Indian Tech Exporters: Accept International Payments In India With Skydo

India’s tech exports hit a massive $199 billion in FY24—a clear sign of how resilient and innovative India’s tech sector is, even in tough global times. This growth is putting India on the map as a global leader in technology and services.

But let’s be honest: while the numbers look great, the reality for Indian exporters can be challenging. One of the biggest pain points? Getting paid. Despite all the advancements, receiving international payments is still slow, complicated, and often way too expensive.

So, how do you, as a tech professional, keep your cash flow healthy and focus on growing your business globally? That’s where Skydo comes in. We take the headache out of receiving international payments, cutting through the delays and unnecessary costs, so you can focus on what really matters—your growth.

Limitations of Existing Payment Channels in India

The existing international payment landscape in India is extremely cumbersome and time-consuming for businesses.

The majority of international remittances take place through the following channels:

- SWIFT/correspondent banking post

- Rupee Drawing Arrangement (RDA)

- Money Transfer Service Scheme (MTSS)

The following are the challenges that tech exporters face while receiving international payments through these channels:

Steep Fees and Unfavourable Exchange Rate:

Receiving international payments via SWIFT comes with its own set of costs. You’ll encounter SWIFT fees ranging from INR 500 to 1,000, along with additional charges like tracking fees and FIRA fees. But the real issue lies in the unfavourable exchange rates offered by banks.

Unlike live exchange rates, banks often provide lower rates. For example, if the market rate is 1 USD = INR 86, a bank might offer you a rate of 84. On a payment of USD 10,000, this means you’d receive INR 8,40,000 instead of INR 8,60,000—a loss of INR 20,000, simply due to poor exchange rates. And the worst part? You might not even realise it.

Complex and Time-Consuming FIRA Process:

FIRA, or Foreign Inward Remittance Advice, is a critical compliance document that every exporter must secure after receiving cross-border payments. It serves as proof of the international payment you’ve received for your services.

However, obtaining FIRA from banks is far from simple. The process often involves repeated follow-ups, long waiting times, and, to make matters worse, most banks charge an additional fee for issuing the document. This not only adds to the complexity but also increases the overall cost of managing international payments.

Inadequate Customer Support

When it comes to customer support, banks often fall short—understandably so, given the sheer volume of customers they handle daily. However, this leaves exporters like you in a tough spot. Even a straightforward query can take weeks to resolve, requiring multiple follow-ups along the way. For busy tech exporters juggling countless priorities, this lack of timely support can quickly become a source of frustration.

Slow Processing Time

Receiving a SWIFT transfer can take upto 5 business days, longer if there are multiple intermediary banks involved. This wait time can not only be frustrating but can also cause a cash crunch for exporters.

Why is Skydo Important, and What Does it Solve?

Skydo is transforming the way businesses handle international payments with innovative, affordable solutions. With features like automatic FIRA generation, automated invoicing, flat transaction fees, and responsive customer support, Skydo takes the hassle out of cross-border payments, letting you focus on growing your business.

We understand the unique challenges tech exporters face when dealing with international transactions—hidden fees, delays, and endless follow-ups. That’s why Skydo is designed to tackle these issues head-on, making global payments fast, transparent, and stress-free.

Here’s how Skydo addresses common pain points and becomes your go-to solution for international payments.

