Increase Your Freelance Income With Skydo: The Best Payment Gateway for Freelancers

As a freelancer, you have finally booked your first foreign high-ticket client who will pay you over $1000. Now, you are looking for an international payment gateway that allows seamless and quick payment withdrawal by charging a minimum amount.

You start looking for platforms to compare. Some common platforms Indian freelancers use are PayPal, RazorPay, Wise, and Payoneer.

The most significant issue with these payment platforms is the exorbitant withdrawal fee and other processing fees they charge each time you want to transfer funds to your bank account. Let's see what some of these platforms charge for withdrawals.

| Name of the Platform | Withdrawal Fee |

|---|---|

| PayPal | 4% currency conversion fee for withdrawing money held in foreign currency in the PayPal account.An additional fee of 250 INR in case a withdrawal transaction fails. |

| Wise | 4.54 USD + 0.5% of the transaction |

| Payoneer | Up to 2% above market foreign exchange rate at the transaction time if you receive the money in a foreign currency and want to withdraw it in INR. |

| Stripe | 3% for Mastercard and Visa cards issued outside India (+ 2% if currency conversion is required)3.5% for American Express cards issued outside India (+ 2% if currency conversion is required)4.3% for international cards with USD or other currency presentment (+ 2% if currency conversion is required) |

| PingPong | 1% withdrawal fee |

The above table indicates that most international payment gateways for freelancers in India charge up to 4% of your earnings. It may seem small for a few transactions, but repeated deductions can significantly reduce your earnings.

For example;

First Transaction

- Earnings: $500

- Deduction (4% fee): $20

- Total Earnings: $480

Second Transaction

- Earnings: $500

- Deductions (4% fee): $20

- Total Earnings: $480

This process repeats for eight more transactions, each resulting in a $20 fee deduction. By the end of the month, the cascading effect looks like this:

Total Earnings for 10 Projects: $5,000

Total Deductions (4% fee for each project): $200

Actual Earnings After Deductions: $4,800

So, despite initially earning $5,000, the cumulative effect of 4% fees for each transaction results in an actual income of $4,800.

Moreover, additional charges, such as platform fees, international payments remittance fees, dispute fees, forex fees, and other processing fees reduce your final withdrawn amount. How do you avoid the extra costs and secure your earnings?

Skydo, a modern payment solution, aims to resolve the challenges related to freelance payments and forex rates (FX rates) by offering a transparent pricing model. This blog guides you through the unique features of the Skydo platform and explains how you can maximise your earnings by using the platform.

