Wise Transfer Charges in India: A Detailed Breakdown

As a freelancer or an exporter, getting paid on time is the most crucial aspect of your business. Wise (earlier known as TransferWise) is one of the most reliable and popular platforms for receiving international transfers from cross-border clients. But what about affordability? Are Wise transfer charges affordable for your business?

In this blog post, we break down Wise transfer charges using practical examples and provide a clear overview of how Wise works for receiving international money transfers. Our aim is to help you understand the costs and features so you can choose the best option for your needs.

Wise Transfer Charges: What do you need to know about them?

Wise takes pride in its transparency, ensuring no hidden fees are included in its pricing. But what are the different components of its transparent fees? Let's find out:

Mid-market exchange rate + Conversion fee

Wise considers the mid-market exchange rate to convert the value of currency. It is derived as the mid-point of the rate at which bankers are ready to buy and sell a currency. The mid-market exchange rate is real, and fair, and helps you get paid without getting stuck in the quagmire of exchange rate movements.

Wise charges 1.7%-1.8% of the transaction amount in Wise fees. For a payment of $10,000, Wise charges $161.99 as Wise fees.

e-FIRC charges (varies across currencies).

e-FIRC is an abbreviation for Electronic Foreign Inward Remittance Certificate. With every transfer, Wise sends you a digital FIRA, which they call an e-FIRC. The charges for e-FIRC is there equivalent if $2.50/FIRA. For example, if you receive $1,000 from the US, the e-FIRC charges will be $2.50. For receiving €1000, the e-FIRC charges are €2.24.

Applicable wire or miscellaneous charges

Along with the above charges, additional fees could be applied to the total cost. These miscellaneous charges are due to the nature of the transaction or bank fees. For example, if you receive $1,000 from a client in the US through a Wire transfer, the Wise fees will be $28.94 – $6 more compared to a Wise account transfer. In the wire transfer payment method, the money is credited to your bank account. Because there are more participating financial institutions, the transfer fee increases marginally.

Does Wise charge a transfer fee?

You can open an account in Wise free of charge, but all the above charges are applicable while making a transfer.

How long does a Wise transfer take?

The duration of a Wise payment transfer depends on several factors. These factors include currency conversion (which usually takes up to two business days), the country you're sending money to and from, payment method, security checks, and public holidays and banking hours. Overall, Wise Transfer can take anywhere between 1-5 business days.

Wise Transfer Charges: How much do I need to pay to receive global payments in India

With Wise, you can accept payment in international currencies. However, Wise money transfer charges are variable fees, that is they are not fixed and depend on the currency.

Don’t worry we won’t leave you hanging there. We have come up with two examples, using different foreign currencies. This example explains how the charges will differ and the net amount you can expect to receive from the currency transfers.