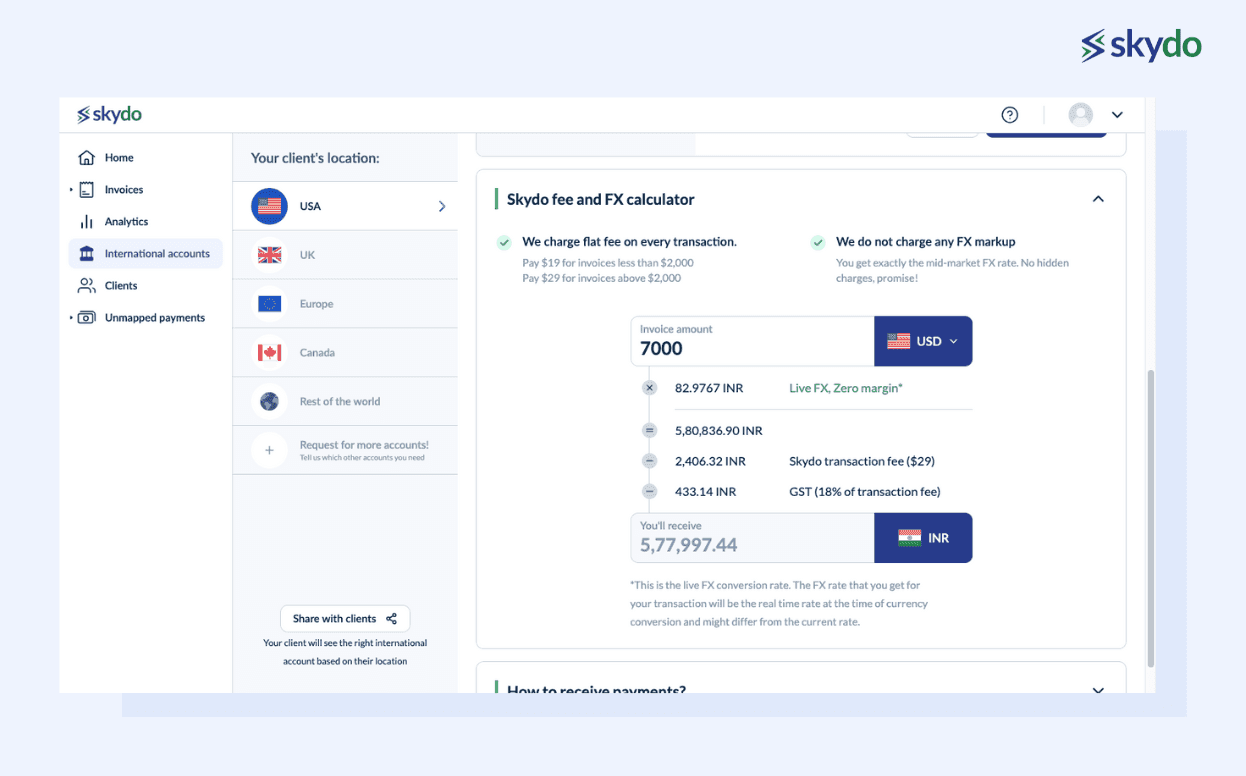

1. Flat transaction fee

One of the most significant benefits of the Skydo payment platform is the flat transaction fee for receiving international payments.

- Transaction fee up to $2,000 is $19

- Transaction fee per $10,000 is $29

For payments above USD 10,000, Skydo charges a 0.3% fee, much more affordable than most other payment platforms.

You can view the exact transaction fee when you generate an invoice. Thus, Skydo ensures transparency and helps you save unnecessary hidden charges levied by other payment gateways.

