Self-Employment Tax vs Payroll Tax: How to Boost Tax Savings

According to a survey by Fiverr, 66% of respondents plan to join a freelance platform for better flexibility, prevent job insecurity and gain financial freedom.

The survey also reveals that the top three goals of freelancers in 2024 were earning, saving and investing. If you also have these goals and want to switch to full-time freelancing, you should consider several factors, especially tax benefits.

This blog helps you understand the difference between self-employment tax vs. payroll tax in the U.S. with tips on how to maximise tax savings as an employee or independent contractor.

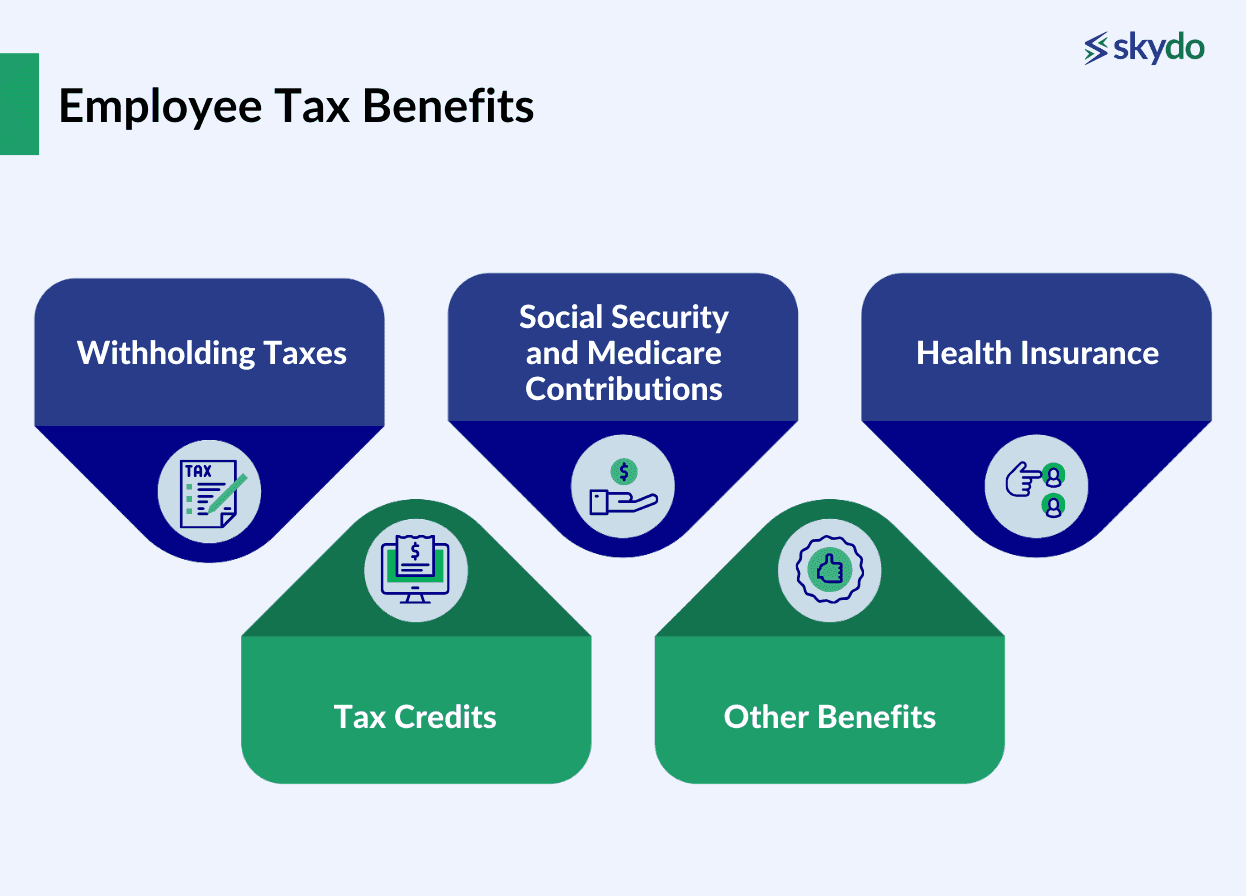

Employee Tax Benefits

Here are some of the tax benefits that U.S. employees enjoy.

