Streamline Cross Border Payments for Your Business with Skydo

Consider a scenario where an innovative tech startup in India has designed a groundbreaking software solution coveted by clients worldwide. To seize global opportunities, the company must seamlessly transact with partners in different currencies, navigate diverse regulatory landscapes, and wrestle with the ebb and flow of exchange rates. This intricate ballet of elements underscores the complexities inherent in cross border payments.

For these Indian tech exporters, the efficacy of these cross border payments holds the key to unlocking their full potential. The impact is not solely monetary – it resonates through every facet of their operation. In this interconnected world, the efficiency of international transactions isn't just a matter of convenience; it's a strategic imperative.

The world is at our fingertips, yet the complexities of this global exchange often lurk beneath the surface. Let us discuss the different international payment methods, unraveling the threads of traditional channels and digital platforms while unveiling the challenges that can hinder the smooth flow of cross-border transactions.

Traditional Channels: Bank Transfers and checks

Bank transfers and checks have long been the pillars of international trade, trusted by businesses to facilitate cross border payments. Bank transfers, while reliable, can be a maze of intermediary banks, each taking their slice of the payment, resulting in high transaction fees that can eat into profits.

One significant component of these fees is the SWIFT (Society for Worldwide Interbank Financial Telecommunication) fee.

SWIFT fees can be a significant burden for businesses engaged in cross-border transactions, ranging up to USD 40. The fee depends on various factors like the destination, intermediary banks involved, and the currency being exchanged. These fees can quickly add up, eroding profits and making international trade less cost-effective.

Furthermore, the fund transfer across these networks is far from instantaneous, often spanning several days or weeks before reaching the intended recipient. This sluggish pace can hamper businesses that require timely payments for operations, supplier relationships, and more.

Cheques, though a time-honored method, often introduce additional complexities. They're subject to international mail delays, manual processing, and the uncertainty of clearance times. These factors collectively create an environment ripe for delays and disputes, eroding the reliability of this channel.

Digital Platforms: PayPal and Stripe

The arrival of technology has led to platforms like PayPal and Stripe designed to expedite international transactions with the tap of a button. These platforms boast convenience and speed, delivering a new era of financial connectivity. However, this convenience comes at a cost. While transaction fees might be lower than traditional methods, they still accumulate, potentially straining profit margins, especially for high-volume transactions.

