Set Up Your Freelance International Bank Account in Just 5 Minutes

The Global Freelancer Survey Report 2022 reveals invoicing, billing and managing international payments as one of the top three freelancing challenges.

You have scaled your business by catering to global clients. However, each client has different payment terms and pays in different currencies. How do you manage all cross-border transactions with clients?

You can tackle this challenge using Skydo. This modern payment platform helps you streamline international payments for your freelancing business by opening an international bank account in just five minutes.

This blog explains how you can open multi-currency bank accounts, with Skydo and track payments in real-time.

Create an International Bank Account with Skydo in 5 Minutes

Opening a virtual international bank account with Skydo enables your foreign clients to do a local bank transfer.

Once you receive the payments in your international bank account, Skydo facilitates a seamless transfer of funds to your Indian bank account within 1 day.

Multicurrency accounts reduce the risk of payment delay, payment failure and high transaction costs.

Here is how you can open an international bank account with Skydo in 6 simple steps.

1. Eligibility

Skydo aims to tackle issues related to cross-border transaction issues for global freelancers. To open an international bank account, you should have at least one paid invoice and or a contract with an international client to show that you engage with foreign clients.

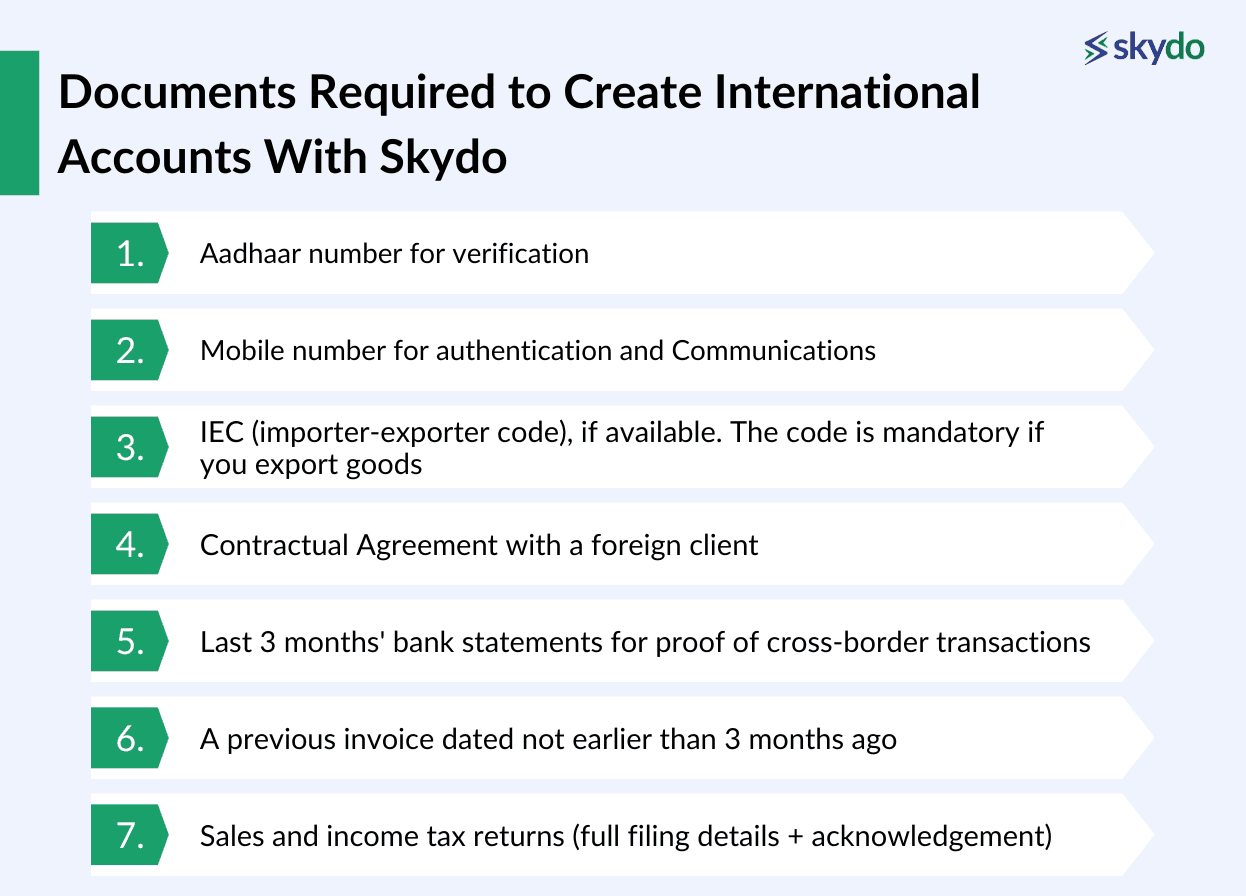

2. Documents Required to Create International Accounts With Skydo

Once you are eligible to open an international bank account with Skydo, collect all the following documents for virtual KYC.

- Aadhaar number for verification

- Mobile number for authentication and Communications

- IEC (importer-exporter code), if available. The code is mandatory if you export goods

- Contractual Agreement with a foreign client

- Last 3 months' bank statements for proof of cross-border transactions

- A previous invoice dated not earlier than 3 months ago

- Sales and income tax returns (full filing details + acknowledgement)

3. Verify Email ID

Enter your email ID and verify it using an OTP to register on Skydo.

4. KYC

Next, you have to complete the virtual KYC formalities. The page will display all relevant instructions and the required documents to open an international bank account. You will have to click on ‘Accept and Continue ‘.

It will redirect you to a window where you have to enter your freelancing service details, bank account details and other relevant information along with uploading copies of the required documents.

5. Verify Aadhar No.

After uploading relevant documents, you must verify your Aadhar number through an OTP sent to your mobile number.

6. Bank Account Verification

The last involves bank account authentication, where a nominal amount of ₹1 or ₹2 is deposited in your bank account to verify the details.

The entire process is designed for a smooth and fast user experience which facilitates opening an international bank account within 5 minutes.

Benefits of Using Skydo for Your International Freelance Payments

The key benefits of using Skydo for freelance international payments include the following.