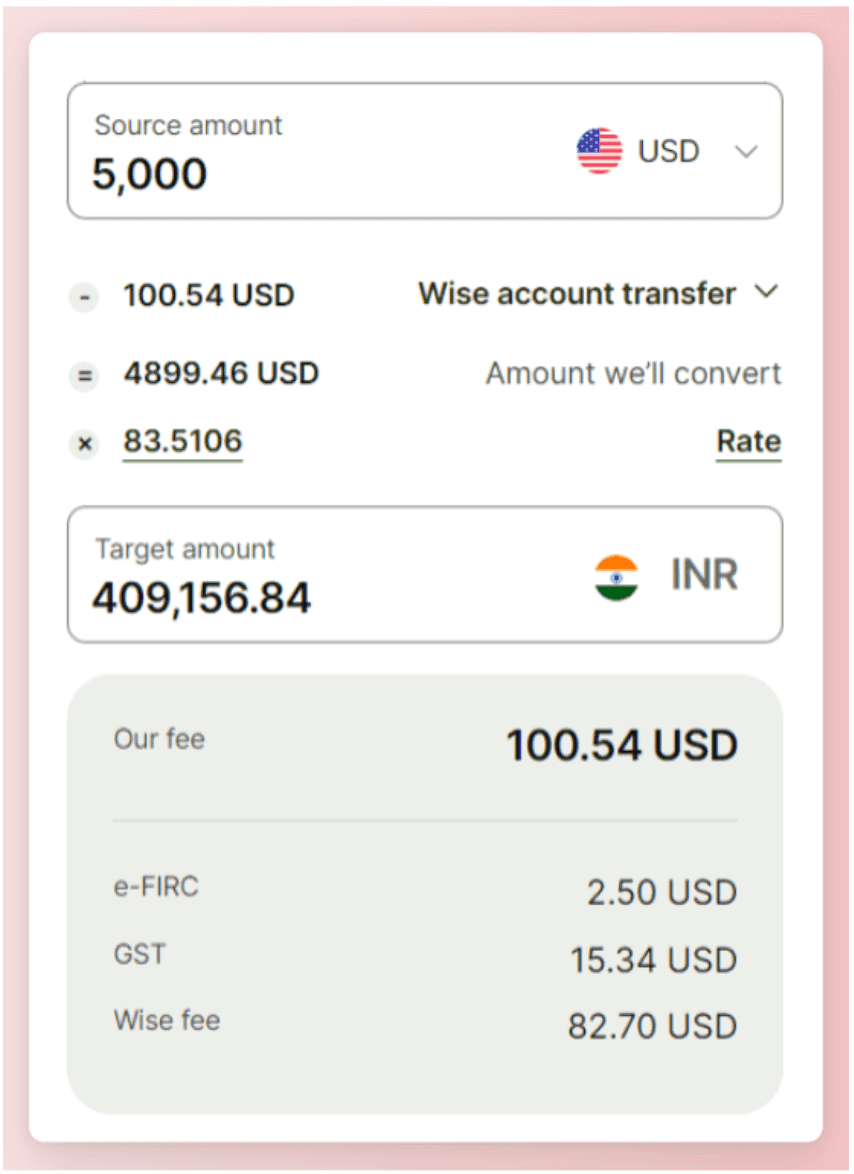

Wise Fees for Receiving USD 5000 In India

We used Wise’s Transfer Fees calculator to determine the total Wise transfer fee for receiving $5000 in India and the total amount you can expect.