2. Seamless payment processing within a few hours

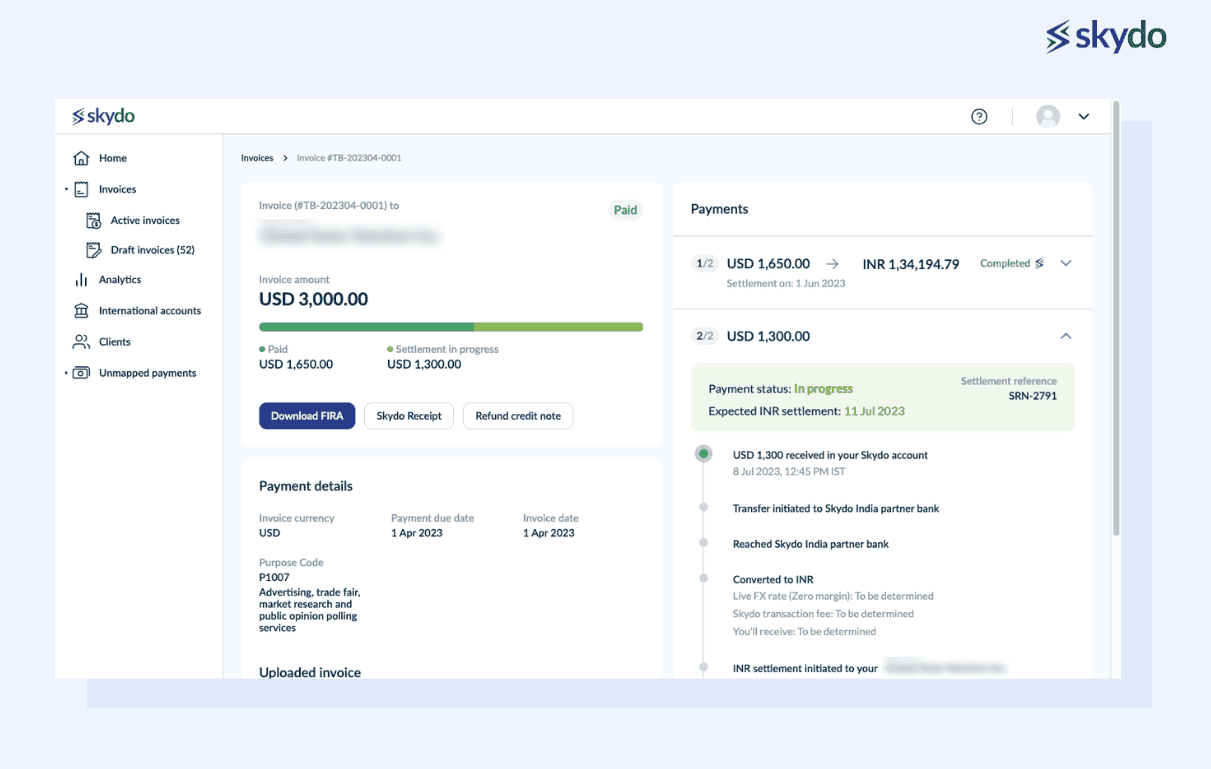

Skydo provides you with virtual international accounts in multiple key regions including the US. UK, Europe, Australia, Singapore and more. So, in these regions, your clients pay you in these virtual accounts, making it a local transfer rather than an international one. Skydo then consolidates these payments and settles it in your Indian bank account within just 24 hours—no more long wait times, just smooth and consistent cash flow. Plus, with our real-time payment tracking feature, you’ll always know exactly where your payment is at every step of the process.

3. Live FX rates with zero margin

Skydo converts the payment received in international currency into INR as per the live foreign exchange rates without levying any additional fee. This means that you get the exact amount in your bank account as per the prevailing currency rate without any deductions.

