Manage Your End-To-End Accounts Receivable With Skydo

Business owners know that a good sale ends only when the client’s money hits their bank account. Along with service delivery, receivable management is equally important to manage a business. For instance, GlobalTech Solutions is a tech-based company that operates in multiple countries and deals with various clients and vendors.

They face numerous challenges:

- Diverse currencies and payment terms

- Varying financial regulations

- Fluctuating exchange rates that eat into profitability

Moreover, time differences and varying banking practices often result in delayed payments, leading to longer accounts receivable cycles that must be effectively managed for the company's financial success.

Transparency is a major concern in today's global market, as tracking payments and reconciling accounts with cross-border transactions becomes increasingly difficult. This lack of clarity can lead to errors and financial losses.

The solution? Accounts Receivable Assistant! With the market expected to grow from USD 2.72 billion in 2023 to USD 4.76 billion by 2028 at a CAGR of 11.84%, it offers numerous benefits such as time and cost savings, improved efficiency, and better financial management for businesses dealing with high volumes of transactions.

Introducing Skydo - Your End-To-End Solution

Skydo is a standout in the field of accounts receivable management. Skydo streamlines the end-to-end process, providing unmatched efficiency for businesses navigating cross-border transactions and diverse currencies in the complex financial landscape.

Here are some key features of Skydo:

Transparency

We track and record every transaction, payment, and invoice so you can clearly and accurately understand your financial standing and make informed decisions.

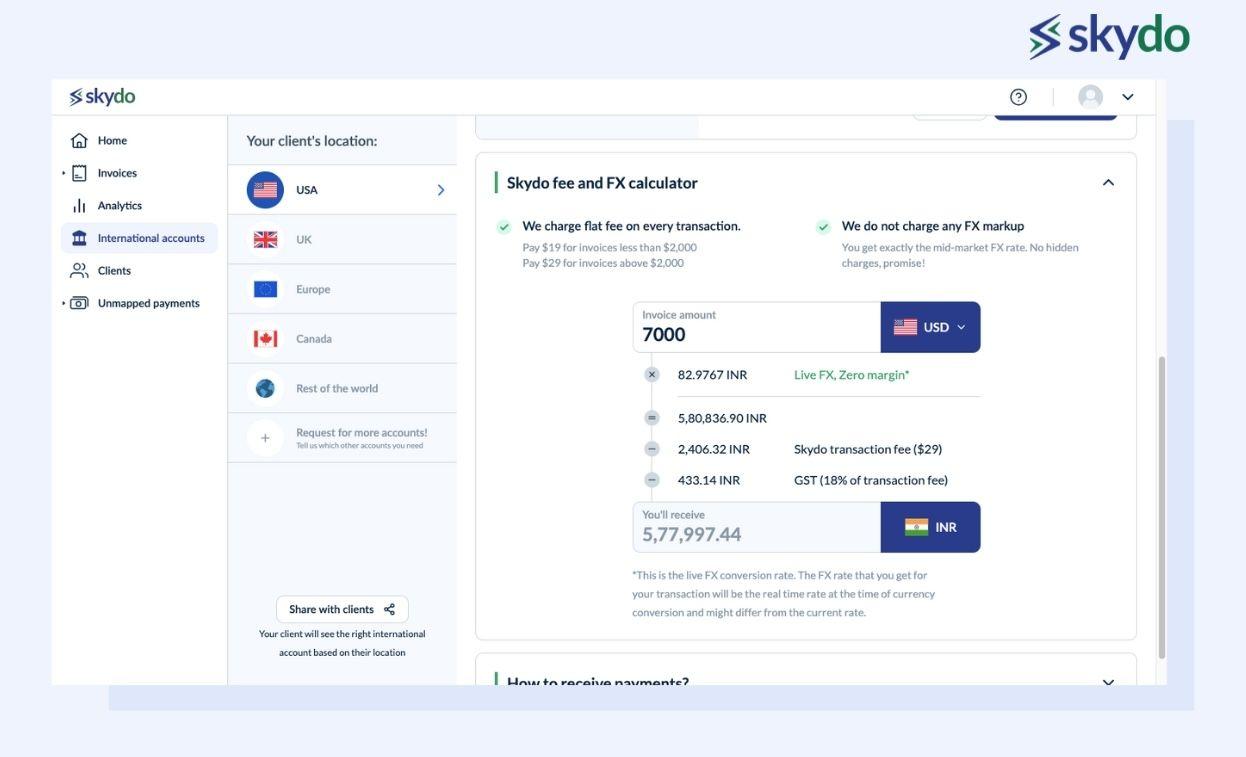

Live FX Rates

For businesses involved in international transactions, fluctuations in currency can be a major concern. We offer real-time foreign exchange rates with zero margin to help businesses better manage and prepare for the effects of these fluctuations on their receivables. No more unexpected losses due to sudden changes in currency values with Live FX.

Consolidated Data

Effortlessly keep track of outstanding payments with Skydo. Our platform provides a comprehensive overview of all pending payments, making it easier for businesses to prioritize their collection efforts and maintain a healthy cash flow.