1. Withholding Taxes

An employer deducts or withholds this amount from your salary and pays to the government on your behalf. It reduces your liability to calculate payable tax based on your salaried income.

Moreover, employees can seek government benefits such as social security income, unemployment insurance, disability insurance and medicare benefits with payroll tax deductions.

Withholding taxes also serves as income proof, making it easier to avail loans and clear other relevant applications.

2. Social Security and Medicare Contributions

All employees in the U.S. have to pay Social Security tax and Medicare tax. However, this tax isn’t paid directly to the government.

Employers deduct these taxes from the wages and deposit them with the government on behalf of the employees as per the Federal Insurance Contributions Act (FICA). Therefore, it reduces the burden on employees.

Moreover, the employers also make FICA contributions of 6.2% of each employee’s salary to Social Security tax and 1.45% to Medicare tax.

3. Health Insurance

U.S. employees also get access to health insurance with minimum essential coverage. Moreover, many employers offer other health insurance benefits such as disability cover, vision and dental support.

4. Tax Credits

Low-to-moderate-income employees can avail of the Earned Income Tax Credit (EITC). This tax benefit lowers the tax liability of individuals.

Some amount is credited to the taxpayer's account, depending upon their marital status and number of children. Therefore, the Earned Income Tax Credit maximises tax savings. You can check the eligibility, application requirements and credit limits here.

Additionally, during COVID-19, the U.S. government introduced the Employee Retention Tax Credit (ERTC) for employees working at organisations shut down during the pandemic.

5. Other Benefits

Full-time employees can avail the benefits provided under the Fair Labor Standards Act (FLSA). It offers fair standards for minimum wages, overtime, leaves and holidays, among others. However, it does not protect independent contractors’ rights.

For example, as an employee, you have fixed working hours, approximately 40 hours per month. If you must take up any work requiring long working hours, you will get adequate overtime compensation. However, as an independent contractor, there is no fixed standard for overtime if you spend extra hours on client projects.

Employees are also eligible for stock option schemes. Thus, employees get higher financial benefits as the company grows. However, Independent contractors do not inherit stock option schemes.

Some additional benefits available to employees include the following.