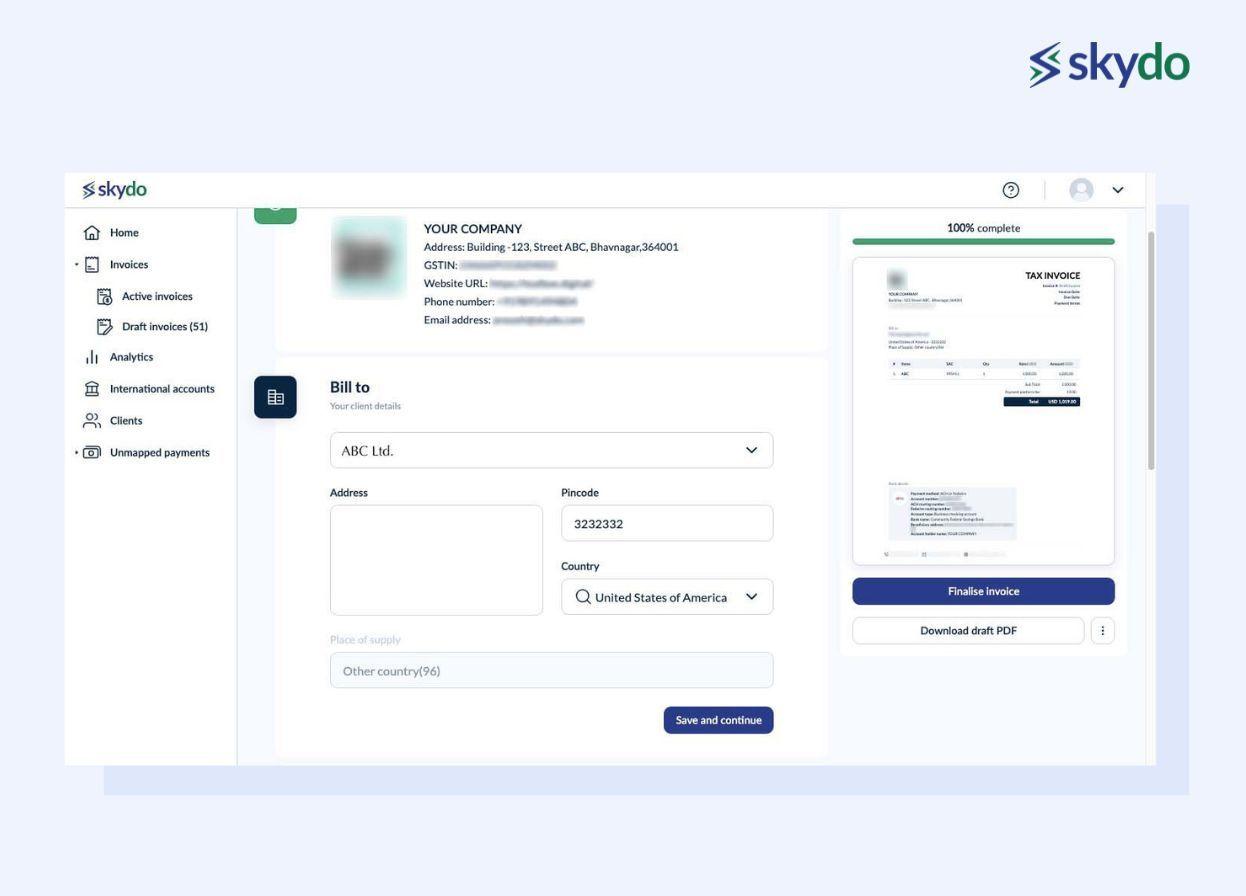

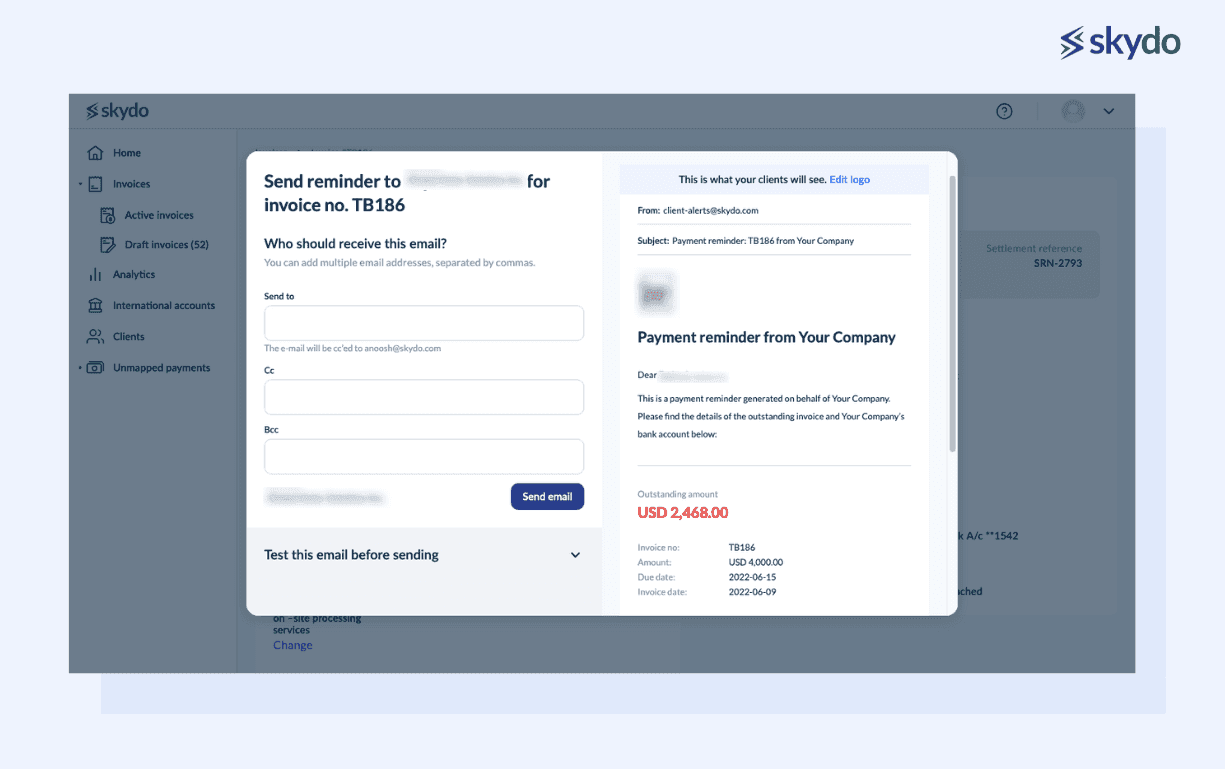

4. Invoice generation and payment reminders with the auto-generated invoice number

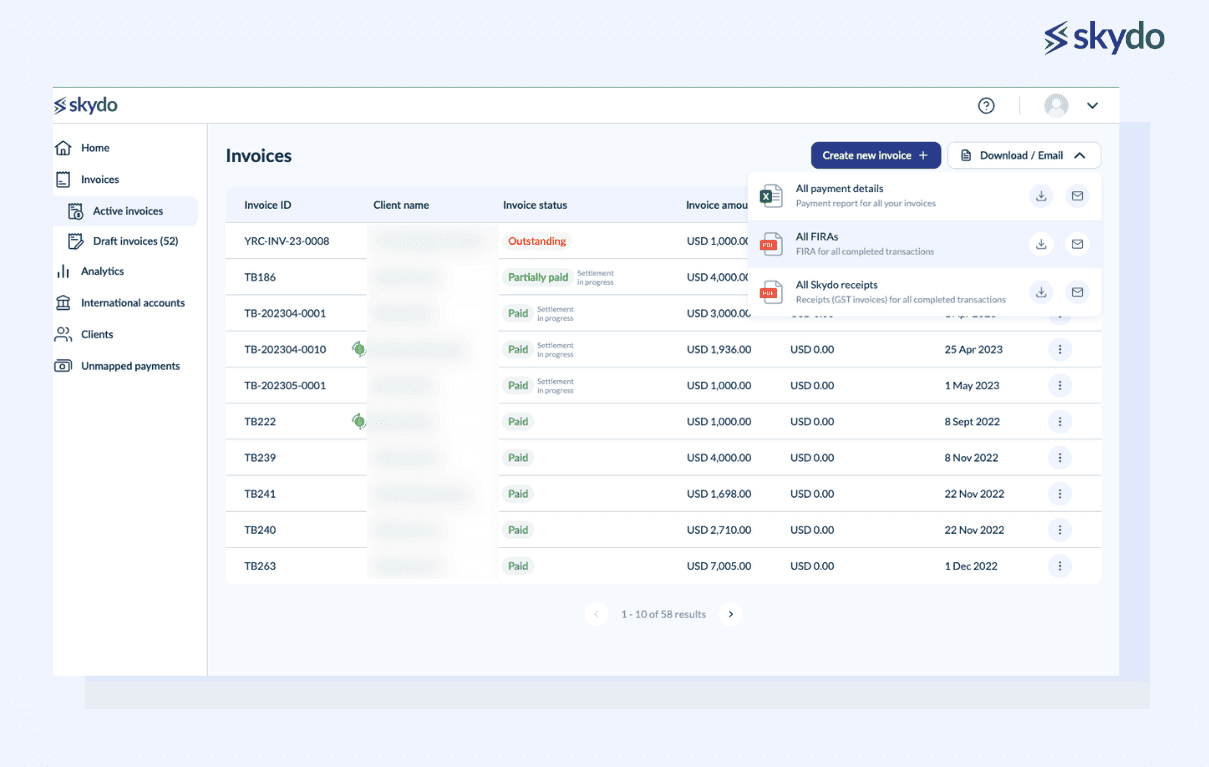

Invoicing is one of the best features of the Skydo payment platform. It helps you save on time and manual efforts by creating automatic invoices.

Skydo provides customisable professional invoice templates to suit your business requirements. The payment platform automatically adds the invoice number every time you generate an invoice.

Moreover, you can track the real-time status of all your invoices on a single dashboard and send payment reminders to clients through Skydo.

Learn more: Transforming Your Invoicing Experience With Skydo

5. Compliance with Indian regulations - Automated FIRA

Foreign Inward Remittance Advice (FIRA) certificate provides complete details of all foreign services provided by Indian exporters. It is essential for businesses to maintain all FIRA receipts to reconcile their financial statements and for tax compliance purposes.

Skydo automatically generates FIRA certificates for all transactions, making it easier for you to comply with tax laws.