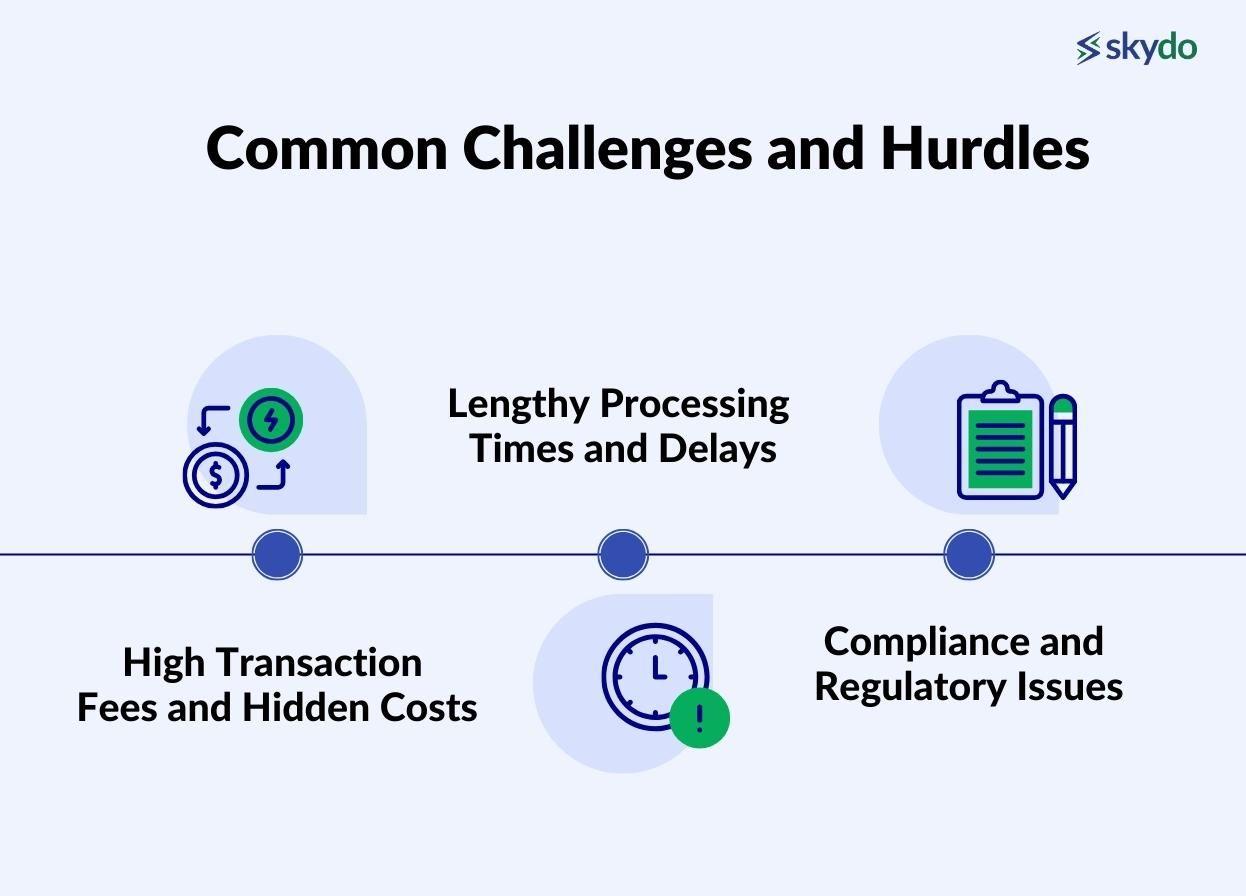

Common Challenges and Hurdles

Despite the promises of convenience, the landscape of international transactions is subject to the following challenges.

- High Transaction Fees and Hidden Costs: Both traditional and digital methods can saddle businesses with substantial transaction fees, impacting profitability. Moreover, hidden costs might compound these fees, leaving businesses with less than they bargained for.

- Lengthy Processing Times and Delays: Traditional methods can test a business's patience, with funds traversing an intricate web of banks and intermediaries. Even digital platforms, while faster, might not be instant, causing delays that could be critical in time-sensitive transactions.

- Compliance and Regulatory Issues: Navigating international regulations and compliance requirements can be formidable. Different countries have varying rules, and missteps can lead to funds being frozen or returned, causing frustration and lost opportunities.

In this complex landscape, businesses seek a solution that transforms these hurdles into stepping stones.

Elevating Global Financial Flows: Skydo's Cross Border Payments Transformation

As businesses expand their horizons across continents, a partner that can streamline these financial flows becomes invaluable. Skydo, a pioneer in advanced payment solutions, steps onto the stage as a catalyst for change, promising to revolutionise the landscape of cross-border transactions.

