Sole Proprietorship vs. Freelancer: What’s the Difference?

India is fast growing as a gig economy, and projections indicate the gig economy can contribute 1.25% to India’s GDP while creating a staggering 90 million non-farm jobs. While it is natural to assume that gig workers are generally freelancers, that’s not always the case. Professionals and sole proprietors also form a significant contributor to the gig workforce.

Sole Proprietorship and Freelancer may both feel the same. You may picture a one-man (or woman) army juggling all tasks alone. A freelancing business may transition into a sole proprietorship or any other business structure. The same is the case with sole proprietorship. However, there are substantial differences between their features, regulations, characteristics, and growth potential. But to start off, what should be your business structure between sole proprietorship and freelancing? The blog sheds light on the key differences, letting you choose the most suitable one.

Freelancer: Who are They?

Freelancers are self-employed individuals who offer their services, skills, or expertise to various clients without being exclusive. Although they provide their services to a host of clients, such as companies, they are not considered salaried employees of the company, i.e., they are not on payroll.

Freelancers are not bound to a long-term commitment with a single employer and have the flexibility to choose their clients, projects, and working hours. A freelance contract is generally time-bound and is specified in the agreement signed by the freelancer and the client before the offering of the service begins.

Freelancers do not have any limitations on the type of service they can offer across industries as long as the nature of work is legal and is offered after signing a valid freelance contract. Freelancers offer their services in industries such as:

- Writing and Content Creation: Blogging, Copywriting, Content Creation, etc.

- Design and Multimedia: Web design, Graphic design, Video editing, etc.

- Programming and Development: Web development, App development, Software development, etc.

- Marketing and Sales: Digital Marketing, Social media management, SEO optimization, etc.