6. User-friendly interface

The intuitive dashboard has been designed to help users easily navigate through Skydo's payment platform. It provides you access to all the details related to your transaction within a few seconds.

How Does Skydo Ensure 100% Safe and Secure Payments?

Questions around safety and security become paramount when it comes to international payments. Here's how Skydo ensures 100% compliant payments every time.

1. Skydo's Collaboration with Indian and Foreign Financial Institutions

Skydo has partnered with renowned financial institutions around the world including HDFC and Banking Circle and many more to simplify international payments for Indian exporters and service providers. We are also actively in talks with many other renowned institutions to be able to offer virtual accounts in more regions

Learn More: Enjoy Seamless Payment Experience by Creating International Bank Accounts in Just 5 Minutes

2. Securing What Matters Most

Skydo is now RBI-approved as a Payment Aggregator for Cross-Border Payments (PACB)! This milestone reflects our commitment to making your payments secure, seamless, and fully compliant with RBI regulations.

We’re also SOC 2 certified, meaning your data’s safety is non-negotiable for us. With end-to-end encryption, secure storage, and regular security checks, we ensure your data stays private and protected—always.

3. Ensuring Compliance with Reserve Bank of India (RBI) Guidelines

We understand how important it is to comply with RBI’s strict guidelines, not just for us but for our tech exporters too. That’s why Skydo provides free and instant FIRA for every transaction, eliminating the need for repeated bank visits and ensuring your payments are always RBI-compliant—without the extra hassle.

4. How Skydo Streamlines Know Your Customer (KYC) Processes

One thing business owners despise the most about payment and banking platforms is the tedious KYC process. With Skydo, the process is simple.

As soon as the users enter the business PAN, the platform automatically extracts relevant details such as the company's name, GSTIN, and CIN from the Ministry of Corporate Affairs database.

Even when the directors upload their PAN, the platform automatically collects information from the uploaded file. Thus, Skydo offers smooth and quick KYC processes.

