Top 5 Accounting Tools for Indian Tech Exporters

Accounting and bookkeeping in the export tech service business can often resemble the puzzling twists and turns of a Rubik's Cube. Each face of the cube represents a different aspect of your financial operations - sales, expenses, taxes, and more.

Balancing these facets is akin to aligning the cube's vibrant sides, ensuring that every financial move clicks into place. Only by carefully manoeuvring through the intricate complexities can you unlock the solution to your financial puzzle and achieve sustainable success.

However, a report shows that 60% of small business owners feel they aren’t well-read about accounting and bookkeeping. Let's delve into the importance of accounting and bookkeeping, the associated bottlenecks, and how appropriate accounting tools can help you overcome them.

The Importance of Bookkeeping for Tech Exporters/Small Businesses

Accurate bookkeeping is vital as it ensures financial transparency, facilitates informed decision-making, aids in tax compliance, and enables efficient cash flow management. It helps further in the following ways.

- Tracking Income, Expenses, and Profitability: By maintaining accurate financial records, you can gain insights into your revenue streams, identify cost-saving opportunities, and make informed decisions to enhance profitability.

- Legal and Tax Compliance: Maintaining organised and accurate financial records through accounting/bookkeeping proves useful during audits, tax filings, and regulatory inspections, avoiding penalties and legal complications.

- Financial Insights for Informed Decision-Making: Bookkeeping provides valuable insights and, when analysed, provides financial data that helps make informed decisions regarding budgeting, pricing strategies, and investment opportunities. This helps optimise resource allocation and maximise profitability.

- Risk Reduction and Transparency: Accurate bookkeeping reduces the risk of errors, fraud, and misappropriation of funds. Implementing internal controls and regular reconciliation processes ensures transparency and trust in their financial operations. This instils confidence in stakeholders, including investors, partners, and clients.

- Cash Flow Monitoring and Future Planning: Bookkeeping also allows tech exporters to monitor their cash flow, plan for future expenses, and forecast revenue. This way, businesses can effectively manage working capital, plan for investments, and establish long-term sustainability and growth strategies.

Despite its numerous benefits, many companies face challenges while maintaining good accounting or bookkeeping practices. Here’s why.

The Challenge of Bookkeeping in Tech Exports

The challenges of bookkeeping in tech exports arise due to the unique characteristics of the technology industry. Here are some common bottlenecks tech exports often face with bookkeeping:

Dealing with bank reconciliation manually

Tech companies that operate globally face challenges when dealing with transactions and currency conversions across borders. This makes the bank reconciliation process more complicated.

Verifying transactions and reconciling differences manually takes a lot of time and can lead to mistakes. This is especially challenging when dealing with multiple bank accounts and large transaction volumes, which can cause financial inaccuracies.

Managing cash flow

Various factors hinder a business’s cash flow. Fluctuating international sales creates uncertainty, as revenue streams may vary significantly from one period to another. Additionally, delayed client payments can disrupt cash flow, causing a strain on operational expenses and the ability to invest in growth.

Currency exchange rate fluctuations further complicate matters, as they can impact the value of international transactions and affect the business's financial position. Moreover, effectively managing expenses is crucial, as unexpected costs or overspending can deplete cash reserves.

Error-prone and time-consuming work

Even as a small business, you need to deal with a large amount of financial data, such as invoices, receipts, and expense reports, which require high precision. Manual handling of such tasks is time-consuming and increases the risk of mistakes in data entry, classification, or calculations. This shortcoming goes back to the primary need for accurate bookkeeping mentioned in the section above.

Complying with regulations

Exporting businesses must follow many rules, like export controls and tax laws. These rules can make bookkeeping more complicated. Non-compliance with the rules can lead to legal trouble, fines, and harm to the company's image.

You can overcome these challenges and streamline your bookkeeping procedures by embracing automation, which eliminates:

- Repetitive data entry

- Tedious handling of invoices, receipts, purchase orders, and expense reports

- The need for extensive manual record-keeping and reconciliation

- Human errors in data classification and calculations

With greater accuracy in your financial records through accounting tech tools, you gain real-time insights into your financial health.