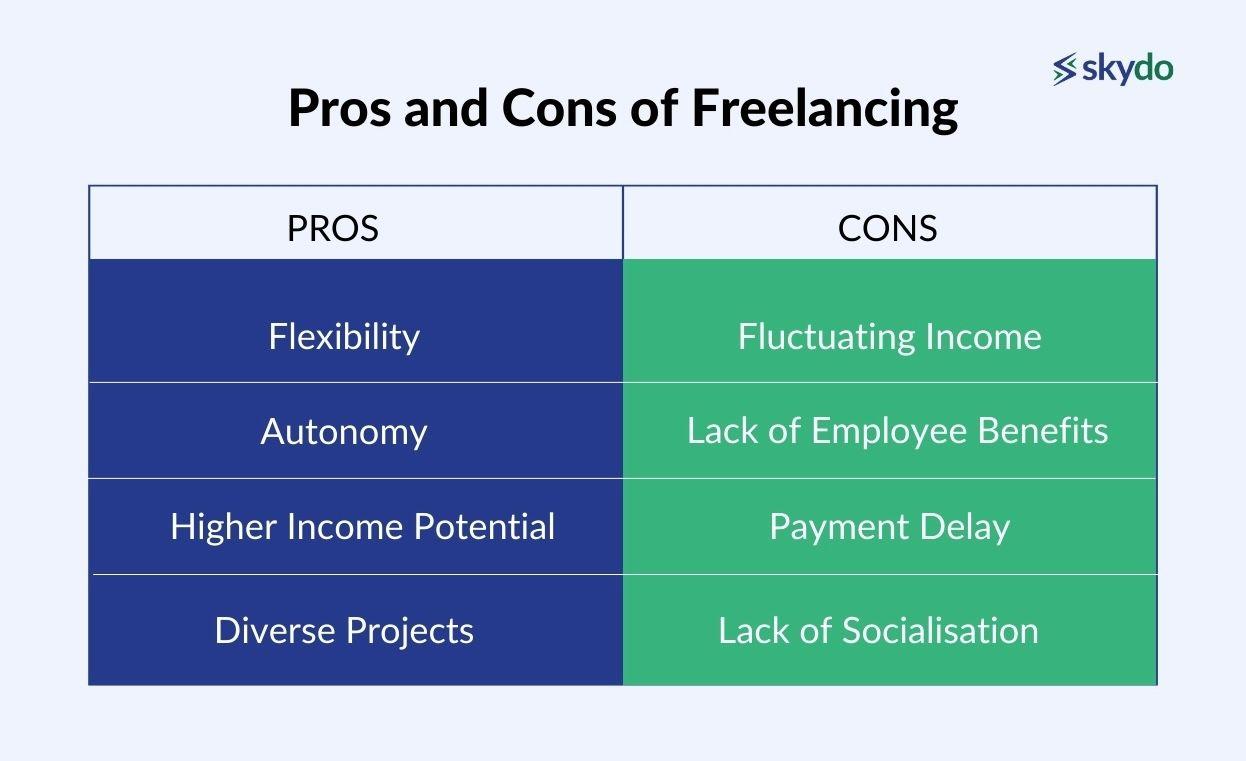

Freelancing is one such type of business that allows freelancers to earn at their convenience, but it may have some disadvantages. Here are the pros and cons of freelancing:

Pros:

- Flexibility: Freelancers have control over their schedules and can work from anywhere.

- Autonomy: Freelancers can choose clients, rates, and projects without being bound.

- Higher Income Potential: Since there is no restriction on the number of clients, freelancers can earn a higher income by onboarding multiple clients.

- Diverse Projects: Freelancers can have access to diverse projects, which can build their portfolio, providing leverage for higher income.

Cons:

- Fluctuating Income: The income may not be consistent, and there might be periods with no projects.

- Lack of Employee Benefits: Freelancers do not get employee benefits such as health insurance, PPF, allowances, etc, nor do most of them get any employee rewards and recognition.

- Payment Delay: Freelancers may face payment delays from clients as their payment is not prioritised over salaried employees.

- Lack of Socialisation: Freelancers may miss the social aspect of working in an office and communicating with fellow colleagues.

What is Sole Proprietorship?

Sole Proprietorship is a business owned, managed, and operated by a single individual. It is one of the simplest forms of business structures and offers simplicity and ease of operation. Since the business owner, called the sole proprietor, operates and manages the business independently, the sole proprietor is held accountable and answerable for all of the business’s debt, liabilities, and losses.

