Quote vs Invoice – What’s the Difference?

A quote and an invoice are necessary for any transaction, yet they serve distinctly different purposes.

A quote is a preliminary offer extended to potential clients, allowing them to weigh their options before committing to a service. If the client accepts the quoted price and terms, you can issue the final invoice, formally requesting payment.

These documents are pivotal in keeping your endeavours organised, maintaining a steady cash flow, and serving as a testament to your reliability as a freelance professional.

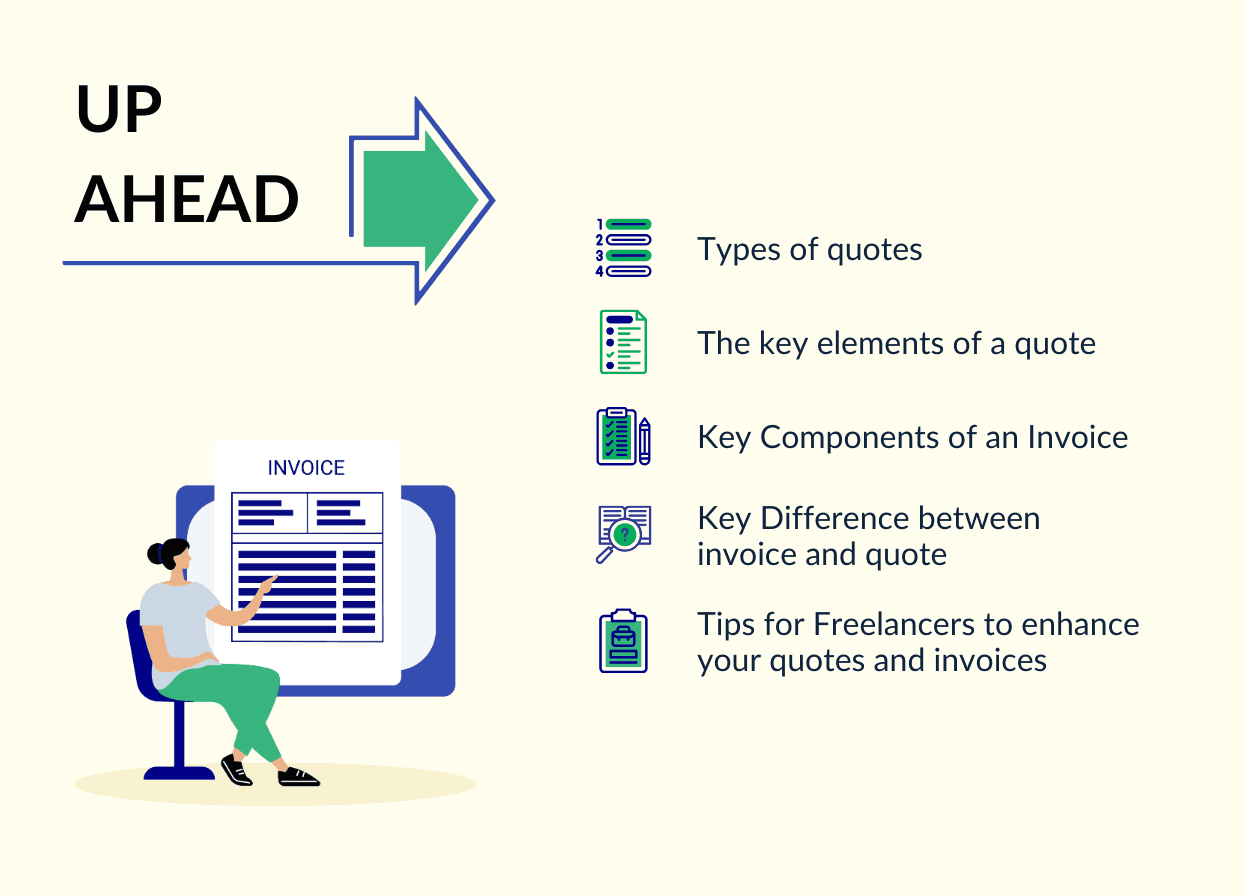

The blog includes an overview of Quote vs Invoice, best practices for quoting and invoicing, and the key differences.

What is a Quote?

A quote, often known as a quotation, is a formal document that sellers or service providers give to potential customers. Its primary purpose is to convey the rendered services, payment terms, and available payment options. It enables customers to make informed decisions about purchasing your services.

