Softex Explained: What Indian Software Exporters Must Know About RBI Compliance

What Is a Softex Form?

Imagine you’ve just landed a big overseas software contract, exciting, right? Now, whether you’re an individual developer or run a full IT agency, the SOFTEX form is something you might need to deal with.

Softex actually stands for “Software Export Declaration”. It’s an RBI-regulated document that tracks when Indian businesses export software or IT-enabled services. In simple terms, the Softex form is like a digital “shipping bill” for software exports. The RBI uses it to ensure that your foreign income is legitimate and is eventually brought back to India (typically within 270 days).

The Softex form acts as a declaration of:

- Who exported the software/service

- What was exported (project, service, deliverable)

- The foreign client involved

- The amount earned and remitted

- The details of the contract and invoice

Once filed, the Softex form is certified by STPI or SEZ authorities and then submitted to your Authorized Dealer (AD) bank, completing the export reporting process under RBI guidelines.

Who Needs to File Softex?

Softex filing is a regulatory requirement set by the Reserve Bank of India (RBI) to track and certify the export of software and IT-enabled services (ITeS) from India. This obligation applies not only to large IT companies but also to individual freelancers and small businesses.

You Must File Softex if:

- You export software, IT services, or IT-enabled services (ITeS): This includes developers, agencies, BPOs, SaaS providers, designers, etc., if your client is located outside India and pays you in foreign currency.

- You operate as a company, partnership, sole proprietorship, or even as an individual freelancer

- You are registered as an STPI or SEZ unit:All registered STPI (Software Technology Parks of India) and SEZ (Special Economic Zone) units must always file Softex.

- You are a “non-STPI unit” (i.e., not registered in STPI/SEZ):Even without STPI or SEZ registration, you must still register with the local STPI as a non-STPI exporter for Softex processing and compliance

Practical scenario where Softex will be required:

A SaaS (Software as a Service) company based in India, registered under Special Economic Zone (SEZ), sells subscriptions on a recurring basis to international clients. The software is delivered purely online via cloud hosting, and customers access the platform through their web browser or a mobile app. Payments from clients arrive in USD via Stripe, PayPal, or direct wire transfer to the company's Indian bank account. In this case, the company will have to file a SOFTEX form, as it is registered under SEZ, and the software service is likely not covered under P0802.

Who Does NOT Need to File Softex?

Some transactions and service types are exempt from Softex filing:

- Exports unrelated to software or IT/ITeS: If you export physical goods, non-tech services, crafts, or products, regular export documentation (such as FIRA, invoices) suffices—Softex is not required.

- Domestic sales only: Softex never applies to rupee payments from Indian clients or entirely domestic business activity.

- Personal remittances, gifts, and non-business payments: These are not subject to Softex.

- Software services covered under RBI Purpose Code P0802: This is a critical, often-misunderstood exemption. If your inward foreign remittance uses the Purpose Code P0802 ("software implementation/consultancy (other than those covered in SOFTEX form)"), Softex filing is NOT required.

P0802 distinguishes remittances for software services not covered under Softex reporting. Banks process these by tagging them with P0802, and you stay compliant without the Softex process.Examples: Freelance consultancy, minor bespoke scripting, certain support and maintenance remittances, and some SaaS-type payments can fall under P0802—as long as they are expressly not covered by the Softex regime.

Always cross-check with your bank: If they instruct you to use Purpose Code P0802, typically only documentation such as an invoice or contract is required—not a Softex form

Why File the Softex Form?

It might feel like extra paperwork, but filing Softex pays off in a few big ways:

- Track Your Payments: RBI requires software export earnings to be repatriated (brought back) within a set time (about 9 months). A certified Softex form is proof that the foreign revenue came from real software exports. It helps prevent illegal fund transfers and keeps India’s forex records clean.

- Claim GST & Refunds: Exports under STPI/SEZ are “zero-rated” for GST. To get GST refunds on your input taxes, you need a valid Bank Realisation Certificate (BRC). Banks will issue a BRC only after verifying your Softex form. File on time so banks can certify your export and let you claim those tax credits.