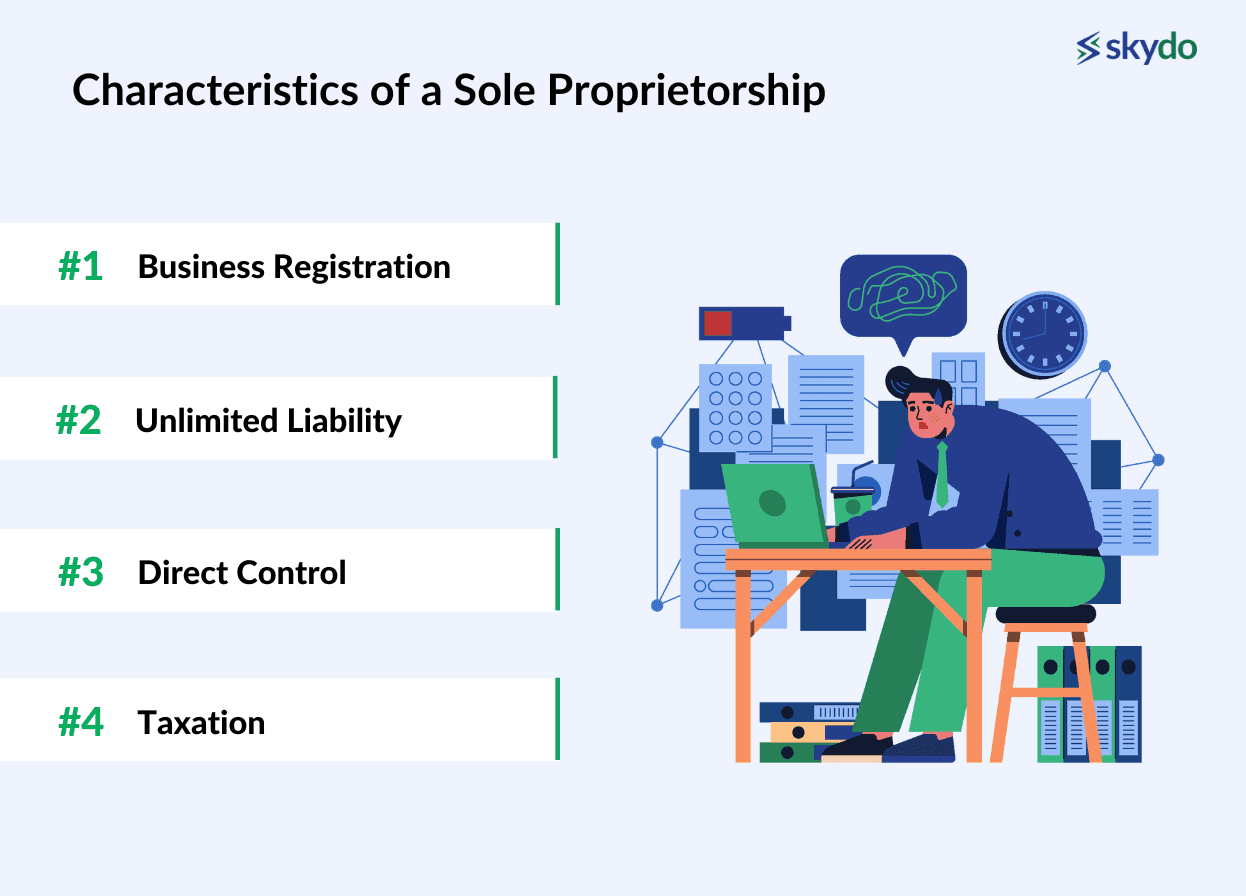

Furthermore, the sole proprietor realises all the profits and can use them for personal or business purposes. Here are some of the most common characteristics of a sole proprietorship:

- Business Registration: Although there is no specific requirement to register the business, registration is deemed beneficial. The proprietor may choose to register the business under the Shops and Establishment Act after obtaining the business’ PAN card. The sole proprietor can also register the business for GST if the annual turnover exceeds Rs 20 lakh and as a Micro, Small, and Medium Enterprise (MSME) under the MSME Act.

- Unlimited Liability: A sole proprietorship has unlimited liability, which means that the sole proprietor's personal assets are not separate from the business assets. He may have to sell his belongings in challenging times to repay business commitments. Similarly, at the time of liquidation, the personal assets can be used to pay off business debt.

- Direct Control: The sole proprietor has complete control and decision-making authority over the business. They make all the decisions related to operations, finances, and management. The process makes it easy to register and operate the business.

- Taxation: The income or profits are taken as the individual owner's personal income in a sole proprietorship. The profits are taxed at the individual income tax rates applicable to the proprietor. Furthermore, the sole proprietor is personally liable to file taxes.

