Skydo: The Solution To Cross Border Payments Challenges

For Indian tech exporters like Ravi in the bustling city of Bengaluru, the booming tech industry offers immense opportunities. However, managing cross-border payments can be incredibly complex.

From navigating international transaction fees to dealing with currency conversion rates and delayed payments to cumbersome documentation - understanding and overcoming these obstacles can be difficult and time-consuming.

B2B cross-border payment challenges can have more than just financial impacts. They can lead to strained client relationships, delayed projects, and decreased trust. These issues are especially damaging in digital marketing, where timely delivery and trust are key to success.

This blog explains how Ravi and other tech exporters can solve this problem, moving from chaos to convenience.

Cross-Border Payments for Tech Exporters Today

India is a powerhouse of tech innovation and digital solutions. Over the past decade, it has become one of the world's biggest internet markets, with an estimated tech revenue of $245 Bn in 2023 - exports alone will contribute $194 Bn while showcasing 9.4% growth. With its rich software development capabilities, India provides cutting-edge technological advancements revolutionising the global tech industry.

However, these figures merely hint at the tip of the iceberg. Beyond the numbers, an exhilarating ecosystem thrives, encompassing a myriad of startups, renowned tech giants, and enthusiastic individuals, collectively propelling the limits of what can be achieved.

India's tech industry is an ever-expanding powerhouse of potential and talent, filled with innovators from every corner of the nation. The growth opportunities are seemingly endless, from Bengaluru's tech-savvy entrepreneurs to Hyderabad's leading AI and machine learning experts.

As technology advances, India aims for rapid expansion within its borders and strives to become a renowned force in the global market. With each tech solution comes possibilities to achieve success on an international scale—from Mumbai's bustling city to New York’s metropolis.