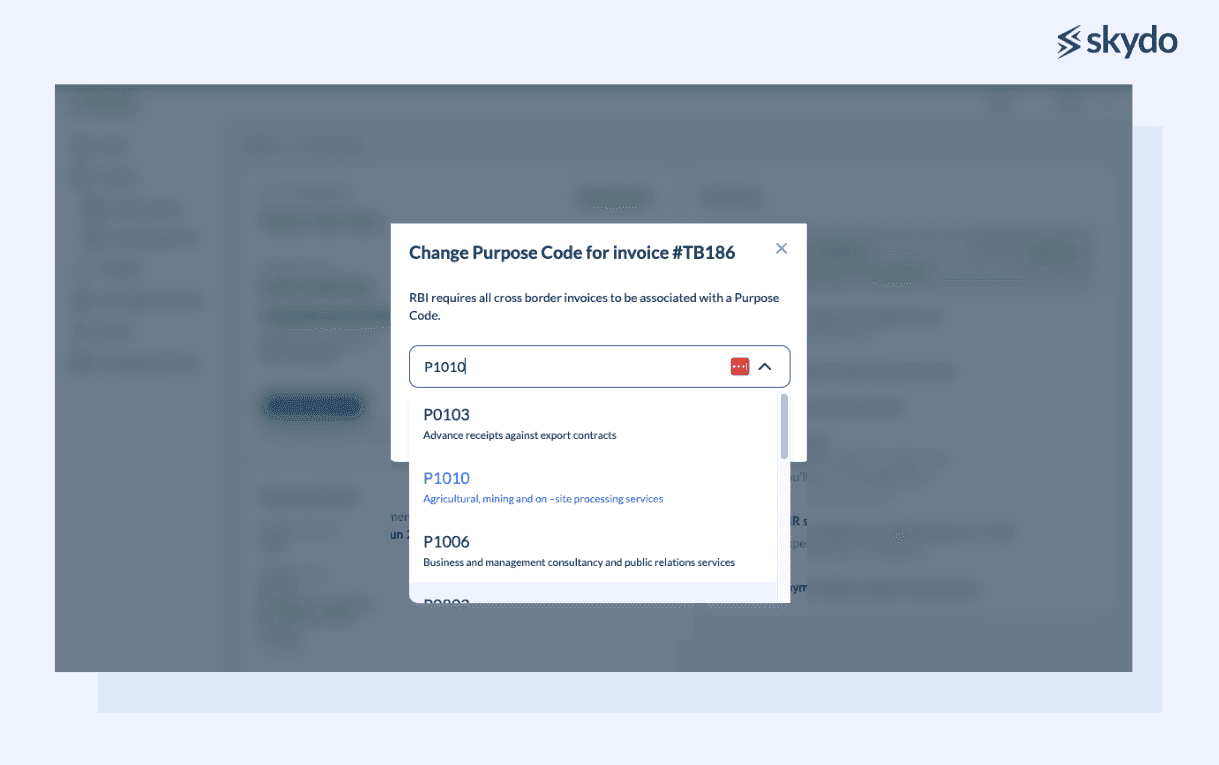

4. Auto-generated Purpose Code based on RBI Guidelines

As per the RBI guidelines, all invoices related to the export of goods or services must have a purpose code to identify the type of service provided. Without the purpose code, the banks reject the payment received from an overseas account.

There is a long list of different purpose codes that you can find online. Entering the purpose code manually for every transaction is time-consuming and leaves scope for error.

Skydo's payment platform prefills the purpose code in your account post-registration. This code is then automatically available in a drop-down based on the services rendered in that invoice. This ensures that you send accurate invoices and receive payments on time.

Harshal, founder of Mobiprise, and a proud Skydo customer, couldn't contain his enthusiasm when he said, "Compliance with Skydo is not only good but great! It’s been very painful all these years." With Skydo, you too can experience the benefits of hassle-free cross-border payments.

Conclusion

While businesses are keen on expanding their services globally, challenges related to international payments act as restraints. Add to this multiple regulatory processes and banking norms. Consequently, payment gets delayed, making it difficult for merchants to scale their business.

Skydo streamlines the payment process by providing automated invoicing services and charging flat transaction fees. It also has a vast network of Indian and foreign bank accounts, enabling businesses to open a local bank account in the US. This facilitates quick receipt of international payments to your local bank account in India.

Request a demo today to expand your business internationally with Skydo!