Introducing Skydo: A Solution Tailored for Freelancers

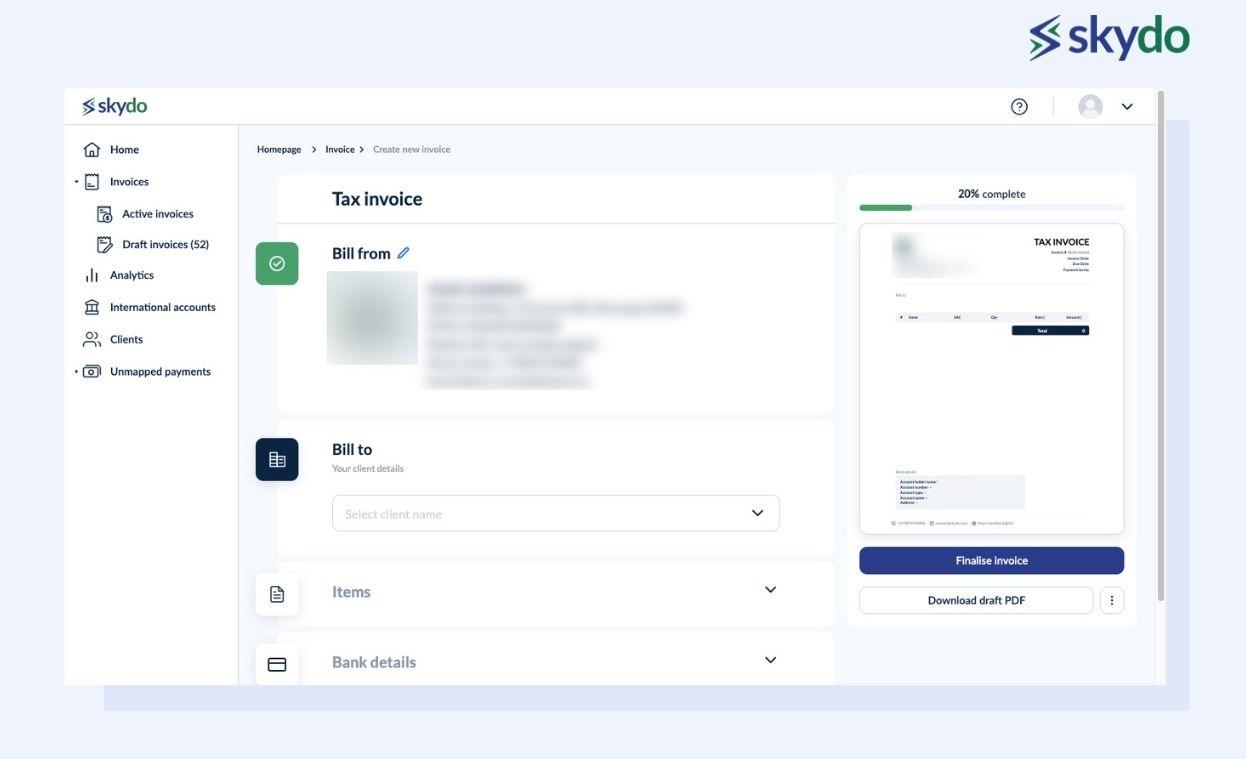

Skydo offers a user-friendly dashboard where you can create invoices for their foreign clients and send them directly to them within minutes.

Opting for a gateway like Skydo, which integrates effortlessly with platforms like Toptal, Deel, Upwork, and Freelancer.com, ensures a streamlined and efficient payment process.

One of the best features of Skydo is the live payment tracking that allows you to monitor when the client has received the invoice and processed the payment. Moreover, Skydo also enables freelancers to send quick reminders to clients for unpaid invoices.

Let's see some of the most significant features of Skydo that help boost your freelance earnings!

Transparent Pricing and Low Fees

A study on self-employed people in Germany suggests that nine out of ten self-employed people contribute to more than half of their household income, and moderate-income losses lead to a significant drop in living standards.

Moreover, income cuts lead to a drop in income below the adequate level, making it difficult for freelancers to maintain their living standards. While the study was conducted specifically on Germans, it can also apply to other global freelancers because many self-employed professionals have an unstable source of income.

Therefore, ambiguous payment platform fees can majorly impact your income. If you ask for payments directly in your bank account, you have to pay SWIFT fees, processing fees, currency conversion fees, FIRA fees, and several other hidden charges.

However, Skydo has a simple flat-fee pricing model that charges the following amount for processing your international freelance payments.

- Flat USD 19 for transactions up to USD 2,000

- Flat USD 29 for transactions above USD 2,000 to 10,000

This flat fee structure helps you save on unnecessary costs, correctly predict your earnings, and plan and maintain budgets easily.