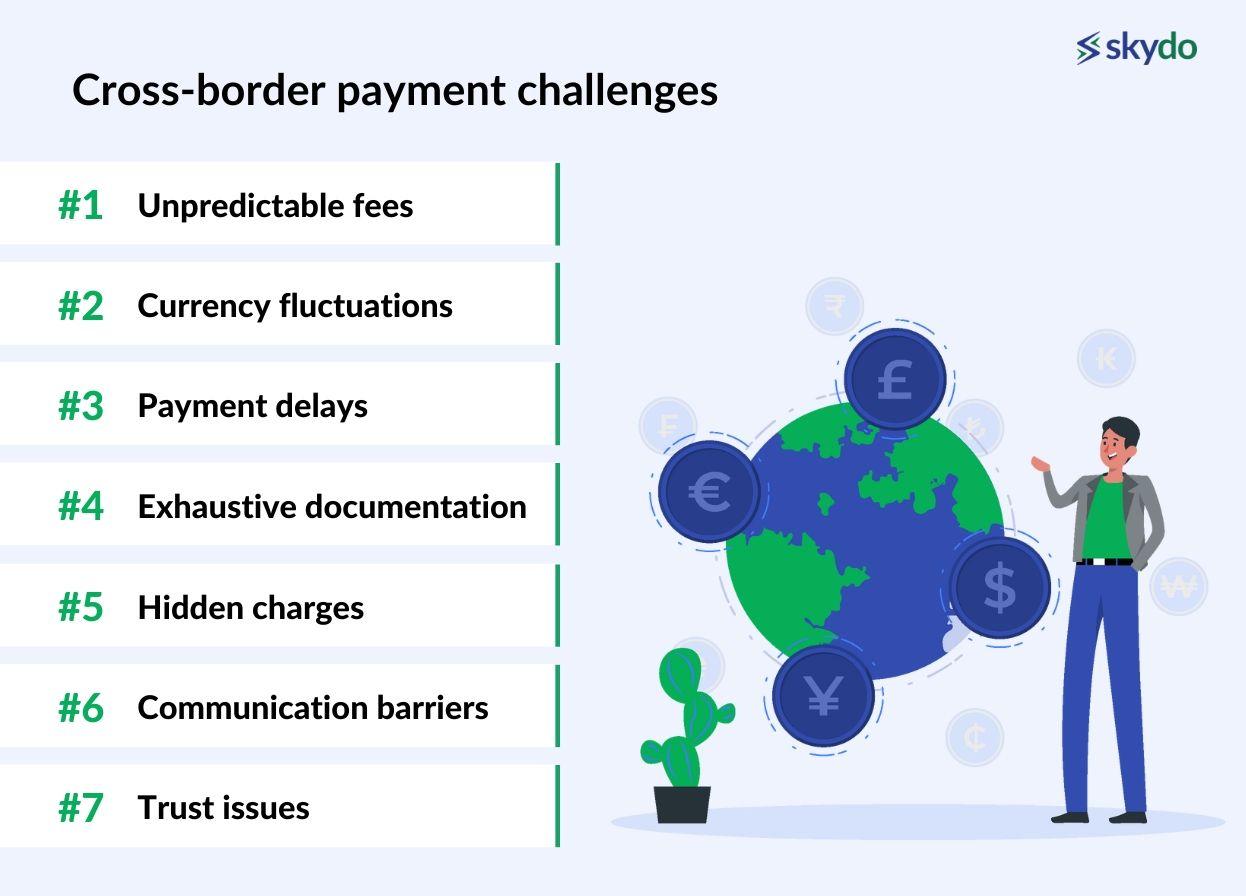

Cross-Border Payment Challenges

As a tech exporter, Ravi's business encounters numerous obstacles regarding cross-border payments. With each transaction, he faces a daunting list of challenges.

- Unpredictable fees: Ravi must deal with varying fees for every international transaction, which can significantly impact his budgeting efforts, potentially leading to financial strain.

- Currency fluctuations: The unpredictable nature of currency exchange rates means that Ravi may receive a lower amount than expected, causing uncertainty and impacting his business profits.

- Payment delays: Payment delays for international transactions can be prolonged and severely disrupt Ravi's cash flow, leading to difficulty paying employees and vendors or investing in his business.

- Exhaustive documentation: Ravi spends considerable time and effort on the excessive documentation required to comply with local and international regulations, often leading to erroneous mistakes that result in further delays.

- Hidden charges: On top of regular fees, additional intermediary bank charges or unexpected fees are possible, leading to a further reduction in the received amount.

- Communication barriers: Ravi faces communication issues when dealing with international banks or clients, and the different time zones and languages can cause confusion, misunderstandings and further delays.

- Trust issues: Due to payment defaults or fraudulent activities by new clients or partners, Ravi naturally hesitates to expand his client base, impacting his business's potential growth.

For Ravi, these issues represent more than just operational inefficiencies. These obstacles potentially hinder his business's growth and prosperity, impacting profitability, client relationships, and his ability to compete effectively in the global market.

Skydo: A Game-Changer in Cross-Border Payments

Skydo offers a comprehensive solution designed specifically for tech exporters like Ravi. Here's why Skydo is the ultimate game-changer:

1. Fast payments

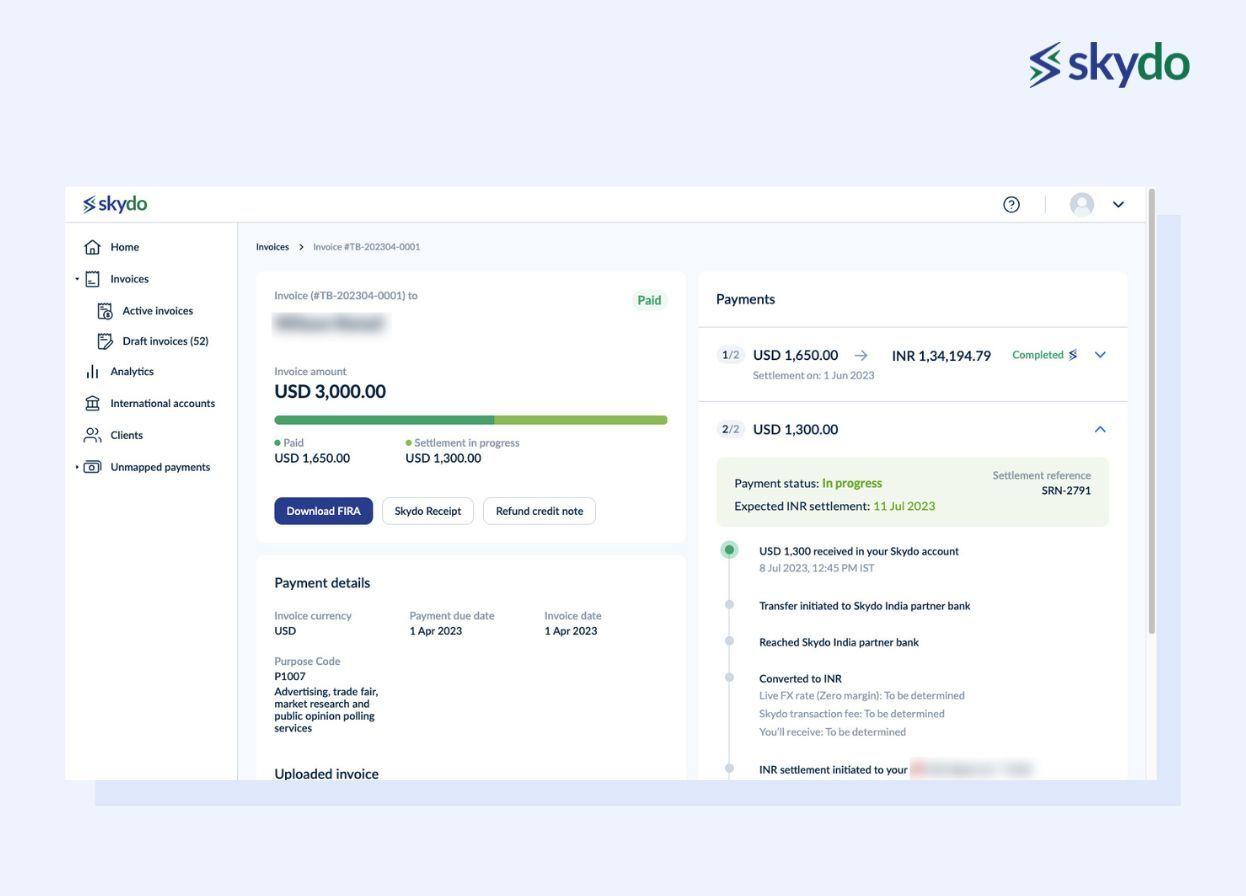

With Skydo, Ravi can bid farewell to lengthy payment wait times. Skydo guarantees quick payment processing with real-time payment tracking, ensuring a steady cash flow for tech exporters allowing them to focus on scaling their businesses.

2. Secure transactions

Security is paramount to Skydo. Robust security measures are implemented, safeguarding every transaction against potential threats. Ravi can rest easy, knowing that his payments are protected.

