Global Finance Made Easy With Skydo

Technology has been evolving to make global payments easier, but it comes with a complex web of intricate systems. While many of these payment systems are technically innovative, they don't always offer the intuitiveness and simplicity that users need. This can be especially overwhelming for businesses trying to keep up with the pace of a rapidly changing global economy.

Naturally, you’d want a payment solution that prioritizes user experience, is technologically advanced, intuitive, and tailored to the unique challenges of cross-border transactions. Skydo simplifies the process, making international payments easier, more streamlined, and creating a user-centric cross-border transaction experience.

Introducing Skydo: A new era of International payments

Skydo is revolutionizing international business payments with its innovative approach. You can now receive payments from all over the world quickly, easily, and securely with Skydo's simple and cost-effective solutions.

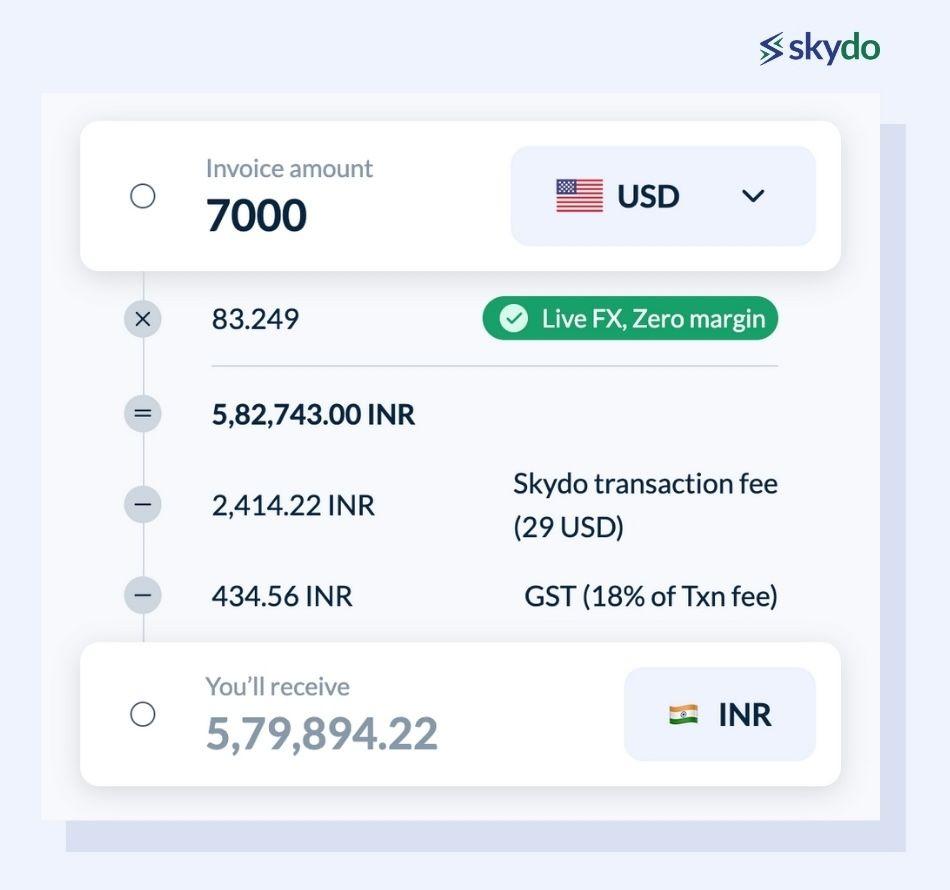

With live foreign exchange (FX) rates, zero margins, and a uniform flat fee structure, you can rest assured that all transactions are transparent, fair, and cost-effective. No more costly or cumbersome bank processes.