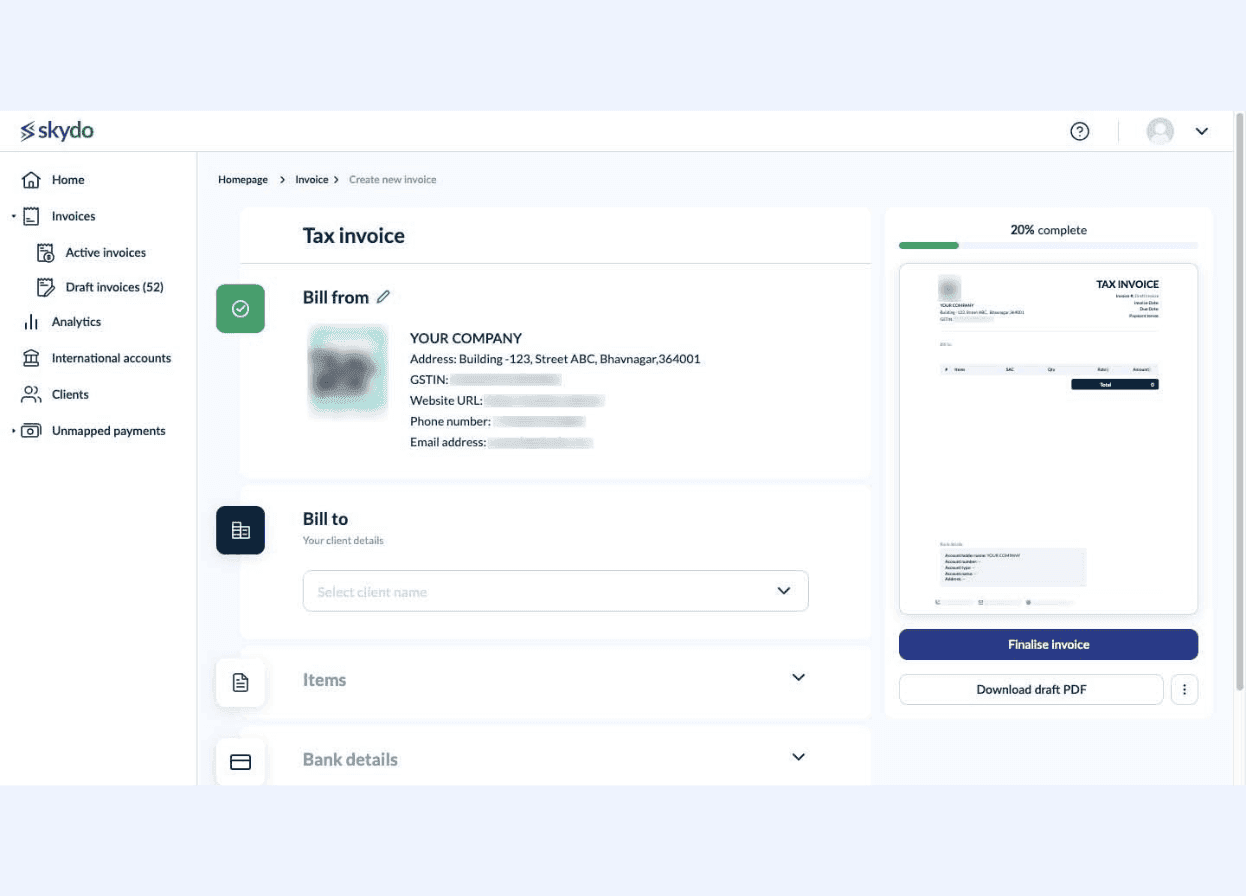

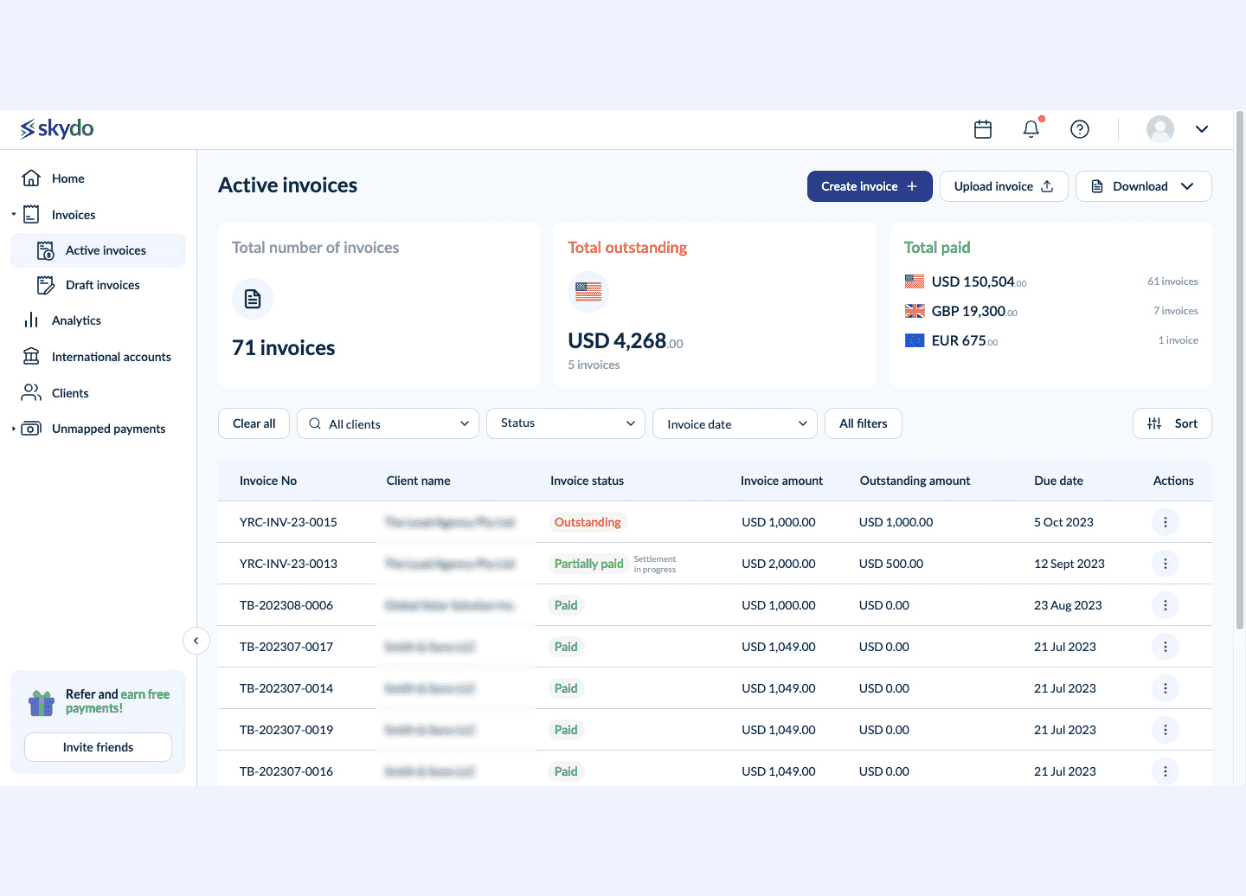

1. Automated Invoicing

As a freelancer, you are alone responsible for client acquisition, project management, project delivery, sending invoices, following up for payments and all other operational tasks.

You can free up a lot of your bandwidth and improve efficiency by using Skydo's automated invoicing features.

Skydo provides customisable invoice templates for each client and prepares automatic drafts. Moreover, it automatically adds the purpose code to each invoice and allows you to send e-invoices. Therefore, you can generate and send recurring invoices to clients in no time.