Enhanced Payment Efficiency and Streamlined Processes

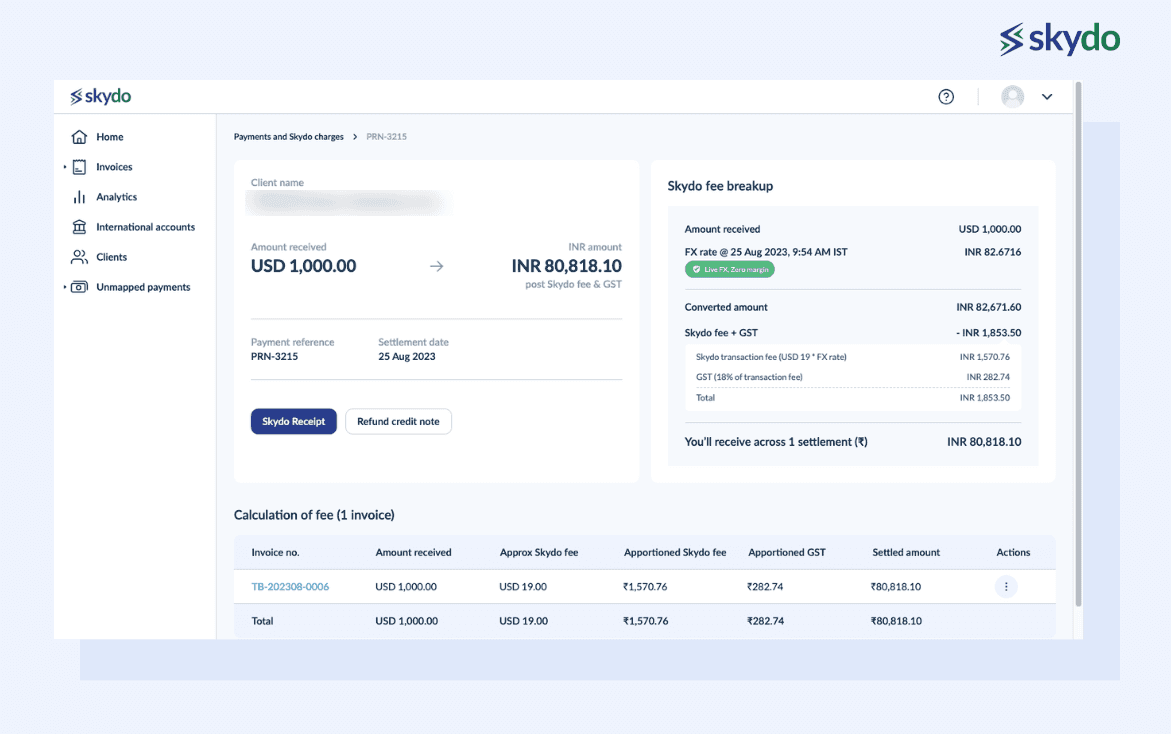

Skydo revolutionises cross border payments with an ingenious approach that maximises payment efficiency and streamlines processes. Through an intuitive user interface, automated compliance checks, real-time tracking, and robust data security.

Skydo empowers businesses to initiate, monitor, and complete transactions seamlessly. This transformative solution eliminates traditional complexities, enabling swift and transparent movement of funds across borders. Skydo's commitment to innovation redefines the cross-border payment experience, catalysing businesses to engage in global opportunities with confidence and ease.