Key Features and Benefits of Skydo

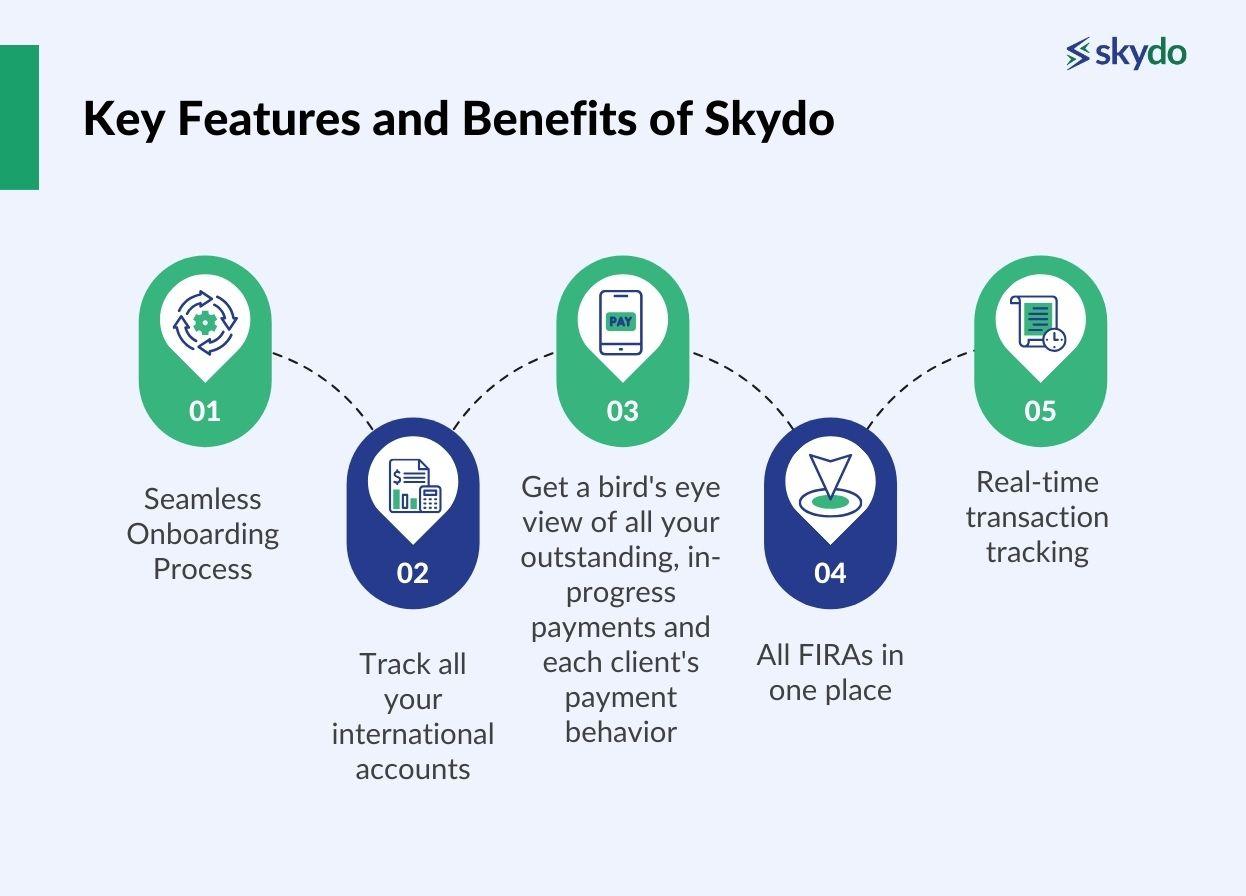

- Seamless Onboarding Process

Skydo's intuitive platform is designed to be user-friendly, making it easy for businesses to integrate and benefit from its services immediately and efficiently.

- Track all your international accounts

Skydo offers a convenient way for businesses to obtain international bank accounts across over 20 countries, including the USA, UK, Europe, and Canada. The process is 100% legal and compliant, without hidden fees or maintenance costs.

- Get a bird's eye view of all your outstanding, in-progress payments and each client's payment behavior

Real-time insights and tracking make financial management and forecasting easier. With up-to-date information, you can quickly identify potential risks and opportunities to make informed decisions about cash flow.