Amount sent from the US: $5,000

Wise transfer fee: $82.7

e-FIRC: $2.50

GST: $15.34

Total fees: $82.7+ $2.5+ $15.34 = $100.54

Total amount to be converted: $5000-$100.54 = $4899.46

Current mid-market exchange rate: 83.5106

You get: 4899.46 X 83.5106= INR 409,156.84

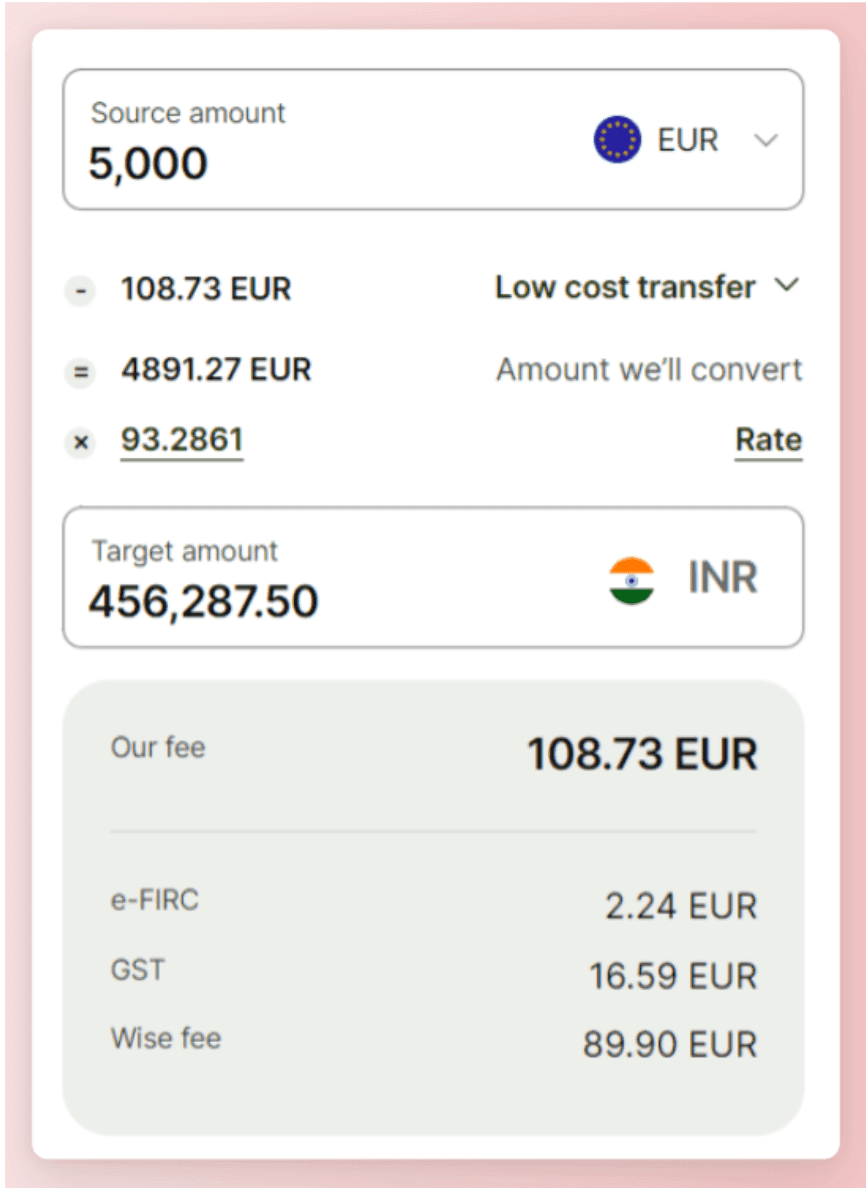

Wise Fees for Receiving Euro 5000 In India

How does the calculation change when a client transfers the same amount albeit in a different currency from Europe? Let’s find out by switching the US Dollar to Euro.

Wise offers two payment methods for receiving payment from European clients: low-cost transfer and Wise account transfer. However, the fees are the same for both methods.

Amount sent: €5,000

Wise transfer fee: €89.9

e-FIRC: €2.24

GST: €16.59

Total fees: €89.9+ €2.24 + €16.59 = €108.73

Total amount to be converted: €5000-€108.73 = €4891.27

Current mid-market exchange rate: 93.2861

You get: 4891.27 X 93.2861 = INR 456,287.50

Receiving global payments with Wise vs Skydo: Comparing Wise transfer fees with Skydo

Skydo is a great alternative for receiving payment in international currencies in India. You can create an account for free and all the transfer charges are shared with you upfront – no hidden costs.

Skydo charges a flat fee of $19 for transferring up to $2,000 and $29 for payments between $2,001 and $10,001. Moreover, it offers international virtual accounts meaning your clients can transfer money to your account directly like they’re making a local transfer.

Let’s quickly compare Wise and Skydo to find out how much fees each platform charges for receiving the same amount of money in US Dollars.

| Particulars | Wise | Skydo |

| Amount sent | USD 10,000 | USD 10,000 |

| Fees | USD 197.53 | USD 29 |

| Balance before conversion | USD 9802.47 | USD 9971 |

| Assumed exchange rate for 1 USD | INR 84 | INR 84 |

| You get | INR 823,407.48 | INR 837,564 |

From the above calculation, it’s clear that Skydo offers better value than Wise and is the least expensive option to receive international transfers. You save $168 in total fees which means an extra income of INR. 14,000.

If you want to get the best value for currency exchange and switch from traditional bank transfer to a more modern, transparent platform, create a free account with Skydo or book a demo with us.

Does Wise charge a transfer fee?

Wise charges a conversion fee, e-FIRC charges, and miscellaneous charges that might be applicable for certain currencies

Is Wise transfer safe in India?

Can I withdraw money from Wise in India?