Top 4 Accounting Tools for Tech Exporters

If you are seeking reliable accounting tools, here are the cream-of-the-crop options to consider:

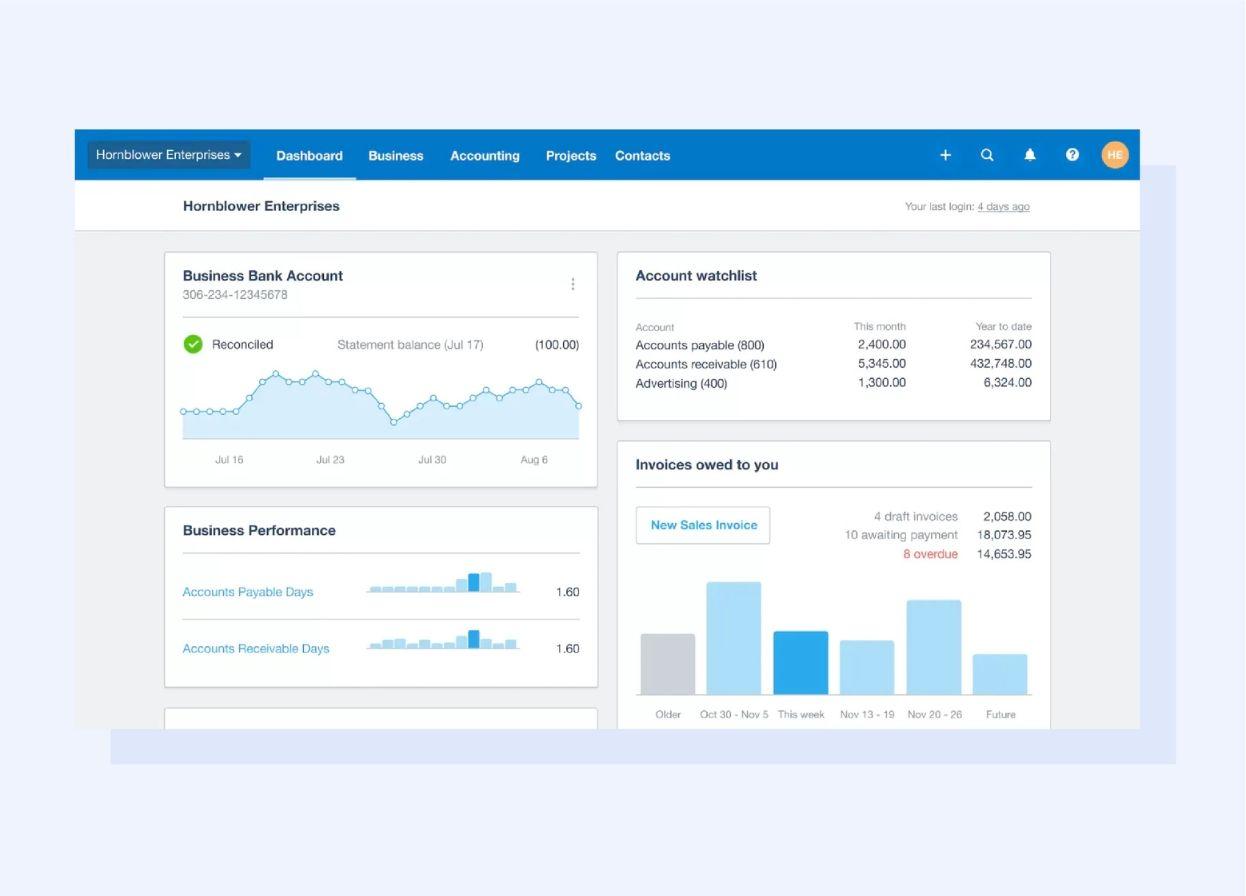

#1: Xero

Xero is a cloud-based accounting software that is designed to be easy to use and affordable.

Fig1: Dashboard of Xero, Source

It offers a wide range of features that are specifically designed for tech exporters, including:

- Invoicing and payments

- Inventory management

- Project management

- GST and VAT compliance

- Multi-currency support

- Claim expenses

- Bank reconciliation

- Accounting reports

- Integrate apps

- Automatically calculate sales tax on transactions

- Analytical reports to see future cashflow

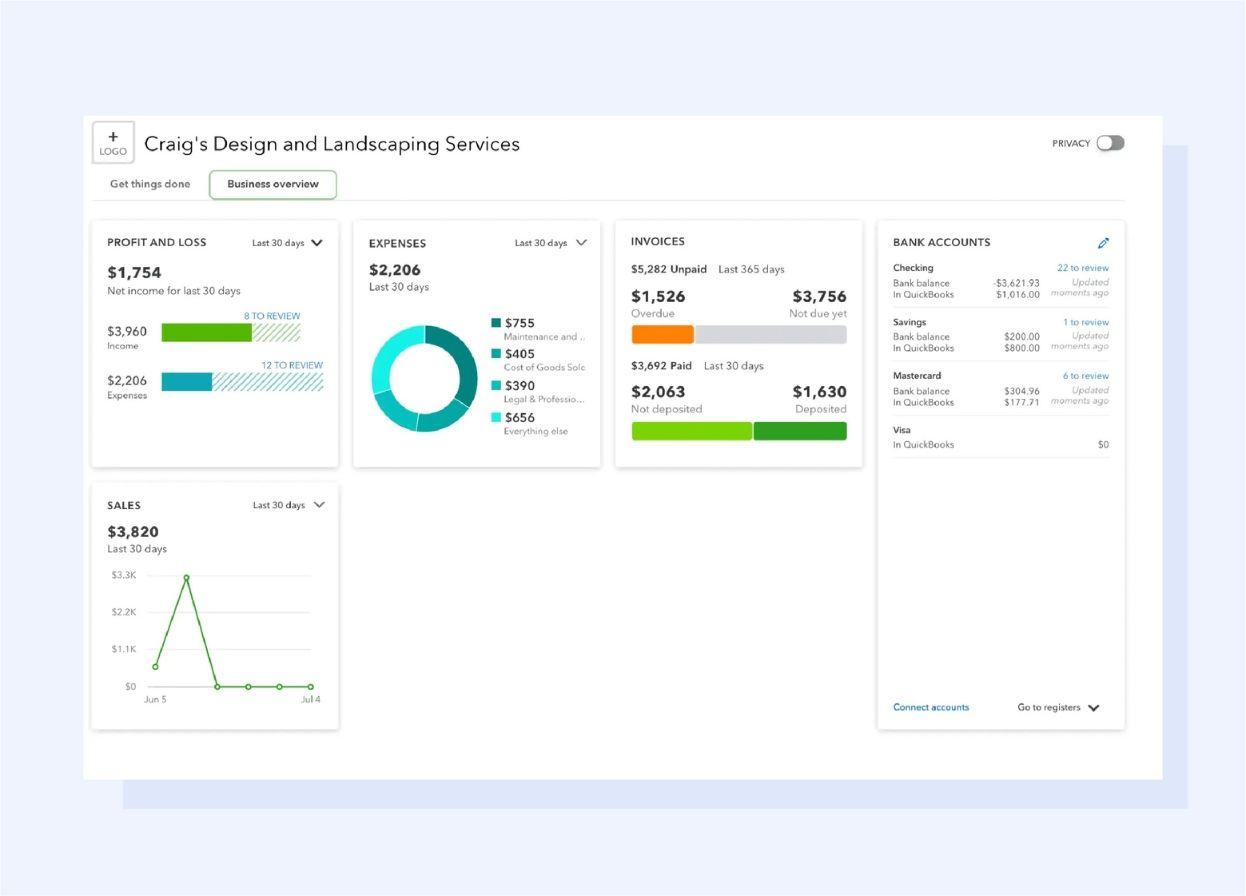

#2: QuickBooks Online

QuickBooks Online is another popular cloud-based accounting software that is well-suited for tech exporters.

Fig2: Dashboard of QuickBooks Online, Source

It offers a similar range of features to Xero, but it also has some additional features that are specifically designed for small businesses, such as:

- Time tracking

- Expense management

- Customer relationship management (CRM)