- All FIRAs in one place

Skydo's automatic Foreign Inward Remittance Certificate (FIRC) system makes it easy for businesses to stay GST-compliant. All FIRCs can be downloaded with a single click from the dashboard, allowing them to manage their GST refunds effortlessly and remain compliant with government regulations.

- Real-time transaction tracking

Skydo provides businesses with real-time transparency in every transaction. Our platform allows you to track each step of the process to monitor progress and stay up to date with any changes.

Currency Conversion Made Simple

Say goodbye to the complexities of currency conversion with Skydo! Our platform is designed to provide businesses with easy-to-use tools and features that offer the utmost clarity and convenience. You can accurately convert currencies quickly and effortlessly.

- Real-time exchange rates and transparency in pricing

Skydo offers real-time foreign exchange (FX) rates with zero margin and full transparency in pricing. This means you always get the most competitive rates without any hidden markups, so you can rest assured that your money is getting the best possible value.

- Flat conversion fees

For any transaction below USD 2,000, you can enjoy a flat fee of just USD 19. For those above this amount, the fee is still only USD 29 - no matter the transaction size!

- Minimal transaction fees compared to traditional financial institutions

Skydo is the smarter way to do banking, helping you to save significantly on fees compared to traditional financial institutions. With our low-cost transactions, your money goes further, so you can make more informed financial decisions.

Comparing Skydo with Traditional Alternatives

- Speed and efficiency

Traditional financial systems involve juggling between multiple platforms, each dedicated to specific functions such as invoicing and currency conversion. This fragmentation can lead to inefficiencies, manual data entry, and potential errors. To solve this problem, Skydo offers a comprehensive solution that helps businesses streamline their operations and processes by integrating all account receivables into one unified platform.

- Cost-effectiveness

Conventional banking systems can be expensive and complex, with stacked fees, service charges, currency conversion markups, and intermediary bank fees. Even worse, these costs are often hidden, and the lack of transparency in FX rates can mean businesses don't always get the best rate for their transactions.

This can be a significant cost for businesses dealing with frequent international transactions. Skydo offers flat fees for all transactions with real-time exchange rates so that you can save money compared to traditional banking methods. Skydo’s FX rate also offers zero margins, so you always get the best value for your money.

- Invoicing at no cost

Traditional systems may not have built-in invoicing solutions, so businesses invest in separate software or platforms. This can add extra costs and complexity as data between banking and invoicing platforms need to be reconciled.

Plus, if a bank does offer an invoicing service, they're likely to charge additional fees or require customers to upgrade their service tier. With Skydo, you can benefit from an integrated invoicing feature at no extra cost. This makes it easy for businesses to manage their finances, send invoices, and receive payments from one place.

- Effective payment reminders

Traditional banking payment reminder services may lack the advanced features businesses need to manage payments effectively. Features like a detailed history of reminders sent, customizations to cater to specific client relationships, and automated tracking can often be absent. Without these features, businesses rely on manual processes or third-party applications, leading to inefficiencies and missed opportunities for prompt collections.

With Skydo, you can send payment reminders and view the full history of all reminders sent. This helps you stay on top of receivables and manage client relationships more effectively.

Dive into Skydo for Your International Payment Needs

As the world becomes more interconnected, traditional financial systems are struggling to keep up with modern demands due to their multiple platforms and hidden fees. Skydo is the perfect solution for businesses looking for a reliable way to send money across borders.

Skydo's standout features

- Unified platform: Say goodbye to juggling multiple platforms. Skydo provides a one-stop shop for all of your foreign payment requirements.

- Transparent pricing: Flat costs, real-time FX rates, and no hidden charges ensure you always know what you're paying for.

- Efficient invoicing: With integrated invoicing, you can manage finances, send invoices, and receive payments in one location, saving you money.

- Effective payment management: Thanks to smart reminder systems and a detailed history of reminders sent, you are always in charge of your receivables.

Take the leap with Skydo and experience firsthand the future of global transactions. With simplified and efficient solutions, Skydo is perfect for any business, Don't let yourself get tangled in the complexities of traditional finance – explore Skydo to unlock your full potential today.