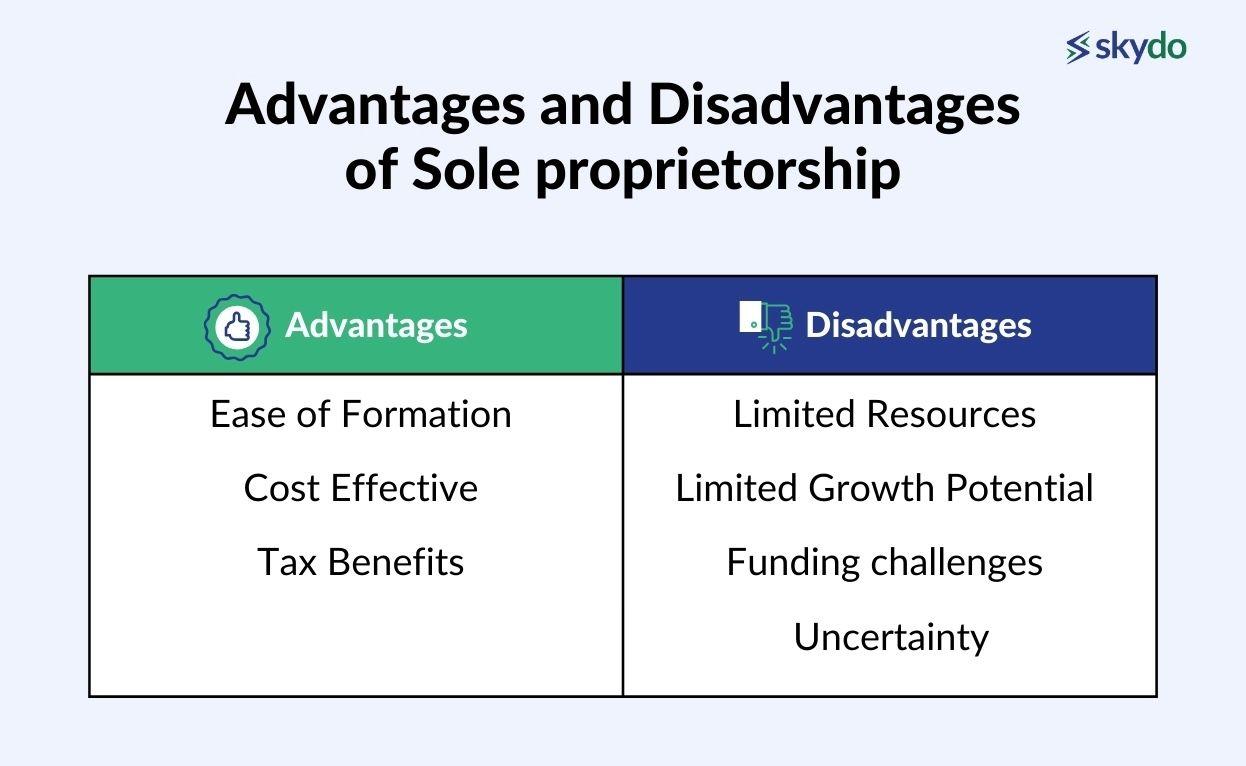

Similar to freelancing, sole proprietorship also comes with its set of advantages and disadvantages. These are:

Advantages:

- Ease of Formation: Setting up a sole proprietorship is simple and involves minimal documentation and paperwork. There are no compulsory requirements for registration.

- Cost Effective: Setting up a sole proprietorship requires lower investment than other business structures and results in lesser operating costs.

- Tax Benefits: As the business income is treated as personal, sole proprietorships can lower the taxable income through numerous deductions available under sections such as 80C or 80D.

Disadvantages:

- Limited Resources: Sole proprietorships see high investment amounts, and the sole proprietor may face challenges in raising capital for business expansion since the business's capital is often limited to the owner's personal funds.

- Limited Growth Potential: Although sole proprietors hire staff members, the limited skill set, expertise, and resources often create problems for sole proprietors regarding expansion and scalability, limiting the overall growth potential.

- Funding challenges: Banks and NBFCs prefer lending to incorporated entities like private limited companies or LLPs. Sole proprietors may find it difficult to obtain a loan at attractive terms.

- Uncertainty: The proprietorship’s success heavily depends on the skills and abilities of the proprietor. The owner's lack of skills or expertise can affect the business's performance and can result in a shutdown.

Sole Proprietorship vs. Freelancer: What's the difference?

It is important to understand the difference between freelancing and sole proprietorship to choose the ideal business structure. Here is a detailed table to understand the difference between sole proprietorship & freelancing:

| Aspect | Freelancing | Sole Proprietorship |

|---|---|---|

| Nature of Work | Provides specific skill-oriented services to various clients on a project basis. | Engages in a broader range of business activities, such as the sale of products or services. |

| Legal Structure | Freelancing is not recognised as a legal business structure as freelancers operate in their individual capacities. | Recognised as a legal business structure that is separate from the sole proprietor. They can even have a bank account in the business name. |

| Ownership | Freelancers only own and manage the work or service they offer. | The owners, called sole proprietors, own, manage, and operate the business. |

| Liability | Limited liability: the freelancers are not personally responsible for the client's business outcomes. | Unlimited liability: the owner is personally responsible for business debts and liabilities. |

| Business Registration | No formal business registration is required for freelancing but may need to comply with tax regulations or GST. | Business may need to be registered under the Shop and Establishment Act and other applicable laws. |

| Taxation | Freelancers are taxed as individuals, and income is reported under the individual's income tax return. | Business income is treated as the owner's personal income, subject to the individual’s applicable income tax rates.However, you can deduct business expenses from the total income to reduce your taxable income. |