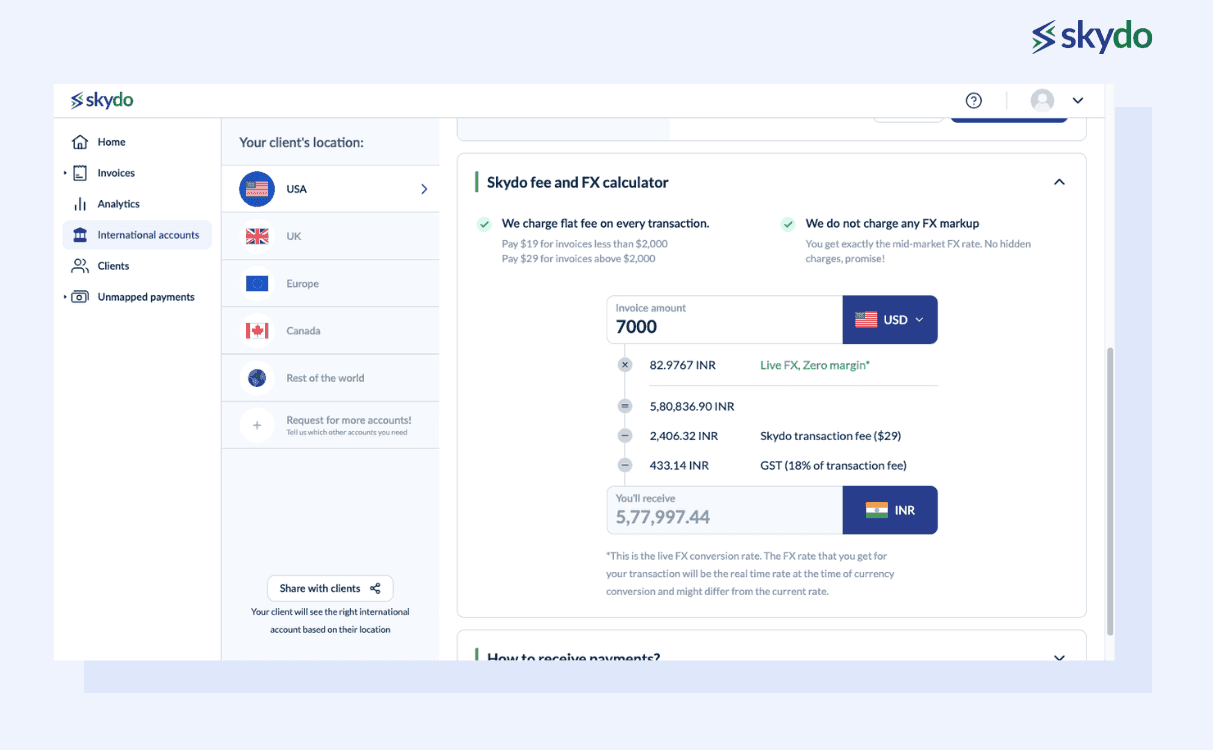

Retain Profits Through Real-time Exchange Rates and Flat Fees

In cross border payments, every cent matters. Therefore, Skydo’s services are designed with your business’s financial well-being in mind.

With real-time, up-to-the-minute exchange rates for your transactions, you'll always get the most accurate and competitive rates available in the market, ensuring the best value for your money.

Furthermore, with a flat fee charge for Skydo’s services, you'll know exactly how much you're paying for each transaction. There are no hidden costs or surprise charges, giving you peace of mind and predictability in your financial transactions.

By eliminating hidden fees and offering a flat fee structure, Skydo empowers businesses to engage in cross border payments confidently.

Improved Cash Flow Management with Faster Settlement Times

Skydo revolutionises cash flow management by prioritising rapid settlement times. Through streamlined workflows and advanced technology, Skydo accelerates the movement of funds from sender to recipient. This approach empowers businesses with enhanced liquidity, agility, and the ability to seize opportunities promptly.

By minimising transaction delays, Skydo ensures consistent and reliable cash flows, enabling businesses to allocate resources effectively and thrive in the dynamic realm of global commerce.