- Paid maternity/paternity leaves

- Paid vacation leaves

- Commuting/travel allowances

- Gym/wellness benefits

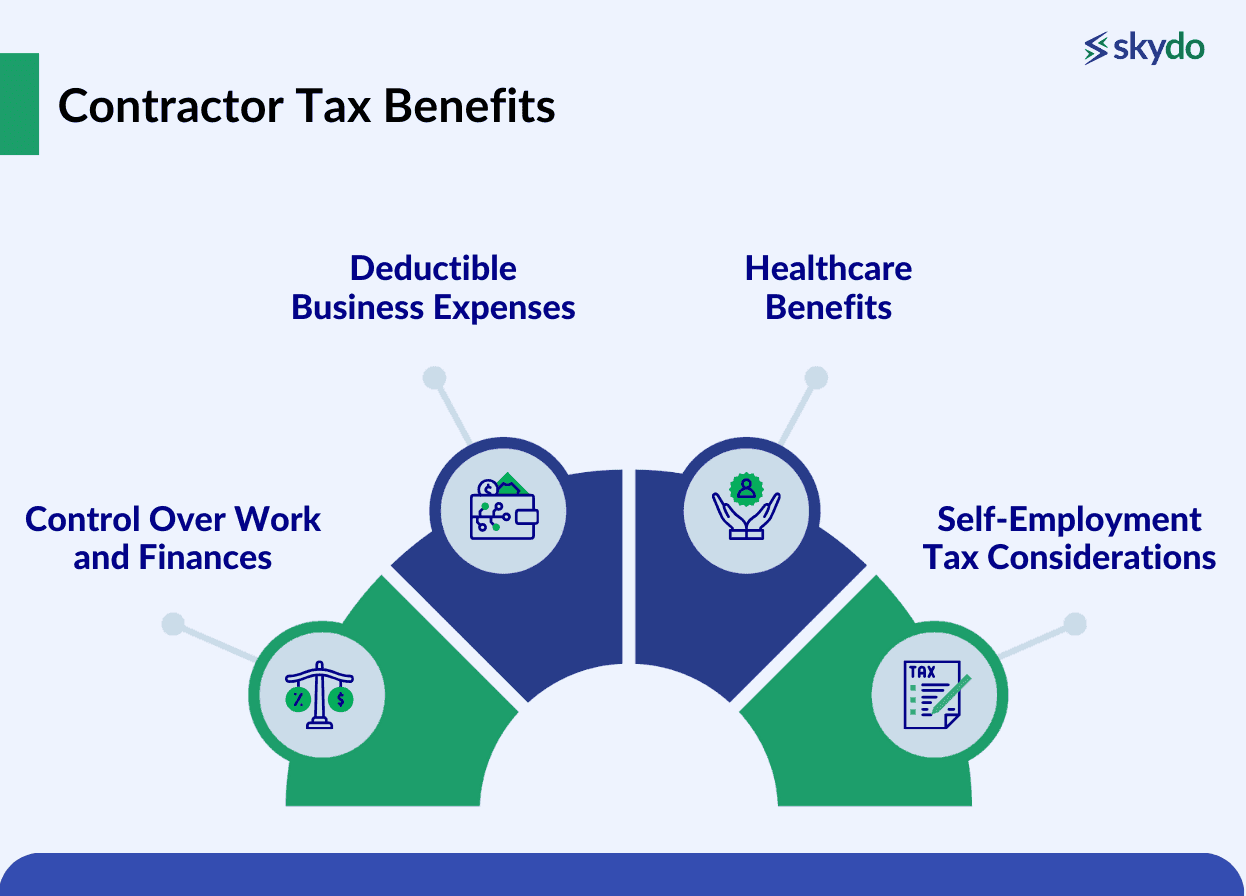

Contractor Tax Benefits

Some significant tax benefits available to independent contractors or self-employed individuals include the following.

1. Control Over Work and Finances

Work flexibility and significantly growing earnings are the two key benefits of working as an independent contractor. You can show several expenses as business expenses and seek deductions to reduce your taxable income.

Moreover, sole proprietorships can also avail of the Qualified Business Income (QBI) Deduction as per Section 199A. This scheme allows Independent contractors to reduce their QBI by up to 20%. However, there are several limitations to availing QBI according to business type and other factors.

Additionally, if the business expense of independent contractors is higher than their business income, they can deduct the net loss from their gross income.

2. Deductible Business Expenses

Independent contractors can show most of their expenses as business expenses and deduct them from the total income to maximise tax savings. These tax deductions for contractors include common expenses like home office costs, internet bills, and travel expenses, among others. Some of the standard business deductions you can claim in the U.S. are listed below.

- Home office deduction, including rent, maintenance and repairs, mortgage interest and home depreciation

- Business Insurance

- Health insurance

- Office expenses, including maintenance, utilities and supplies

- Advertising expenses

- Travel expenses

- Internet bills

- Vehicle expenses

- Education Expenses

3. Healthcare Benefits

The Affordable Care Act allows access to affordable healthcare benefits for independent contractors. You may also be eligible for tax credits if you purchase the insurance from the Health Insurance Marketplace.

4. Self-Employment Tax Considerations

Independent contractors or sole proprietors in the U.S. have to pay two types of taxes: the income tax and self-employment tax which comprises Social Security and Medicare taxes.

While finalising their self-employment tax consideration, independent contractors can also deduct the amount which would have otherwise been paid by an employer and adjust the gross income accordingly.

Key Tax Differences

Here are some major differences between tax benefits for employees and independent contractors, including self-employment tax vs. payroll tax.