Making A Choice: Sole Proprietorship or Freelancer?

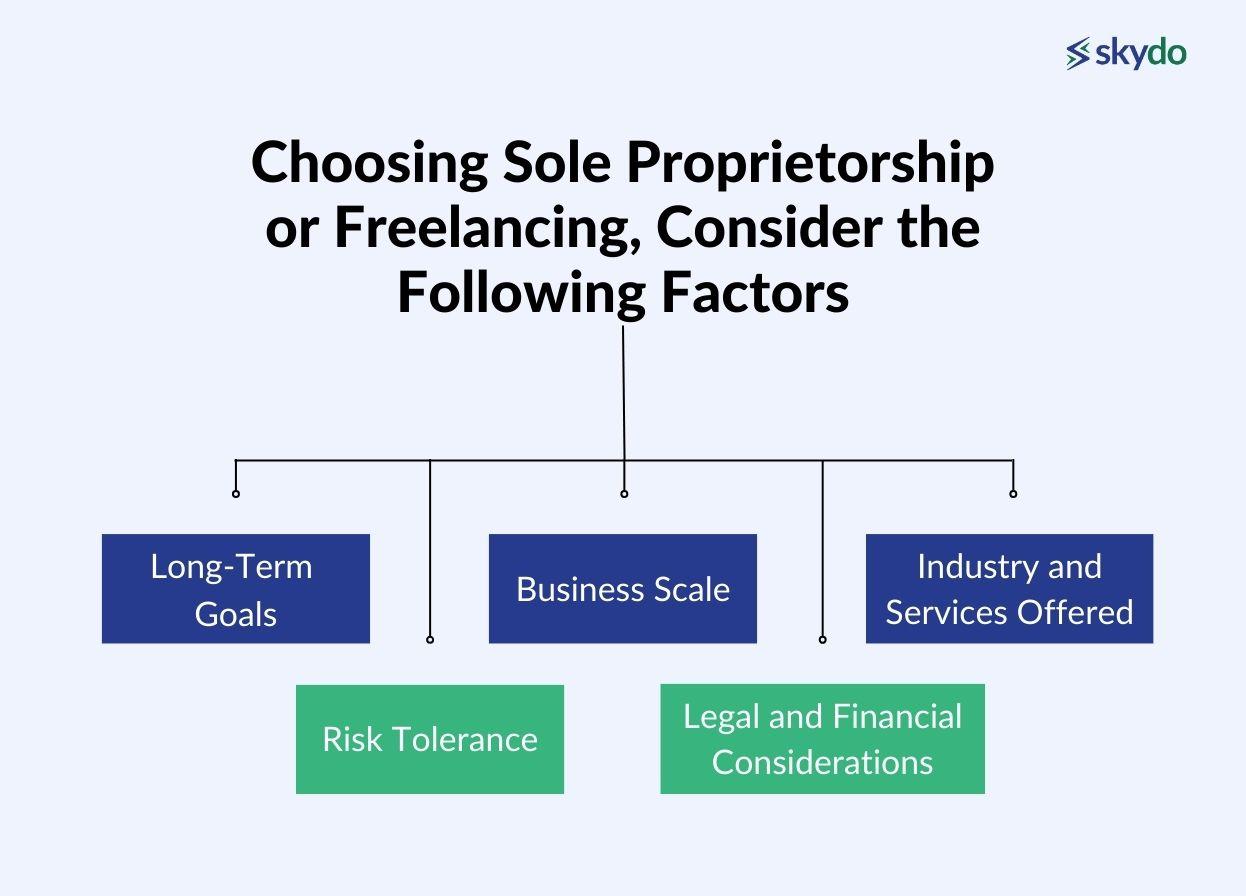

Before choosing sole proprietorship or freelancing, consider the following factors:

- Long-Term Goals: A sole proprietorship might be more suitable if your long-term goal is to manage an outright business, which may expand to other areas with multiple employees. It has the potential for unlimited expansion if you can garner the required resources and skilled employees.