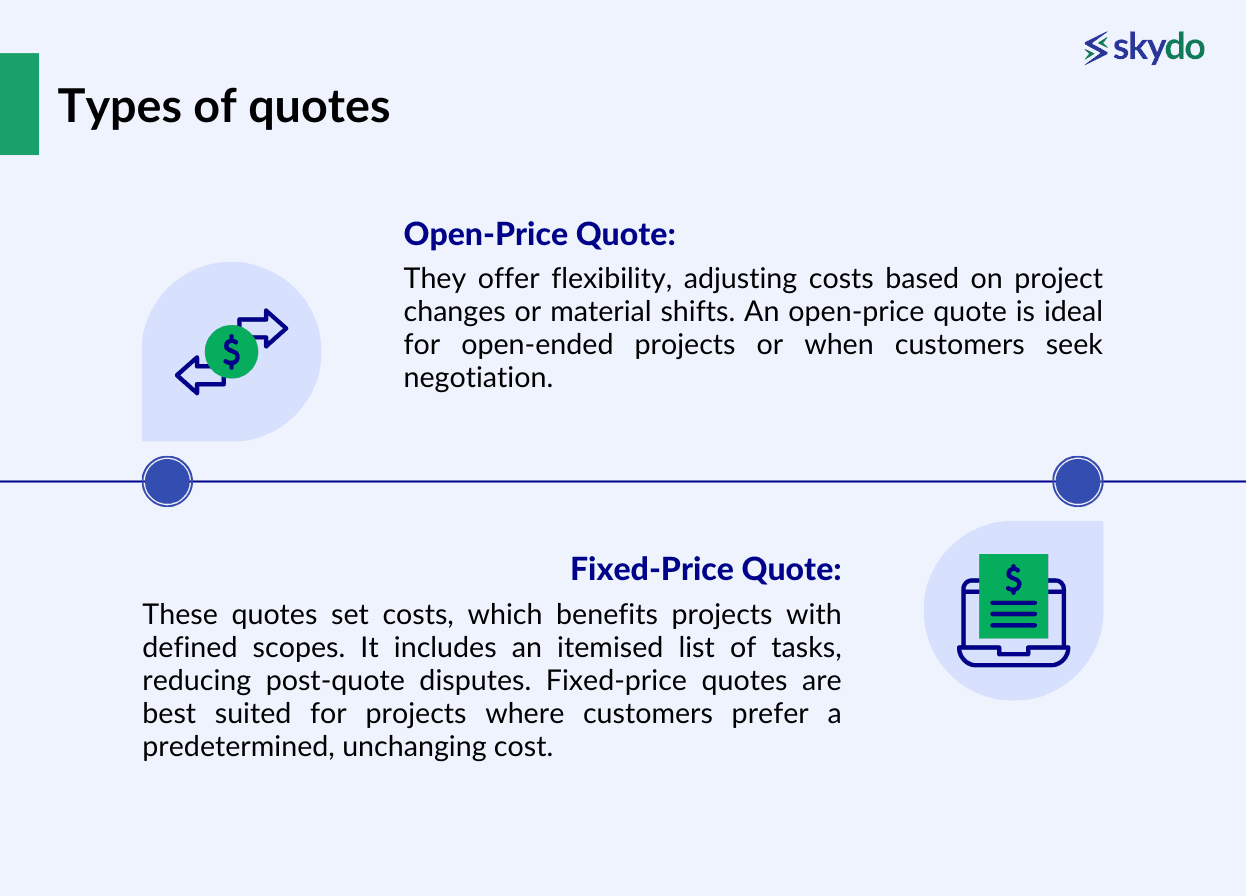

The types of quotes include the following.

- Open-Price Quote

They offer flexibility, adjusting costs based on project changes or material shifts. An open-price quote is ideal for open-ended projects or when customers seek negotiation.

- Fixed-Price Quote

These quotes set costs, which benefits projects with defined scopes. It includes an itemised list of tasks, reducing post-quote disputes. Fixed-price quotes are best suited for projects where customers prefer a predetermined, unchanging cost.

Let's break down the key elements of a quote.

- Description of Services/Products

A quote begins with a clear description of the products or services offered. It outlines what the customer can expect to receive.

- Breakdown of Estimated Costs

This includes materials, labour, and other relevant expenses. A detailed cost breakdown helps the customer understand where their money is going.

- Payment Terms and Deadlines

A quote specifies the terms and conditions for payment. It includes details like the total amount due, instalment plans (if any), and deadlines for payment. Clarity on payment terms ensures a smooth transaction process.

- Validity Period of the Quote

Every quote has an expiration date. It signifies the period during which the quoted prices and terms are valid. Both parties must be aware of this timeframe to avoid misunderstandings.

- Optional - Disclaimer on Cost Fluctuations

Some quotes may include a disclaimer regarding potential cost fluctuations. It is particularly relevant when factors beyond the service provider's control, such as market changes, influence the final cost.

These elements ensure professionalism, build trust and contribute to a successful quoting process.

What is an Invoice?

An invoice is a formal and legally binding document created after a sale detailing products, costs, and payment terms. This document requests payment from the customer and serves as recorded proof of the transaction.

Its key components include the following.

- Date of Issue

The date the invoice is issued helps track the transaction's timeline and sets a reference point for payment. It also aids in accounting for the parties involved.

- Client Information

An invoice must include the client's name, address, and contact details, ensuring accurate identification and communication. It may also include any outstanding balance or credits.