- Smooth Banking: Without Softex, banks may question or even hold up incoming export payments. A properly filed form tells your bank that “yes, this $100k was for real software exported,” so they clear it with RBI. In practice, Softex shows your transactions are legitimate – during audits and compliance checks, it’s the key document that proves “we did export software.”

How to File Your Softex Form?

For STPI-Registered Units

Step 1: Generate Softex Number from RBI

Before you can file any Softex form, you need to obtain a Softex number from the Reserve Bank of India. Visit the RBI website and generate either single or bulk Softex numbers. This RBI-generated number will be used to link your export declaration to the banking system

Step 2: Access the STPI Online Portal

Log in to the STPI online portal using your registered credentials. If you have not registered your unit, you can follow this detailed user guide to learn how it’s done. Log in to the portal using your credentials. Click on the Export button on the left side of the dashboard, and then Export Certification (Softex)

Step 3: Fill Out the Online Softex Form

Download the CSV format, which consists of details like contract number, contract date, invoice number, invoice date, currency code, export value and more. We have shared the entire list below:

Step 4: Upload Required Documents

Fill the CSV file accurately and upload it to the online portal. Once that is done, you will find a View option to upload the following documents:

- Export invoices (scanned copies)

- Contract details (if not pre-registered with STPI)

Step 5: Review and Submit

After you have uploaded all the documents, you will see a Final Submit button. Tap on the button, and you will see another screen open. Here, you must upload the RBI letter related to the Softex numbers, the Internet bill, and the location of the unit from which the goods were exported. Click on the Final Submission button.

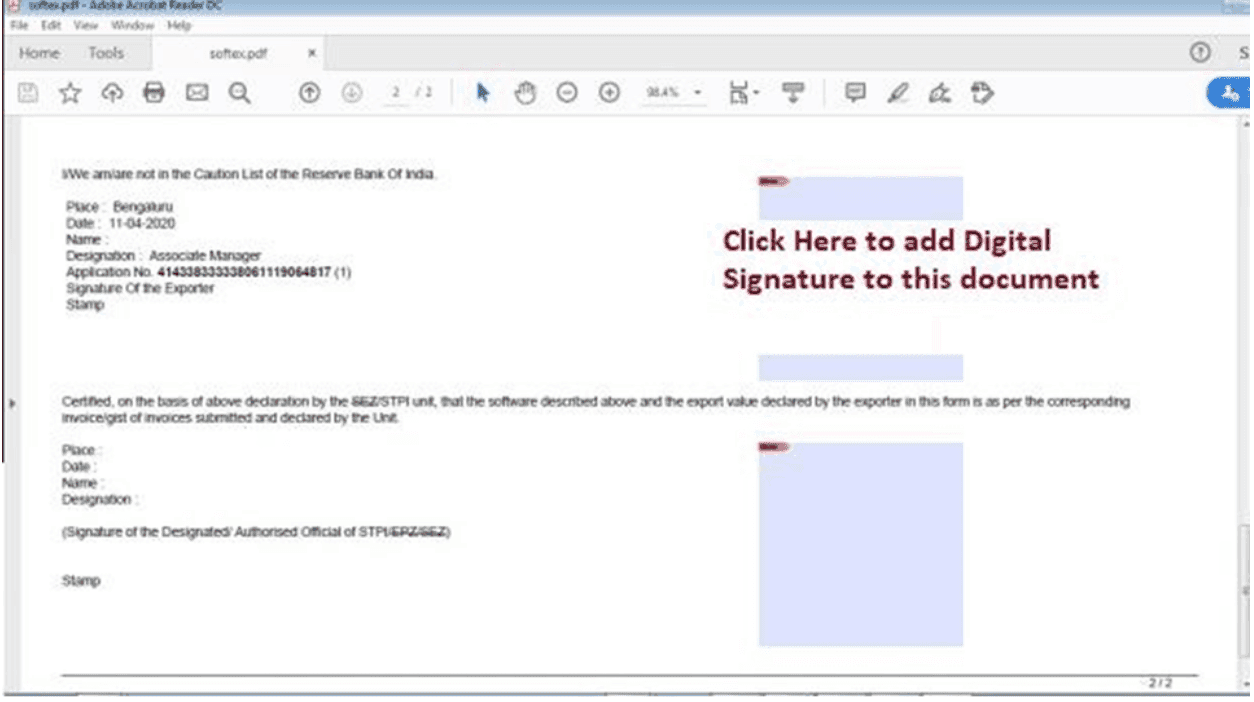

Step 6: Digital Signature and Softex PDF document

Once the final submission is done, you will see the application number displayed under the Submit Request screen. Click on the application number, and a PDF document will be generated, which you must download to your computer. On the last page of the downloaded document, you must add your digital signature. Now go back to the screen, and upload this digitally signed PDF. Click on the Final Submit button to complete the process.

