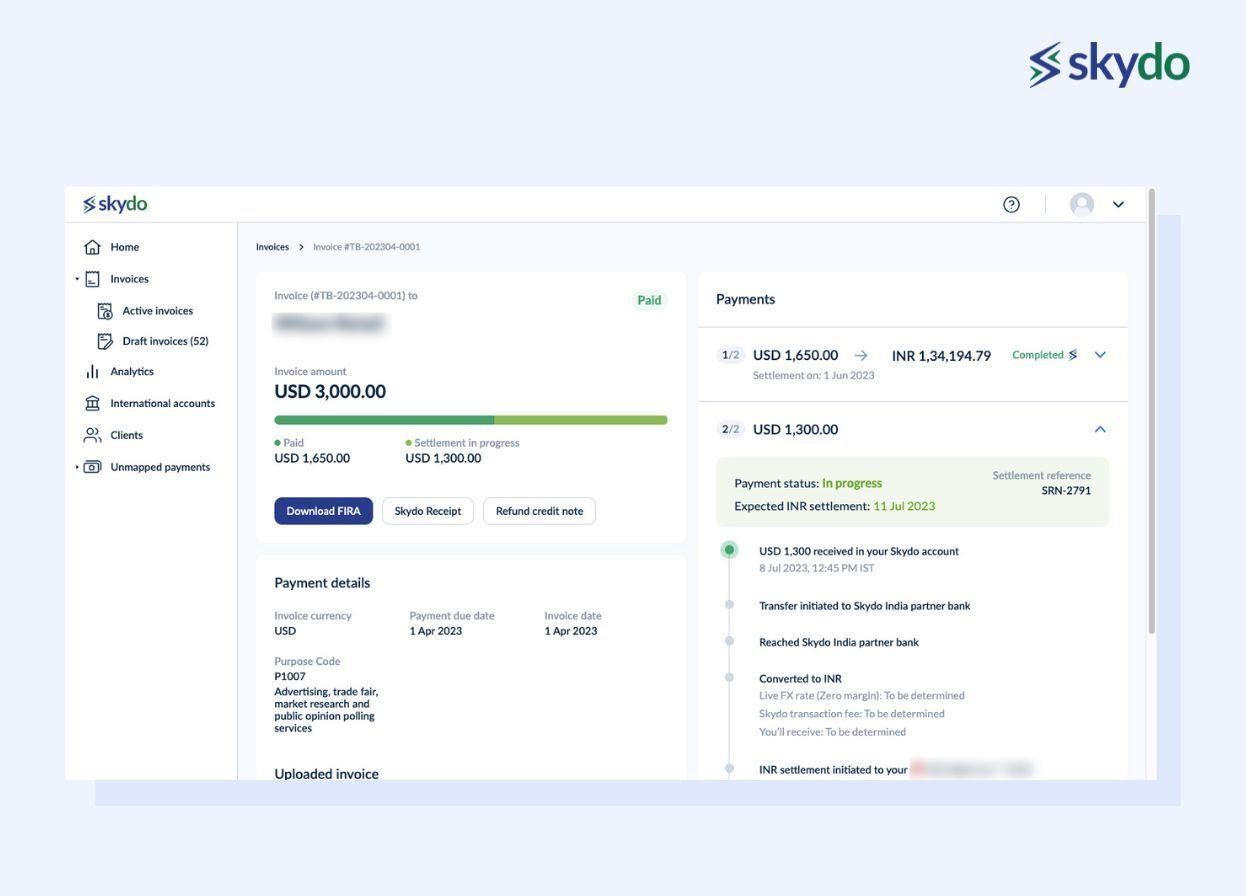

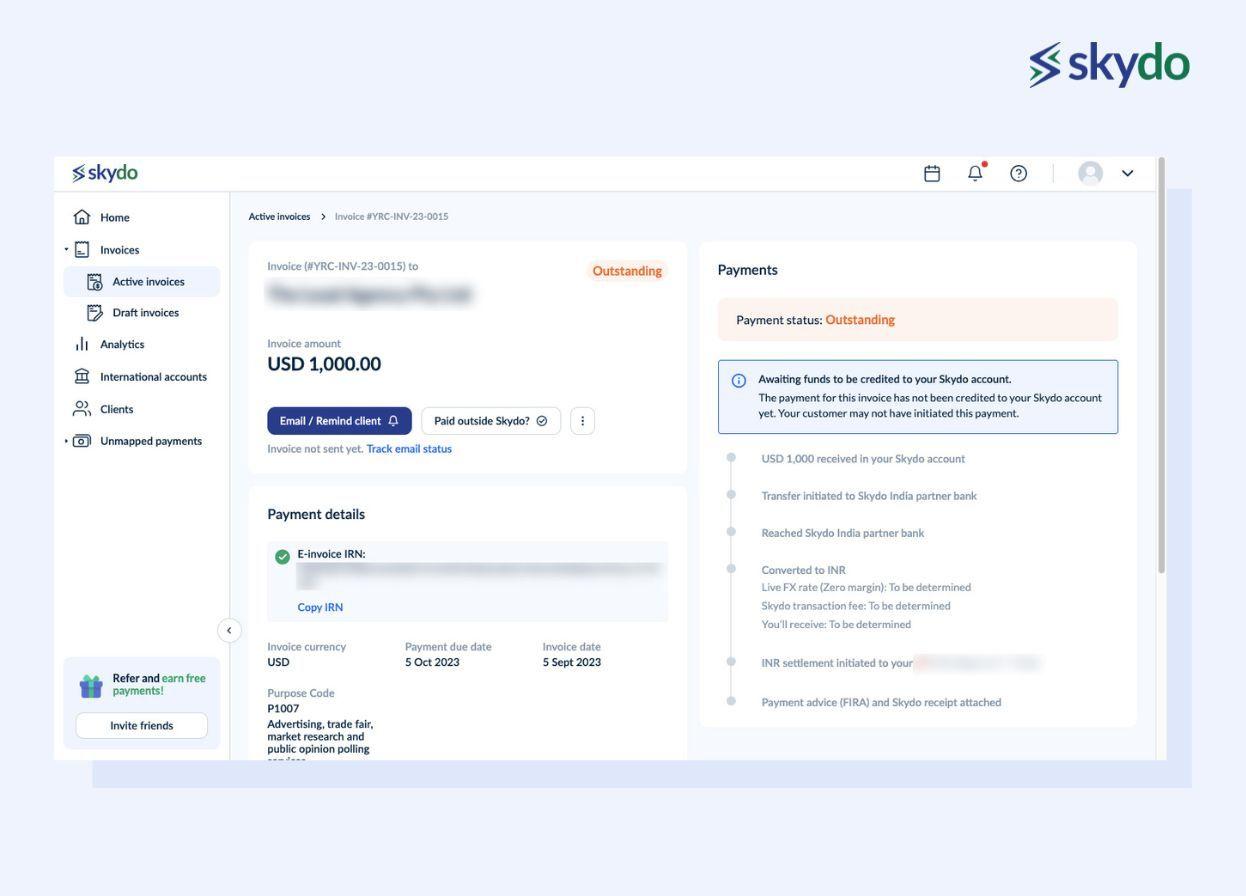

Enhancing Real-time Visibility and Control

Tracking payments in real-time is essential for efficient cash flow management. With our cutting-edge technology, Skydo provides real-time payment tracking, ensuring they are always in the know and can make proactive decisions to drive their business forward.

2. Ledger view

Financial transparency and accountability are crucial for any business. Thus, Skydo's ledger view is a must-have tool, providing a detailed record of all financial transactions to ensure clarity, accuracy, and informed financial planning.

Wrapping up

As finance heads face significant challenges, such as regulatory compliance and real-time data visibility, they can overcome these hurdles with the proper strategy and tools.

Skydo's payment platform is a comprehensive and innovative tool designed for modern finance heads. With features like auto-generated FIRAs and real-time payment tracking, it offers a holistic solution to the challenges faced by top finance officials. With Skydo, you can ensure compliance and efficiency while also utilising real-time data to make strategic decisions.

If you are a CFO or financial leader looking to transform and elevate your financial operations, Take the first step towards a more efficient, strategic approach to financial management with Skydo today.