- Description of Services/Products Delivered

It provides a clear breakdown of the services or products delivered, outlining the scope of the transaction. A reference to any additions or customisation provides further clarity.

- Total Cost

It specifies the amount owed, calculated based on the work done or materials supplied. Including the line-by-line bifurcation of cost, taxes, and discounts (if any) is helpful.

- Payment Terms and Deadlines

An invoice clearly outlines the delivery date, terms and conditions for payment, the due dates, and any applicable late fees.

- Tax Information (If Applicable)

If taxes apply to the transaction, the invoice includes relevant tax details to ensure compliance with tax regulations. For example, the invoice must include the client's and service provider's GSTIN for tax benefits.

Key Difference Between Invoice and Quote

Quotes and invoices serve distinct roles in business transactions, each with key differences that impact their timing, purpose, content, and legal implications.

- Timing

Quotes are issued before the commencement of work. They serve as preliminary agreements outlining estimated costs and terms. However, invoices are generated after work completion, formally requesting payment for the services or products.

- Purpose

The primary purpose of quotes is to provide clients with an anticipated cost for a potential project or service. It helps in setting expectations and establishing terms. Invoices have the specific purpose of requesting payment for work already completed. They serve as the final step in the transaction process.

- Content

Quotes may include estimated costs, breakdowns, and terms. They are more flexible and subject to negotiation. Invoices contain actual costs incurred during the project, detailing the final amount owed by the client based on the completed work.

- Legal Implications

Quotes are generally non-binding unless formally accepted by the client. They provide a framework for negotiations. Invoices carry legal weight as they constitute binding contracts. Once issued, they represent an obligation for the client to fulfil payment based on the agreed terms.

Understanding the difference between invoice and quotation is vital for businesses to navigate the various stages of a transaction, from providing initial cost estimates to formalising payment requests after the successful completion of services or delivery of products.

Now that the difference between invoice and quotation is clear, let's delve into some essential tips tailored specifically for freelancers to optimise their client interactions and financial processes.

Tips for Freelancers to enhance your quotes and invoices

For freelancers, maintaining clarity and professionalism in your client interactions is crucial. Here are some key tips to enhance your quote and invoice processes.

- Document Clarity

Clearly state whether you provide a quote or an invoice on each document. - Professional Templates

Use professional templates for quotes and invoices. A polished and consistent appearance enhances your brand image and conveys professionalism to clients.

- Detail-Oriented Descriptions

Be specific and accurate in your descriptions. Clearly outline the scope of work, services, or products, and provide a detailed cost breakdown.

- Record Keeping

Keep meticulous records of all your transactions, including quotes, invoices, and corresponding communications. Maintaining organised records aids in tracking deadlines, avoiding disputes, and ensuring a smooth financial workflow. - Error-Free Documentation

Prioritise error-free documents by checking for mistakes.

- Transparent Pricing

Specify whether a deposit is required, the total amount due, and the expected timeline for payment. Communicate your late-payment policy in advance to foster transparency and avoid surprises.

- Upselling Strategies

Suggest additional options for upselling, avoid undercutting, and focus on showcasing value over cheapness.

- Client Approval and Scope Changes

Obtain client approval before starting work, adapt to scope changes with new quotes, and provide detailed breakdowns to set clear expectations. - Branding Integration

Enhance professionalism by incorporating your logo and branding. - Cash Flow Consideration

Consider cash flow, offer multiple payment options and express gratitude with thank-you notes.

- Know Your Limits

Quote only for jobs you can confidently handle to maintain professionalism and trust.

Conclusion

Understanding the distinctions between quotes and invoices is pivotal for freelance professionals. It lays the groundwork for transparent client communication and efficient financial management. You can enhance your professionalism by differentiating when to issue a quote and when to provide an invoice.

Clear document types, professional templates, accurate descriptions, and transparent payment terms contribute to smoother interactions. This knowledge empowers freelancers to establish trust with clients, fostering successful and sustainable freelance endeavours.

For those seeking continuous improvement, additional resources and learning opportunities, such as online courses and communities, offer valuable insights. Embrace these distinctions, refine practices, and embark on a journey of professional growth in the dynamic world of freelancing.

Frequently Asked Questions

Q1. Do I need a quote and an invoice for each project?

Ans. It is advisable to have both. Quotes provide estimates before work begins, while invoices formalise payment requests after project completion.

Q2. Can I change the cost on my invoice compared to the quote?

Ans. It's crucial to maintain transparency. While slight adjustments may be necessary, significant changes should be communicated and agreed upon with the client.

Q3. What if my client refuses to pay my invoice?

Ans: Establish clear payment terms in advance. If issues arise, communicate openly and consider legal assistance if necessary.

Q4. Can I use the same template for both quotes and invoices?

Ans: A consistent quote or invoice template maintains professionalism. However, ensure clarity by specifying whether it's a quote or an invoice.

Q5. What software can I use to manage quotes and invoices?

Ans: Various tools like Skydo, Tally, and others streamline the process. Choose software that aligns with your business needs for efficient management.