3. Transparent process

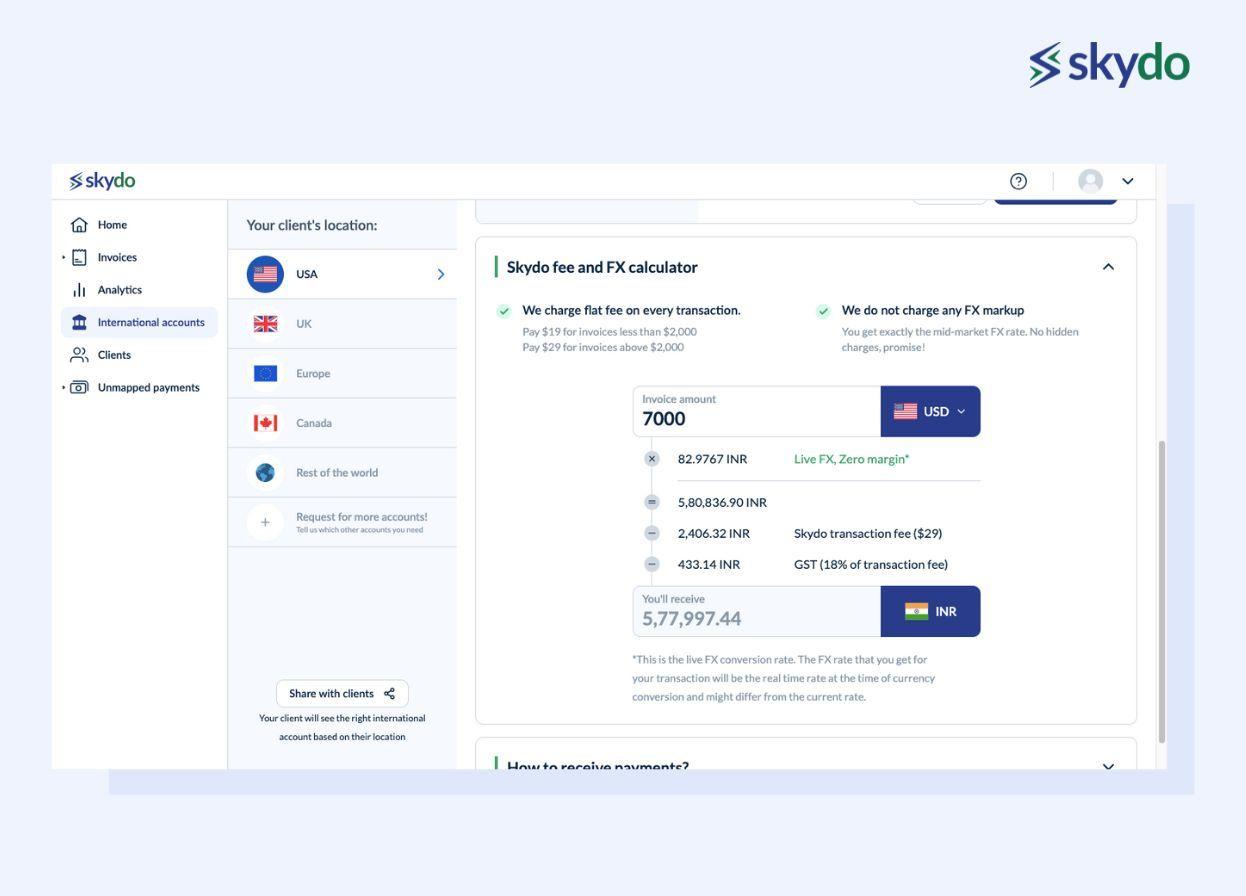

Skydo's platform provides complete transparency, clearly laying out all transaction fees and exchange rates. Ravi can effortlessly track payments without any hidden costs.

4. User-friendly interface

Skydo's user-friendly interface allows Ravi to navigate effortlessly, saving time and effort. It's simplicity at its best.

5. Cost-effectiveness

Skydo stands out with its cost-effective approach. Competitive transaction fees and favourable exchange rates allow Ravi to maximise profits without compromising service quality.

6. Direct integration with banks

Skydo's direct integration with banks ensures seamless payments, with no intermediary delays. This direct link simplifies the process, saving time and boosting efficiency.

7. Dedicated customer support

Ravi can rely on Skydo's dedicated customer support, which is always available to promptly address any challenges or queries. Smooth operations are guaranteed.

Skydo is the long-awaited B2B cross-border payment solution that tech exporters like Ravi have been searching for. It revolutionises the cross-border payment landscape, transforming a once cumbersome process into a seamless, efficient one.

Leverage your Cross-Border Payment System

Cross-border payments can be complex, but with the right approach, you can streamline the process and ensure efficient international transactions. Here are some valuable tips to make the most of your B2B cross-border payment solutions.

1. Leverage transaction tracking

Instant access to real-time transaction details can be a game-changer when resolving client queries or addressing issues. Opt for payment platforms that provide comprehensive transaction tracking to stay informed and take immediate action if needed.

2. Stay compliant

Different countries have specific financial regulations, and adhering to them is crucial. Before initiating any international payment, familiarise yourself with the compliance guidelines relevant to the transaction's origin and destination. This helps to ensure your payments stay within the boundaries of the law and avoids potential penalties.

3. Use notifications effectively

Enable notifications on your payment platform to receive instant alerts for completed transactions. This is particularly valuable when dealing with numerous payments daily. Stay updated through mobile apps or email notifications to track your payment progress effortlessly.

4. Automate regular payments

Consider setting up automated transfers for recurring obligations like monthly vendor payments. With automation, you can ensure timely settlements without manual intervention for every payment. This reduces hassle and guarantees punctuality for your regular transactions.

5. Engage with support teams

Don't hesitate to reach out to the support team of your payment platform when faced with uncertainties or challenges. They can provide guidance, clarity, and assistance in facilitating smooth transactions. Look for platforms with responsive customer support to help you navigate any hurdles.

By implementing these strategies and proactively managing B2B cross-border payments, tech exporters can streamline their processes, ensuring efficient and timely international transactions. Maximise the potential of your cross-border payment system and unlock growth opportunities for your business.

Wrapping Up

In the digital era, tech exporters have a wealth of opportunities at their fingertips. To successfully capitalise on these opportunities, they need to ensure efficient back-end processes and seamless operations, emphasising timeliness and precision.

Skydo is a cross-border payment system that facilitates this. It simplifies financial transactions, minimising delays and ensuring timely payments. With streamlined financials enabled by Skydo, tech exporters can focus on innovation and expansion as they look to tap into new markets and diversify their client base sustainably in the future.

Reach out for a quick demo of Skydo today.

FAQs

Q1: What are cross-border payments?

Ans: Cross-border payments refer to financial transactions that involve the transfer of money or value across national borders, typically between individuals, businesses, or financial institutions located in different countries.

Q2: How do cross-border payments work?

Ans: Real-time cross-border payments work through a series of intermediaries, such as banks or payment processors, that facilitate the transfer of funds between the payer and the payee, often involving currency conversion and complying with international regulations.

Q3: What are the challenges with B2B cross-border payments?

Ans: Challenges with B2B cross-border payments include currency conversion costs, varying regulatory frameworks, delays in processing, and the complexity of dealing with different banking systems and payment methods across countries.