The form goes through a maker-checker process where a designated approver from your company digitally signs and submits the application to STPI officials for final certification.

For SEZ-Registered Units

Step 1: Get RBI Softex Numbers

Generate Softex numbers, single or bulk from the RBI EDF portal. These are mandatory for every Softex submission and must be included in the SEZ system.

Step 2: Assign User Access

Ensure "Unit Maker" and "Unit Approver" roles are set up with access to the Softex module in the SEZ Online system.

Step 3: Prepare the Softex Form

The Unit Maker must log in to the SEZ Online portal and open the Softex form. Enter export details, invoice period (maximum 90 days), authorized dealer name and code, and select Single or Bulk Softex, depending on the number of buyers. In case you are unaware of the authorized bank information, you can use the search picker denoted by a magnifying glass 🔍

Step 4: Upload Invoices

Download Excel templates from the SEZ Online website and fill in the invoice and royalty data as required. You can upload the Excel templates using the system's invoice uploader; the system will confirm once the upload is successful

Step 5: Enter Declaration and Save

In the next step, go to the Declaration tab. Confirm remittance details and declaration of export compliance, and save the form to generate a Request ID

Step 6: Submit for Internal Approval

The Unit Approver must review the saved Softex form. If all details are correct, they confirm and digitally sign using a Digital Signature Certificate (DSC). The form is then submitted to the Development Commissioner’s (DC) office

Step 7: Respond to Queries (if any)

If the DC office raises queries or marks deficiencies, the form is sent back for corrections. Make required changes and resubmit through the same process

Step 8: Get Approval and Certification

Once verified, the DC office certifies the Softex form. You may take a printout (Original, Duplicate, Triplicate) from the portal for your records

Step 9: Submit to the Bank

Send the certified Softex form to your Authorized Dealer bank. This completes the RBI reporting and foreign remittance compliance process

What If You Don’t File Softex?

Failure to file (or late filing) has serious consequences:

- FEMA violation: Skipping Softex is a breach of FEMA rules, and RBI can impose penalties.

- Heavy fines: SEZ/DTA units risk a fine of up to 3× the undeclared export value, plus ₹5,000 per day of default.

- Export benefits lost: Non-compliance means your exports may not count toward official software export statistics.

- Bank classification issues: Banks may treat remittances as ordinary service exports, not software, blocking you from claiming GST refunds and other benefits.

- Cash flow disruption: Payments can be frozen, audits triggered, and in some cases, you may even be blacklisted by your bank.

Bottom line: Filing Softex on time safeguards your business reputation and keeps your cash flow healthy.

Common Misconceptions Around Softex

There are a few common misconceptions about Softex filing. We have picked the top three and set the record straight :

“All service exporters need to file it” — This is not true. Only exporters exporting software and IT-enabled services (ITeS) from India, and not covered under purpose code P0802, need to file softex

“My bank takes care of it” — This is partly correct. Banks handle the processing of foreign remittance documents, but do not file the Softex form on your behalf.

“Freelancers need to worry about it” — Not necessarily. Suppose you’re a freelancer or service provider exporting software and IT-enabled services (ITeS) from India and not covered under p0802, you will need to file SOFTEX.

Why Exporters Choose Skydo for Simpler Compliance

Whether or not Softex filing applies to your business, staying audit-ready and compliant is non-negotiable when you’re dealing with international clients.

That’s where Skydo helps.

With features like:

- Instant FIRA generation

- Automated eBRC for Amazon global sellers

- Auto-saved purpose codes

- Invoice-payment reconciliation

- GST-ready invoicing

- And full RBI and FEMA compliance under the PA-CB license

Skydo takes the paperwork and uncertainty out of your export operations — so you can focus on building your business, not chasing documents.