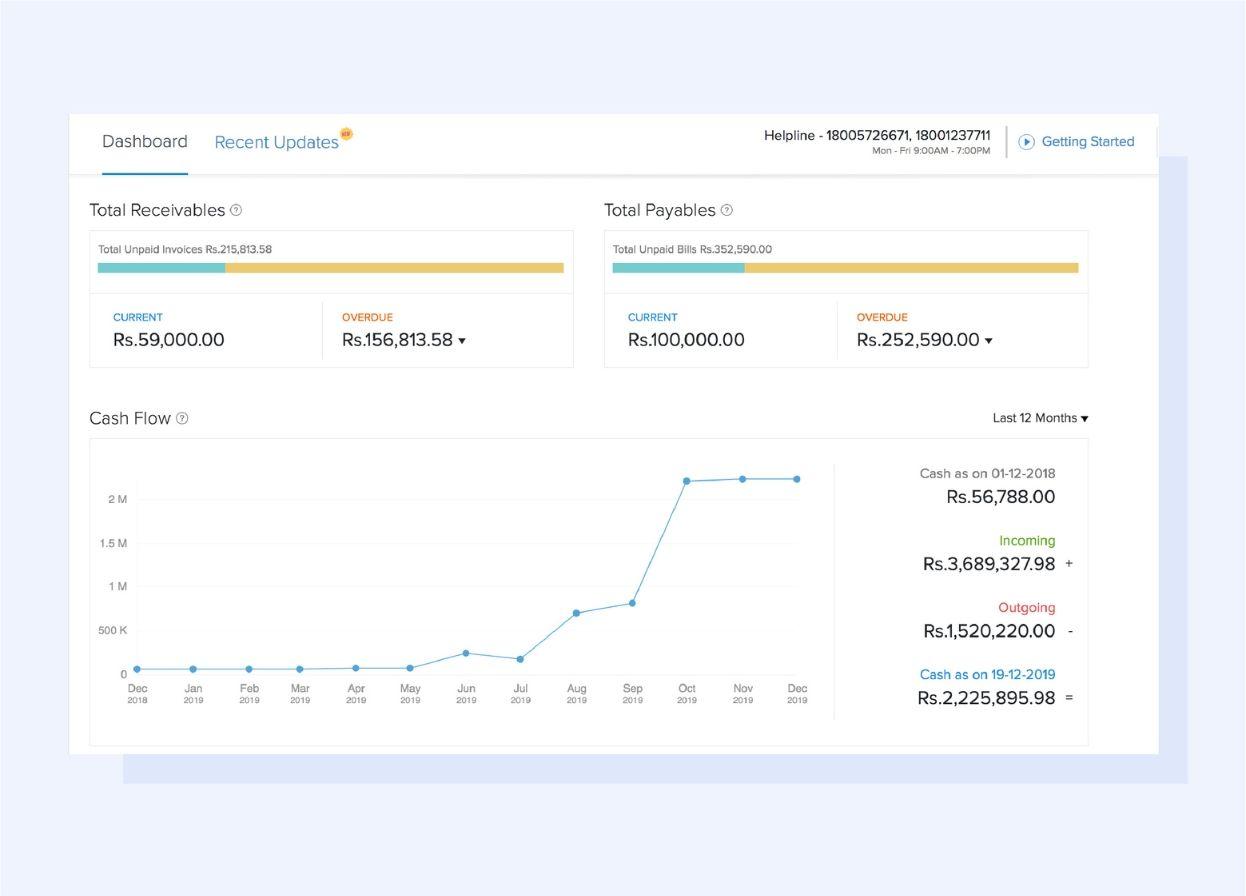

#3: Zoho Books

Zoho Books is a powerful cloud-based accounting software designed specifically for small businesses and startups.

With a range of features comparable to Xero and QuickBooks online. It also offers unique capabilities that are customised for tech exporters, including:

- Reports and analytics

- Simple and affordable pricing

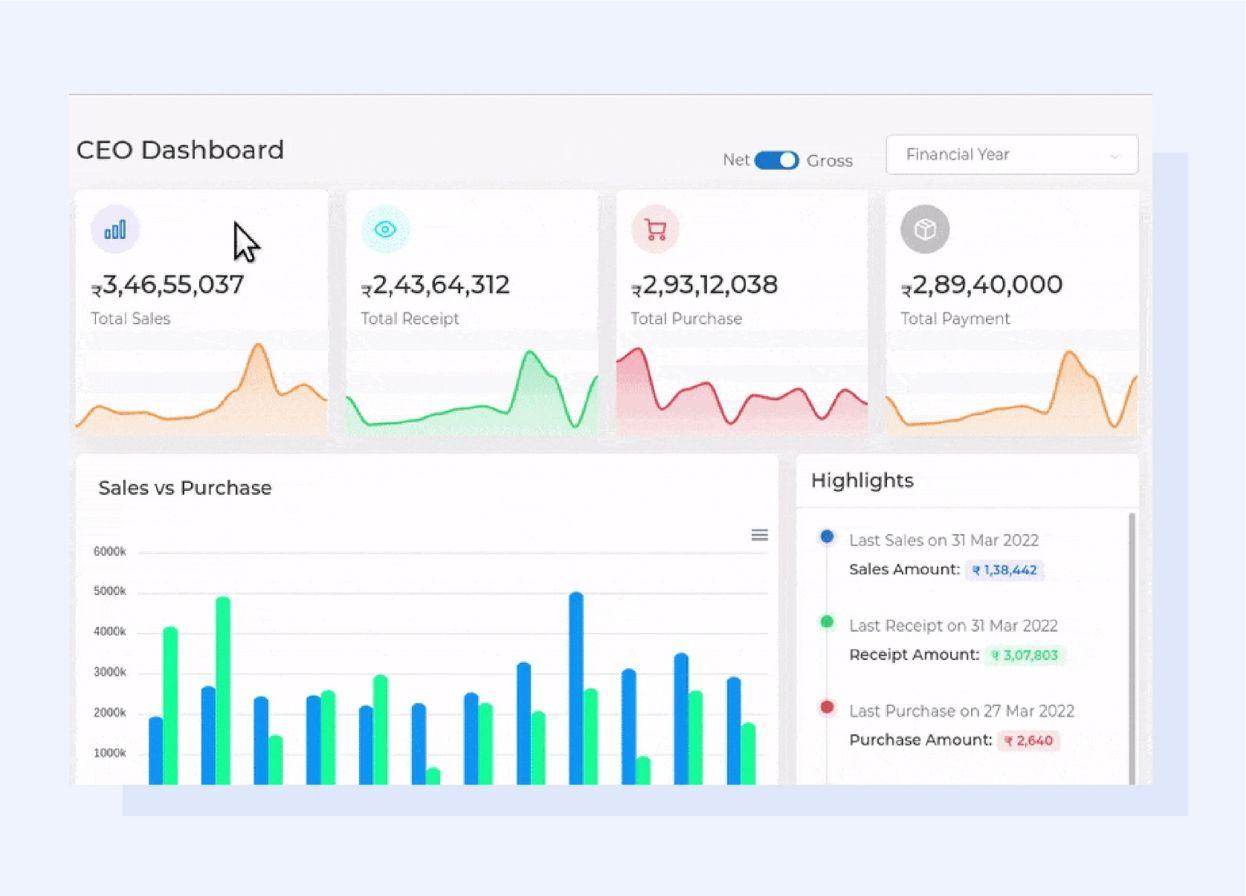

#4: Tally

Tally is an advanced accounting tool that is simple and modest in appearance.

This accounting tool boasts a range of features that are on par with other options on the market. Additionally, it has a user-friendly interface, making it a top pick for small businesses and entrepreneurs.

However, managing ERP and accounting with separate software tools can be challenging for small businesses. Therefore, they usually look for a single solution that can handle both functions seamlessly. Typically, ERP systems like Oracle or SAP are used to manage the order to invoicing process, while accounting systems like Tally are used to manage the invoicing to the accounting process.

#5: Refrens

Refrens is a powerful yet easy-to-use accounting platform designed to simplify finances for Indian tech exporters.

From creating export invoices with built-in currency conversion to managing TDS, GST, and client payments, Refrens streamlines it all. Its automation features help tech businesses reconcile international payments faster, track expenses, and stay compliant with Indian tax regulations.

Plus, with Freya, its AI assistant, you get intelligent insights to manage cash flow, raise invoices, and close books effortlessly. Whether you're a startup or a scaling SaaS exporter, Refrens helps you stay focused on growth, not spreadsheets.