1. Different Tax Forms (W-2 vs. 1099)

W-2 is a form employers provide to their employees which comprises information related to federal and state taxable income and social security and medicare income. It helps employees file their income tax return and avail credits or refunds, if any.

If you are an independent contractor, you must take a Form 1099-NEC from your clients to file the annual tax return. It tells how much payment a business has made to you in the previous tax year.

2. Self-Employment Tax vs. Payroll Tax

An employer deducts payroll tax from employees’ wages. The tax rate is usually 15.3%, from which employer and employee pay 7.65% each.

Independent contractors pay self-employment tax on 92.35% of the net earnings. Like payroll tax, the self-employment tax is 15.3%, which independent contractors must pay completely.

Moreover, the initial $168,600 of the net earnings will be considered for payment of social security tax in 2024.

3. Impact of Deductions and Credits

Independent contractors can use deductions in the form of business expenses to reduce taxable income. On the contrary, employees who earn low-to-moderate income can reduce their tax liability by availing Earned Income Tax Credit benefit.

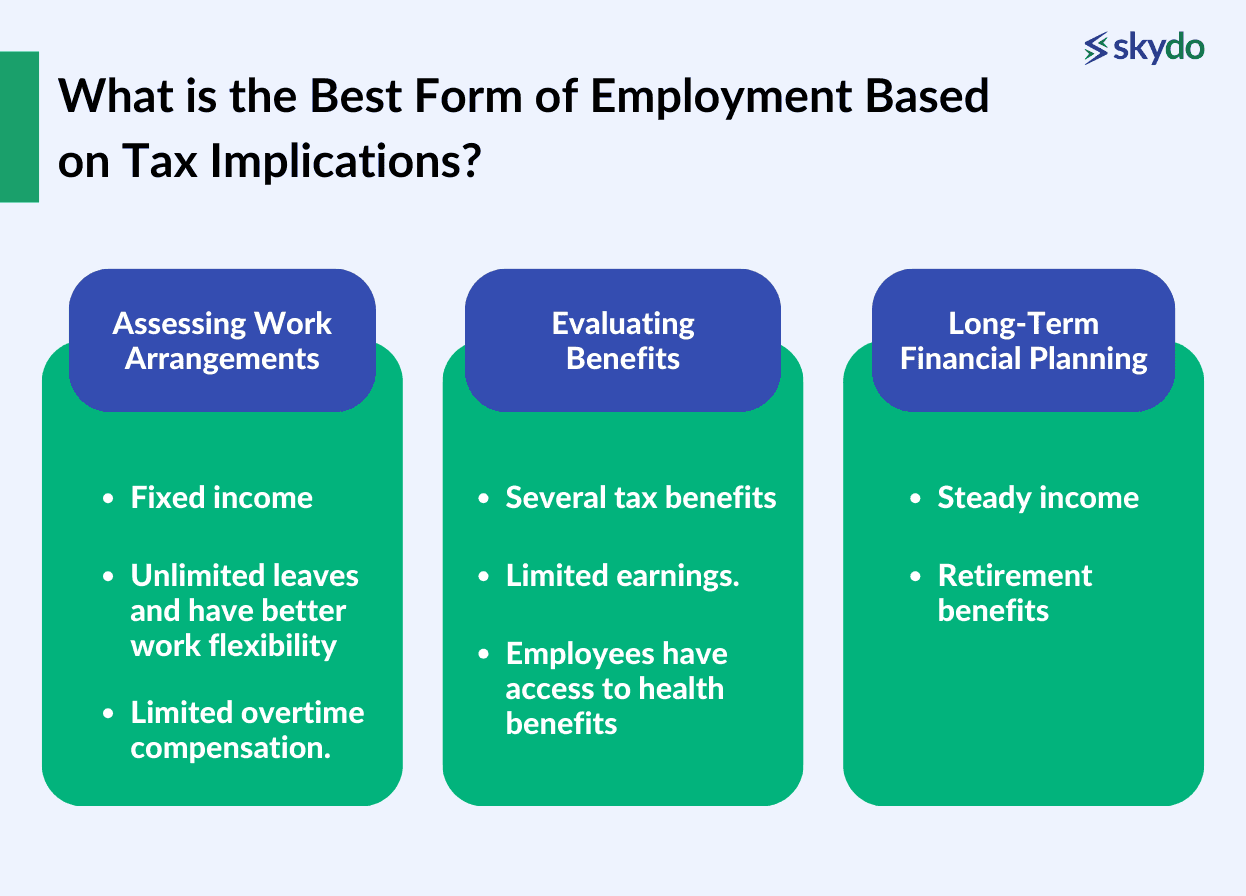

What is the Best Form of Employment Based on Tax Implications?

1. Assessing Work Arrangements

Employees have a structured work arrangement but a fixed income. They cannot control their working hours and workload. However, independent contractors can decide their workload and working hours.

They get unlimited leaves and have better work flexibility. They can also maximise their savings by taking on more clients. However, employees get limited overtime compensation.

2. Evaluating Benefits

There are several tax benefits for employees and independent contractors. Employees have more convenient tax calculations and filing because most of the work is done by the employers. However, that also means limited earnings.

Independent contractors, on the other hand, have to calculate and file taxes by themselves, but there is no cap on earnings.

Employees have access to health benefits, and the employer pays half the payroll taxes. Even though independent contractors lack such benefits, they have better work autonomy and can compensate for additional expenses by increasing their freelance earnings.

3. Long-Term Financial Planning

Employees have a steady income and get retirement benefits. However, independent contractors have variable earnings and can plan their retirement according to their savings.

Practical Tips for Maximising Tax Benefits

Here are a few tips to reduce taxable income and maximise tax savings.