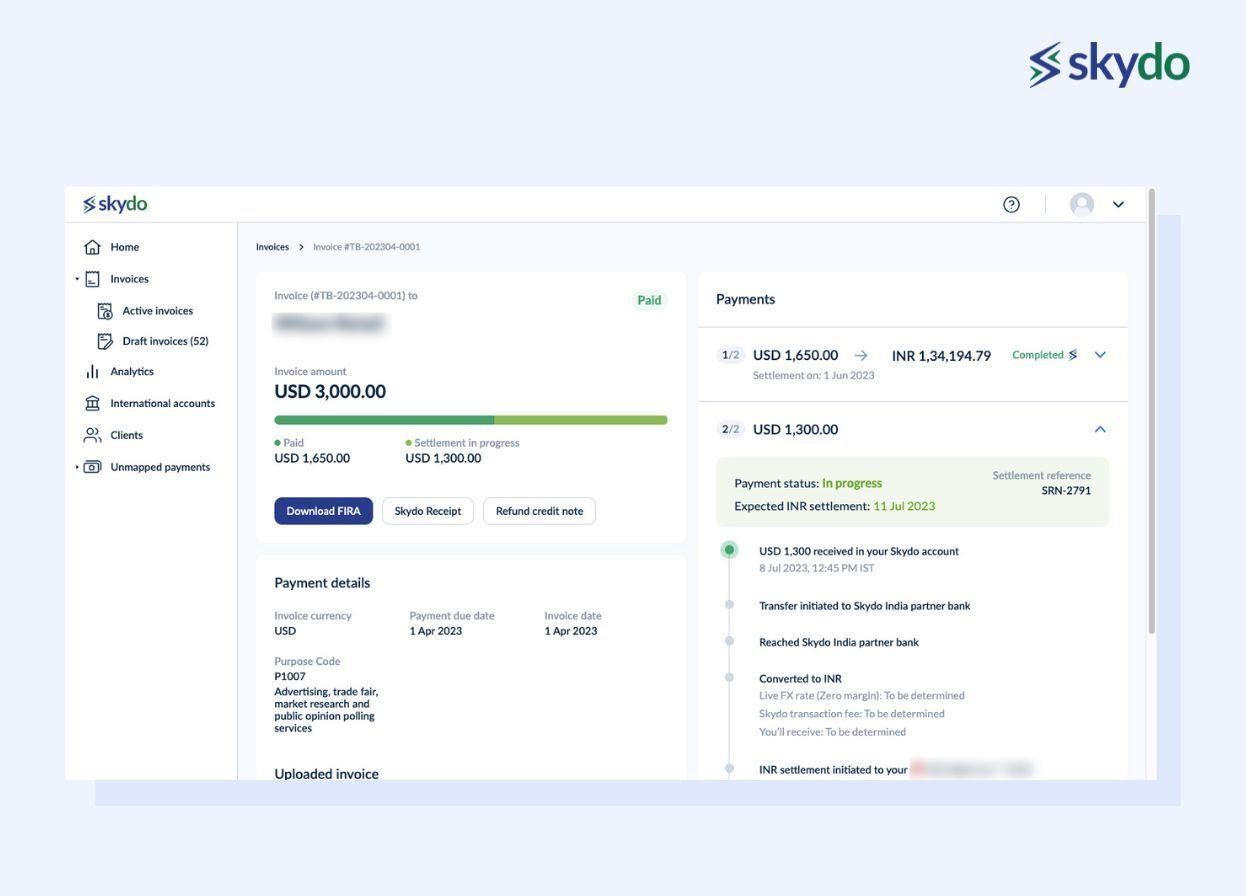

FIRA

Skydo transforms invoicing by providing real-time monitoring and a holistic view of payment progress. We ensure a seamless transition from invoice creation to Foreign Inward Remittance Advice (FIRA), eliminating delays and discrepancies for highly efficient accounts receivable management. With a centralized overview of business financial transactions, Skydo significantly enhances overall financial stability.

Invoice Management

Skydo offers multiple features to make invoice management easier for businesses.

- Users can provide detailed information on each invoice, including the amount, due date, payment terms, and any associated notes or comments. This transparency helps in keeping track of payment obligations.

- Easily update the invoice payment status, keeping the accounts receivable data accurate. Users can also send payment reminders directly from the platform to clients for timely payments, reducing the risk of overdue invoices.

- In case of errors or cancellations, delete invoices while maintaining the accuracy of financial records. This streamlines the invoicing process and ensures efficient and organized business financial management.

Managing Outstanding Amounts and Payment Reminders

Efficiently managing payments is crucial for any business, and our platform offers a range of features to help with this process. Our payment reminder tool helps you send reminders to clients, ensuring timely payments and maintaining a healthy cash flow.

Keep track of all past payment reminders with our platform, providing a clear history of communication and follow-ups for each invoice. Plus, it can easily manage and track outstanding amounts so businesses can view their receivables.