The Pros and Cons of Top 4 Accounting Tools for Tech Export Business

To make an informed decision about which accounting tool to use, here is a detailed table outlining the pros and cons of each option:

| Tool | Pros | Cons |

|---|---|---|

| Xero | 1. Plans at low prices2. Users and clients are unlimited3. Free 30-day trial4. Extensive online training and support to master more complex systems | 1. There is a monthly limit of 20 quotes and invoices2. There is a learning curve involved3. Only the top subscription tier has access to several currencies |

| QuickBooks Online | 1. Frequently used by bookkeepers and accountants2. A simple method for keeping financial records3. Simple implementation | 1. Subscription costs a lot of money2. Limited assistance3. The adjustments in the learning curve might be challenging. |

| Zoho Books | 1. Free plan available2. Accounting software with a lot of features3. Strong mobile app4. Excellent customer service options | 1. A maximum of ten users are permitted2. For advanced features, higher-level plans must be purchased3. Integration is restricted |

| Tally | 1. Remote access with the help of Tally.NET2. Various language support3. Numerous functions performing various tasks (Especially in the case of GST) | 1. Lacks back office support for users2. Lack of advanced features3. Compatibility issue |

Making the Right Choice: Factors to Consider

Choosing the right accounting tool requires careful consideration of your business's unique needs, budget, and long-term goals. Here are some points to choose a top-notch accounting tool for your tech export business:

- Determine your specific needs, such as invoicing, expense tracking, payroll, or inventory management. Consider whether you need a cloud-based option, integration with other business tools, or multi-user access.

- Evaluate its ability to support your business's growth and changing needs without incurring significant additional costs. This includes assessing its budget and scalability.

- Seek out reliable providers, peruse user reviews, and compare pricing plans, features, and customer support. This will enable you to make a well-informed decision.

- Look for a user-friendly interface that doesn't demand a lot of technical know-how or training to use effectively.

- Ensure its compatibility with other essential tools like payment processors, CRM systems, or e-commerce platforms. This ensures seamless data transfer between the various tools and guarantees a smooth workflow.

- Ensure the software offers strong measures to safeguard your information, such as encryption, regular data backups, and secure user access controls.

- Assess the quality of customer support provided by the software provider. Find out if they offer training materials, tutorials, or access to a skilled support team to help you with any inquiries or problems.

Case Study

Having the right accounting tool is vital for any tech export business. This has been revealed by Soffit, a software company that offers IT infrastructure solutions to businesses of all sizes. They chose Zoho Books for its real-time updates, automated billing, impressive features, and affordability.

Soffit uses Zoho Books to save time and money. It helps them avoid manual data entry and easily create financial reports. Their customer service has also improved by using automated invoicing and receipts, which reduces customer inquiries. Zoho Books has helped Soffit be more efficient and satisfy its customers.

The Future of Bookkeeping: AI and Machine Learning

AI and machine learning have improved bookkeeping by helping with repetitive tasks, finding patterns and trends, and providing insights to help businesses make better financial decisions. Tools like Accounting AI by calculator-online.net demonstrate how AI can already assist with quick, error-free accounting calculations, reducing manual workload for businesses.

In the future, AI and ML are likely to play an even greater role in bookkeeping. For example, using AI on data sets can decrease fraud by constantly auditing company finances to ensure they follow local, federal, and international regulations.

Conclusion

Efficient bookkeeping enables you to pinpoint areas where you can reduce expenses. You can identify where you are overspending and adjust your budget by keeping track of your revenue and expenses.

This will boost your profit margin and increase the profitability of your tech exports. Take action today and initiate your bookkeeping process now!

FAQs

Q1. How can I improve my bookkeeping?

Ans: Improve bookkeeping by using free accounting software like Wave or ZipBooks for small businesses. Regularly reconcile accounts, categorise expenses accurately, and keep organised records. Consider online tutorials or hiring a professional for advanced guidance.

Q2. What is a bookkeeping tool?

Ans: A bookkeeping tool is software designed to record financial transactions, manage accounts, and generate financial reports. Examples include Wave, ZipBooks, or Tally for efficient and error-free bookkeeping.

Q3. What tools do you mostly use in accounting?

Ans: In accounting, commonly used tools include software like QuickBooks, Xero, and Wave for bookkeeping. These tools streamline tasks such as invoicing, expense tracking, and financial reporting, enhancing overall accounting efficiency.

Q4. What software do bookkeepers use?

Ans: Bookkeepers often use software like QuickBooks, Xero, or Wave for seamless financial management. These applications offer features such as invoice creation, expense tracking, and bank reconciliation, making bookkeeping more accurate and time-efficient.

Q5. What are the three golden accounting rules?

Ans: The three golden accounting rules are:

- Debit the receiver, credit the giver.

- Debit what comes in, credit what goes out.

- Debit expenses and losses, credit income and gains.

Adhering to these principles ensures accurate recording and reporting of financial transactions.