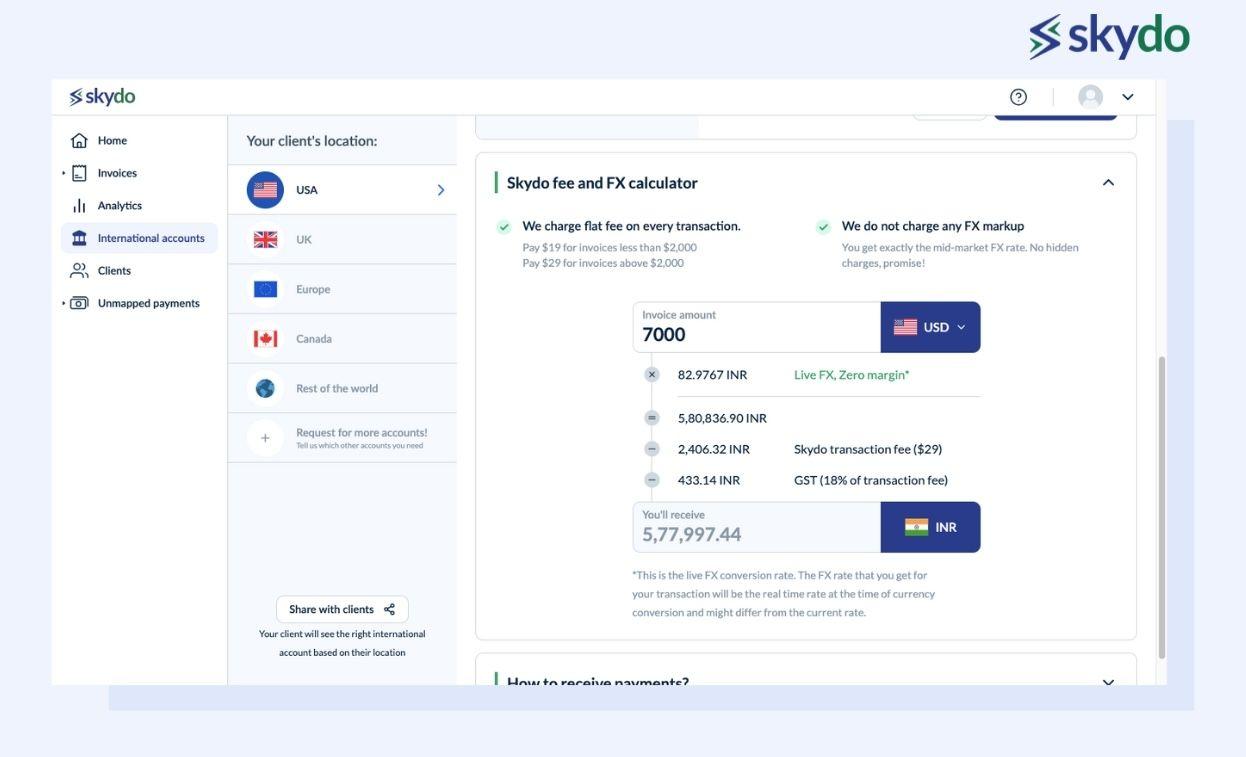

Moreover, you can use Skydo's FX savings calculator to predict how much you save by escaping extra fees on freelance payments. It offers a sense of security and reduces unnecessary financial stress.