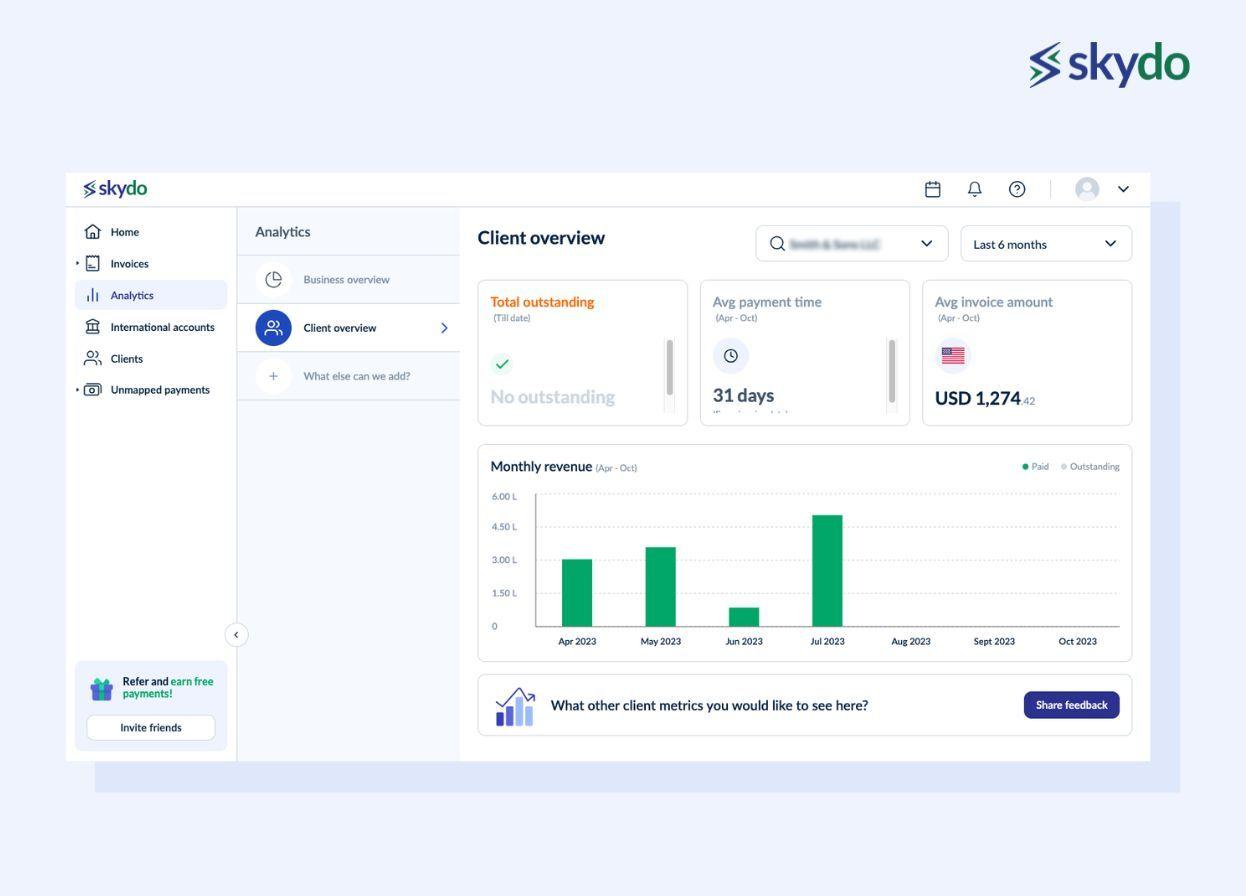

Real-Time Payment Tracking and Analytics

You have access to a comprehensive real-time payment tracking system, allowing you to monitor each step in the process for each payment to stay on top of their payment status and maintain a healthy cash flow. This feature lets you easily identify potential issues before they become critical.

Moreover, Skydo comes with detailed business and client analytics, providing valuable insights for making informed financial decisions. Never miss a beat with our powerful analytics tools.

Client Management and Ledger Overview

Our Clients List feature offers businesses a quick and easy way to access a comprehensive list of their clients and payment history. With just a click on a client's name, users can view detailed information about their financial interactions, providing a holistic view of the client's account.

Our 'View Ledger' feature allows businesses to track invoices and payments over time, giving them a clear understanding of their financial standing. For added transparency and trust-building with clients, we offer the option to share the ledger directly with them.

What Next? Transform the Way You Manage Accounts Receivable With Skydo

Managing receivables is no longer a problem. Irrespective of the number of clients, size of payment, or geography, Skydo offers a seamless, efficient, and transparent solution for businesses of all sizes.

With robust invoice management, proactive tracking of outstanding amounts, and insightful analytics, leverage the power of technology to optimize cash flow and make the right decisions. A holistic approach to client interactions and financial transactions will increase customer trust and efficiency in your business relationships.

Elevate your financial management with Skydo and drive your business towards success.