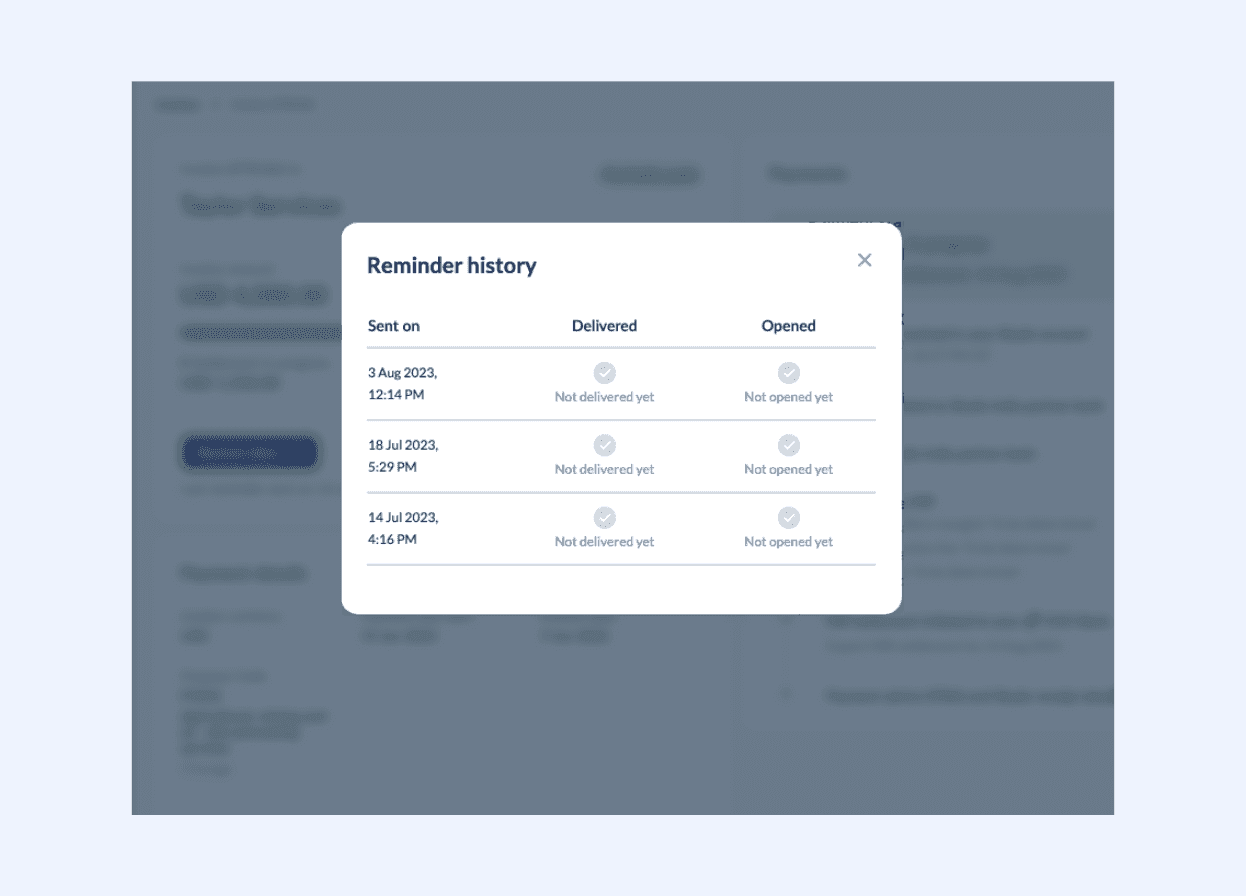

2. Track Payment Reminders

In addition to automated invoices, you can also send automated payment reminders to clients through Skydo in just one click.

It saves you the time and effort required to write several follow-up emails. The best part is that you can track your payment reminders and check when the client has viewed the reminder email.

3. One-Click FIRA Download for GST Compliance

The Foreign Inward Remittance Certificate (FIRA) is one of the most crucial GST compliance documents for Indian freelancers and businesses exporting goods and services.

It serves as proof of payment details and verifies that your foreign earnings are legitimate.

Most freelancers and vendors collect FIRA from local banks. However, seeking FIRA for each international payment requires a lot of manual effort.

Skydo simplifies this process by automatically generating FIRA for each cross-border transaction. You can download all the FIRA receipts in one click from Skydo's dashboard.

4. Flat Fee With Live FX Rate and Zero-Margin

Other payment solutions like PayPal and Payoneer charge a 3-5% currency conversion fee in addition to the transaction fee, which significantly impacts your total earnings.

However, Skydo charges a flat transaction fee of $19 for payments up to $2000 and $29 for payments of $2001-$10,000.

Moreover, Skydo charges zero margin for currency conversion, thus maximising your freelance earnings. You can view the live Foreign Exchange (FX) rate on Skydo's platform.