Escaping the Grip of High FX Rates

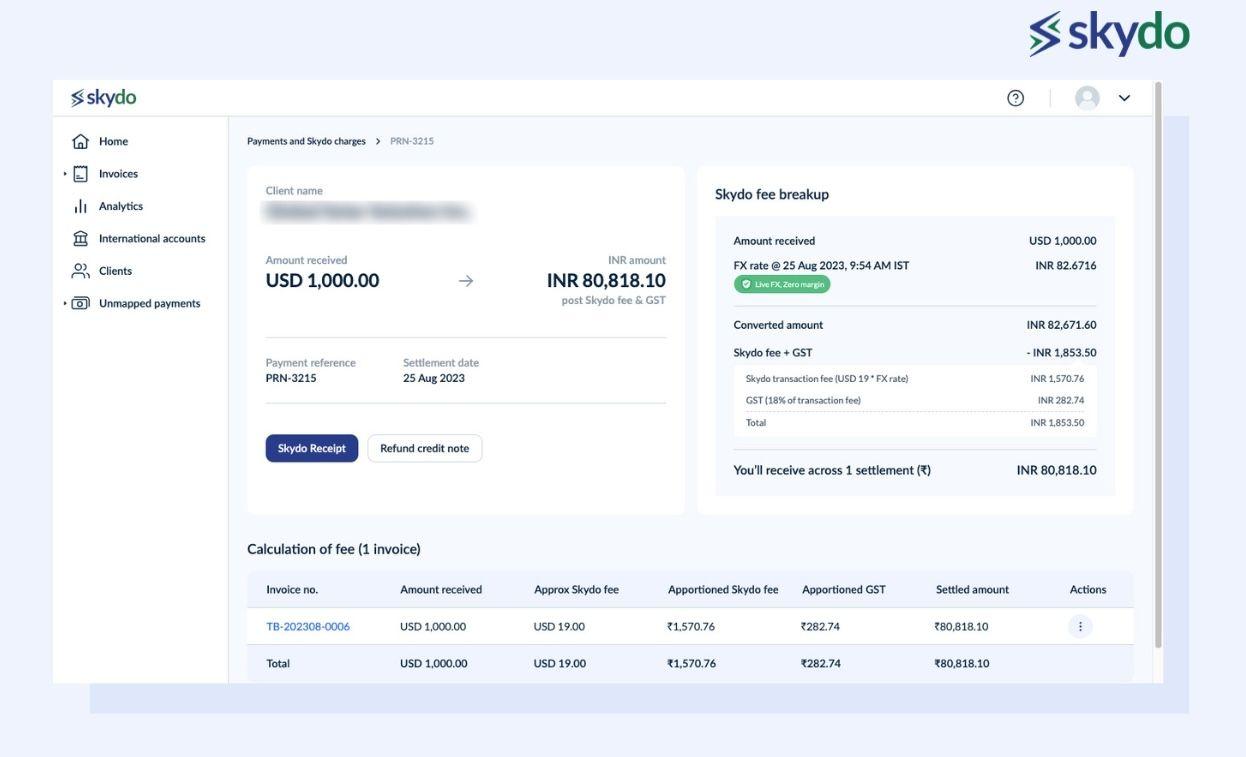

Banks and international payment gateways for freelancers charge markup FX rates of 3-4% per foreign transaction. Thus, if a client owes you $100, you might receive $90 or even less as the final amount. The rest of the amount is reduced as FX rates. However, Skydo is different.

Skydo adopts a unique and transparent pricing model to solve this FX markup issue. It does not charge extra FX rates. It converts the currency at the prevailing rates. You can check the conversion date and time stamp to validate the exchange rate at the time.

Thus, Skydo helps you save a significant sum you would otherwise have paid as FX markup fees.

Countering Withdrawal Delays

Most international payment gateways for freelancers take up to 5-7 days to process money withdrawals in bank accounts. It can also take up to 15 days or even more, depending on the amount withdrawn, the nature of the transaction (withdrawing in the same or different currency), and several other banking factors.

This becomes a hassle because it further burdens the lengthy process of receiving payments from international clients. However, Skydo cuts down on unnecessary delays, and the withdrawal amount is reflected in your bank account within 24-48 hours, thus reducing liquidity risk.

Effortless withdrawals can further benefit your freelancing business in the following ways.

- Faster access to money improves financial stability by reducing the need for credit

- You can invest the money diligently, grow your wealth, and build a safety net

- Surplus money from freelance payments can also be invested for learning purposes by doing skill-based courses or purchasing tools to automate your workflow and improve productivity.

Another interesting advantage of using Skydo as an international payment gateway for freelancers is that you can easily integrate it into your Upwork, Toptal, Deel, and Freelancer accounts and withdraw freelance payments easily into your bank account with up to 50% fewer charges.

Conclusion

The freelancing business suits professionals who thrive in an independent environment and want to earn handsomely. However, it's also a fragile business model that requires you to be extremely cautious with your earnings, investments, and expenditures.

Freelancers don't have a fixed income stream or any monetary benefits or allowances given to salaried employees. Relying on costly international payment gateways for freelancers to receive money from foreign clients adds fuel to the fire.

Volatile FX rates and vague pricing models can lower your earnings and disrupt your cash flow, ultimately impacting your financial stability. Hence, weigh the pros and cons of various platforms and use the best freelance payment solution according to your business needs.

Join Skydo today and be a part of our growing freelancers community and make wise payment decisions!

FAQs

Q1. How to save money on international transactions as a freelancer?

Ans: To optimise tax savings on freelance income, leveraging Skydo's seamless integration with platforms like Toptal, Deel, Upwork, and Freelancer.com provides a comprehensive financial management solution.

Q2. What is the minimum withdrawal from freelancers?

Ans: The minimum withdrawal from freelancers varies based on the platform. Skydo's integration with freelance platforms facilitates easy tracking and withdrawal processes, ensuring you can efficiently manage your earnings.

Q3. What is the best payment withdrawal method on Freelancer.com?

Ans: Skydo, the best payment gateway for freelancers in India supports diverse payment withdrawal methods with Freelancer.com allowing freelancers to choose the most convenient and cost-effective option for accessing their earnings.

Q4. Is there a withdrawal fee for freelancer.com?

Ans: While withdrawal fees on Freelancer.com depend on the chosen withdrawal method, Skydo's integration streamlines the process, helping users stay informed about any associated fees for a more transparent financial experience.

Q5. How to avoid paying fees on Upwork?

Ans: Effectively manage your finances by using Skydo's integration with Upwork, which streamlines payment processes. To minimise fees on Upwork, consider exploring direct bank transfers or alternative payment methods supported by Skydo for better earnings and financial efficiency.