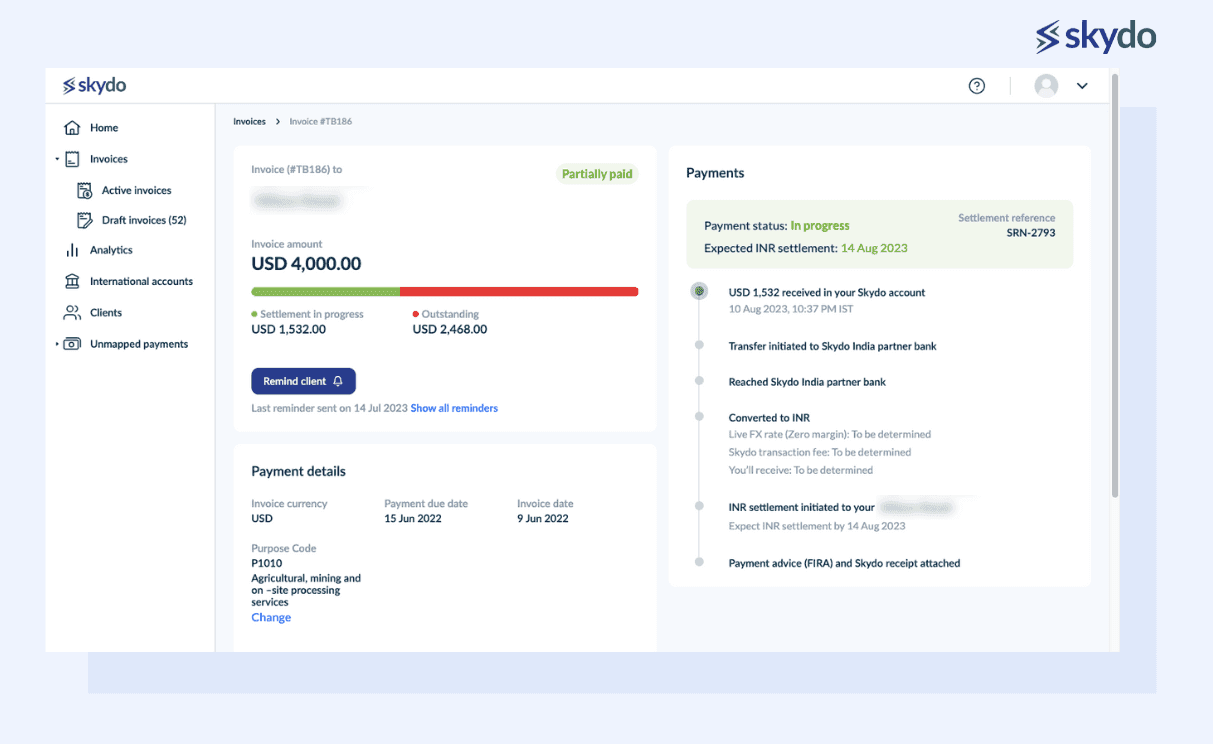

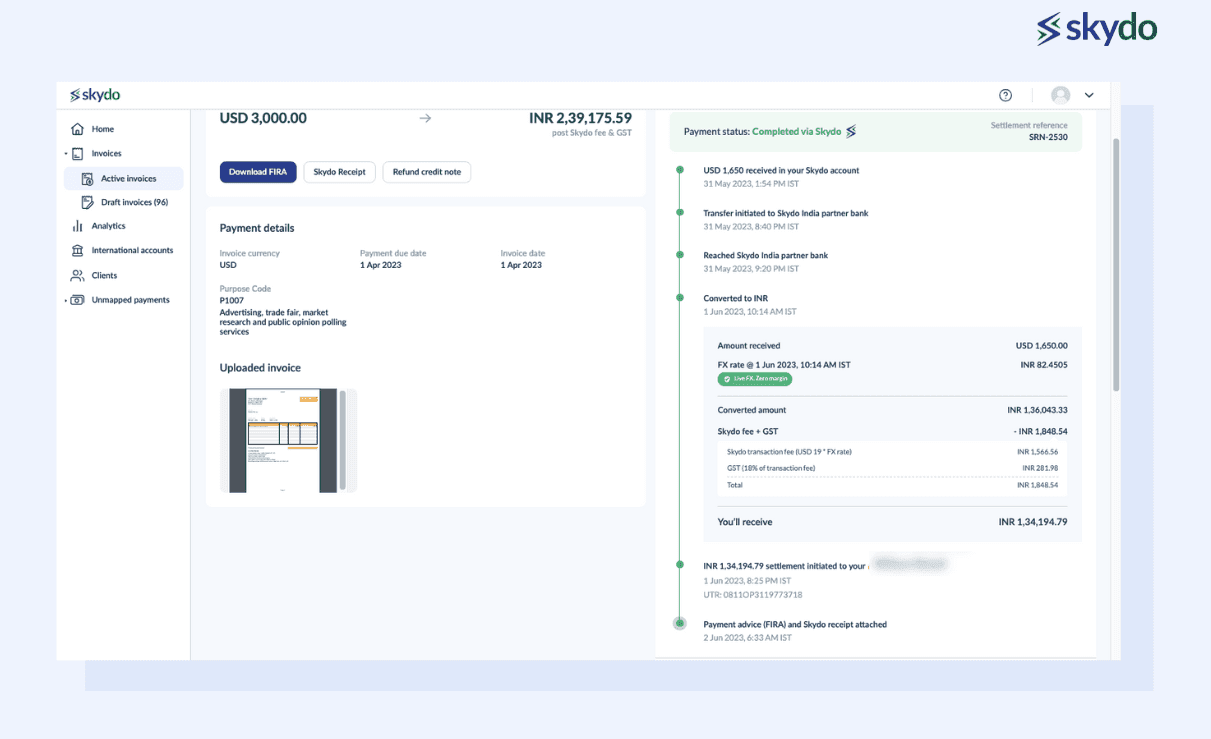

Enhanced Transparency and Visibility into Payment Statuses

Through real-time updates and comprehensive tracking, Skydo keeps businesses informed at every stage of the transaction journey. This level of insight ensures that senders and recipients are equipped with accurate, up-to-the-minute information, mitigating uncertainties and instilling confidence.

As a business owner, you want to know exactly when and how your money is being converted during cross border payments. Through Skydo’s transparent payment tracking mechanism, you can see the date and time of conversion prominently in all our transaction details. You can also cross-check exchange rates at the specified timestamp via reputable sources like Google and XE.

In a world where clarity is paramount, Skydo's commitment to transparency reshapes the cross border payments landscape.

See How Skydo is Revolutionising International Transactions for the Exporters Like You