Check your potential savings through Skydo's FX calculator.

5. Boost Earnings from Freelance Platforms

Moreover, one of the best use cases of Skydo is that it enables hassle-free payment withdrawals from freelance platforms like Upwork, Freelancer, Toptal and Deel. This helps reduce transaction costs by up to 50%.

Get Started with Skydo Now

Skydo offers a variety of automated features to streamline your payment processes and maximise your savings. Join Skydo today to receive international payments hassle-free!

Frequently Asked Questions

Q1. Why should I open an international bank account?

Ans. Receiving cross-border payments is a cumbersome affair. Payment completion can take up to 15-20 days. Not to forget the risk of payment failure, high transaction costs and hidden fees.

Opening an international bank account simplifies cross-border transactions by allowing your client to transfer the payment to a local bank account. It reduces payment failure risk and reduces losses due to currency conversion.

Q2. What additional features does Skydo offer?

Ans. Skydo is a comprehensive payment platform that offers holistic solutions for global businesses and freelancers. In addition to opening an international bank account, it provides automated invoicing and payment reminders, real-time payment tracking, automatic FIRA generation and an intuitive dashboard.

Q3. How many virtual international bank accounts can I open with Skydo?

Ans. Through Skydo, you can open a virtual international bank account in 20 countries, including the US and the UK.