1. Invest in Pre-Tax Retirement Savings

If your annual income is $70,000, you invest $2,100 in pre-tax savings. The net taxable income will be $67,900.

Employees can invest in pre-tax savings through 401(k) or 407(b). Ensure that you and your employer make the same amount of contribution to the retirement fund to maximise your savings.

However, independent contractors who run a business alone or with their spouse, without any employee, can benefit from a solo 401(k) or self-employed 401(k). Independent contractors can contribute both as an employer and an employee. The total contribution limit for 2024 is 25% of the gross income or $69,000 for 2024.

2. Take Advantage of Employer-Sponsored Benefits or Self-Employment Deductions

The easiest way to maximise your tax savings as an employee is to avail employee benefits, including paid sick, family, personal, or vacation leaves, health insurance and retirement benefits.

Independent contractors can reduce tax liability by deducting the maximum possible business expenses from their gross income.

3. Make Charitable Donations

Employees and independent contractors can reduce their taxable income by making charitable donations in the form of money or goods to tax-exempted organisations. However, you need to itemise the deduction by filing Form 1040.

Conclusion

Both employee and independent contractor roles have unique tax benefits. Therefore, you must learn the tax liabilities in both cases to make the best decision for your career. It is always recommended to consult a tax professional to understand tax deductions, liabilities and other compliances according to the nature of your work.

If you are an independent contractor or are planning to pivot to freelancing, Join Skydo today to streamline your invoicing and payment processes and maximise your freelance earnings!

FAQs

Q1. What deductions can independent contractors claim to maximise tax savings?

Ans. Independent contractors can deduct all ordinary business expenses from their gross income. These expenses include home office, Internet and phone bills, travel, vehicle use, business insurance and education.

Q2. What is the key difference between self-employment tax vs payroll tax?

Ans. The self-employment tax is paid by independent contractors, freelancers, or sole proprietors. It includes Social Security tax and Medicare tax. An employer deducts payroll or withholding taxes from the employees’ wages.

Q3. What is the difference between self-employment tax and income tax?

Ans. Independent contractors or freelancers and employees have to pay income tax. However, independent contractors must also pay self-employment tax, including Social Security tax and Medicare tax.