Freelancing might be more suitable if your long-term goal is to maintain independence and have flexibility in project selection and working hours. Freelancers can adapt their workload based on personal preferences and market demand.

- Business Scale: Sole proprietorships are suitable for those looking for a business structure that can expand with a larger client base or customers and end up transiting to other complex business structures such as partnerships or companies.

Freelancing is ideal for individuals who prefer a simple, smaller-scale business to provide independence and flexibility. Here, the idea is to transition into charging more with time and increase earnings.

- Industry and Services Offered: A sole proprietorship is appropriate for a wide range of industries that offer products and services that other businesses or end customers can use. It is ideal for offering a diverse range of products and services under one business entity.

Freelancing is best suited for industries and sectors where a specific skill is in demand, such as writing, marketing, consulting, designing, etc. However, an individual freelancer has to stick to a specific niche and build a reputation based on expertise.

- Risk Tolerance: A sole proprietorship involves a higher risk due to unlimited personal liability. Here, raising external capital can be risky as personal assets can be used to pay off debt.

Freelancing has a lower risk level as freelancers work on a project basis and have limited liability. The risk is limited to non-payment of remuneration by clients and does not extend to personal assets.

- Legal and Financial Considerations: Sole proprietorships require more legal and financial considerations as they are recognised as legal business entities and may require to register the business.

Freelancing requires lower legal and financial considerations, as freelancers are not required to register their businesses. The only requirement that may arise is for registering under GST if the annual turnover is more than Rs 20 lakhs.

How to Build a Website and Portfolio for Your Services

Building a website and portfolio/brochure is crucial for freelancers and small business owners to showcase their services, attract clients, and establish a professional online presence.

Once you have defined your brand, niche, or services, you can utilize numerous tools, such as Wix, WordPress, Google Web Designer, Notion, Canva, etc., to create a free website. If you find it complex, you can hire a third-party website design agency to make one for you.

If you’re a freelancer in the media/marketing space, you can create an online portfolio to showcase your past work using tools such as Behance, Adobe Portfolio, Dribble, Crevado, etc.

Conclusion

As long as business structures go, both sole proprietorships and freelancing offer simple processes to establish, manage, and operate the business with utmost flexibility. However, the choice between a sole proprietorship and freelancing hinges on various factors, each with its advantages and disadvantages.

Sole proprietorships offer a more formal and recognised business structure but lack the flexibility and convenience provided by freelancing. However, it entirely depends on the sole proprietors or freelancers to scale the business to new heights, which may result in higher earnings while retaining all the advantages.

When choosing between the two, you should analyze your personal preferences, career aspirations, and the desired level of involvement in business operations. If your business results in onboarding foreign clients, you can create an account on Skydo to receive foreign currency payments seamlessly.

FAQs

Q1. Can I transition from freelancing to a sole proprietorship or vice versa?

Ans: Yes, there are no restrictions for transitioning between freelancing and a sole proprietorship and vice versa. Many individuals start as freelancers and later transition into a sole proprietorship. Conversely, some business owners may freelance in specific projects while operating as a sole proprietor.

Q2. Can I earn more in sole proprietorship than freelancing?

Ans: The earning potential entirely depends on the nature of the business and how many clients or customers choose your products or services. You can increase your earning potential in both the business structures by creating a website and portfolio and by marketing your business.

Q3. What factors should I consider when deciding between sole proprietorship and freelancing?

Ans: Consider your long-term goals, the scale of your business, the nature of your services, industry and sector demand, risk tolerance, and financial and legal considerations.