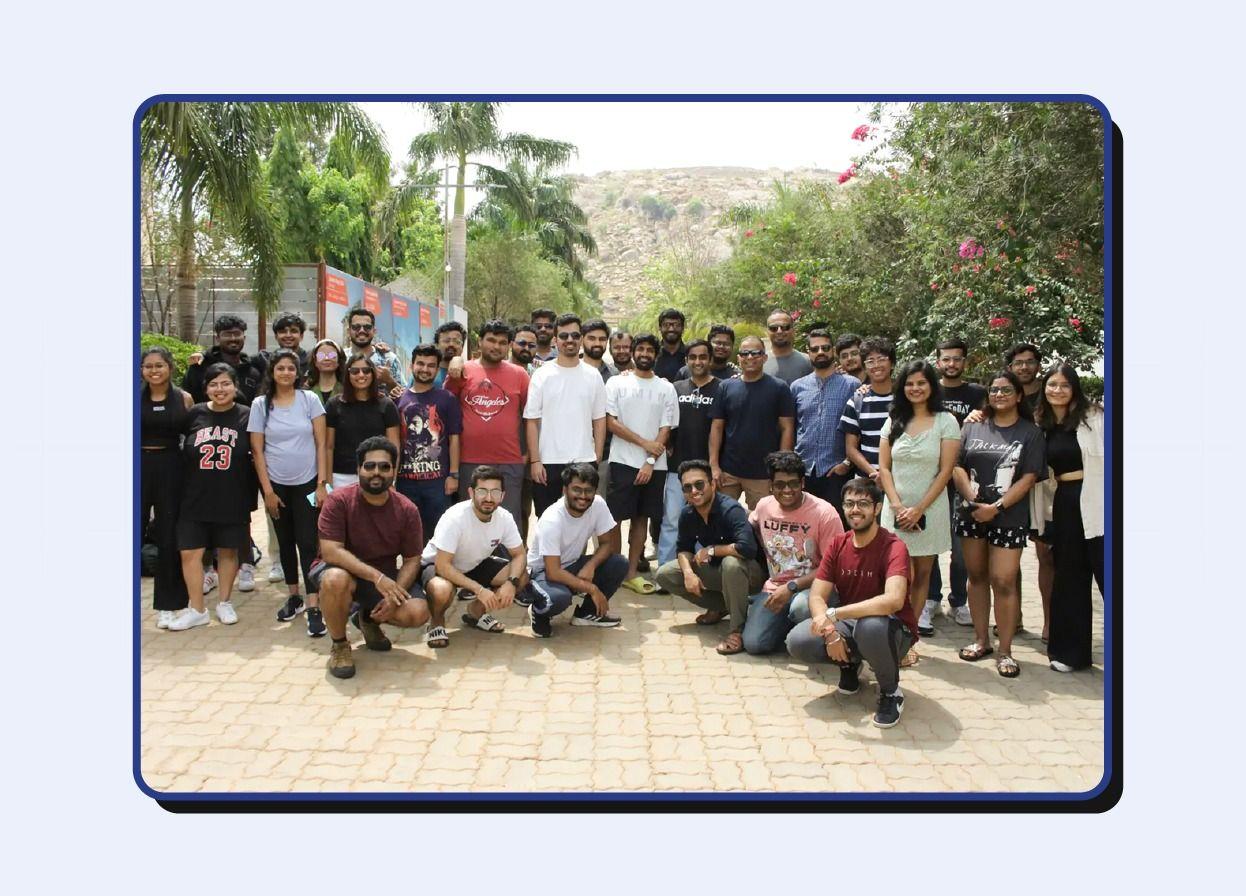

Abhishek, the founder of a technology export business, Aidetic, in India, faced recurring challenges when receiving cross border payments. These issues included delays and uncertainties related to international money transfers.

In November 2021, Abhishek was eagerly anticipating a $7,000 payment from a new client located in Canada. The payment had been initiated via the SWIFT network nine days prior, but Abhishek had not received confirmation of the funds. His bank's relationship manager couldn't provide clarity on the payment's status, leaving Abhishek frustrated. These payment-related problems were not new to him, and they posed a significant obstacle to his technology export business's growth.

A turning point arrived in Abhishek’s path, when he discovered Skydo, through a tweet from Movin, the platform's founder, who expressed interest in assisting Indian export business owners with cross-border payment issues. He quickly reached out to Movin, and they connected over a Zoom call.

During this conversation, Abhishek realised that Skydo was tailor-made to resolve his payment woes. Without hesitation, he became one of Skydo's first customers. Shortly after, he acquired virtual accounts in the United States, the United Kingdom, Canada, and Europe through Skydo's platform.

Abhishek's testimonial reflects the positive impact of Skydo's services on his business:

"Running a startup presents numerous challenges, and the last thing I want to worry about is how to receive our hard-earned revenue. Thankfully, Skydo has beautifully solved that problem for us, and now we can look forward to expanding our business to more countries without the constant concern of how to collect payments from our clients."

His experience with Skydo demonstrates how the platform effectively addresses the challenges of cross-border payments for businesses, enabling them to focus on growth and expansion while eliminating the frustrations associated with traditional payment methods.

Conclusion

Streamlined cross-border transactions emerge as the cornerstone of success for export-oriented businesses. This journey, though complex, becomes an opportunity when partnered with Skydo, the catalyst for optimising payment efficiency. Reflecting on this voyage, it's evident that businesses cannot rely on traditional methods and face the challenges alone.

Skydo's ingenious approach addresses the pain points of high fees, lengthy processing times, and compliance hurdles, redefining international transactions into a seamless, efficient process.

In this era of boundless possibilities, seizing global growth opportunities hinges on a strategic partnership. Skydo stands as that partner, offering the tools to navigate the complexities, unlock efficiency, and capitalise on the global marketplace.

Book a demo to witness Skydo's features and unlock a world of prosperity.